The real time M3 SPY Trader has given XIV a neutral reading for the first time in 2 weeks. As of the close today M3 with a #1 ranking has gone to cash.

Coupled with recent abnormal acceleration in XIV versus SPY the argument can be made that from a risk/reward standpoint cash may be warranted at this point.

The current signal by M3 does not necessarily mean SPY's run is over, but that the proportionately greater returns that have been derived from recent uber bullishness in XIV should be locked in now.

VIX is now at a 52 week low and given seasonal considerations and the end of the month cusp trade expiring on Monday the decision to close XIV is strictly an odds decision.

BTW...some subscribers have received emails today apparently sent from ETFMosaic...these are phishing mails sent by hackers using parts of this address as a cover. Authentic emails from ETF Mosaic will always contain "M3" in the subject line.

Friday, May 30, 2014

Thursday, May 29, 2014

SPY Roars On...5.29.14

A late day rally into the close pushed the markets to all new highs and if current momentum prevails its only a matter of days until SPY hits 200.

XIV went negative early on but then joined the party and closed solidly in the green.

Low volume continues to characterize the action over the last 2 weeks = few sellers.

The rally was board based and across all sectors and the only caveat is that we are now firmly in overbought territory. However, this condition hasn't stopped the markets at previous such junctures from breaking out to substantially higher levels and given the usual end of month push we may not see any meaningful pullback until next week.

XIV went negative early on but then joined the party and closed solidly in the green.

Low volume continues to characterize the action over the last 2 weeks = few sellers.

The rally was board based and across all sectors and the only caveat is that we are now firmly in overbought territory. However, this condition hasn't stopped the markets at previous such junctures from breaking out to substantially higher levels and given the usual end of month push we may not see any meaningful pullback until next week.

Wednesday, May 28, 2014

XIV Pause....5.28.14

The markets closed in the red today but only modestly so. As we approach the end of the month cusp this may simply be a setup for the usual bullish pop. There was a slight change of leadership as XLU surged and XLF faltered. The markets were actually quite choppy as can be seen from the SPY VIXEN.

Also note how XIV has gone its own way relative to SPY on the TrendX charts in the right side panel.

As of today's close the M3 Trader is maintaining the XIV,SSO, SPY bullish ranking.

Also note how XIV has gone its own way relative to SPY on the TrendX charts in the right side panel.

As of today's close the M3 Trader is maintaining the XIV,SSO, SPY bullish ranking.

Tuesday, May 27, 2014

XIV Goes Parabolic...5.27.14

It's hard to imagine the slope of XIV's ascent getting any steeper...it's almost vertical at this point...reflecting the apparent strength in the markets as the major indices hit new highs on uber low volume.

So much for yesterday's caveat regarding the M3 short term ALERT...XIV blew the doors off once again today.

A closer look at the markets shows not all sectors are participating with equal vigor but financials and the Qs were leading the pack today and previous bullish periods have been led by this pair so today's odds favor more of the same.

We are approaching overbought levels although strong economic news in terms of housing starts and consumer confidence along with reasons for calm in the Ukraine may push prices higher.

So much for yesterday's caveat regarding the M3 short term ALERT...XIV blew the doors off once again today.

A closer look at the markets shows not all sectors are participating with equal vigor but financials and the Qs were leading the pack today and previous bullish periods have been led by this pair so today's odds favor more of the same.

We are approaching overbought levels although strong economic news in terms of housing starts and consumer confidence along with reasons for calm in the Ukraine may push prices higher.

Monday, May 26, 2014

SPY High...5.26.14

On the other hand......looking back the past 4 years the first part of the week following Memorial Day has been dismal and with a new high in hand there may be some profit taking once volume returns.

Meanwhile, the Mosaic big picture screener maintains a bullish trend although XLE shows signs of pulling back...at least short term.

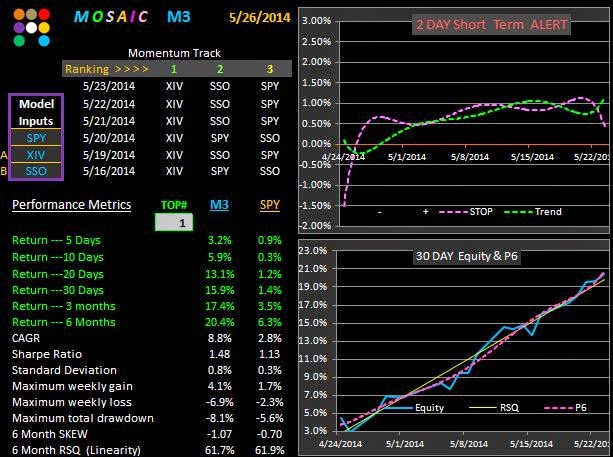

XIV has been on fire for the past 2 weeks as reflected in the XIV, SSO, SPY Trader ( 5 minute and daily bars) and, M3 has been able to book some great returns with XIV in the #1 rank.

M3 fired a Short Term reversal ALERT at Friday's close...another reason to consider lightening up a bit.

(see performance chart below).

Thursday, May 22, 2014

XIV at New High....5.22.14

I'll be on the road today to no post tonight...but early action in XIV has provided an opportunity to compare the weekly long term chart of XIV versus VXX (presumably its inverse). Both are ETNs, so derivatives of futures and options and back in 2010 I suggested that if you made one trade it would be to short VXX and hold forever. Let's see how that played out and how you could have retired off that trade>>>>

VXX is SO BAD they have to keep reverse splitting it just to keep it alive.

A $2000 short on 1/1/2010 would have netted you $1965 as of today.

The beauty of VXX is that it is a short product by design so you don't have to incur the usual restrictions and trading requirements of having a short position.

Meanwhile, here's the comparative XIV chart>>>

VXX is SO BAD they have to keep reverse splitting it just to keep it alive.

A $2000 short on 1/1/2010 would have netted you $1965 as of today.

The beauty of VXX is that it is a short product by design so you don't have to incur the usual restrictions and trading requirements of having a short position.

Meanwhile, here's the comparative XIV chart>>>

Wednesday, May 21, 2014

XIV...AGAIN!!...5.21.14

XIV continues to make headway relative to the indices.

Just check out the daily bar XIV, SSO, SPY trader below>>>>...the action of XIV is truly unique from a historical perspective.

The VIX itself crumbled 8% today, a completely out of scale reaction to the slow pace of SPY gains.

With VIX now below 12 a lot of traders are pondering what's next...how low can the VIX decline before we see a reversal and a day of reckonng? The FED's usual double-speak pronouncements today also helped boost the markets into the close.

Just check out the daily bar XIV, SSO, SPY trader below>>>>...the action of XIV is truly unique from a historical perspective.

The VIX itself crumbled 8% today, a completely out of scale reaction to the slow pace of SPY gains.

With VIX now below 12 a lot of traders are pondering what's next...how low can the VIX decline before we see a reversal and a day of reckonng? The FED's usual double-speak pronouncements today also helped boost the markets into the close.

Tuesday, May 20, 2014

The XIV Surprise.....5.20.14

While SPY has been wobbling lately the XIV (VIX inverse) has been enjoying a steady rise. A quick look at the XIX/ XIV VIXEN chart (XIV is yellow line) illustrates the negatively correlated relationship of these 2 issues (most of the time). If you had no other data inputs and just glanced at this chart you would (I suspect) most likely be inclined to say XIV still has room to grow. (the heavy blue line is the VIX 8 day MA).

Below the VIX/XIV chart shows the latest M3 returns and charts how XIV has indeed outperformed SPY by a considerable margin.

Note that we had a P6 equity cross on the 19th as well as a 2 Day ALERT cross..

Below the VIX/XIV chart shows the latest M3 returns and charts how XIV has indeed outperformed SPY by a considerable margin.

Note that we had a P6 equity cross on the 19th as well as a 2 Day ALERT cross..

Monday, May 19, 2014

Monday Starts Green....5.19.14

Computer problems over the weekend prevented me from posting but we're up and running again after several hours of frustrating keyboard time on Saturday and Sunday.

After a quick drop at the open today (Monday) the markets have turned green (the DOW is still slightly in the red) but the TICK is trending negative so it's anybody's guess at this point. More at the end of the day.

Continuing our look at investment alternatives, here's a pairs perspective on several countries versus their currencies. It would logically seem that there's a high correlation between a country's economy and its currency although factors such as debt, trade balance, GNP, etc, etc, have to be factored into that equation.

While some country/currency pairs appear to provide only a marginal trading edge there are a few that sparkle like nuggets and here are three: Japan, Australia and Europe.

These are not optimized settings and application of some basic money management time stops can improve returns in all examples shown.

NOTE >>>> MO2 pairs algorithms are somewhat different from Market Rewind and the results may vary for those who try to recreate these results on the ETFP platform.

After a quick drop at the open today (Monday) the markets have turned green (the DOW is still slightly in the red) but the TICK is trending negative so it's anybody's guess at this point. More at the end of the day.

Continuing our look at investment alternatives, here's a pairs perspective on several countries versus their currencies. It would logically seem that there's a high correlation between a country's economy and its currency although factors such as debt, trade balance, GNP, etc, etc, have to be factored into that equation.

While some country/currency pairs appear to provide only a marginal trading edge there are a few that sparkle like nuggets and here are three: Japan, Australia and Europe.

These are not optimized settings and application of some basic money management time stops can improve returns in all examples shown.

NOTE >>>> MO2 pairs algorithms are somewhat different from Market Rewind and the results may vary for those who try to recreate these results on the ETFP platform.

Thursday, May 15, 2014

Bad to Worse to Better.....5.15.14

An ugly start to the day that only got worse with Walmart's sad earnings report and a weak home building market at least partially responsible (recall previous post on shorting the home builders by Gundlach).

The good news is that the afternoon saw a decent recovery rally in many issues although financials were clearly lagging, bonds were booming and utilities (XLU) buying was in evidence.

Friday will likely be volatile as expiration dynamics transpire and, coupled with the propensity for Friday's to be down days, the odds are with the bears.

M3 went to cash this morning and we're now in a wait and see mode.

Next month the new Mosiac format will be operational and offered on a monthly subscription basis.

The service will provide live M3 signals both at the market open and 20 minutes prior to the market close for 3 differnt M3 models. More details later this weekend.

The good news is that the afternoon saw a decent recovery rally in many issues although financials were clearly lagging, bonds were booming and utilities (XLU) buying was in evidence.

Friday will likely be volatile as expiration dynamics transpire and, coupled with the propensity for Friday's to be down days, the odds are with the bears.

M3 went to cash this morning and we're now in a wait and see mode.

Next month the new Mosiac format will be operational and offered on a monthly subscription basis.

The service will provide live M3 signals both at the market open and 20 minutes prior to the market close for 3 differnt M3 models. More details later this weekend.

Wednesday, May 14, 2014

Pullback Predicted by M3 Volatility Sort...5.14.14

As expected in yesterday's post all the major indices pulled back today on moderate volume. The big surprise was that XIV ...our M3 leader...actually rose throughout much of he day before dramatically collapsing in the late afternoon session.....see below.

Prospects for tomorrow are muted. May options expire the end of this week and we can expect the usual volatility surge as traders rollout, rebalance and attempt to drive prices to pin strikes. If you think that doesn't happen...think again.

Finally, see the new M3 volatility based sort below that combines volatility indices as well as ETN products tradeable in the same fashion as ETFs and stocks. This is just a little research project based on the thinking that if we examine the wider spectrum of volatility metrics related to SPY we may get a clearer consensus of how volatility products are likely to perform in the short term (<7 days in this case).

Prospects for tomorrow are muted. May options expire the end of this week and we can expect the usual volatility surge as traders rollout, rebalance and attempt to drive prices to pin strikes. If you think that doesn't happen...think again.

Finally, see the new M3 volatility based sort below that combines volatility indices as well as ETN products tradeable in the same fashion as ETFs and stocks. This is just a little research project based on the thinking that if we examine the wider spectrum of volatility metrics related to SPY we may get a clearer consensus of how volatility products are likely to perform in the short term (<7 days in this case).

Tuesday, May 13, 2014

Bull Run Prospects & SPY / Currency Pairs project continued......5.13.14

Note how the short term indicator (blue line) in the SPY TrendX right side panel has turned upslope (it was downslope yesterday. BUT..also note that the TrendX is now at upper level resistance so our expectation is for a momentum slowdown or reversal in the near term.

This suspicion was confirmed by today's M3 cross of the Equity line and the P6 (not shown) as well as the afternoon cratering of the XIV (3rd chart below).

This suspicion was confirmed by today's M3 cross of the Equity line and the P6 (not shown) as well as the afternoon cratering of the XIV (3rd chart below).

Continuing with our SPY/currency pairs study... here's how FXC (canadian dollor), FXA (Australia dollar) and FXY (yen) work out when paired against SPY. Note that FXC and FXY are actually divergent with SPY while FXE (shown last night) and FXA are convergent. Either way, these pairs generate a nice revenue stream.

Later this week we examine a completely different paradigm and show how various country/currency pairs can also generate a nice high probability and low risk return.

Monday, May 12, 2014

SPY/FXE Trade & More.....5.12.14

A quick look at the right side panel says it all....per Friday's close the XIV TrendX is soaring and SPY is showing that there's still room to the upside before overhead resistance is hit.

M3 is flashing the bullish XIV, SSO, SPY ranking sequence and the short term ALERT is green. The only negative consideration for now is that volume is thin as the DOW hits a new high mid day.

There's a lot going on over on the Mosaic site including the addition of a free (for now) FX TrendX charts tab link for the Euro, the Australian dollar and the pound. (see below)

Our crack research team has been testing a variety of alternate investment scenarios and one of the most promising uses the MOSAIC enhanced Market Rewind pairs platform to trade a basket of currency ETFs when paired against SPY.

Now you could always just trade the FX markets (this generally works best for insomniacs or others who have irregular sleep patterns) but our goal is to develop live signals that can be used in the US markets during normal trading hours and which will capture the current trend and momentum of various currencies.

These are not daytrades but seek to trade with a maximum 10 day holding period.

Here's how the SPY/FXE looks over the past 6 months. The model has only been vested for 50 days out of the last 180 so we spend most of the time on cash waiting for the momentum divergence to set up.

Tomorrow we'll show how this set up works on the yen, the Australia dollar and the Canadian dollar.

M3 is flashing the bullish XIV, SSO, SPY ranking sequence and the short term ALERT is green. The only negative consideration for now is that volume is thin as the DOW hits a new high mid day.

Our crack research team has been testing a variety of alternate investment scenarios and one of the most promising uses the MOSAIC enhanced Market Rewind pairs platform to trade a basket of currency ETFs when paired against SPY.

Now you could always just trade the FX markets (this generally works best for insomniacs or others who have irregular sleep patterns) but our goal is to develop live signals that can be used in the US markets during normal trading hours and which will capture the current trend and momentum of various currencies.

These are not daytrades but seek to trade with a maximum 10 day holding period.

Here's how the SPY/FXE looks over the past 6 months. The model has only been vested for 50 days out of the last 180 so we spend most of the time on cash waiting for the momentum divergence to set up.

Tomorrow we'll show how this set up works on the yen, the Australia dollar and the Canadian dollar.

Saturday, May 10, 2014

Signals Remain Positive...5.10.14

Despite the narrow range behavior of SPY the markets were able to book some modest gains and M3 has a positive signal as XIV has been able to sustain a top ranking for days.

Check on Traderfeed's recent post on the state of the Russell and how that has played out in the past.

And, the FSC composite momentum look at the markets also shows a fading of the short term red buttons, supporting a bullish situation...at least short term. (as a cautionary note check the prevailing high short interest in some of the bigger momentum ETFs, including the EURO...more on that in a later post)

Check on Traderfeed's recent post on the state of the Russell and how that has played out in the past.

And, the FSC composite momentum look at the markets also shows a fading of the short term red buttons, supporting a bullish situation...at least short term. (as a cautionary note check the prevailing high short interest in some of the bigger momentum ETFs, including the EURO...more on that in a later post)

Thursday, May 8, 2014

SPY Negative Outflow for the Year....5.8.14

If you don't know about Dr. Brett Steenbarger you should put him on your daily check list. Here's a guy who was advisor to one of the largest global hedge funds and his insights on trader behavior and trading setups can only improve your trading skills and hopefully bottom line. He was out of circulation for a few years while acting in his advisory role but he's back and sharing his nuggets of knowledge with the blogosphere once again. Well worth your time for a daily wakeup, IMHO.

Following my comments yesterday Brett notes that since he first of the year SPY has seen net outflow,

which is actually something to be concerned about given the odds of a seasonal pullback and the net outflow of almost $ 4 Billion from mutual funds last month (although why anybody would have money parked in a mutual fund continues to mystify me...especially when there are so many liquid ETFs that can accomplish the same sector mining without the multiple flaws intrinsic to mutual funds.)

Today's rally fizzled,,especially in the Qs although we did see some buying strength into the close.

XLE saw red for the first time in a LONG while. The surprise was that XLU was similarly weak.

This weakness may be tried to the unlikely situation that XLU has been acting more like a momentum ETF than a safe haven index and it may be time for that momentum to fade.

Note the divergence of the SPY and XIV TrendX charts in the right side panel.

Our short term M3 ALERT is signalling cash.

Following my comments yesterday Brett notes that since he first of the year SPY has seen net outflow,

which is actually something to be concerned about given the odds of a seasonal pullback and the net outflow of almost $ 4 Billion from mutual funds last month (although why anybody would have money parked in a mutual fund continues to mystify me...especially when there are so many liquid ETFs that can accomplish the same sector mining without the multiple flaws intrinsic to mutual funds.)

Today's rally fizzled,,especially in the Qs although we did see some buying strength into the close.

XLE saw red for the first time in a LONG while. The surprise was that XLU was similarly weak.

This weakness may be tried to the unlikely situation that XLU has been acting more like a momentum ETF than a safe haven index and it may be time for that momentum to fade.

Note the divergence of the SPY and XIV TrendX charts in the right side panel.

Our short term M3 ALERT is signalling cash.

Wednesday, May 7, 2014

A Bounce or Just FED Fluff?...5.7.14

It looked like a solid rally from oversold levels but not everybody joined the party. The Qs were actually down over 1% at one point in the day and managed to close in the red despite strong intraday turnarounds by tech stalwarts like MSFT.

Volume was also suspicious today and looking at the bigger picture SPY has traded in a narrow 4% range for the past 12 weeks...the tightest range in the past 5 years.

Just to get the anxiety factor ratcheted up a little bit it should noted that last month saw a $3.98 Billion outlflow from mutual funds...adding to concerns that there's a lot of smoke and mirrors holding the markets up.

What's a guy to do?

For now we'll follow our game plan and rigorously enforce the money management stops.

Mosaic is also pursuing another safety valve...trading the FX (forex) markets with M3 and a new variant to be known at Mosaic FX.

I've incorporated several of the FX pairs in the freestockcharts matrix as the product moves forward.

Keep in mind that the freestockcharts are live 24 hours a day...just like the FX markets.

As we move forward the technical indicators for the FX pairs will refined to reflect the lower beta and longer cycle which most FX pairs exhibit.

Volume was also suspicious today and looking at the bigger picture SPY has traded in a narrow 4% range for the past 12 weeks...the tightest range in the past 5 years.

Just to get the anxiety factor ratcheted up a little bit it should noted that last month saw a $3.98 Billion outlflow from mutual funds...adding to concerns that there's a lot of smoke and mirrors holding the markets up.

What's a guy to do?

For now we'll follow our game plan and rigorously enforce the money management stops.

Mosaic is also pursuing another safety valve...trading the FX (forex) markets with M3 and a new variant to be known at Mosaic FX.

I've incorporated several of the FX pairs in the freestockcharts matrix as the product moves forward.

Keep in mind that the freestockcharts are live 24 hours a day...just like the FX markets.

As we move forward the technical indicators for the FX pairs will refined to reflect the lower beta and longer cycle which most FX pairs exhibit.

Tuesday, May 6, 2014

Weakness Persists....5.6.14

Selling persisted throughout today's session, closing at or near daily lows. The market's somewhat ambivalent position on selling last week is now solidifying...to the downside.

I hope some of you have taken advantage of the free stock charts site and set up a real time watchlist to help track any active or potential positions.

For this update I've added the Latest Short Interest column which reveals the high level of negative sentiment in IYR, XLU, XLV and XRT. The moving average columns also indicate that the maximum bearish position has been achieved with SH and TLT in the top momentum slots, while IYR,QQQ,SPY, XIV and XLV have become the top momentum movers to the downside.

Using this matrix is like having a second set of eyes examining market flux and dynamics and it can be used in conjunction with M3 or M6 to confirm momentum rankings and/or to provide another money management stop completely different than the M3 auto-stop or the P6.

A look at today's SPY TrendX and Vixen charts shows the strength and persistance of the downtrend. Although XIV was actually in the green during the early session, the fact that VIX was also green at the same time should always serve as a caution that such conditions cannot be sustained. In this case, as expected, XIV broke to the red and followed SPY weakness.

I hope some of you have taken advantage of the free stock charts site and set up a real time watchlist to help track any active or potential positions.

For this update I've added the Latest Short Interest column which reveals the high level of negative sentiment in IYR, XLU, XLV and XRT. The moving average columns also indicate that the maximum bearish position has been achieved with SH and TLT in the top momentum slots, while IYR,QQQ,SPY, XIV and XLV have become the top momentum movers to the downside.

Using this matrix is like having a second set of eyes examining market flux and dynamics and it can be used in conjunction with M3 or M6 to confirm momentum rankings and/or to provide another money management stop completely different than the M3 auto-stop or the P6.

A look at today's SPY TrendX and Vixen charts shows the strength and persistance of the downtrend. Although XIV was actually in the green during the early session, the fact that VIX was also green at the same time should always serve as a caution that such conditions cannot be sustained. In this case, as expected, XIV broke to the red and followed SPY weakness.

Friday, May 2, 2014

A Snapshot of Market Momentum...5.2.14

The markets remain range bound and most of today's gains or losses are not very useful from a technical standpoint in forecasting the next likely big move...which is likely.

Here's a snapshot of a screen you can easily set up at www.freestockcharts.com , the site that drives the Mosaic TrendX and Vixen charts in real time.

You can add stocks or ETFs as a watctlist and then set up columns of metrics to examine performance of said watchlist on a day to day basis. This watchlist includes VEGA, GAMMA and M3 components to examine momentum on both sides of the Long/Short spectrum.

There's also a column called Volume Buzz that shows how daily volume is acting....HINT..pay attention to the big number issues.

The shown columns include crossing up and down thru the 3 day moving average, above and below the 3 day moving average and above and below the 7 day moving average. You can make these columns any values you choose, adjust colors, add other indicators, etc. AND ITS FREE.!

What's weird with the current market?

The 3 highest rated issues are SH, XLE and XIV.

The 3 lowest rated issues are IYT, QQQ and SPY......showing the confused and unaligned situation in the markets.

The position of these rankings also argues for an M3 type of market analysis, which combines both a volatility (XIV) and equity (SPY) component. More on this argument in further posts.

Here's a snapshot of a screen you can easily set up at www.freestockcharts.com , the site that drives the Mosaic TrendX and Vixen charts in real time.

You can add stocks or ETFs as a watctlist and then set up columns of metrics to examine performance of said watchlist on a day to day basis. This watchlist includes VEGA, GAMMA and M3 components to examine momentum on both sides of the Long/Short spectrum.

There's also a column called Volume Buzz that shows how daily volume is acting....HINT..pay attention to the big number issues.

The shown columns include crossing up and down thru the 3 day moving average, above and below the 3 day moving average and above and below the 7 day moving average. You can make these columns any values you choose, adjust colors, add other indicators, etc. AND ITS FREE.!

What's weird with the current market?

The 3 highest rated issues are SH, XLE and XIV.

The 3 lowest rated issues are IYT, QQQ and SPY......showing the confused and unaligned situation in the markets.

The position of these rankings also argues for an M3 type of market analysis, which combines both a volatility (XIV) and equity (SPY) component. More on this argument in further posts.

Thursday, May 1, 2014

Waiting on the Jobs Report..5.1.14

It was actually a fairly neutral day with a surge into the close as some traders bet the jobs report on Friday won't really be as bad as many have predicted. Other than that the major indices just glided along in a rather surprising fashion...some of the indices didn't fluctuation more than a few cents over extended periods of the session. There's no clear sector leadership at this point and based on a few intraday dips into the red it would appear that not everyone is betting on the upside.

The XIV is limping along in the green and appears to be losing momentum.

David Einhorn (Greenlight Capital) thinks the next tech bubble is in the wings and the current lagging behavior of the Qs argues in his favor. Coupled with the Sell in May mantra popping up variously on many trading blogs this is probably not a time to bet large.

The XIV is limping along in the green and appears to be losing momentum.

David Einhorn (Greenlight Capital) thinks the next tech bubble is in the wings and the current lagging behavior of the Qs argues in his favor. Coupled with the Sell in May mantra popping up variously on many trading blogs this is probably not a time to bet large.

Subscribe to:

Comments (Atom)