Things may be about to get volatile if the new Ponzo risk profile of the SPY is any indication.

Regulars know I'm very risk adverse and the Mosaic models have done a great job of minimizing drawdowns while still keeping ahead of the S&P so far.

A good friend of mine who advises many hedge funds and is the recognized guru on target date funds is now projecting a 20% pullback in the S&P sometime this year. Just keep it in mind.

I keep harping about capital preservation and I firmly believe we may be in for a rocky ride this year...sooner or later. Here's a recent clip from the President of the NAAIM....National Association of Active Investment Managers...its members are arguably some of the smartest guys in the room with billions and billions under active (as opposed to passive) management.

Then go grab a stiff drink and look at the Ponzo forecast below....we have not seen this level of risk divergence in the model for the 2 years I have been tracking it.

Saturday, February 28, 2015

Thursday, February 26, 2015

Mixed Signals...02.26.15

The SPY TrendX is rolling over (right side panel) but the SPY/UPRO/XIV alignment (lower chart) remains in tact. The markets are technically oversold and have been for several days. It;s unclear what the impetus might be for further gains at these levels but the markets never fail to surprise so we just need to follow the risk plan and play small for now. We had a new signal on LM at the close.

Wednesday, February 25, 2015

MO2 Pairs SPY/UPRO...02.25.15

Following yesterday's post on the SPY/SH pair here's a look at the current status of the SPY/UPRO pair. This model is also in cash for the time being and the A chart realtive price change looks different than the SPY/SH but that's because this is a convergent pair. What's interesting is the concurrence of the trades of record,....they are exactly the same using a 12 day fixed time stop..

This alignment is encouraging for the reliability of the signal as for now we're just in a wait and see model until the next signal fires. Given the current bullish environment it will likely be a short signal for SPY on SPY/SH and a short signal on UPRO on SPY/UPRO.

This alignment is encouraging for the reliability of the signal as for now we're just in a wait and see model until the next signal fires. Given the current bullish environment it will likely be a short signal for SPY on SPY/SH and a short signal on UPRO on SPY/UPRO.

Tuesday, February 24, 2015

MO2 SPY/SH Pair Status...02.24.15

So why hasn't the pairs model fired a signal recently? That question has been asked by a few readers and here's what's going on over at MO2 central. The apirs signals are based on the Z-score algorithm which looks for disparities in the standard deviation of the target pair. We complicate the matter a bit by examining a divergent pair based on beta whereas a normal application of the program would be to look at convergent paits such as SPY and UPRO. (see tomorrow's post) We can see from chart A that there are clearly periods when the standard deviations converge and those are out signal points, but we are currently not in such an environment presently.

Monday, February 23, 2015

Good for a Laugh...02.23.15

A marginally down day today based on slow news ....at least according to Briefing.com.

Meanwhile we're seeing some technical deterioration in the majors and the SPY TrendX is in imminent danger of rolling over. The shining light for tomorrow is the FED, whose incoherent pronouncements are typically received with unbridled enthusiasm.

The SPY VDX profiled last week has hit new highs but is looking more and more risk prone. > >

Meanwhile we're seeing some technical deterioration in the majors and the SPY TrendX is in imminent danger of rolling over. The shining light for tomorrow is the FED, whose incoherent pronouncements are typically received with unbridled enthusiasm.

The SPY VDX profiled last week has hit new highs but is looking more and more risk prone. > >

Sunday, February 22, 2015

A Few Changes...02.22.15

Going forward there will be two changes in the daily updates:

1. We will use the expanded Lazy Man model (M3 LM) with SSO and SDS (SPY ultras long and short). The reason for this is simple. Our goal is to maximize gains and minimize risk. Comparing the returns for the 3 input and 5 input variations of LM we see that our maximum exposure is very similar between the models but the % returns are considerably different. As an alternative to trading SSO and SDS when they are raked #1 simply trade the #2 ranked position...the net returns will be almost exactly half of those using the ultras. Another advantage of using the ultras is that when they cease to be #1 ranked, either long or short, its generally a pretty good early warning sign that current trend momentum is waning and/or about to reverse.

2. Per our survey results only M3+ results will be posted although I'll continue to track M3 and post any divergence in the M3+ and M3 signals.

The jury is still out on the value of the 6:50 AM signal post. It showed little value this week as all the morning dips were reconciled to the upside by the close. We'll give it another week or so before deciding to hold or fold these posts.

Here's the classic LM with 3 inputs>

And the version that includes SSO and SDS>

1. We will use the expanded Lazy Man model (M3 LM) with SSO and SDS (SPY ultras long and short). The reason for this is simple. Our goal is to maximize gains and minimize risk. Comparing the returns for the 3 input and 5 input variations of LM we see that our maximum exposure is very similar between the models but the % returns are considerably different. As an alternative to trading SSO and SDS when they are raked #1 simply trade the #2 ranked position...the net returns will be almost exactly half of those using the ultras. Another advantage of using the ultras is that when they cease to be #1 ranked, either long or short, its generally a pretty good early warning sign that current trend momentum is waning and/or about to reverse.

2. Per our survey results only M3+ results will be posted although I'll continue to track M3 and post any divergence in the M3+ and M3 signals.

The jury is still out on the value of the 6:50 AM signal post. It showed little value this week as all the morning dips were reconciled to the upside by the close. We'll give it another week or so before deciding to hold or fold these posts.

Here's the classic LM with 3 inputs>

And the version that includes SSO and SDS>

Friday, February 20, 2015

VDX Reverse View...02.20.15

OP EX Friday's tend to close poorly with subsequent buying on the following Monday and/or Tuesday. Just something to keep in mind in considering today's dynamics.

Meanwhile I've been running some studies using the VDX (last 2 days posts) and I think a contrarian view of Ponzo concept may have some merit. Ponzo tactic is to buy high and sell higher. My thinking is buy low and sell higher and I've reformatted the VDX algorithms and charts according. I'll post some more VDX updates this weekend but for now this technical overlay appears to do a good job detecting buying (and selling) opportunities.

Meanwhile I've been running some studies using the VDX (last 2 days posts) and I think a contrarian view of Ponzo concept may have some merit. Ponzo tactic is to buy high and sell higher. My thinking is buy low and sell higher and I've reformatted the VDX algorithms and charts according. I'll post some more VDX updates this weekend but for now this technical overlay appears to do a good job detecting buying (and selling) opportunities.

Thursday, February 19, 2015

SPY vs. XIV Using the VDX...02.19.15

Following up on yesterday's VDX post here's an expanded look at what can be done with the VDX to examine relative performance and volatility among various issues...in this case SPY vs. XIV.

The VDX charts make an understanding of XIV's failure to launch easier to see and that we're clearly at an important juncture in XIV's future at this point.

The VDX charts make an understanding of XIV's failure to launch easier to see and that we're clearly at an important juncture in XIV's future at this point.

Wednesday, February 18, 2015

Overbought Creep...02.18.15

Ther SPY TrendX in the right side panel says it all. We're creeping into overbought levels and we should expect a pullback sooner or later. Based on this morning's action it may be sooner.

Since I'm always on the lookout for tools to make your investing more interesting and hopefully more profitable here's some from the desk of Peter Ponzo, the Canadian economist who created the Time Machine we update every 2 weeks.

http://www.financialwisdomforum.org/gummy-stuff/EMA.htm

Of course I've added several minor tweaks but the net effect is actually easy to use and quite reliable on a longer term basis.

Since I'm always on the lookout for tools to make your investing more interesting and hopefully more profitable here's some from the desk of Peter Ponzo, the Canadian economist who created the Time Machine we update every 2 weeks.

http://www.financialwisdomforum.org/gummy-stuff/EMA.htm

Of course I've added several minor tweaks but the net effect is actually easy to use and quite reliable on a longer term basis.

Tuesday, February 17, 2015

A Pause in Momentum...02.17.15

Its typical that the markets pause or marginally reverse after 3 up days and that's what we witnessed today egged along by the continuing uncertainty of a Greek bailout solution, a laughable Ukraine truce and the usual concerns about what the FED might do.

Tomorrow should give a stronger indication of whether new highs are likely.

Tomorrow should give a stronger indication of whether new highs are likely.

Sunday, February 15, 2015

Fuel for the Bulls...02.15.15

Here's a look at Friday's close status for 2 divergent pairs (SPY/SH and XIV/VXX) and one convergent pair (SPY/UPRO)...one of our favorite pairs that's performed well over the past year although only the past 6 months returns are shown. If you examine the 3 studies carefully the net conclusion is that we still have breathing room to the upside before a potential reversal kicks in.

This conclusion is further supported by the SPY TrendX....right side panel.

We've been burned before in the face of bullish odds by negative news surprises but the odds for now are clearly to the upside.

This conclusion is further supported by the SPY TrendX....right side panel.

We've been burned before in the face of bullish odds by negative news surprises but the odds for now are clearly to the upside.

Thursday, February 12, 2015

XIV Kicks Into Sync...02.12.15

Apparent Russia-Ukraine ceasefire and on-going hope for a Greek bailout goosed the markets today and the big tehnical news was the behavior of XIV, which finally assumed its beta position relative to SPY and UPRO that has been missing for over a month.(see below). If the paradigm can hold together there's potentially huge gains ahead for XIV positions. Of course. things could fall apart quickly in the face of discouraging news but at least we've taken one step forward.

Wednesday, February 11, 2015

Market on Hold...02.11.15

Greece continues to hold market momentum captive...apparently it s big deal. In the meantime we had a few false breakouts today but ultimately ended flat. APPLE propped up the Qs to finish in the green.

Tuesday, February 10, 2015

SPY Pairs Signals...02.10.15

As we struggle to find some traction in the current market milieu I looked back at the MO2 Pairs module for some possible guidance. The defaults are set to a maximum hold time of 12 days.

Here are the results of today's midday run of SPY / SH.

The model is currently OUT/OUT.. meaning cash but the longer term results reinforce our contention that the markets are and have been in a state of churn.

Once MO2 gives a new signal that may provide a higher odds threshold for new positions.

I'll add a morning update of MO2 SPY/SH pair to the new AM signal on the M3 login page starting tomorrow just to add another technical viewpoint of market dynamics..

Here are the results of today's midday run of SPY / SH.

The model is currently OUT/OUT.. meaning cash but the longer term results reinforce our contention that the markets are and have been in a state of churn.

Once MO2 gives a new signal that may provide a higher odds threshold for new positions.

I'll add a morning update of MO2 SPY/SH pair to the new AM signal on the M3 login page starting tomorrow just to add another technical viewpoint of market dynamics..

Monday, February 9, 2015

Churn and Burn...02.09.15

Frustrating see-saw markets continue to be the dominate theme. I've posted about the lack of trend and momentum conviction previously and last night's post by Rob Hanna over at Quantifiable Edges (subscription service) illustrated that many quants share my perspective on the current difficult trading milieu.

Let me reinforce Rob's comments and repeat my previous strategy for trading this environment.... trade small or stay in cash.

Yes, we do have some new improvements to the M3 models but keep in keep in mind that P6 remains below the RSQ line in both models M3+ and LM and it has always been my contention that these are indicators that the trading paradigm is unstable and unreliable.

Eventually the technicals will kick back into line and a tradable trend will develop either up or down...until then caution and patience are critical...as is executing money management stops, either the defaults or discretionary, in order to minimize drawdowns.

Let me reinforce Rob's comments and repeat my previous strategy for trading this environment.... trade small or stay in cash.

Yes, we do have some new improvements to the M3 models but keep in keep in mind that P6 remains below the RSQ line in both models M3+ and LM and it has always been my contention that these are indicators that the trading paradigm is unstable and unreliable.

Eventually the technicals will kick back into line and a tradable trend will develop either up or down...until then caution and patience are critical...as is executing money management stops, either the defaults or discretionary, in order to minimize drawdowns.

Saturday, February 7, 2015

The XIV Conundrum...02.06.15

OK market party goers, that was a lousy Friday but we avoided being stopped out of our SPY and SSO positions and Monday's picture does have a bullish technical edge.

XIV meanwhile, which should be displaying a beta of between 4.5 and 6 has been a dismal performer of late as a quick look at the XIV premium chart reveals (% change in XIV measured against SPY).

If the bulls are going to gain any traction the XIV premium needs to get going upslope. meaning a lower VIX and a smaller intraday volatility range. Of course for now there's nothing proactive to be done except track these indicators and apply our risk management accordingly.

The new M3 login password will go into effect Sunday night around 6 PM PST.

It has been emailed to all active subscribers. If you haven't received yet, let me know.

XIV meanwhile, which should be displaying a beta of between 4.5 and 6 has been a dismal performer of late as a quick look at the XIV premium chart reveals (% change in XIV measured against SPY).

If the bulls are going to gain any traction the XIV premium needs to get going upslope. meaning a lower VIX and a smaller intraday volatility range. Of course for now there's nothing proactive to be done except track these indicators and apply our risk management accordingly.

The new M3 login password will go into effect Sunday night around 6 PM PST.

It has been emailed to all active subscribers. If you haven't received yet, let me know.

Thursday, February 5, 2015

New Model on Monday.....02.05.15

Thanks for taking the user survey...the results are almost unanimous with all but one user favoring LM and M3+.

As as result, starting Monday the new models will be posted and, in lieu of the morning BUZZ, there will be an overnight update on the LM and M3+ signals for the next day at 6:50 +/- AM PST just to set the tone for the day. There will still be the 12:45 PM update before the close.

M3+ reflects considerable research and the momentum algorithms are more refined and risk tuned than the M3 version. Given the risk environment that is likely to prevail in the coming months this model should help keep us on the right side of the volatility markets.

A new M3 password will be emailed out this weekend.

Here are a few more details on M3+....... the results with and without the limit stops.

The stops have fired 12 times in the past 6 months

First, with no stops....

Then with limit stops.

As as result, starting Monday the new models will be posted and, in lieu of the morning BUZZ, there will be an overnight update on the LM and M3+ signals for the next day at 6:50 +/- AM PST just to set the tone for the day. There will still be the 12:45 PM update before the close.

M3+ reflects considerable research and the momentum algorithms are more refined and risk tuned than the M3 version. Given the risk environment that is likely to prevail in the coming months this model should help keep us on the right side of the volatility markets.

A new M3 password will be emailed out this weekend.

Here are a few more details on M3+....... the results with and without the limit stops.

The stops have fired 12 times in the past 6 months

First, with no stops....

Then with limit stops.

Wednesday, February 4, 2015

Robots Skew the Game....02.04.15

After see-sawing off and on the pivot for most of the day we finally got a channel break to the upside in the last 60 minutes and it looked like we were destined for R1 or better by day's end.

THEN....the market demonstrated Murphy's Law as the robots kicked in and wiped out the day's gains in twenty minutes with over 20% of the day's total volume. That was a freight train you did not want to be standing in front off and lots of stop orders got blown through (not LM and M3s) although we did close our positions via a late minute ALERT thereby avoiding the after hours plunge.

With the robots and algorithmic trading accounting for over 70 % of daily volume (the last 20 minutes today was probably about 90%) it often feels like the deck is stacked against the average retail trader as well as many money managers trading off non-algorithmic daily models.

Just for fun...the answer to last night's final question on JEOPARDY was '"algorithm", derived from the name of a ninth century Arab mathematician. Betcha didn't know that.

Chart courtesy of SCHWAB EDGE platform

THEN....the market demonstrated Murphy's Law as the robots kicked in and wiped out the day's gains in twenty minutes with over 20% of the day's total volume. That was a freight train you did not want to be standing in front off and lots of stop orders got blown through (not LM and M3s) although we did close our positions via a late minute ALERT thereby avoiding the after hours plunge.

With the robots and algorithmic trading accounting for over 70 % of daily volume (the last 20 minutes today was probably about 90%) it often feels like the deck is stacked against the average retail trader as well as many money managers trading off non-algorithmic daily models.

Just for fun...the answer to last night's final question on JEOPARDY was '"algorithm", derived from the name of a ninth century Arab mathematician. Betcha didn't know that.

Chart courtesy of SCHWAB EDGE platform

Tuesday, February 3, 2015

PONZO Update...02.03.15

SInce you asked how the PONZO model for SPY reacted to the recent swoon here's the update.

The forecast is actually a little gloomier for the next 6 months than the last look around so the past 2 days may just have been a warm up for some longer term selling. We'll take it one day at a time with the VIX down almost 9% today but still hovering in the 17-18 range.

The forecast is actually a little gloomier for the next 6 months than the last look around so the past 2 days may just have been a warm up for some longer term selling. We'll take it one day at a time with the VIX down almost 9% today but still hovering in the 17-18 range.

Monday, February 2, 2015

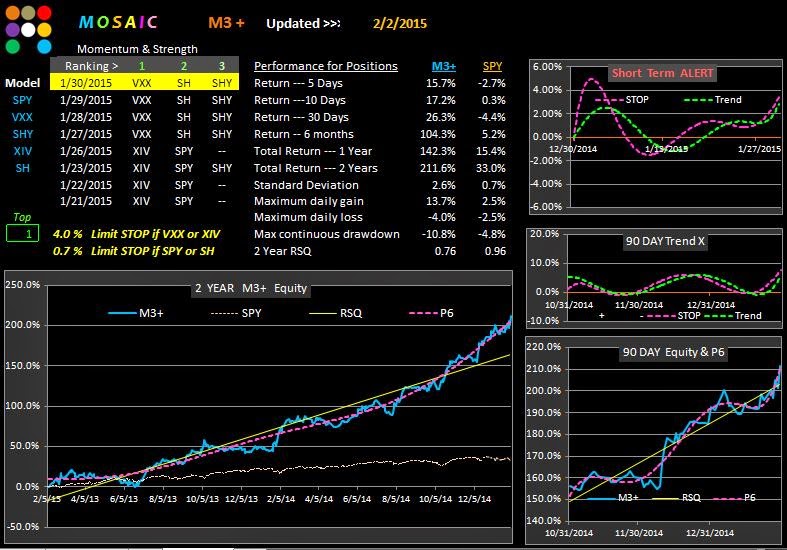

M3+ 2 Year Details....02.02.15

For those that haven't voted please look at the Mosaic Model survey and make your selections.

http://www.mosaicm3.com/survey.html

Per several inquiries here are the results for M3+ over a 2 year timeframe.

So far the survey results have been unanimously in favor of 2 models...voting closes Wednesday.

http://www.mosaicm3.com/survey.html

Per several inquiries here are the results for M3+ over a 2 year timeframe.

So far the survey results have been unanimously in favor of 2 models...voting closes Wednesday.

Sunday, February 1, 2015

Please Select Mosaic Models.....02.01.15

The Mosaic M3 survey for the models to be posted henceforth is now live.

Please select your favorites and SUBMIT.

Via Weebly the survey inputs are anonymous (not sure why that should even matter)

http://www.mosaicm3.com/survey.html

Please select your favorites and SUBMIT.

Via Weebly the survey inputs are anonymous (not sure why that should even matter)

http://www.mosaicm3.com/survey.html

Friday Collapse...01.30.15

Last trading day of the month is bullish over 70% of the time, but not this month.

The majors have all gotten down to oversold levels and XIV looks particularly nasty.

Yin Yang earnings have kept volatility volatile and geo-political instability in Greece, Syria and elsewhere have not helped smooth over the uncertainty factor.

The majors have all gotten down to oversold levels and XIV looks particularly nasty.

Yin Yang earnings have kept volatility volatile and geo-political instability in Greece, Syria and elsewhere have not helped smooth over the uncertainty factor.

Subscribe to:

Comments (Atom)