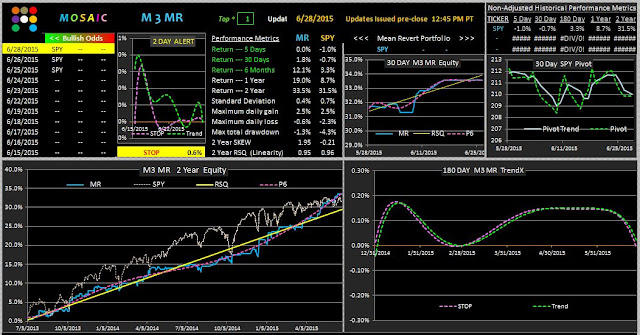

Meanwhile, work on the MR (mean reversion) model continues, with several new features and rather interesting results. Below are a few examples of how MR works. The auto-stop feature has been re-programmed so that the MR algorithm can be turned on or off, enabling us to compare performance metrics for either a momentum based or mean reversion based algorithm with a single click.

The first two panels show a binary model of SPY and SH.

The first panel is the momentum based version, the second is the mean reversion version.

This is more than a bit surprising to me We can make money using either tactic....now we just have to figure out how to filter out the "noise" of low probability trades and focus capital on the higher odds trades. One way we can pursue this line of inquiry is to expand our universe of securuites by adding on outlier that has some momentum and mean reverting behavior relative to SPY. There's a number of possibilities to consider but the following panels show what happens with XLU (utilities) added to the mix.

First as a momentum model and then as a mean reverting version. Note that in the second version I've selected Top 2....meaning we switch to the top 2 ranked issues at each close. This little tweak gives the model the best linearity of the bunch and also the lowest Max drawdown...a metric we are ALWAYS concerned about. Work continues on variations of the MR model with the goal of making it the main workhorse in our stable.