Some positive action from the open today and huge closing volume (40M on the SPY in last 20 minutes and afterhours). After hours SPY was down 50 cents and tomorrow may see additional positive momentum before the Friday bearish bias kicks in. We did bounce off the August lows, which is a relief, but there's really no change in the current downslope trend. Just to complicate things next Tuesday begins earnings season and that may likely set the tone for the coming Fall trend.

The lower chart shown is the NYAD on a daily basis and based on the pattern we've seen over the past 4 months the outlook is neutral to bearish.....for now.

The NYAD is shown below (daily bars)

Wednesday, September 30, 2015

Tuesday, September 29, 2015

SPY Ponzo Forecast and VDX Update.....09.29.15

It looks like we have some positive mojo this morning after a shaky start. As mentioned yesterday we now need to be wary of the dreaded Trap Door setup wherein it appears the market is in a recovering rally mode and then suddenly implodes. The Trap Door has opened many times in the recent past and always with severe pain for the bulls. Keep in mind that on particularly high volume days the percentage of that volume can often reach 80% or more attributable to the HFTs and is not necessarily reflective of authentic accumulation or distribution.

FYI...Goldman just lowered growth projections to -4% with a similar S&P forecast.

Here are the SPY Ponzo and VDX charts as of Monday's close>>>>>>>>

FYI...Goldman just lowered growth projections to -4% with a similar S&P forecast.

Here are the SPY Ponzo and VDX charts as of Monday's close>>>>>>>>

Monday, September 28, 2015

The Good,the Bad and the Ugly....9.28.15

It went from bad to ugly today with no reprieve from the selling....there just weren't any buyers. The NYAD range was .11 to .33 and volume really kicked in the last hour to somewhat stabilize prices. The DJ finished down 312 points and the August lows are a foregone conclusion at this point. The good news? Spy only crumbled to S3. It may be hard to swallow but things could have easily gotten really ugly in that last hour with a drop to S5. The possibility of a Trap Door setup now loom.

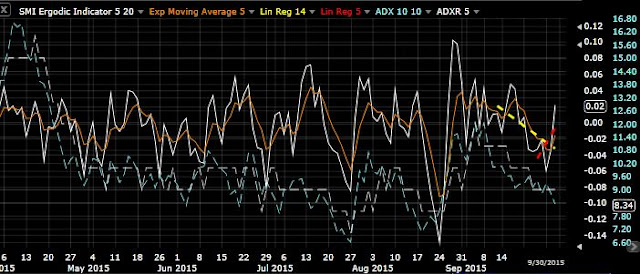

The HFTs were hard at work today per the Ergodics/ADX divergence but the skew was clearly biased to the downside. And the VIX was up 17% to boot. Given the current dangerous trading environment we're favoring cash or some version of the SS delta neutral model which worked out just fine today.

The HFTs were hard at work today per the Ergodics/ADX divergence but the skew was clearly biased to the downside. And the VIX was up 17% to boot. Given the current dangerous trading environment we're favoring cash or some version of the SS delta neutral model which worked out just fine today.

Friday, September 25, 2015

VDX Updates and more....09.25.15

If you haven't been exposed to ZERO Hedge here's his latest on the implosion of the global economies. Not a piece to help you sleep at night if you're bullish but unformed traders tend to make wiser investment decisions. It's the real deal and he's been at it for years. You have to weed through the ads but there's typically more nuggets of actionable trading info here than on most paid sites.

Meanwhile the markets are going nowhere fast and today's stunning reversal caught many traders off guard. Behold the benefit of trailing stops. Some wild HFT action in the last 2 hours.

Meanwhile the markets are going nowhere fast and today's stunning reversal caught many traders off guard. Behold the benefit of trailing stops. Some wild HFT action in the last 2 hours.

Thursday, September 24, 2015

August Lows Ahead?....09.24.15

That's a rhetorical question. Twice a week I join an open line of a couple hundred Schwab traders to review a variety of technical charts and their possible implications for the near term. Lasst Tuesday the moderator asked how many thought we would revisit the August lows. Results were 62% yes.

Today the question was repeated and the results were 91% yes. That's a substantial pop in bearishness. I don't in any way claim that my colleagues and I are any kind of brain trust in market forecasting, I just pass this info along for what its worth. Each new day seems to bring news of slowdown or pullback in some industry or sector. Today it was CAT and the transports (minus the airlines). Each time the bad news hits the markets drop and it doesn't help that global markets including China, Japan, Germany, etc are all in defined downtrends....the worst in 6 years.

So...odds of revisiting the August lows seem pretty good all things considered.

PS. The old reliable TrendX chart (shown below) is now bearish.

Today the question was repeated and the results were 91% yes. That's a substantial pop in bearishness. I don't in any way claim that my colleagues and I are any kind of brain trust in market forecasting, I just pass this info along for what its worth. Each new day seems to bring news of slowdown or pullback in some industry or sector. Today it was CAT and the transports (minus the airlines). Each time the bad news hits the markets drop and it doesn't help that global markets including China, Japan, Germany, etc are all in defined downtrends....the worst in 6 years.

So...odds of revisiting the August lows seem pretty good all things considered.

PS. The old reliable TrendX chart (shown below) is now bearish.

Wednesday, September 23, 2015

Going Nowhere...09.23.15

Another day of market malaise with the HFTs hard at work scalping mils off the spread.

Volume was curiously very low and contrary to the previous few days the action was slow.

How do I gauge the "speed" of the market. Very simple...I just monitor a Schwab EDGE platform tool that records daily highs and daily lows on the NYSE and NASDAQ on a TICK basis. When the markets are moving fast the screen is rolling up in green (new highs) or rolling down in the red (new lows). The speed of the scrolling immediately reveals the current pace of trading.

We ultimately closed dead on the pivot today having previously hit R1 and then S1 intraday.

Once again the setup for tomorrow looks neutral to bearish.

Volume was curiously very low and contrary to the previous few days the action was slow.

How do I gauge the "speed" of the market. Very simple...I just monitor a Schwab EDGE platform tool that records daily highs and daily lows on the NYSE and NASDAQ on a TICK basis. When the markets are moving fast the screen is rolling up in green (new highs) or rolling down in the red (new lows). The speed of the scrolling immediately reveals the current pace of trading.

We ultimately closed dead on the pivot today having previously hit R1 and then S1 intraday.

Once again the setup for tomorrow looks neutral to bearish.

Tuesday, September 22, 2015

SPY Weekly Ponzo Update....09.22.15

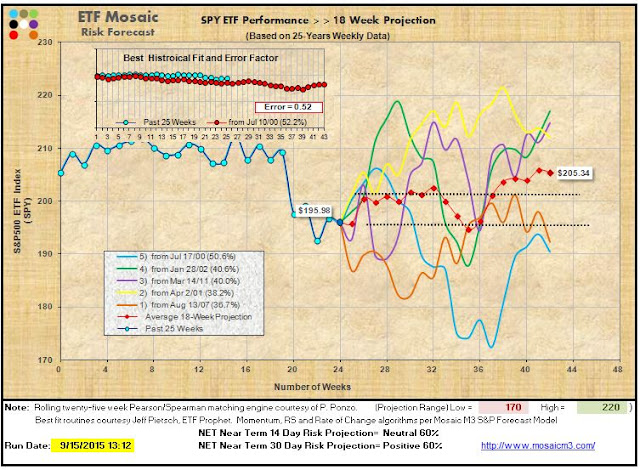

Here's the latest SPY risk forecast as of Monday's close. The best fit scenario is bearish for the rest of the year although Ponzo is predicting some pockets of strength along that path.

Today's action was particularly grim with the NYAD trading range only .10 to .27....the most bearish since the recent flash crash. Obviously investors are still fretting over the FED;s recent lack of action and the continued slide in the Chinese markets.

The fact that the transports (IYT) are under performing SPY is not a good sign for the bulls.

Caution remains the watchword for now and cash is looking attractive.

Today's action was particularly grim with the NYAD trading range only .10 to .27....the most bearish since the recent flash crash. Obviously investors are still fretting over the FED;s recent lack of action and the continued slide in the Chinese markets.

The fact that the transports (IYT) are under performing SPY is not a good sign for the bulls.

Caution remains the watchword for now and cash is looking attractive.

Monday, September 21, 2015

A Volatile Day...09.21.15

Another wild ride on low volume with SPY rotating between the pivot, R1 and the previous close. At one point SPY (and QQQ) were in the red but then sporadic buying kicked in and we closed in the green. With the pendant trading formation today the skew is neutral for tomorrow...although after hours SPY is up 60 cents (just like Friday's after hours session).

The divergence of the Ergodics and the ADX strongly suggest that the HFTs were hard at work today so we shouldn't lend too much credibility to today's green close.

The divergence of the Ergodics and the ADX strongly suggest that the HFTs were hard at work today so we shouldn't lend too much credibility to today's green close.

Sunday, September 20, 2015

VDX Updates...SPY, XLU and FXI...09.20.15

This week's VDX updates show the negative reaction to the FED's lack of action and accompanying dovish comments. Some informed economists who have watched the FED's behavior throughout the whole QE debacle are now suggesting that not only will the FED NOT raise rates in 2015 or 2016 but that there are arguments to be made supporting the FED's commencement of a new QE program.

That would raise a few eyebrows. For now its one day at a time and the forecast for this week is neutral to bearish. The following week we get to the first of the month...typically bullish...but it didn't turn out to be so last month. Historically this is the most bearish week of the year.

That would raise a few eyebrows. For now its one day at a time and the forecast for this week is neutral to bearish. The following week we get to the first of the month...typically bullish...but it didn't turn out to be so last month. Historically this is the most bearish week of the year.

Thursday, September 17, 2015

A Wild Ride...09.17.15

As expected, today's range expanded considerably accompanied by accelerating volume and the HFTs on steroids into the close. Despite the FED's decision to hold steady and what looked like a strong rally to R3 the markets ultimately collapsed in the last hour on increasing volume as the buy the rumor sell the news crowd mentioned yesterday bailed out and ultimately closed the markets in the red...a scenario that was basically unthinkable 60 minutes before the close..

Tomorrow also promises to be volatile as options expire and market makers play games to manipulate prices to target strike pins. The skew is now bearish for Friday.

Tomorrow also promises to be volatile as options expire and market makers play games to manipulate prices to target strike pins. The skew is now bearish for Friday.

Wednesday, September 16, 2015

Bullish Ahead of the FED...09.16.15

Another solid green day although volume was muted and the transports did not join the party. Based on the action yesterday and today it sure looks like odds favor the bulls, regardless of what the FED decides. We need to heed the mantra...buy the rumor, sell the news...just in case it turns out that last 2 days gains have been mostly market manipulation driven by the HFTs...

For my own purposes I favor a delta neutral approach for Thursday's blastoff...a bracket order placed at today's close with equal dollar amounts of SDS and SSO and a fixed limit stop per the M3 site settings. In most cases this is a no maintenance trade but for tomorrow I'll be keeping an eye on it just to make sure the highly probable wild whipsaws don't close me out of both sides of the trade.

Good luck Thursday!

For my own purposes I favor a delta neutral approach for Thursday's blastoff...a bracket order placed at today's close with equal dollar amounts of SDS and SSO and a fixed limit stop per the M3 site settings. In most cases this is a no maintenance trade but for tomorrow I'll be keeping an eye on it just to make sure the highly probable wild whipsaws don't close me out of both sides of the trade.

Good luck Thursday!

Tuesday, September 15, 2015

A Big Hint and the Ponzo Update....09.15.15

It looked like it was going to be another slow, low volume day until midday when caution was thrown to the wind and buying ensued into the close with a dramatic rise of SPY to bullish R3 levels. Volume was below normal although the last 20 minutes saw volume expansion. Tomorrow we'll see how much of today's enthusiasm was late day short covering.....and then comes Thursday. Based on today's action all the paranoid hype about a possible FED hike of .25% may turn out to be just smoke and have little or no effect on the market trend ....which as we mentioned before ....is about to enter the go-go Fall months.

Unfortunately....the SPY PONZO best fit scenario is not so rosy. Keep in mind this scenario is just based on what happened before over the past 25 years when faced with the current 25 week price pattern and no guarantee that the past will repeat.

Unfortunately....the SPY PONZO best fit scenario is not so rosy. Keep in mind this scenario is just based on what happened before over the past 25 years when faced with the current 25 week price pattern and no guarantee that the past will repeat.

Monday, September 14, 2015

Waiting....09.14.15

Good presales reports for APPLE phones were positive but lousy economic productivity reports from China (down 2% overnight) made for a quick pop and drop market that basically went nowhere in slow motion and on very thin volume. SPY finished the day dead on the pivot as the HFT robots were probably responsible for about 85% of today's volume versus the usual 72-77%. We're likely to be range bound tomorrow also and then..as we get closer to the 17th....insiders and those who think they are insiders will make some moves that may betray the FED's thinking and the trend of the next couple months. What's not clear... and I have not yet seen a concise risk analysis offered by anyone... is what sectors will profit and.or suffer depending on the FED's actions. Financials will certainty be hurt if the FED's don't raise and tech is likely to benefit if they don't but other than that I'm not sure how a modest .25% interest rate pop will significantly effect the current market malaise.

Saturday, September 12, 2015

VDX Updates for SPY, FXI and XLU....09.12.15

Friday's turnaround from morning red to closing green (on the high) was surprising and encouraging for the bulls given the sudden surge of volume and buying momentum into the close.

One consideration from that atypical Friday behavior is that investors have already priced in a possible .25% bump by the FED on Thursday and are now ramping up for the usual Fall surge.

Just a thought, but keep in mind that some of the nastiest market swoons have occurred in the Fall so the validity of that argument is subject to caution.

Before I ran the VDX updates for this week I thought they would look bullish based on this week's positive action (traders consensus at the start of the week was 78% bearish). In fact , the charts are ambiguous for our 3 focus ETFs....all are downslope VDI+ but all have upslope P6 .

Going forward it looks like the risk environment is still volatile and will likely remain so until Thursday and possibly beyond, depending on how the markets react to the FED.

One consideration from that atypical Friday behavior is that investors have already priced in a possible .25% bump by the FED on Thursday and are now ramping up for the usual Fall surge.

Just a thought, but keep in mind that some of the nastiest market swoons have occurred in the Fall so the validity of that argument is subject to caution.

Before I ran the VDX updates for this week I thought they would look bullish based on this week's positive action (traders consensus at the start of the week was 78% bearish). In fact , the charts are ambiguous for our 3 focus ETFs....all are downslope VDI+ but all have upslope P6 .

Going forward it looks like the risk environment is still volatile and will likely remain so until Thursday and possibly beyond, depending on how the markets react to the FED.

Thursday, September 10, 2015

Waiting on the FED....09.10.15

Looking at the daily charts suggests the HFT machines have pretty much taken over the markets while actual investors while for the FED's decision on the 17th....which according to the latest Fed Fund numbers...have a probability of 22%......a number which is worth absolutely nothing as far as traders go. While European markets were down the US markets were up...a complete reversal of yesterday's dichotomy....go figure. Technically the charts are a mess and any momentum is likely to be very selective and short term.

Wednesday, September 9, 2015

SPY Ponzo and VDX Updates.....09.09.15

Here's a look at the Ponzo update for SPY as well as yesterday's VDX update on SPY after the big runup. Things are looking a little less scary on the Ponzo range forecast although there's no clear -skew either bullish or bearish going forward. The VDX meanwhile is showing a convergence of the VDI + and - lines which is bullish until proven otherwise (despite today's $4 swing in SPY to the downside. Bottom line >>> Sept 17 remains the 800 lb gorilla that will likely drive momentum for at least a few days and until then we're likely to just see more posturing and intraday scalping.

Tuesday, September 8, 2015

A Strong Day...09.08.15

SPY opened at R3 and held together for the entire day, ultimately closing at R4 and the highs of the day. The Ergodics and ADX were in sync. a bit surprisingly, but the markets liked the overseas markets over the weekend, especially China, creating the stimulus for a relief rally. SPY is now short term overbought and the one worrisome note on today's action was the extremely low volume....only about 70% of normal, whereas the previous 2 weeks have often seen volume 2 or 3 times normal.

Tomorrow we'll see how much of today's surge was short covering but I ultimately expect more volatility ahead of the FED meeting on the 17th...only 7 trading days away.

Tomorrow we'll see how much of today's surge was short covering but I ultimately expect more volatility ahead of the FED meeting on the 17th...only 7 trading days away.

Saturday, September 5, 2015

VDX Updates....09.05.15

Here are the VDX chart updates for SPY, FXI, XLU and QQQ. As we suspected on Thursday Friday did not end on a good note although it was down another 100 points midday so in perspective...it could have been worst. The markets continue to fret about what the FED will do on the 17th. According to the FED Futures, the odds are now 62% the FED will postpone any increase until December (at least)...odds were 47% previous week.

There's probably a great strategy to play the likely volatility explosion that will occur on the 17th, .....I'll try and post at least one prior to that point in history.

The market's are closed Monday...but not in China...so the markets are going to be doubly coiled to spring come Tuesday's open.

FXI (China 25) continues to deteriorate...if it gets down to 32 the bullish odds for a bottom increase.

XLU (utilities) which is normally regarded as a safe haven, is one of the worst performing sectors and we're looking for a swoon down to 38 as a possible entry point.

Finally, QQQ (NAZ 100) is (surprisingly) looking worse than SPY in terms of losing momentum. Keep in mind the just a few big names APPLE, GOOG, MSFT, etc. dominate the capitalization of the Qs and despite the on-going hype APPLE counts on China for 30% of its revenue and, as we mentioned a couple weeks ago, market share there is being captured by a new Chinese (private) phone provider with technical features much superior to APPLE. Just something to keep in mind.

There's probably a great strategy to play the likely volatility explosion that will occur on the 17th, .....I'll try and post at least one prior to that point in history.

The market's are closed Monday...but not in China...so the markets are going to be doubly coiled to spring come Tuesday's open.

FXI (China 25) continues to deteriorate...if it gets down to 32 the bullish odds for a bottom increase.

XLU (utilities) which is normally regarded as a safe haven, is one of the worst performing sectors and we're looking for a swoon down to 38 as a possible entry point.

Finally, QQQ (NAZ 100) is (surprisingly) looking worse than SPY in terms of losing momentum. Keep in mind the just a few big names APPLE, GOOG, MSFT, etc. dominate the capitalization of the Qs and despite the on-going hype APPLE counts on China for 30% of its revenue and, as we mentioned a couple weeks ago, market share there is being captured by a new Chinese (private) phone provider with technical features much superior to APPLE. Just something to keep in mind.

Thursday, September 3, 2015

Fizzle...09.03.15

It looked like we were going to get a strong follow through with the NYAD opening above 4...but the bears took control after the first 90 minutes and sold the markets down all day and into the close. Technically this is a bad sign and the odds for a bearish Friday just got a lot higher. Monday's Labor Day so no trading and with the general tone of nervousness pervasive in the the markets anybody with a head for risk exposure in going to be selling into Friday's close...and any buying is likely to be HFT induced and not trustworthy as true accumulation. Good luck out there!.

Wednesday, September 2, 2015

Rally....09.02.15

We got a reaction rally at the open. The technicals were so overdone to the down side that it was almost inevitable. Momentum quickly faded done to the pivot and it was only in the late afternoon session...actually the last 30 minutes that the markets picked up steam to close on the highs of the day. In stark contrast to yesterday's action the Ergodics and the ADX were in sync most of the day. Volume was about half of yesterday and the technicals are still precarious. The bottom line is that traders are still worried about what the FED will do on September 17th and you can bet that's going to be a truly memorable...and volatile...day. Until then we may just swing back and forth at this worrisome level in the midst of elevated volatility levels.

Tuesday, September 1, 2015

Poop....09.01.15

Well that was a lousy way to start September. So what happened? Bottom line is you never really know....its all just speculation in the midst of rampant market manipulation goosed by another overnight hit to the Chinese markets. Note the continually divergence of the Ergodics and the ADX showing the HFT robots hard at work as they relentlessly drove the markets down today. Volume finally accelerated into the last hour and it wasn't to buy. The NYAD range was utterly dismal today .11 to .20 and the RSI2 closed at less than one.

Tomorrow? Anybody's guess The aftermarket was up a tad but we've mentioned before how the prop shops like to pump the after markets in anticipation of trading contrary the next day. CAUTION.

Tomorrow? Anybody's guess The aftermarket was up a tad but we've mentioned before how the prop shops like to pump the after markets in anticipation of trading contrary the next day. CAUTION.

Subscribe to:

Comments (Atom)