The narrow range theme continues with odds for a break escalating. VDX echos the theme and the direction of the break is the question of the day.

Note that only TLT and GLD (gold) have upsloping VDI+ charts. Straddling the SPY may be strategy to consider looking out to the Aug 19 strikes. We'll look at some risk/reward scenarios of Monday.

Gundlach (who was right on the recent turn in Treasuries) has strong opinions on which way the break will go although his recommendation on gold doesn't really provide a large upside potential.

Saturday, July 30, 2016

Thursday, July 28, 2016

Momentum and Mean Reversion Meet Parity.....07.28.16

August and September are historically weak and very weak months but the whole Sell in May mantra hasn't worked out for the bears this year so maybe 2016 will be different. Tomorrow is the last trading day of the month so that's a bullish skew even though its Friday which is 70%+ bearish. This is not a simple trading environment. To compound momentum confusion even more I noticed that both the momentum and mean reversion modes of the M6 market model have almost identical returns even though the portfolio inputs and the limit stops are the same.

What;s a guy to do?. Just stick with your trading plan and enforce those loss stops. SPY has been in a narrow range trading pattern and we're due for a break. The question is Up? or Down?.

What;s a guy to do?. Just stick with your trading plan and enforce those loss stops. SPY has been in a narrow range trading pattern and we're due for a break. The question is Up? or Down?.

Wednesday, July 27, 2016

The Always Entertaining Apple...07.27.16

Apple opened at 104.35 today...exactly at the 8% pop factor I've mentioned previously. It was actually at 104.60 in the pre-market but subsided a bit at the open. LQB has calculated that over the past 8 earnings sessions Apple had moved 8% +/- on the day of the announcement and then adjusted that delta to 4% within 2 days so be wary of longer term holding of these pop/drops. As expected Apple traded 92 million shares today while SPY traded 82 million and most of the SPY volume kicked in after the FED's non-decision mid morning.

Note the closing 2 minute bar on Apple...a quick .50 drop of 1.7 million shares to the low of the day.

Attached is the M1 spin on Apple with the mean reversion filter.

Note the closing 2 minute bar on Apple...a quick .50 drop of 1.7 million shares to the low of the day.

Attached is the M1 spin on Apple with the mean reversion filter.

Tuesday, July 26, 2016

Ponzo Updates ...07.26.16

Apple is up about 7 points after hours and we're likely to see even more gains Wednesday as the short sellers cover their positions. Once again the "gurus", including the frequent bad guesser Jim Cramer., were wrong.....predicting AAPL would falter badly this quarter.

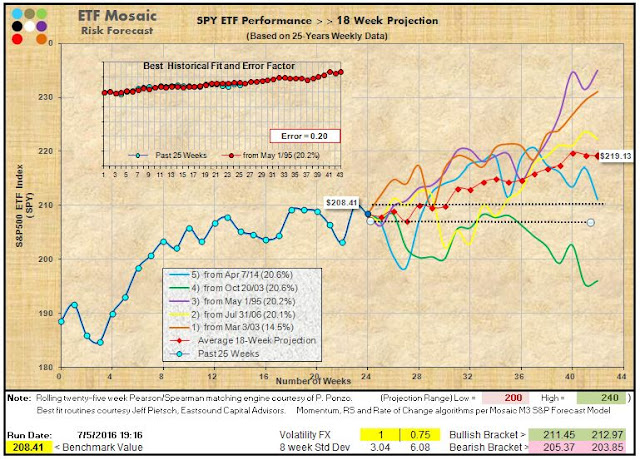

The Ponzo Updates this week maintain a strong bullish tone with the VIX displaying a rather surprising flatline forecast until the end of the year when odds for some volatility kick in. This is just odds based forecasting of course and any number of factors could derail these rosy outlooks but for now the momentum is firmly with the bulls.

The Ponzo Updates this week maintain a strong bullish tone with the VIX displaying a rather surprising flatline forecast until the end of the year when odds for some volatility kick in. This is just odds based forecasting of course and any number of factors could derail these rosy outlooks but for now the momentum is firmly with the bulls.

Monday, July 25, 2016

APPLE Earnings Straddle and OpStop.....07.25.16

APPLE announces earnings after Tuesday's close so this setup is one day ahead of the optimum time to place it. You get the idea. AAPL typically moves 8% up or down on earnings announcement and this is a simple spread to take advantage of which even way it breaks. Based on today's action the odds appear to be to the downside based on several analysts' forecasts as the stock hugs an S# pivot collapse. the setup should be recalculated as of midday Tuesday for a more balanced straddle but this example would produce a quick gain if the stock only moves 5 points up or down. The option expires on the 29th but the position would likely be closed most favorably on the 27th.

As mentioned over the weekend OpStop is a little stand alone program that calculates "best odds" limit stops for any of the M programs. Its very fast and accommodates NYSE/NASDAQ stocks, ETFs and ETNs. If you are a user of any M program (M1, M3, M6, M11) just drop an email to receive a copy.

As mentioned over the weekend OpStop is a little stand alone program that calculates "best odds" limit stops for any of the M programs. Its very fast and accommodates NYSE/NASDAQ stocks, ETFs and ETNs. If you are a user of any M program (M1, M3, M6, M11) just drop an email to receive a copy.

Saturday, July 23, 2016

VDX Updates, Schwabpaloosa and M3 performance updates....07.23.16

The weekly VDX updates still display intrinsic weakness in the SPY and TLT VDI+ slope as SPY hits new highs and TLT's forecast flies into a cloud of volatile confusion (same condition holds with VIX). So far earnings have been mixed with a skew to the upside but we are once again hitting overhead technical resistance with the VIX hugging a placid 12...... so beware.

As a follow up to my Schwab M6 portfolio posting I've added a new tab on the M3 site devoted to various models using the Schwab no fee ETFs I'm working with a local Schwab user group to test more variations of these models and so far they have had good results. Once a few details are fine tuned I'll offer the Schwab models as a package (about 10 days).

I've also updated the M3 layout and performance metrics including the User Guide as well as DN models to reflect current returns.

Apple earnings come out on the 26th and Monday before the close we'll look at a very short term straddle that can take advantage of the typical 8% move on earnings day.

I'll also introduce the OpStop limit stop calculator (free to all holders of any version of M software.).

As a follow up to my Schwab M6 portfolio posting I've added a new tab on the M3 site devoted to various models using the Schwab no fee ETFs I'm working with a local Schwab user group to test more variations of these models and so far they have had good results. Once a few details are fine tuned I'll offer the Schwab models as a package (about 10 days).

I've also updated the M3 layout and performance metrics including the User Guide as well as DN models to reflect current returns.

Apple earnings come out on the 26th and Monday before the close we'll look at a very short term straddle that can take advantage of the typical 8% move on earnings day.

I'll also introduce the OpStop limit stop calculator (free to all holders of any version of M software.).

Thursday, July 21, 2016

VXX Traders Take Note...07.21.16

VXX traders are a gutsy bunch as daily volatility can frequently run 5% or more.....which is why it appeals to risk lovers. With daily volume often 10% more than SPY and great liquidity even in after hours markets VXX has a unique risk/reward profile and is most advantageously approached as a day trade....definitely not for consideration as a long term hold due to the intrinsic decay factor of VXX.

Below the 130 minute Bollinger band chart for VXX and the Mosaic delta neutral report for XIV/VXX. Although the 130 minute VXX chart has been reliable in forecasting VXX turns in the past we did have one recent signal failure (red line) and we are now poised to test a new reversal signal (yellow line). Note that tomorrow's delta neutral rankings favor VXX.

Below the 130 minute Bollinger band chart for VXX and the Mosaic delta neutral report for XIV/VXX. Although the 130 minute VXX chart has been reliable in forecasting VXX turns in the past we did have one recent signal failure (red line) and we are now poised to test a new reversal signal (yellow line). Note that tomorrow's delta neutral rankings favor VXX.

Wednesday, July 20, 2016

M6 Default Model Bullish.....07.20.16

Here's the current M6 market model...pretty simple and reflecting a full +1 to -1 beta spectrum.

It managed to catch the surge in QQQ today and projects that strength to continue. Long term market followers know that tech and the financials most often lead rallies and if that's any guide the bears are in trouble. Is this recovery for real? Some doubters make a thoughtful argument to the contrary and we need to keep in mind that the more the market rallies the higher the odds the FED will raise rates and deflate the party balloon. The current short term overhead resistance on SPY is 225 by the way.

It managed to catch the surge in QQQ today and projects that strength to continue. Long term market followers know that tech and the financials most often lead rallies and if that's any guide the bears are in trouble. Is this recovery for real? Some doubters make a thoughtful argument to the contrary and we need to keep in mind that the more the market rallies the higher the odds the FED will raise rates and deflate the party balloon. The current short term overhead resistance on SPY is 225 by the way.

Tuesday, July 19, 2016

Two Market Views..M11 and Schwab M6...07.19.16

We're seeing a minor pullback today following overnight weakness in the foreign markets. As long as the pullback remains modest the odds for the bulls are in tact. TLT was up almost 1% today coming of oversold conditions but if equities soar its likely to fall again. Earnings are the key now.

Here's the M11 full market spectrum model with the Short Term momentum mode turned on.

And here's the Schwab no fee market model with the Short Term momentum mode turned on.

Note that in both the M11 and M6 model the 2 Day Alert has crossed over the trend line...indicating the odds for the currently ranked signals are in jeopardy and should be avoided or watched closely.

Here's the M11 full market spectrum model with the Short Term momentum mode turned on.

And here's the Schwab no fee market model with the Short Term momentum mode turned on.

Note that in both the M11 and M6 model the 2 Day Alert has crossed over the trend line...indicating the odds for the currently ranked signals are in jeopardy and should be avoided or watched closely.

Monday, July 18, 2016

Bull Ride Continues with PONZO Updates...07.18.16

This week's Ponzo updates continue the bullish forecast for SPY and the short term weakening of TLT. 4 out of the 5 SPY Ponzo forecast are full bore bullish.The outlook for VIX is a bit more muddled but we should expect volatility spurts along the way as market forces, either contrived or fundamental, modulate the uncertainty factor. With new highs on all the indices the bull market is poised for even higher highs going forward. One of my favorite technical forecasters at Schwab sees SPY at 237 by year's end and looking at the SPY Ponzo chart that level appears to be a real possibility. With 90 companies reporting earnings this week the tone for July and August will likely be set and woe to those who don't follow the trend.

Saturday, July 16, 2016

VDX Updates....07.16.16

The VDX updates this week are characterized by near oversold levels on VIX and TLT. Note that the VDI+ is downslope in all three charts, reflecting a lack of positive commitment short term.

This week's collapse of TLT has been stunning in its momentum and in the PIMCO/Gundlach diverse forecasts for TLT posted earlier in the week Mr. Gundlach gets a gold star. The VIX was in a convoluted downward cycle this week and next week will see earnings ramp up and the possible fallout from Turkey's coup or attempted coup, depending on who you believe. However, looking back on the strong rebound from the Brexit vote the impact of the Turkey's situation is likely to produce only a small impact on market momentum.

This week's collapse of TLT has been stunning in its momentum and in the PIMCO/Gundlach diverse forecasts for TLT posted earlier in the week Mr. Gundlach gets a gold star. The VIX was in a convoluted downward cycle this week and next week will see earnings ramp up and the possible fallout from Turkey's coup or attempted coup, depending on who you believe. However, looking back on the strong rebound from the Brexit vote the impact of the Turkey's situation is likely to produce only a small impact on market momentum.

Thursday, July 14, 2016

Schwab No Fee M6...07.14.16

This is a follow up on my previous Schwab M6 model using their no fee ETFs. This is one of my bread and butter models as it makes money in both bull and bear markets with a solid linearity.

B mimics SPY, Z mimics AGG, A mimics IWM, E mimics EEM, H mimics IYR and SPLV is the low volatility version of SPY. All have good daily volume and narrow spreads. If you are a Schwab client you can day trade or swing trade these ETFs, and 94 more for no commission.

This version of M6 is fine tuned for the Schwab beta correlated basket. If you are a Schwab client and would like a copy of the software just drop me a line and I'll give you the particulars.

B mimics SPY, Z mimics AGG, A mimics IWM, E mimics EEM, H mimics IYR and SPLV is the low volatility version of SPY. All have good daily volume and narrow spreads. If you are a Schwab client you can day trade or swing trade these ETFs, and 94 more for no commission.

This version of M6 is fine tuned for the Schwab beta correlated basket. If you are a Schwab client and would like a copy of the software just drop me a line and I'll give you the particulars.

Wednesday, July 13, 2016

TLT Volatility Accelerates...07.13.16

TLT is acting like a bug in a hot frying pan...after yesterday dropping 2% it rebounded 75% of yesterday's move on almost equal volume.

There are two camps of thought on the near and long term future of treasuries and some of the biggest names in the bond business have radically different forecasts.

The Mosaic forecasting models for TLT have held their ground although the mean reversion mode, which well outperformed the buy and hold benchmark for thr first 6 months of the year, has seen its timing edge reduced to near parity with a non-stopped TLT model.

The 130 minute Bollinger Band study of TLT below shows the dramatic reversals in momentum.

There are two camps of thought on the near and long term future of treasuries and some of the biggest names in the bond business have radically different forecasts.

The Mosaic forecasting models for TLT have held their ground although the mean reversion mode, which well outperformed the buy and hold benchmark for thr first 6 months of the year, has seen its timing edge reduced to near parity with a non-stopped TLT model.

The 130 minute Bollinger Band study of TLT below shows the dramatic reversals in momentum.

Tuesday, July 12, 2016

New Highs on SPY and DIA.....07.12.16

Another day of risk on trading with new highs on SPY and DIA and a collapse of TLT...all actions confirming both our weekend VDX templates and the PONZO forecasts. Technically the markets are overbought but with earnings kicking in and Alcoa leading the pack with good news the likely scenario here will be to buy pullbacks...until proven otherwise. Are there danger spots? Yes and real estate may be one.

Below is the current M6 short term mode of the full spectrum beta markets.

Below is the current M6 short term mode of the full spectrum beta markets.

Monday, July 11, 2016

PONZO Updates..07.11.16

This week's Ponzo Updates argue for a distinctly bullish outlook....at least for the next few months. SPY is on a strong upward momentum while the VIX shows a waning trend and, perhaps most telling, the outlook for TLT is bearish. Of course, with SPY at an all time high and TLT only one day off its all time high there may be some volatility at this level but the odds favor a bullish SPY.

Such a forecast is at odds with many of the more respected market gurus and with the onset of earnings season we may see some negative reactions to expected weak earnings...mentioned in the State Street link this weekend....especially in the wake of Brexit.

Such a forecast is at odds with many of the more respected market gurus and with the onset of earnings season we may see some negative reactions to expected weak earnings...mentioned in the State Street link this weekend....especially in the wake of Brexit.

Saturday, July 9, 2016

VDX Updates and Weekend Reading....07.09.16

The VDX updates indicate TLT's extreme overbought status and the VIX's initial penetration of the mid term support levels (although still rated NEUTRAL). Given the substantial rebound form the BREIXT "crisis" its clear that for now traders are discounting the effects of the vote although new potential defections may raise the uncertainty factor in the coming months.

The stellar employment report helped push the markets on Friday and its not unreasonable to expect new all time highs in the major indices.

What's surprising is the corresponding rise in TLT (at another all time high Friday) as its unusual for SPY and TLT to run in lockstep. What we are likely witnessing are 2 different camps of risk management...one buying equities and the other buying treasuries for the yield..

For further insights check out>

Schwab's Weekly Trader's Outlook

State Street's Mid-year Outlook

The stellar employment report helped push the markets on Friday and its not unreasonable to expect new all time highs in the major indices.

What's surprising is the corresponding rise in TLT (at another all time high Friday) as its unusual for SPY and TLT to run in lockstep. What we are likely witnessing are 2 different camps of risk management...one buying equities and the other buying treasuries for the yield..

For further insights check out>

Schwab's Weekly Trader's Outlook

State Street's Mid-year Outlook

Thursday, July 7, 2016

XIV and VXX Trading...Part 2...07.07.16

Continuing yesterday's initial look at XIV and VXX here are views of the 130 minute bar charts of each with a 2 standard deviation, 14 period Bollinger Band (BB) overlay and an 8 period moving average band of the high and low (blue band). This is really all you need to trade these varmints,.... everything else should be considered confirmation signals.

The strategy here is to watch for violations of the BB followed by a reversal of 2 bars. The threshold triggers are noted by the vertical purple lines. Note the position of the RSI2 in each instance...this should also be regarded as a confirmation signal of an impending trigger.

The charts indicate the current BB intersects as ripe for a reversal although entries right now should be considered premature and risky.

NOTE: this BB setup is configured for XIV and VXX. Lower beta ETFs and stocks seldom produce reversal signals as clearly defined when using this layout.

The strategy here is to watch for violations of the BB followed by a reversal of 2 bars. The threshold triggers are noted by the vertical purple lines. Note the position of the RSI2 in each instance...this should also be regarded as a confirmation signal of an impending trigger.

The charts indicate the current BB intersects as ripe for a reversal although entries right now should be considered premature and risky.

NOTE: this BB setup is configured for XIV and VXX. Lower beta ETFs and stocks seldom produce reversal signals as clearly defined when using this layout.

Wednesday, July 6, 2016

XIV and VXX Trading..Part 1...07.06.16.

Many traders maintain a fascination for the trading possibilities offered by XIV and VXX, 2 ETN derivatives of the VIX volatility index. VXX often has 10-20% more daily volume than SPY, has a rich option chain with narrow spreads and it trades good volume in the after hours markets. There are a few caveats trading VXX...the biggest is that it is intrinsically decaying and in a long term flat market it would eventually resolve to zero. VXX is not a buy and hold candidate. VXX is a hit and run trade...holding longer than a week is akin to sitting on a keg or dynamite....BUT, and this is a big BUT...the return can be spectacular if you're on the right side of the trade. XIV is a horse of a different color, offers no options, has daily volume significantly below but does trade afterhours.

As with VXX daily volatility in XIV can range to 10% or more and the profits can be stunning.

I prefer to trade this dynamic duo as a delta neutral pair but I'm an old man with a weak heart so please forgive my lazy man approach.

This week, for more aggressive traders we will explore several algorithmic constructs that may help mitigate the drawdowns that poor directional choices in these ETNS will inevitably produce.

For today's research here are the MVP PCL (previous close to low)/volatility studies of VXX and XIV. There are 2 versions of MVP...one long that trades positive beta issues like XIV and one short that trades inverse issues with negative beta like VXX. The yellow arrows highlight areas where price fell significantly but the model kept you in cash and out of danger.

Tomorrow we'll look at these performance metrics in more detail.

As with VXX daily volatility in XIV can range to 10% or more and the profits can be stunning.

I prefer to trade this dynamic duo as a delta neutral pair but I'm an old man with a weak heart so please forgive my lazy man approach.

This week, for more aggressive traders we will explore several algorithmic constructs that may help mitigate the drawdowns that poor directional choices in these ETNS will inevitably produce.

For today's research here are the MVP PCL (previous close to low)/volatility studies of VXX and XIV. There are 2 versions of MVP...one long that trades positive beta issues like XIV and one short that trades inverse issues with negative beta like VXX. The yellow arrows highlight areas where price fell significantly but the model kept you in cash and out of danger.

Tomorrow we'll look at these performance metrics in more detail.

Tuesday, July 5, 2016

PONZO Updates and New M3 Insight...07.05.16

Uncertainty is still the name of the game as worries abound over the BREXIT fallout. Who's next? is the topic of conversation for the talking heads.

We have a new M3 Insight post on the current state of our delta neutral basket and an updated VXX/XIV delta neutral panel in the VXX/XIV Case study #2.

The Ponzo Updates suggest the markets might be exhausted from the recent volatility but the really interesting scenario is on TLT with the purple outlier. Think it can't happen?. We're well above all time highs on TLT right now and no end of momentum in sight.

We have a new M3 Insight post on the current state of our delta neutral basket and an updated VXX/XIV delta neutral panel in the VXX/XIV Case study #2.

The Ponzo Updates suggest the markets might be exhausted from the recent volatility but the really interesting scenario is on TLT with the purple outlier. Think it can't happen?. We're well above all time highs on TLT right now and no end of momentum in sight.

Sunday, July 3, 2016

VDX Updates and Weekend Reading.....07.03.16

While you're sitting around this weekend stuffing yourself with BBQ and otherwise enjoying 4th of July festivities there's a storm brewing in Europe that may be the catalyst for a renewed VIX jump.

The markets tend to look 6 months out,especially in the futures markets, so we may not feel the pressure building quite yet but there are numerous danger signs rising and then there's that pesky election in November that may further rattle the markets.

Here are a few articles that may help put the current market dynamics in perspective:

OANDA on the state of the Euro.

Schwab and the Weekly Trader's Outlook.

Mauldin on European concerns.

Bloomberg on the state of hedge funds

Below are the VDX updates for SPY, VIX and TLT.

We continue to see a decoupling of SPY/TLT correlations which is likely the product of global consensus that the lowest risk investments (for now) are US equities and longer term treasuries.

The markets tend to look 6 months out,especially in the futures markets, so we may not feel the pressure building quite yet but there are numerous danger signs rising and then there's that pesky election in November that may further rattle the markets.

Here are a few articles that may help put the current market dynamics in perspective:

OANDA on the state of the Euro.

Schwab and the Weekly Trader's Outlook.

Mauldin on European concerns.

Bloomberg on the state of hedge funds

Below are the VDX updates for SPY, VIX and TLT.

We continue to see a decoupling of SPY/TLT correlations which is likely the product of global consensus that the lowest risk investments (for now) are US equities and longer term treasuries.

Subscribe to:

Comments (Atom)