A mildly volatile day with low range exposure meant the mode never triggered and we're left net/net at the close. Another shortened trading week may see pump and dump action renewed while tantalizing news that Chinese trade negotiations are "going well" may provide the grease necessary to move the markets. Underlying economic data is woeful but that's never impacted the markets before so why expect things to change now.

With delta neutral we don't care.

Sunday, December 30, 2018

Thursday, December 27, 2018

Delta Neutral Update...12.27.28

Another surprise day...this time with the NYAD rising from a bearish .20 one hour prior to the close to a closing value of 1.07. Blame the pension funds once again trying to avoid cash.

Tomorrow is December options expiration so we may see volatility once again as rollovers surge and traders try to pin the close. Meanwhile our longer term silver (SLV) calls close out tomorrow for a nice gain over the past few months.

Tomorrow is December options expiration so we may see volatility once again as rollovers surge and traders try to pin the close. Meanwhile our longer term silver (SLV) calls close out tomorrow for a nice gain over the past few months.

Wednesday, December 26, 2018

Delta Neutral Update....12.26.18

Well, that was a surprise...especially to the majority of CTAs... who were 100% short at today's open.

Pension fund buying was the reason given for the surge..that and short covering. Let's see if the surge continues through the weekend.

Pension fund buying was the reason given for the surge..that and short covering. Let's see if the surge continues through the weekend.

Tuesday, December 25, 2018

Delta Neutral Update...12.25.18

A scary slide in a shortened trading day on the 23rd has once again produced a nice gain for DN traders. I did notice some weirdness 90 minutes in to the day when the Qs were down 1.2% and QLD was only down 1.7% ...when properly balanced leveraged should have made QLD down 2.4% , our trade trigger. Needless to say, by the end of the brief 3 1/2 hour trading day the QQQ/QLD skew had returned to the expected 1:2 ratio.

Sunday, December 23, 2018

Delta Neutral Update... 12.23.18

Futures are all over the place Sunday evening as the fear index hits new highs. Expect low volume but high volatility Monday (shortened session). No hedging here just straight rules based delta neutral setups and remember to implement trailing stops once the limit stop trigger. We're still looking for the high volume capitulation trade but until we see the NYAD at .10 or below that's unlikely to happen. The govt. (partial) shutdown is not helping the risk outlook.

Tee DN trade remains the safest and laziest trade at this time....if you follow the rules.

Tee DN trade remains the safest and laziest trade at this time....if you follow the rules.

Thursday, December 20, 2018

Delta Neutral update...12.20.18

The DN model continues to be the gift that keeps on giving as new selling pressures arise daily.

The House passed a stopgap budget that includes 5 billion for the wall but the Senate will probably kibosh it and the odds of a resultant govt shutdown Friday night are looking ominous.

The good news is that as DN traders we really don't care...these volatility swings make us money with extremely limited risk. What greatly surprised me is the recent blow up of supposedly savvy high profile "delta market" hedge funds. Clearly they had a different concept of "neutral" than me.

The House passed a stopgap budget that includes 5 billion for the wall but the Senate will probably kibosh it and the odds of a resultant govt shutdown Friday night are looking ominous.

The good news is that as DN traders we really don't care...these volatility swings make us money with extremely limited risk. What greatly surprised me is the recent blow up of supposedly savvy high profile "delta market" hedge funds. Clearly they had a different concept of "neutral" than me.

Tuesday, December 18, 2018

Delta Neutral Update...12.18.18

A modest reversal day as traders try to game FED day tomorrow. After hours looks ugly with QLD down 1% so expect some volatility tomorrow and the possibility that we see new lows across the board. The prospects for a Santa Claus rally this year are fading fast although the apparent avoidance of a govt. shut down on Friday is a positive.

Monday, December 17, 2018

Delta Neutral Update ....12.17.18

Another good day for the DN model. Anticipation of a govt. shutdown on Friday and uncertainty about the FED has the markets spooked. Technically speaking we are in oversold territory and a rally looked possible today but risk off positions are few and far between even as overall market short interest is extremely low.

The NYAD (NYSE advance/decline line) hit a low of .13 today. We typically see major market capitulations when the NYAD hits .10 or less. This could happen at any time.

The NYAD (NYSE advance/decline line) hit a low of .13 today. We typically see major market capitulations when the NYAD hits .10 or less. This could happen at any time.

Wednesday, December 12, 2018

Delta Neutral Update...12.12.18

Another reversal day the left us net flat for the day. Per previous comments this was the expected market behavior short term where the previous close to current close demonstrate considerably less volatility than the open to close metric.

Note the crossovers in the 2 Day Alert, TrendX and Skew...all of which correspond to a declining close to close volatility.

Note the crossovers in the 2 Day Alert, TrendX and Skew...all of which correspond to a declining close to close volatility.

Tuesday, December 11, 2018

Delta Neutral Update...12.11.18

A nasty reversal day apparently based on Trump's confrontation with Pelosi, et al. And if you thought the bulls were in charge today it didn't pan out that way.

And once again....delta neutral saves the day.

And once again....delta neutral saves the day.

Monday, December 10, 2018

Delta Neutral Update...12.10.18

The QLD limit stop of 72.05 never got hit today (low of the day was 72.15) so the model never triggered and closed net flat for the day. I suggested last week that we might be in store more a more or less range bound market for a while and this may be a harbinger. On the other hand, the talking heads are predicting a bull surge into Xmas so anything's possible. The good news....with DN we really don't care.

Saturday, December 8, 2018

Delta Neutral Update....12.08.18

Another nice day for our delta neutral strategy. It started out looking positive but our limit stops did not fire until QLD turned red and blew through our 2.5% stop.

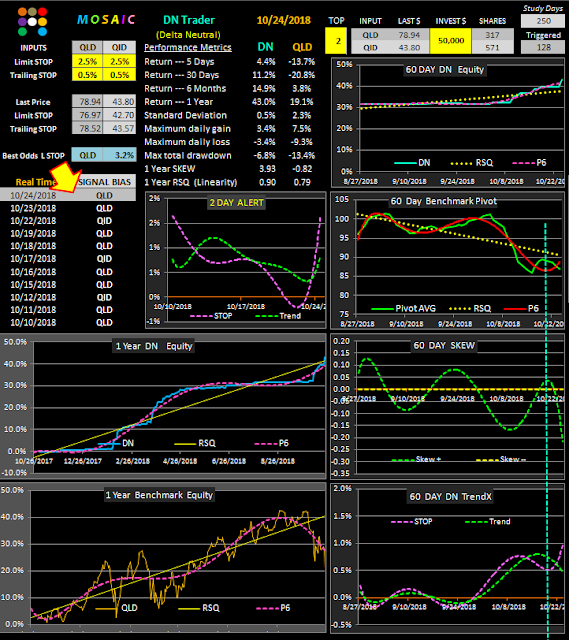

I've rearranged the charts a bit to show the 60 day relative volatility of QLD and QID. The actual platform is actually much bigger graphically but we lose resolution when we try and display it on the blog platform. FYI, the full platform is shown below.

Keep in mind that once volatility fades the frequency of trade triggers will also decline and the equity line will once again flatten out as to look like the May to September portion of the equity chart below.

We're seeing a divergence of the 2 Day Alert and the TrendX (which is closely tracking volatility) so we may see some pullback on further volatility gains for a bit....or Monday could be a washout day.

Major political upheaval in France , England, Italy and imminent demise of the EU, the Saudi issue and other geopolitical questions have spooked the markets...and rightly so.

Pity the poor guys that bought bitcoin at $18,000....now around $4000.

I've rearranged the charts a bit to show the 60 day relative volatility of QLD and QID. The actual platform is actually much bigger graphically but we lose resolution when we try and display it on the blog platform. FYI, the full platform is shown below.

Keep in mind that once volatility fades the frequency of trade triggers will also decline and the equity line will once again flatten out as to look like the May to September portion of the equity chart below.

We're seeing a divergence of the 2 Day Alert and the TrendX (which is closely tracking volatility) so we may see some pullback on further volatility gains for a bit....or Monday could be a washout day.

Major political upheaval in France , England, Italy and imminent demise of the EU, the Saudi issue and other geopolitical questions have spooked the markets...and rightly so.

Pity the poor guys that bought bitcoin at $18,000....now around $4000.

Thursday, December 6, 2018

Delta Neutral Update...12.06.18

Our trailing stop IN QID kicked us out of a another nice DN trade today and now we're looking at the possibility that today was a key reversal day, Tomorrow will be a better indicator of reversal confirmation although at this time the markets are red in afterhours. Our trailing stop close gain is not reflected in the metrics shown below...in fact the true value of the 5 day return is 4.5%. and all the other DN metrics are 1.5% better than shown.

Tuesday, December 4, 2018

And That's Why We do Delta Neutral....12.04.18

What a difference a day makes.

As I mentioned yesterday, delta neutral really shines on those big down days that start out with a whimper and today was probably one of the best examples of that axiom ever.

Markets are closed Wednesday so Thursday open could be interesting.

For the really lazy bones traders here's the current update on our Z-score based MOZ model silver(SLV) trade over the past 6 months (see below).

As I mentioned yesterday, delta neutral really shines on those big down days that start out with a whimper and today was probably one of the best examples of that axiom ever.

Markets are closed Wednesday so Thursday open could be interesting.

For the really lazy bones traders here's the current update on our Z-score based MOZ model silver(SLV) trade over the past 6 months (see below).

Monday, December 3, 2018

Delta Neutral Update....12.03.18

Well, the DN model has certainly lagged the past few days...and why is that? If you understand the mechanics of the DN strategy it should be no mystery. What's happened is that we've seen a couple recent blow out days that have exceeded our limit stops so orders never got filled on either side. This is the price we pay for DN protection when the market decides to exceed those limit stop values to the downside/ Still, we're in this for the long run and risk management is always job #1 with us.

Today's news was that even some of the "smartest guys in the room" have cratered badly.

Should've called Bob.

Today's news was that even some of the "smartest guys in the room" have cratered badly.

Should've called Bob.

Thursday, November 29, 2018

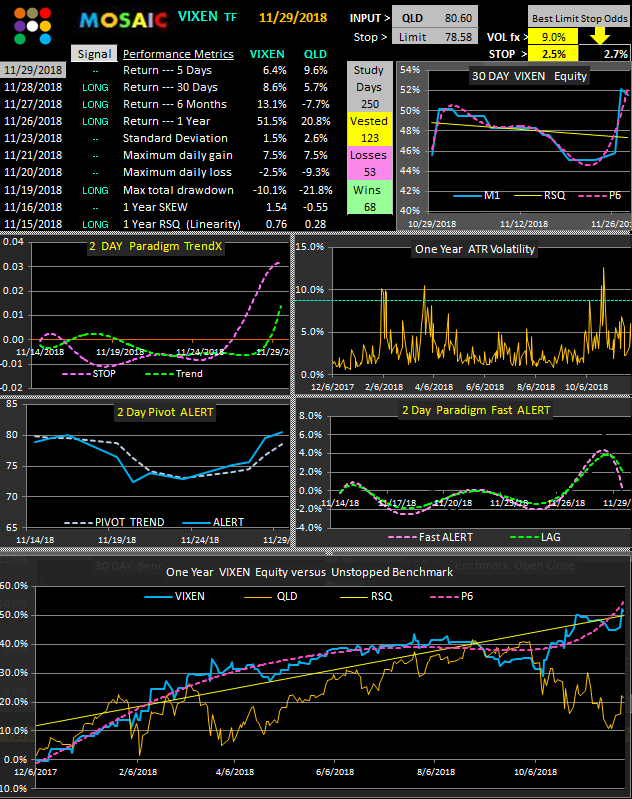

Delta Neutral vs. QLD VIXEN metrics.....11.29.18

Delta Neutral keeps chugging along although we did not get filled today. In the meantime here's a look (below) at the VIXEN version of trading QLD (the bullish side of our DN model). Returns are similar to the DN model but drawdowns and linearity are lower. So why buy the risk of a directional VIXEN trade when you can make similar returns with much less risk exposure using the DN ?

Note that the 2 Day Alert and TrendX have gone divergent in the DN model while the skew has blown through resistance. We are looking for a near term paradigm shift as a result.

DN signal bias has shifted to QID.

Note that the 2 Day Alert and TrendX have gone divergent in the DN model while the skew has blown through resistance. We are looking for a near term paradigm shift as a result.

DN signal bias has shifted to QID.

Wednesday, November 28, 2018

Delta Neutral Update....& Yesterday's metrics......11.28.18

Yesterday's post was a test to see who was paying attention. Robert, Keith, Sam and a few others noted the apparently huge gains relative to the historical equity curve shown over the last few years.

And that's because I turned the TOP # from 2 (delta neutral) to 1 (trading only the bias signal...either QLD or QID, not both simultaneously). Yes...the delta neutral model has had a very good run with the QLD/QID bias trade...it doesn't fare as well with the SPY, Russell or Diamonds x2 ETFs.

Nevertheless, hindsight is a great teacher and the delta neutral bias algorithm, which is a multi variable filter based on rate of change, pivot momentum and the SMI Ergodic signal (resident on the Freestockcharts.com site) has done well although there are significant lull periods and stops have to be carefully executed.

For tonight we return to the Lazy Man delta neutral model and metrics. No excitement here.

And that's because I turned the TOP # from 2 (delta neutral) to 1 (trading only the bias signal...either QLD or QID, not both simultaneously). Yes...the delta neutral model has had a very good run with the QLD/QID bias trade...it doesn't fare as well with the SPY, Russell or Diamonds x2 ETFs.

Nevertheless, hindsight is a great teacher and the delta neutral bias algorithm, which is a multi variable filter based on rate of change, pivot momentum and the SMI Ergodic signal (resident on the Freestockcharts.com site) has done well although there are significant lull periods and stops have to be carefully executed.

For tonight we return to the Lazy Man delta neutral model and metrics. No excitement here.

Tuesday, November 27, 2018

Delta Neutral Update.....11.27.18

Despite the market's gyrations and volatility swings the delta neutral model has performed well.

Regular Mosaic users know that this is strictly a rules based data driven strategy that actually works best in periods of elevated volatility such as we are currently experiencing. It doesn't do well in periods when the VIX is in the 10-12 range, but we take what it gives us with obvious risk considerations.

Regular Mosaic users know that this is strictly a rules based data driven strategy that actually works best in periods of elevated volatility such as we are currently experiencing. It doesn't do well in periods when the VIX is in the 10-12 range, but we take what it gives us with obvious risk considerations.

Thursday, November 15, 2018

Delta Neutral Update....11.15.18

An intra day turnaround turned out well for our DN model. We did not get stopped out in the long side in the morning session as the market dropped but did get stopped out on the short side in the afternoon session and were able to book a net .5% gain for the day. Volatility continues to decline per the ATR and Open//Close skew.

Wednesday, November 14, 2018

Delta Neutral Update....11.14.18

We're seeing a little divergence in the TrendX signal so volatility mat taper off for a bit. We've also see this in the best odds limit stop which is auto calculated based on the ATR and open/close spread, among other metrics. This value has sunk from 3.2 to 2.8 over the past 7 days.

Once again, a strong open led to a gradual price erosion throughout the day and Maxine Waters threats to current financial regs singularly led to the reversal in the financials today. Definitely a rampant risk environment and we're sticking with the Lazy Man delta neutral model for now.

Once again, a strong open led to a gradual price erosion throughout the day and Maxine Waters threats to current financial regs singularly led to the reversal in the financials today. Definitely a rampant risk environment and we're sticking with the Lazy Man delta neutral model for now.

Tuesday, November 13, 2018

Delta Neutral Update....11.13.18

A little lull in volatility today as traders evaluate the risk environment and a possible pullback to recent lows...or worst.

Delta Neutral still looks like an easy way to book some coin and still sleep at night without worry of overnight big moves.

Yes...there are opportunity costs that may be lost but our prime directive is risk management and capital preservation and out QLD/QID model has worked out well so far.

.

Delta Neutral still looks like an easy way to book some coin and still sleep at night without worry of overnight big moves.

Yes...there are opportunity costs that may be lost but our prime directive is risk management and capital preservation and out QLD/QID model has worked out well so far.

.

Monday, November 12, 2018

Delta Neutral Update....11.12.18

And that was a perfect delta neutral day!!!! No risk and a nice one day pop.

Looks like more to come based on the TrendX and Skew.

Looks like more to come based on the TrendX and Skew.

Sunday, November 11, 2018

Delta Neutral looks best for now....11.11.18

This week could get squirrelly as earnings are not showing a lot of promise. Our QQQ leveraged long/short ETFs have so far provided us with a nice linear equity curve with only modest risk exposure and for the short term this is our default trading venue.

Thursday, November 8, 2018

QLD in cash....11.08.18

We followed our own advice re the downslope TrendX and avoided today's swoon. In the market's typical bizarro behavior both the SPY and the VXX were red today, reflecting most probably the changing paradigm in the current VIX term structure and the overdue inherent decay function of VXX. Should have been short...I know....just can't win em all.

Wednesday, November 7, 2018

Tuesday, November 6, 2018

VXX signal still long....11.06.18

The VIXEN is still long the VXX and it really all hinges on the election results so best to hedge our bets and just stand aside on this one as the technicals embedded in the signal are essentially meaningless for tomorrow.

As mentioned yesterday the TrendX is not supportive of the current signal and old time VIXEN watchers know that means trade small or not at all.

As mentioned yesterday the TrendX is not supportive of the current signal and old time VIXEN watchers know that means trade small or not at all.

Monday, November 5, 2018

VXX signal......11.05.18

We bailed on VXX today when it crossed the zero line in anticipation of market strength ahead of the elections tomorrow. Wednesday morning will be interesting to say the least.

We're trading small for now until the TrendX turns more promising.

We're trading small for now until the TrendX turns more promising.

Sunday, November 4, 2018

VXX signal + SPLV Lazy Man signal...11.02.18

Pre-election jitters and the break down of Chinese trade talks may have been the catalyst for Friday's weakness, which the VXX Vixen predicted. Here's the outlook for Monday...........

Also below note the little Lazy Man ultra low risk model using SPLV (the SPY low volatiity ETF). Only 96 trades over the last 250 trading days but an impressive win/loss ratio. You can sleep at night with this one and a big component of my own IRA account.. Note that this is a mean reversion model since we are actually tracking the volatility component of the ETF.

Also below note the little Lazy Man ultra low risk model using SPLV (the SPY low volatiity ETF). Only 96 trades over the last 250 trading days but an impressive win/loss ratio. You can sleep at night with this one and a big component of my own IRA account.. Note that this is a mean reversion model since we are actually tracking the volatility component of the ETF.

Thursday, November 1, 2018

VXX has new Long signal....11.01.18

After a tepid market rally over the last 2 days Apple's poor showing may return us to the downside. At the close VXX was signalling long and is now up 1.5% in after hours trading.

The paradigm TrendX is turning up both medium and fast formats so the odds look favorable.

The paradigm TrendX is turning up both medium and fast formats so the odds look favorable.

Wednesday, October 31, 2018

Tuesday, October 30, 2018

VXX stopped OUT.....10.30.18

Our skeptical view of yesterday's closing long signal for VXX signal was justified as the markets, rose, dove and then climbed slowly and steadily into the close. We closed our long VXX for a modest .5% loss in the morning session after it looked like momentum buying was kicking in. Those that played by the rules got stopped out for a 2.3% loss later in the day but avoided the greater than 3% loss incurred by the buy and holders.

Monday, October 29, 2018

VXX signal stays Long....10.29.18

Looked like the bulls were going to run the day at the open but then sellers showed up and drove the us down to S1 as tech led the way down with AMAZON down 130 in the afternoon session before a modest rally into the close. Volume was moderate and whether we have a Turnaround Tuesday remains to be seen. After this recent bearish run I'm looking for some kind of relief rally so we're ready to bail on sudden green reversals.

Friday, October 26, 2018

VXX signal holds....10.26.18

Another 6% pop in VXX today is pushing our performance metrics to new highs. So far we;ve stayed on the rihgt side of the VXX trade even as we see dramatic intraday swings. VXX is actually down 1.5% in after hours trading but Monday could be a washout with a pullback to recent lows and then some. Our signal is still long but, as noted yesterday it's getting into uncharted territory from a technical standpoint so anything could happen.

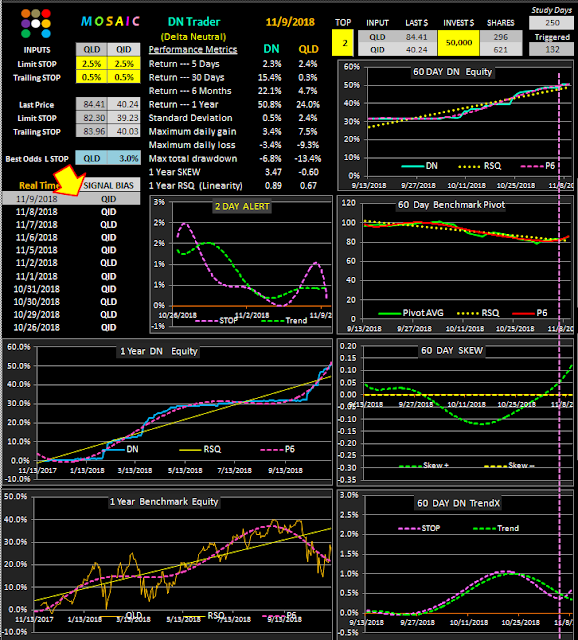

I've also posted a recent performance report on our flagship delta neutral model using the QLD and QID, (2x long and 2x short the QQQs). (see below). This is still a reliable money maker with very low risk...if you follow the limit stop and trailing top rules.

I've also posted a recent performance report on our flagship delta neutral model using the QLD and QID, (2x long and 2x short the QQQs). (see below). This is still a reliable money maker with very low risk...if you follow the limit stop and trailing top rules.

Thursday, October 25, 2018

New VXX signal...10.25.18

Total option market weirdness today as both VIX and VXX fell significantly and yet the entire put option chain for mid November declined...no green numbers....so once again the option market makers rake it in at the expense of direction traders.

For Thursday the VIXEN outlook for VXX is positive and so the signal is vested. The after hours markets are following suit as both AMAZON and GOOGLE are red based on poor earnings.

Also below is the daily trend line for VXX and its clear that today's pullback was dead on the resistance line we saw in July.

This doesn't mean the equity markets are poised for further gains as today's action may have been driven by short squeeze action and a more reasonable exhaustion level for the VIX is in the 50's, not the 30's.

Friday will be REALLY interesting if the markets retrace tomorrow

.

For Thursday the VIXEN outlook for VXX is positive and so the signal is vested. The after hours markets are following suit as both AMAZON and GOOGLE are red based on poor earnings.

Also below is the daily trend line for VXX and its clear that today's pullback was dead on the resistance line we saw in July.

This doesn't mean the equity markets are poised for further gains as today's action may have been driven by short squeeze action and a more reasonable exhaustion level for the VIX is in the 50's, not the 30's.

Friday will be REALLY interesting if the markets retrace tomorrow

.

Wednesday, October 24, 2018

New VXX signal.....cash....10.24.18

Another handsome gain for our long VXX position today as SPY dropped 850 points into the close as the buy-the-dip crowd stayed on the sidelines. For Thursday the VIXEN signal is in cash and we closed our long VXX today at 15 minutes per close...abiding with our standard buy/sell time frame.

Point in fact ...the latest VXX run via the VIXEN has had a certain element of luck to help it out.

And, yesterday's decision to bail when the SPY was at -600 and then buy back in the late after market was a strictly discretionary move off the rules based VIXEN setup, but it netted us an additional 8% above the posted metrics and sometimes you just need to execute those risk off trades when your brain screams..."Time to buy or sell".

Keep in mind that our prime concern is risk management and the success of the VIXEN model becomes most apparent when we examine the max total drawdown of VIXEN versus an unstopped buy and hold VXX position.....7.5 versus 39%,

Point in fact ...the latest VXX run via the VIXEN has had a certain element of luck to help it out.

And, yesterday's decision to bail when the SPY was at -600 and then buy back in the late after market was a strictly discretionary move off the rules based VIXEN setup, but it netted us an additional 8% above the posted metrics and sometimes you just need to execute those risk off trades when your brain screams..."Time to buy or sell".

Keep in mind that our prime concern is risk management and the success of the VIXEN model becomes most apparent when we examine the max total drawdown of VIXEN versus an unstopped buy and hold VXX position.....7.5 versus 39%,

Tuesday, October 23, 2018

VXX Update + silver model....10.23.18

The market tanked in the early session and we sold out our VXX longs when SPY hit -600 or S3 on the pivots. Based on the closing signal, which is still long VXX, we re-entered a long VXX position at the close of after hours trading since the markets were we recovering into the close and in the after hours session. VXX was down 1.7% after hours so our re-entry strategy saved a few risk dollars by waiting until 4:45 PST.

I've also attached the current silver trades using the silver proxy ETF SLV. Note that there returns are over a 6 month period only. This is the Z-score based pairs trading model much discussed in previous posts over the past few years. I have modified it to only track a single input using the Z-score algorithms rather than a long/short pair strategy.

I've also attached the current silver trades using the silver proxy ETF SLV. Note that there returns are over a 6 month period only. This is the Z-score based pairs trading model much discussed in previous posts over the past few years. I have modified it to only track a single input using the Z-score algorithms rather than a long/short pair strategy.

Monday, October 22, 2018

VXX Update....10.22.2018

Our long VXX signal captured a nice 1/5% gain at the close while in after hours trading VXX was up another .75%. A number of significant technical breakdowns are apparent across multiple sectors and the current odds favor more near term consolidated downside action Expect another major short covering rally but beware the subsequent Trap Door setup that's likely to follow.

For now the volatility signals are proving more reliable than the equity signals so that's where our dollars are currently deployed....along with a sizable risk on position in silver (SLV).....with current signal metrics to be posted later this week as time permits.

A reasonable trader looking at the VXX win/loss ratio would likely say..."Well. that looks terrible"

However, the magic of this trading model is hidden in the strict adherence to the specified limit stop and the willingness to accept limited losses while also accepting big winners.

The linearity of the equity curve of the Vixen versus VXX tells the real story.

Keep in mind that out of 250 trading days (1 year) the model was only vested 119 days, slightly less than 50% of the time.

Also keep in mind that VXX has a built in decay function due to it futures composition so betting on any long VXX position is akin to paddling upstream. That's not an excuse for the win/loss ratio, just a extenuating factor that further muddies the water when trying to trade VXX.

For now the volatility signals are proving more reliable than the equity signals so that's where our dollars are currently deployed....along with a sizable risk on position in silver (SLV).....with current signal metrics to be posted later this week as time permits.

A reasonable trader looking at the VXX win/loss ratio would likely say..."Well. that looks terrible"

However, the magic of this trading model is hidden in the strict adherence to the specified limit stop and the willingness to accept limited losses while also accepting big winners.

The linearity of the equity curve of the Vixen versus VXX tells the real story.

Keep in mind that out of 250 trading days (1 year) the model was only vested 119 days, slightly less than 50% of the time.

Also keep in mind that VXX has a built in decay function due to it futures composition so betting on any long VXX position is akin to paddling upstream. That's not an excuse for the win/loss ratio, just a extenuating factor that further muddies the water when trying to trade VXX.

Friday, October 19, 2018

Latest VXX Returns Using the VIXEN model....10.19.18

Finally back in the saddle after some extended medical issues.

For the short term we'll just focus on the trading odds for QLD (X2 QQQ ultra ETF) and VXX (VIX derived proxy ETN).

The current market environment is marked by high volatility, large intraday swings and a tendency to reverse midday. Technical indicators are finding traction difficult.

This VXX study is based on our flagship VIXEN mean reversion model which is based solely on volatility metrics and ignores pricing structure completely.

Our VXX signals can be implemented with actual purchase of the underlying VXX instrument or by employing a variety of option strategies to gain leverage.

The posted metrics are based on purchase/sale of the underlying ETN.

Keep in mind these are daily signals to be executed at the close or in the afterhours trading session (not possible with options).

For Monday the VXX signal is long (bearish for the market) with a 2.2% limit stop.

.

For the short term we'll just focus on the trading odds for QLD (X2 QQQ ultra ETF) and VXX (VIX derived proxy ETN).

The current market environment is marked by high volatility, large intraday swings and a tendency to reverse midday. Technical indicators are finding traction difficult.

This VXX study is based on our flagship VIXEN mean reversion model which is based solely on volatility metrics and ignores pricing structure completely.

Our VXX signals can be implemented with actual purchase of the underlying VXX instrument or by employing a variety of option strategies to gain leverage.

The posted metrics are based on purchase/sale of the underlying ETN.

Keep in mind these are daily signals to be executed at the close or in the afterhours trading session (not possible with options).

For Monday the VXX signal is long (bearish for the market) with a 2.2% limit stop.

.

Tuesday, June 12, 2018

QLD mixed for Wednesday...06.12.18

Vixen has a flat signal for QLD while PVOL is long. TrendX is on the cross. Market technicals and the volatility trends (ATR and OC) are neutral.

There will be no post Wednesday or Thursday.

There will be no post Wednesday or Thursday.

Monday, June 11, 2018

QLD flat for Tuesday....06.11.18

The TrendX is positive, the volatility skew is neutral and the paradigm Alert is positive....yet, contrary to logic, the QLD for tomorrow is flat...just part of the risk equation. All eyes on Singapore.

Sunday, June 10, 2018

QLD long for MOnday....06.10.18

Despite G7 fireworks the general market mood appears to be positive and, depending on the trend of the NOKO/US summit, the market could experience a big jump in enthusiasm. Despite the woefully overbought technical levels the prospects for new highs are clearly evident.

Thursday, June 7, 2018

QLD long for Friday...06.07.18

Defying common sense the QLD Vixen and PVOL models are long while the mean regression MR model flat. To date, the MR model has produced the best win/loss ratio while the PVOL (blended priced pivot momentum and volatility trend) has produced the best total returns (keeping in mind we use the risk management strategy of never allowing an early wing become a loss intraday...this has produced an additional 15.5% total return not reflected in the published metrics.)

Wednesday, June 6, 2018

QLD mixed for Thursday...06.06.18

QLD is mixed for Thursday as volatility continues to erode (see RSQ line). The PVOL model is long, the Vixen is flat...as is the mean regression MR model. Volume is low and liquidity is waning so caution is advised despite the apparent blissful trading meltup.

Subscribe to:

Comments (Atom)