Well, its been a while since my last post. In the meantime I earned a BS in bio-chemistry and am now working with several doctors to run clinical studies on a pain medicine that I developed. You can read about it here...www.PAIN-WALL.com This product has really been a life changer for over 80 folks in my community and word of mouth has led to sales in Australia, Germany. UK, Japan and New Zealand. Several local surgeons use it on their hands during long procedures and one of the doctors has flyers prominently displayed in his office as testimony of his support. Anyhow, give it a look if interested.

My father gave me only a few pearls of wisdom in his lifetime ...one of them that has stuck with me all my life is "If you're the smartest guy in the room then in you're in the wrong room." And so at age 74 I got a BS to complete my other degrees and am now actively working towards a degree in quantum physics. Hence my lack of time to pursue the markets of late.

Nevertheless, here we are and here are the latest PONZO charts for SPY and Gold.

Both best historical fit projections look modestly bullish with the inevitable pullback most likely several months away.

This happy scenario could all change in a moment should a couple sleeper cells decide to make a dramatic statement of displeasure with the US or if investors wise up to the disconnect between market valuations (price) and earnings, both current and forecast.

Good luck to all in the coming year.

Monday, January 13, 2020

Thursday, July 11, 2019

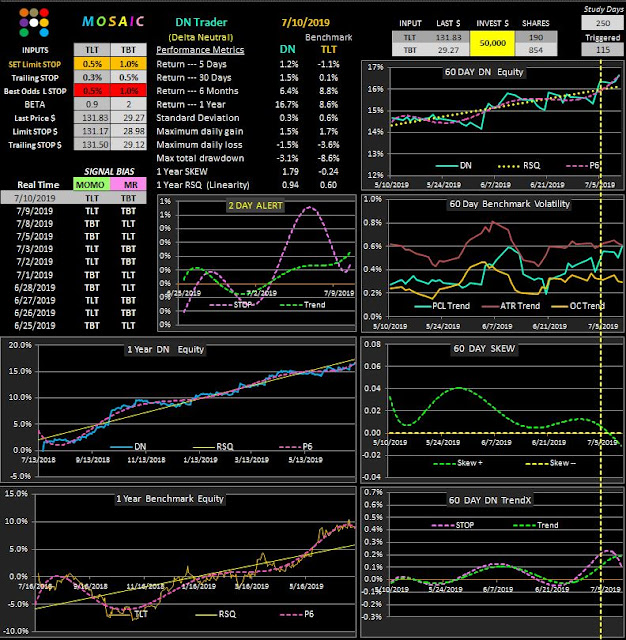

A Timely focus on the TLT /TBT model...07.11.2019

Yesterday's post on the T /T delta neutral model was timely as we saw a nice gain today with a picture perfect example of the delta neutral model in action. We handily made up for our little stop loss on Wednesday and gained a bit of traction today to boot. For now the technical signals all look favorable for further gains but the beauty of the DN model is that even if things reverse we will most likely still see capital appreciation. Friday's have been bullish lately (with a possible modest selloff into the close) so a trailing stop is advisable.

Wednesday, July 10, 2019

The Low Risk TLT Delta Neutral model Update.....07.10.2019

Our caution about the FED day conflict with the long VXX signal turned out to be well founded and we were able to close our small position at the indicated limit stop, saving us a potential $.30 loss beyond our stop. Below is an update of the TLT / TBT 20 year Treasuries model. It doesn't scream returns like VXX and QLD but it plugs along in a nice, predictable and consistent pattern with great linearity and very low risk. As we mentioned before the TBT (TLT inverse) actually is an ultra short ETF meaning its beta is 2 so we have to adjust our limit stop accordingly.

Note thaat the model only triggered 115 out of 259 trading days...another nice risk feature.

Note thaat the model only triggered 115 out of 259 trading days...another nice risk feature.

Tuesday, July 9, 2019

Scalping the VXX... 2 Strategies.......07.09.2019

Following this weekend's post here are 2 similar approaches to trading the VXX volatility ETN.

In the first case we use the PVOL momentum model which combines momentum as measured by price action of the pivot combined with a confirmation signal that the ATR is in a descending pattern.

The second model TFATR1 ignores price action and focuses solely on the behavior of the ATR metrics. As might be expected the combo PVOL model requiring a confirmation signal has a lower net drawdown and a lower net return over our 1 year lookback. The less discriminate TFATR1 model kicks out a better return at the cost of increased risk exposure. TFATR1 also trades 20% more frequently and has a better win/loss ratio than the combo model. That's the tradeoff.

Both models are long VXX for tomorrow....but keep in mind Wednesday is FED day and the historical odds favor a negative VXX behavior 72% of the time so longs should be ready to bail if things turn ugly. Observe the limit stop.

In the first case we use the PVOL momentum model which combines momentum as measured by price action of the pivot combined with a confirmation signal that the ATR is in a descending pattern.

The second model TFATR1 ignores price action and focuses solely on the behavior of the ATR metrics. As might be expected the combo PVOL model requiring a confirmation signal has a lower net drawdown and a lower net return over our 1 year lookback. The less discriminate TFATR1 model kicks out a better return at the cost of increased risk exposure. TFATR1 also trades 20% more frequently and has a better win/loss ratio than the combo model. That's the tradeoff.

Both models are long VXX for tomorrow....but keep in mind Wednesday is FED day and the historical odds favor a negative VXX behavior 72% of the time so longs should be ready to bail if things turn ugly. Observe the limit stop.

Sunday, July 7, 2019

Model Updates with Various Strategies......07.07.2019

Going forward into the second half of the year the general consensus is that things may get a bit rough as earnings expectations and guidance are down, auto sale are terrible, home sales are stagnant and the political environment is explosive, to say the least. Here then are some examples of how our diversified risk managed portfolio has fared so far.

First, the benchmark default delta neutral model has lagged the last six months.

While the momentum based VIXEN (based solely on volatility, not price) has done well with a rather amazing 95% linearity and a much happier drawdown than the benchmark buy and hold QLD..

Then there's our old friend VXX, the VIX proxy ETN that has come back like a zombie from it former depise and replacement by VXXB only to be reincarnated again as VXX. I still consider this the greatest trade of all time when I advised shorting this guaranteed loser when it was at 900.

We're using the VIXEN momentum model with this toad and the results are actually quite good.

Finally, my hands down favorite low risk no brainer easy money trade. The risk adjusted SPY proxy ETF SPLV using our MR3 (3 day pullback) mean reversion model has a drawdown and win/loss ratio that should make this little nugget of trading gold part of every portfolio...IMHO.

First, the benchmark default delta neutral model has lagged the last six months.

While the momentum based VIXEN (based solely on volatility, not price) has done well with a rather amazing 95% linearity and a much happier drawdown than the benchmark buy and hold QLD..

Then there's our old friend VXX, the VIX proxy ETN that has come back like a zombie from it former depise and replacement by VXXB only to be reincarnated again as VXX. I still consider this the greatest trade of all time when I advised shorting this guaranteed loser when it was at 900.

We're using the VIXEN momentum model with this toad and the results are actually quite good.

Finally, my hands down favorite low risk no brainer easy money trade. The risk adjusted SPY proxy ETF SPLV using our MR3 (3 day pullback) mean reversion model has a drawdown and win/loss ratio that should make this little nugget of trading gold part of every portfolio...IMHO.

Sunday, June 30, 2019

Delta Neutral Update and MoDX for Silver and QQQ..........06.30.2019

Momentum's on a rise and volatility is on a fade. Our "best odds" risk stop has once again retreated to almost 1.0, abou half of where we would expect it to be. Nevertheless, we're continuing to bank coin with the low risk QLD/QID model and I've arbitrarily set the stop limit at 1.4% in anticipation of a Chinese trade news item (which has already been debunked as of 7 PM EST.

The 2 attached MoDX charts are for the Qs and silver...one of my favorite short term options ETFs.

The 2 attached MoDX charts are for the Qs and silver...one of my favorite short term options ETFs.

Monday, June 24, 2019

PONZO Update for SPY....06.24.2019

With so much bearishness in the air from the usual talking heads I thought I better run the latest SPY forecast using the PONZO charts. The outlook via PONZO is NOT bearish although the crap can hit the fan at any time especially if IRAN gets squirrely or if China decides to go mano to mano.

meanwhile the PONZO gold forecast fro just a few weeks ago has proven to be right on although a bit reserved as GLD has already hit the 132 target several months ahead of schedule and its probably best to look for some pullback on that one before initiating any new positions..

See PONZO link at the right side if unfamiliar with our benchmark forecasting tool.

meanwhile the PONZO gold forecast fro just a few weeks ago has proven to be right on although a bit reserved as GLD has already hit the 132 target several months ahead of schedule and its probably best to look for some pullback on that one before initiating any new positions..

See PONZO link at the right side if unfamiliar with our benchmark forecasting tool.

Subscribe to:

Comments (Atom)