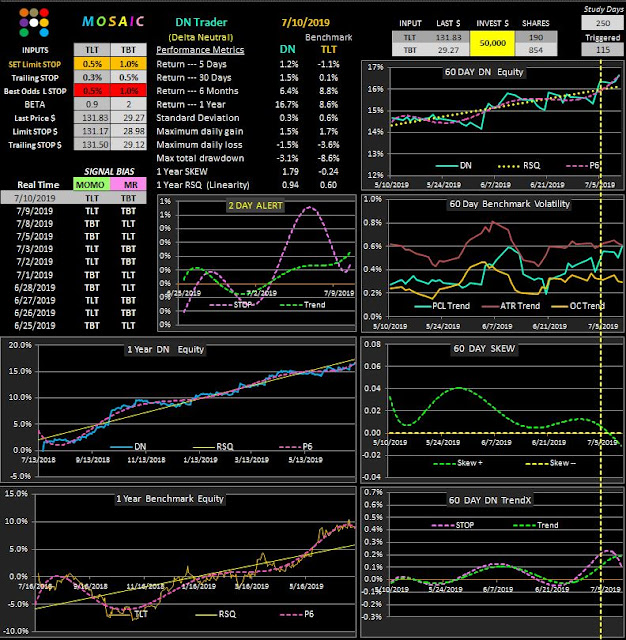

Our caution about the FED day conflict with the long VXX signal turned out to be well founded and we were able to close our small position at the indicated limit stop, saving us a potential $.30 loss beyond our stop. Below is an update of the TLT / TBT 20 year Treasuries model. It doesn't scream returns like VXX and QLD but it plugs along in a nice, predictable and consistent pattern with great linearity and very low risk. As we mentioned before the TBT (TLT inverse) actually is an ultra short ETF meaning its beta is 2 so we have to adjust our limit stop accordingly.

Note thaat the model only triggered 115 out of 259 trading days...another nice risk feature.