We finally got a bounce off the TLT bottoming target at mid $ 116 yesterday and are seeing a continuation today.

Other bond ETFs followed suit and we may see some progress in that trend for at least the next few days.

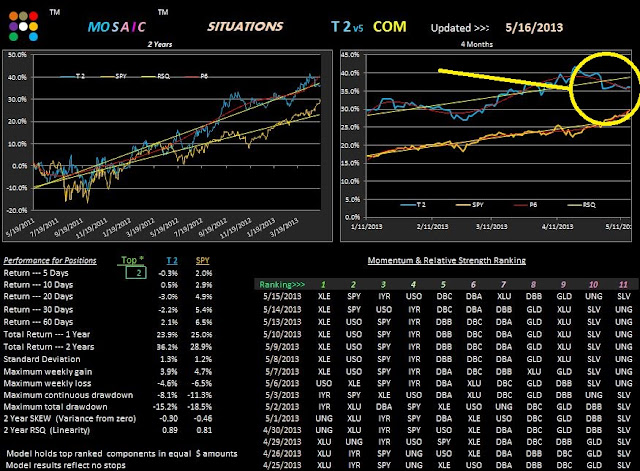

Meanwhile, the Commodity model continues to lag, but positions should have been exited several weeks ago once the P6 went downslope and especially when the RSQ line was violated, thus avoiding the recent net drawdown.

IYR (real estate) and XLE are the best looking charts in the sample portfolio but the metals (GLD and SLV) are still deteriorating and continue to slide further down the RSQ slope.

Click once on chart to enlarge and clarify.