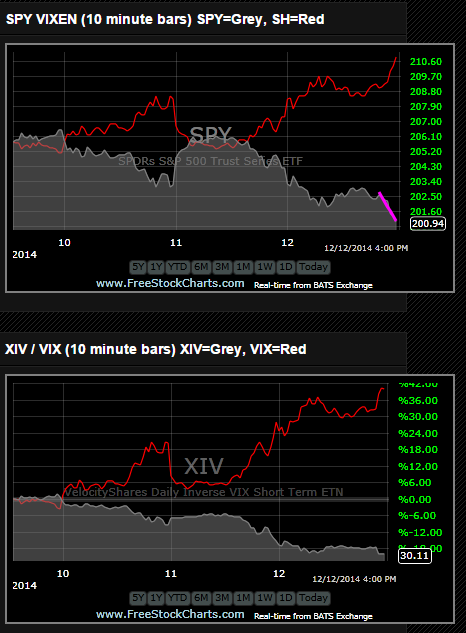

While volatility has shown no indication of slowing down I thought it might be useful to look at a long term weekly chart of VIX (134 weeks), which suggests we might be reaching an exhaustion level for this week's drop. The XIV/VXX skew has been completely out of balance all week (in favor of VXX) but XIV is approaching an exhaustion level down to support and both the UPRO and XIV premiums are close to zero. It's been unusual to see so many days with the NYAD (advance decline line) down in the teens since those levels themselves are usually strong indicators of impending reversals. Nevertheless, here we are and although some gloom and doomers are predicting VIX at 40 (remember December 2008) both economical fundamentals and seasonal history argue for a return to previous highs. When the turn does come it's likely to be explosive, fueled by rampant buying fever and short covering. It looked like we had a shot at that scenario earlier in the week and then the selling took over with a vengeance. Caution and patience are the watchwords and always recall the trading strategy that "the second mouse gets the cheese".