This is important!. The markets are fickle. Murphy's Law is alive and well in the NYSE and NASDAQ and those who've been in the trading trenches for a more than a few years know all about the unexpected curve balls and spit balls the market can pitch us. Trying to catch many of those pitches is iffy...trying to read them for a base hit is even harder.

I've spoken of "paradigm shifts" in the markets before and here's a little study of the Lazy Man (LM) model illustrating the repetitive and fractal nature of those shifts. The LM of course is just like putting on a set of special goggles to examine market dynamics. M3 looks at the markets differently than LM and there are thousands upon thousands of other technical goggles or templates that are available to perform alternate views. What's important is recognizing periods when the markets are not "in focus" with the technical goggles we are using and being ready to act when that focus returns.

I'm not going to spend pages digressing about why the markets behave this way...suffice to say, after watching and trading them for almost 30 years, they do.

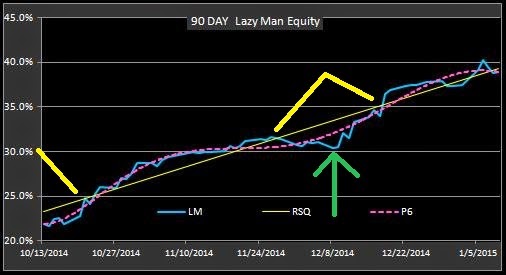

Below are a 90 day and 2 year chart of LM. The paradigm shifts are defined by the yellow calipers and the beginning of the re-focus is indicated by the green arrows (and the upslope behavior of P6.

Alternate templates would likely reveal alternate paradigm shifts.....but being alert to when the markets are behaving out of sync with our analysis format (or another) can avoid unnecessary drawdowns and headaches by engaging simply money management practices such as scaling back positions or simply standing back in cash.