First day of month tomorrow SHOULD BE bullish. Friday is a holiday so Thursday becomes the Friday for this week..SHOULD BE bearish. This keeps with the volatile yin yang theme we've traded through for the past few months and March in particular. Long term trend is still bullish but the TrendX is currently in limbo.. Models are in cash for Wednesday and while the SPY/XIV correlation is in alignment short term, longer term its in contango. ALL eyes are on upcoming earnings and the possible impact of the rising dollar....it could get ugly in a hurry.

Tuesday, March 31, 2015

Monday, March 30, 2015

Low Volume Pop, but...03.30.15

We got a solid move up today, breaking the month long pattern wherein SPY did not make 2 consecutive higher closes for 28 trading days....a situation not seen since 1960.

Volume was very thin and once again we are on alert for a bear trap. Internet chatter continues to focus on likely lousy earnings this time around based on the dollar's surge and the latest run of the Ponzo time machine is in fact tending in this direction.

Last week's Ponzo forecast was 63% negative, this week's forecast is 74% negative. Just something to keep in mind once earnings kick off.

Everything's fine until its not and then things can get ugly in a hurry.

This is still a tenuous market at best.

Volume was very thin and once again we are on alert for a bear trap. Internet chatter continues to focus on likely lousy earnings this time around based on the dollar's surge and the latest run of the Ponzo time machine is in fact tending in this direction.

Last week's Ponzo forecast was 63% negative, this week's forecast is 74% negative. Just something to keep in mind once earnings kick off.

Everything's fine until its not and then things can get ugly in a hurry.

This is still a tenuous market at best.

Saturday, March 28, 2015

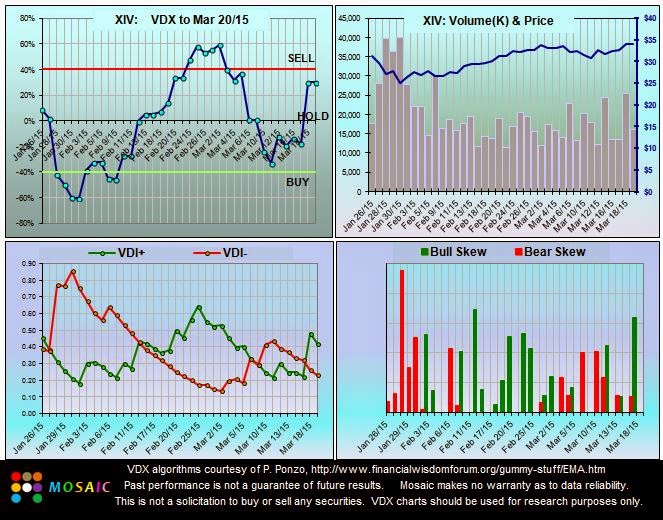

VDX Rising...Maybe...03.28.14

While the TrendX remains downslope the SPY VDX may be about to turn up in sync with the typical

last day of the month pop. I say maybe because we've seen these apparent bullish turns fail in the past (see red arrows) and the actual VDX+ indicator has not actually gone upslope yet.

By comparison the XIV VDX chart is actually more optimistic for the bulls and that's what we have seen on Thursday and Friday.....XIV far outpacing SPY to the upside.

Here's an interesting article on why the DOW index is a fool's errand and why I seldom pay any attention to it.

Please remember that starting next week Chrome will no longer support Silverlight applications so the TrendX charts and FSC can only be read with IE or Firefox.

last day of the month pop. I say maybe because we've seen these apparent bullish turns fail in the past (see red arrows) and the actual VDX+ indicator has not actually gone upslope yet.

By comparison the XIV VDX chart is actually more optimistic for the bulls and that's what we have seen on Thursday and Friday.....XIV far outpacing SPY to the upside.

Here's an interesting article on why the DOW index is a fool's errand and why I seldom pay any attention to it.

Please remember that starting next week Chrome will no longer support Silverlight applications so the TrendX charts and FSC can only be read with IE or Firefox.

Thursday, March 26, 2015

CAUTION!!!!!....03.26.15

Up, down. up, down...that was today's neurotic action as the major indices closed in the red but XIV and VIX were both green. These are dangerous markets and with tomorrow being the bear skewed day of week the possibility of another Trap Door looms large. Now, I'm not a doomsayer, just risk conscious and risk adverse and the M3 models remain in cash in anticipation of Friday's action.

The SPY TrendX is clearly downslope (right side panel), which increases the odds for the bears.

Oil was the big winner on the VEGA model....just like yesterday plus UUP was up (bearish).

The SPY TrendX is clearly downslope (right side panel), which increases the odds for the bears.

Oil was the big winner on the VEGA model....just like yesterday plus UUP was up (bearish).

Wednesday, March 25, 2015

Trap Door Opens..WIDE.....03.25.15

We saw the Trap Door set up I'd been warning about for the past few days and it was a doozey, apparently prompted by a lousy durable goods report. QQQ was particularly hard hit and the only glimmer of green was in the oil sector. There was no selling abatement into the close so we're expecting a carryover into tomorrow. The M3 models were is cash for today's mini-crash and are now skewed to the downside.

Tuesday, March 24, 2015

Muddle Continues...03.24.15

The past 2 days have seen nasty closes and today's open looked like we were going to see a resolution to the downside......but so far at 90 minutes in the markets are holding together (barely) as the NYAD rides the .72 level and ...here's the kicker... the VIX is down 2.5%. while SPY is slightly in the red.

Could be a plunge ahead so heads up on stops and beware the trap door. Very thin volume is also adding to the uncertainty of market stability.

Could be a plunge ahead so heads up on stops and beware the trap door. Very thin volume is also adding to the uncertainty of market stability.

Monday, March 23, 2015

M3 Update....03.23.15

Here's the full M3 panel just to display what's been happening from a larger perspective. M3 is clearly in paradigm as reflected in the equity curve position relative to P6 and the RSQ. Last week's gains of almost 8% were welcome but we have to be realistic and know that the markets can quickly eliminate recent gains given the right bad news. The SPY RSI2 daily reading is only 81 and rising, which is bullish, but there are still dangers afoot.

We must always keep in mind that HFT accounts for over 70% of daily trades and momentum can easily get skewed when the buying or selling programs kick in en mass.

From a market gamesmanship view I fully expect a pullback in the next few days before the typical end of month pop. Meanwhile the short sellers are not faring well and we should expect some market manipulation by the big boys in an effort to recoup those losses.

We must always keep in mind that HFT accounts for over 70% of daily trades and momentum can easily get skewed when the buying or selling programs kick in en mass.

From a market gamesmanship view I fully expect a pullback in the next few days before the typical end of month pop. Meanwhile the short sellers are not faring well and we should expect some market manipulation by the big boys in an effort to recoup those losses.

Saturday, March 21, 2015

VDX Goes Yellow....03.21.15

After a great run for M3 this week (up almost 8%) the VDX for both SPY and XIV are on a cautious SELL signal. The SPY TrendX (right side panel) has not reached overbought levels yet and we may still see some further gains in the majors.

Note on the M3 login tab that stops have been tightened for Monday in order to preserve our gains. There will likely be some pullback ahead of the end of month typical surge and then, when earnings start, be prepared for renewed volatility pops as the dollar's impact on the big multinationals becomes apparent and it probably won't be in a good way.

HEADS UP....Chrome will not support Silverlight after April 1st so The TrendX chart site and the TrendX chart linked to the Newsletter can only be read with IE and Firefox.

Note on the M3 login tab that stops have been tightened for Monday in order to preserve our gains. There will likely be some pullback ahead of the end of month typical surge and then, when earnings start, be prepared for renewed volatility pops as the dollar's impact on the big multinationals becomes apparent and it probably won't be in a good way.

HEADS UP....Chrome will not support Silverlight after April 1st so The TrendX chart site and the TrendX chart linked to the Newsletter can only be read with IE and Firefox.

Thursday, March 19, 2015

A MIld Pullback..03.19.20

Options expiration on Friday so expect some volatility as traders try to pin strikes to their advantage.

We saw the pullback that we forecast yesterday at the close but it was relatively mild (SPY never even got close to S1 pivot) and QQQ actually finished in the green.

The dollar (UUP) did a complete 180 from yesterday and that's a bit worrisome for the bulls. After the FED induced steroid pop on Wednesday next week will be an acid test for the likely trend momentum.

Once earnings kick off in a couple weeks the widely held view is that the rising dollar will produce poor guidance from the large cap multinationals and may spark a sizable sell off. Caveat emptor.

We saw the pullback that we forecast yesterday at the close but it was relatively mild (SPY never even got close to S1 pivot) and QQQ actually finished in the green.

The dollar (UUP) did a complete 180 from yesterday and that's a bit worrisome for the bulls. After the FED induced steroid pop on Wednesday next week will be an acid test for the likely trend momentum.

Once earnings kick off in a couple weeks the widely held view is that the rising dollar will produce poor guidance from the large cap multinationals and may spark a sizable sell off. Caveat emptor.

Wednesday, March 18, 2015

No Patience...03.18.15

As expected (by some) the FED dropped the word "patience" from its forward guidance and a stumbling red market took off like a moon shot thereafter with the DOW finishing the day up 227.

In hindsight the FED move seemed like a no brainer as Yellen doesn't want to be the one blamed for cratering the markets and a slew of bad economic indicators are calling into question the real robustness of the ongoing recovery. Needless to say the markets were poised either way at 11:00 AM PST today and the end results could have easily been just the opposite one of that we saw. Now we need to see if there's any mojo behind day's action. The closing 30 minutes suggests we'll see at least a partial retrace Thursday as the battered shorts try and establish new positions ahead of Fridays options expiration.

In hindsight the FED move seemed like a no brainer as Yellen doesn't want to be the one blamed for cratering the markets and a slew of bad economic indicators are calling into question the real robustness of the ongoing recovery. Needless to say the markets were poised either way at 11:00 AM PST today and the end results could have easily been just the opposite one of that we saw. Now we need to see if there's any mojo behind day's action. The closing 30 minutes suggests we'll see at least a partial retrace Thursday as the battered shorts try and establish new positions ahead of Fridays options expiration.

Tuesday, March 17, 2015

FED Tests Traders' "Patience"

In the market's bizzaro reasoning weak home building stats are viewed as positive since its assumed that will help keep the FED from losing "patience" and considering a Fall rate hike. Everyone's getting pretty sick of being held hostage by the FED's waffling and tomorrow will be no exception. Expect a volatile session that may or may not have a follow through on Thursday and Friday after the FED's pronouncements are nuanced and second guessed ad nausea um.

What was indicative of the mood despite today's low volume was the sudden enthusiasm for XIV in the closing hour as it ran bullish in contrast to the SPY's bearish tone.(see lower chart)

What was indicative of the mood despite today's low volume was the sudden enthusiasm for XIV in the closing hour as it ran bullish in contrast to the SPY's bearish tone.(see lower chart)

Monday, March 16, 2015

Muddled Market...03.16.15

This is a follow up to Saturday's Ponzo posts...a look at the XIV VDX chart.

The several months long disparity of SPY and XIV has been a frustration for making odds on the normal synchronization of these 2 issues since XIV is in fact a derivative of SPY, but right now the signals are in sync.

(M3 is LONG XIV this morning)

Dave Moenning has similar thoughts on the current state of the market. You can sign up for his daily market take and read his most recent post HERE.

These guys manage $5 billion and Dave is the chief investment officer so his words bear attention. There's always a nugget or 2 of wisdom that's way above the usual talking head drivel.

The several months long disparity of SPY and XIV has been a frustration for making odds on the normal synchronization of these 2 issues since XIV is in fact a derivative of SPY, but right now the signals are in sync.

(M3 is LONG XIV this morning)

Dave Moenning has similar thoughts on the current state of the market. You can sign up for his daily market take and read his most recent post HERE.

These guys manage $5 billion and Dave is the chief investment officer so his words bear attention. There's always a nugget or 2 of wisdom that's way above the usual talking head drivel.

Saturday, March 14, 2015

Ponzo Trend Turns Bearish....03.14.15

Friday saw a revisit of Thursday lows and an ultimate closing in the red. With the ongoing rise of the dollar (UUP) the large cap multinationals are suffering badly and it was interesting to hear one of the market gurus who foresaw the dollar's rise several months ago to forecast that the dollar could extend its run FOR THE NEXT 2 YEARS!!!. Of course that's just one opinion, but a pretty informed one.

In that context here's a look at the current PONZO Time Machine and the VDX chart.

Note that the 18 month projection for the SPY now has the odds clearly skewed to the downside...a scenario we have not seen before. The risk profile also continues to expand, adding to the uncertainty factor.

VDX is more upbeat now being in a BUY mode but this is based strictly on technicals and we need to keep in mind that oversold conditions may get worse before they get better.

In that context here's a look at the current PONZO Time Machine and the VDX chart.

Note that the 18 month projection for the SPY now has the odds clearly skewed to the downside...a scenario we have not seen before. The risk profile also continues to expand, adding to the uncertainty factor.

VDX is more upbeat now being in a BUY mode but this is based strictly on technicals and we need to keep in mind that oversold conditions may get worse before they get better.

Thursday, March 12, 2015

POP...03.12.15

At yesterday's close we forecast a bounce that would stick today and we got it in spades. The NYAD opened at 4.15 and typically any opening with a NYAD reading greater than 3 will not fade to the red by day's end. That was the case today as SPY gradually rose to R3 levels and beyond just pre-close although momentum for today's last hour was negative. Tomorrow we'll see how how much of today's mojo was short covering....the opening NYAD reading should provide a good telltale. Tomorrow's Friday, a 70% bearish day of the week, so there's that to deal with also.

As noted on the M3 site I'm switching back to the M3 model from M3+. The performance metrics over the past month have been almost identical but the longer term risk profile of M3 is more attractive. This risk advantage can be traced to M3's use of the SPY ultra ETFs SDS and SSO to gain ground relative to SPY when the volatility based ETNs XIV and VXX are not in timing sync with SPY, which has clearly been the case over the past few months.

M3 subscribers can study the nuances of M3 versus M3+ on today's login page.

Chart courtesy of FreeStockCharts.com

As noted on the M3 site I'm switching back to the M3 model from M3+. The performance metrics over the past month have been almost identical but the longer term risk profile of M3 is more attractive. This risk advantage can be traced to M3's use of the SPY ultra ETFs SDS and SSO to gain ground relative to SPY when the volatility based ETNs XIV and VXX are not in timing sync with SPY, which has clearly been the case over the past few months.

M3 subscribers can study the nuances of M3 versus M3+ on today's login page.

Chart courtesy of FreeStockCharts.com

Wednesday, March 11, 2015

SPY at Support...03.11.15

SPY finally got down to nominal support (and oversold) levels. That doesn't mean we can't go lower but the odds are starting to be skewed in favor of the bulls going forward.

It was a particularly weird opening today withe both the VXX and the SPY in the green. That was a danger sign for any new longs and, sure enough, the final reckoning for the SPY at the close was red....although the closing 10 minutes did not repeat the high volume sell off seen yesterday.

The dollar has been on steroids (UUP), reaching the highest level in a decade and that's got a lot of multinational large caps spooked (like Walmart). Hint>>>watch UUP.

It was a particularly weird opening today withe both the VXX and the SPY in the green. That was a danger sign for any new longs and, sure enough, the final reckoning for the SPY at the close was red....although the closing 10 minutes did not repeat the high volume sell off seen yesterday.

The dollar has been on steroids (UUP), reaching the highest level in a decade and that's got a lot of multinational large caps spooked (like Walmart). Hint>>>watch UUP.

Tuesday, March 10, 2015

Oversold but Dangerous...-3.10.15

The SPY clung to the S5 pivot today, an uber bearish situation we see less than 1% of trading days. Per the SPY TrendX in the right side panel the longer term support level is within striking distance but the big sell off in the last 10 minutes today does not look like a capitulation and I'm expecting at least some carry over selling into the morning session....if not longer.

Monday, March 9, 2015

Rally, kinda....03.09.15

We saw the recovery bounce we were expecting although volume was very low and the closing trend was actually downslope...which is keeping with the SPY TrendX momentum (right side panel). Earnings are still being reported and digested and the odds for a volatility pop are strong.

The MO2 pairs signal was dead on for today and keep in mind the model has a 12 day fixed time stop...or sooner if we drop >.7%. M3 and LM are in cash.

Chart courtesy of FreeStockCharts.com

The MO2 pairs signal was dead on for today and keep in mind the model has a 12 day fixed time stop...or sooner if we drop >.7%. M3 and LM are in cash.

Chart courtesy of FreeStockCharts.com

Saturday, March 7, 2015

XIV / SPY Divergence.....03.07.15

Looking at the VDx charts for SPY and XIV shows the disparity in signal correlation. The VDI +/- chart clearly shows that Friday's was plunge was where the odds lay, whereas the XIV version is much more ambiguous.

I mentioned on the M3 site that I was expecting a relief rally on Monday (with a caveat) and the MO2 pairs model of SPY/UPRO, which has been a solid performer for the past 2 years, has flashed a new bullish signal as of Friday's close.(see below)

The TrendX (right side panel) is still not not to support levels, which is one reason that the pairs signal may be a bit premature, but there it is for the record.

I mentioned on the M3 site that I was expecting a relief rally on Monday (with a caveat) and the MO2 pairs model of SPY/UPRO, which has been a solid performer for the past 2 years, has flashed a new bullish signal as of Friday's close.(see below)

The TrendX (right side panel) is still not not to support levels, which is one reason that the pairs signal may be a bit premature, but there it is for the record.

Thursday, March 5, 2015

TrendX Remains Downslope...03.05.15

We had a modest gain in SPY and the other majors today but the TrendX (right side panel) remains in a negative mode as does the consensus M3 amd LM signals. On the bullish side XIV made a nice bump up today and further clouding the crystal ball is a quick look at the M3 rankings which have SH as #1 and XIV as #2. Employment data out tomorrow AM has typically led to bullish pops over the past 6 months. The offset is that any negative earnings surprises in the high profile stocks could stimulate a further decline in the indices.

Wednesday, March 4, 2015

Tuesday, March 3, 2015

A Setback...03.03.15

Just when it looked like we were going to get a good run going the markets hit a technical setback and followed the TrendX signal down. It's anybody's guess for tomorrow but the signals are skewed to the downside. I'm on the road for the next couple days as I explore some opportunities in Las Vegas to expand M3 applications so posts may be somewhat briefer than usual.

Monday, March 2, 2015

What, me worry?....03.02.15

The first trading day of the month and hope springs eternal for the bulls. Despite the risk profiles posted over the weekend the indications are for at new highs based on the behavior of the XIV, which continues its rise out of the ashes and is now fully in sync with SPY beta momentum. Volume was not supportive today, but we've seen low volume runs before and at these lofty levels there's still a lot of hedging holdimg the markets in check.

Subscribe to:

Comments (Atom)