I put a heavy emphasis on the use of stops and in particular I favor the use of intraday limit stops which allow a little breathing room for stocks/ETFs to recover from morning plunges.

This is first in a multi-post series which will make the case for using these stops and, more importantly, how you can easily construct a risk defined trading program using either a single input or an input and its inverse, when such vehicles exist. Such market setups are termed market neutral strategies and are a favorite of many hedge funds and money managers. (Coming tomorrow).

Rest assured these setups are not difficult to create and/or maintain and it may surprise you to see how easy it is to construct a basket of divergent pairs to cover a variety of sectors.

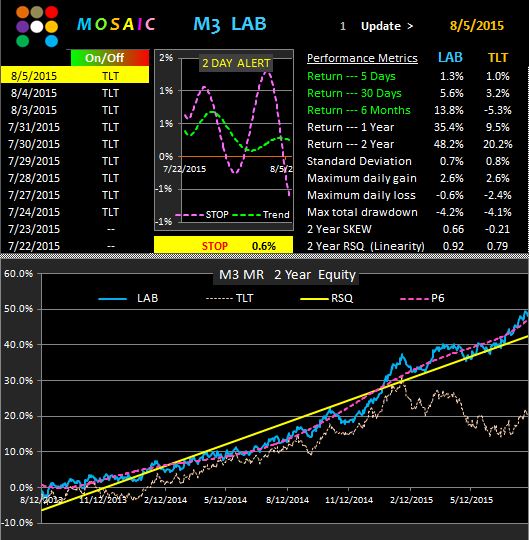

Today we'll just look at 3 popular ETFs....XLU (SPDR Utilities), QQQ (NAZ 100) and TLT (20 year Treasury bonds). We compare 2 sets of metrics for each issue...one for the raw ETF performance and the other (LAB) applying a simple .6% or .5% limit stop. How do these values get defined?. I use a little algorithm to look back 2 years and define daily range of any issue and then determine the value of a limit stop that will fire >95% of the time without giving up excess gains. I think you'll see the potential here in the reduced drawdowns, enhanced gains and linearity in each case.