No trading tomorrow in recognition of Good Friday and there was a sizable sell off at the open to set up risk on positions ahead of the 3 day market closure. That weakness was ultimately resolved to the upside (marginally) as dip buyers gradually emerged in the afternoon. That is a bullish indication of course but the continued low volume reflects a lack of any real commitment one way or the other. Next week is historically weak but then there/s the end of month bullish odds setup only 7 days away.

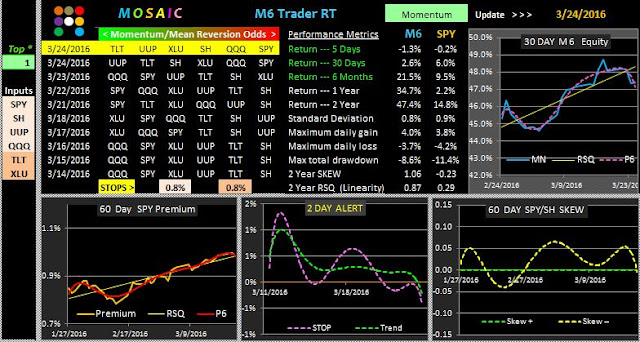

Here's a little different market neutral mix using the M6 platform and looking at the mean reversion versus momentum filters the former currently has the clear edge in reliability.

M6 users please note the position of the 2 Day ALERT signal in each mode. That's risk off..