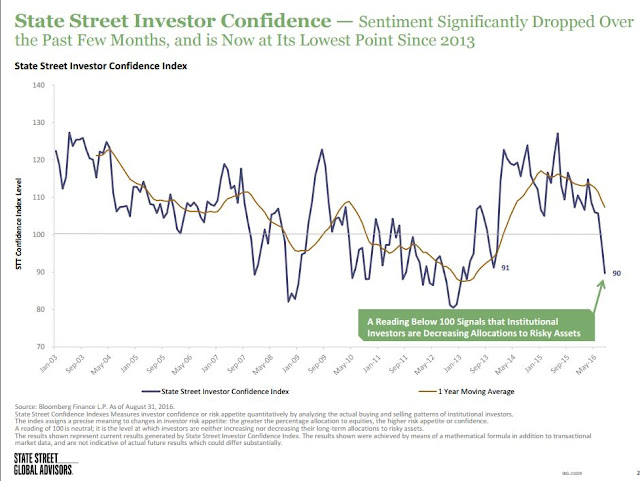

Courtesy of my friends at State Street here are this month's confidence and volatility profiles...both of which would lead one to a near term bearish outlook. Today's selling was modest in the indices but much more pronounced in select stocks and bonds in particular, which saw a sustained S3 pivot collapse as the odds for increasing yields developed.

Friday should be instructive for gauging next week's trading. Statistically we expect Friday to be down (72% odds) but many indices and 20 year Treasuries (TLT) are at or below the lower Bollinger Band....which has most frequently produced a tradeable reversal within a day.