It was turnaround Tuesday for the markets although bonds surged early on and held strong through the close. Silver and gold are on a tear as the dollar slumps and the odds of a FED hike tomorrow are LOW. The VIX has begun a slide back to the 11's and odds are for the bulls for the next 2 days.

SPY momentum looks bullish.

Apple beat and is up after hours,continuing the theme of most of the big techs (not Qualcomm).

The Ponzo forecasts have diverged only marginally over the past month as we move onto February, typically the worst month in election years....the reasons for which are more than I have time for.

We'll just monitor the news, ignore the talking heads and watch the only metric that matters...price.

Tuesday, January 31, 2017

Monday, January 30, 2017

TLT Perspectives...01.30.17

Despite the consensus bullish signals at Friday's close the markets reacted poorly to the immigration bans imposed over the weekend even though they were originally formulated and approved by Obama years ago. Welcome to the brave new world.

Nevertheless ,selling pressure is currently moderate on TLT with multiple arguments suggesting that a run up may be in the wings.

The current M1 and MVP signals are mixed and we're following a cautious approach for now.

Earnings on big tech this week, FB, AAPL, AMD, etc will likely set the tone.................

Nevertheless ,selling pressure is currently moderate on TLT with multiple arguments suggesting that a run up may be in the wings.

The current M1 and MVP signals are mixed and we're following a cautious approach for now.

Earnings on big tech this week, FB, AAPL, AMD, etc will likely set the tone.................

Saturday, January 28, 2017

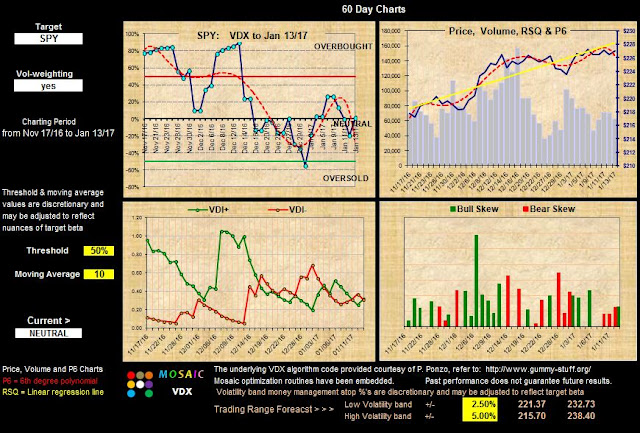

VDX Updates...01.28.17

The market mood has turned bullish with the break above DOW 20k and with the end of month bullish skew in full force next week the odds are for more gains in this overbought market.

The position of the VIX in the 10s is strong supporting evidence for continued moves up...although history has shown that SOMETHING will happen soon to tip that balance ...as evidenced by the forward looking VIX March values which are projected at over 14.

Trader's Outlook shares the bullish view but looming in the background are doubts as to the true resiliency of the recent rally.

Meanwhile, bonds are starting to look attractive if the slope of the yield curve can be contained.

The position of the VIX in the 10s is strong supporting evidence for continued moves up...although history has shown that SOMETHING will happen soon to tip that balance ...as evidenced by the forward looking VIX March values which are projected at over 14.

Trader's Outlook shares the bullish view but looming in the background are doubts as to the true resiliency of the recent rally.

Meanwhile, bonds are starting to look attractive if the slope of the yield curve can be contained.

Thursday, January 26, 2017

EEM Prospects..Part 2...01.26.17

Following yesterday's EEM post here are 2 completely different views based on the MO2 pair trading module....in the first case EEM is paired against UUP (Dollar) and in the second EEM is paired against EWJ (Japan). These are both divergent pairs...that is..when EEM goes up UUP and EWJ typically go down. Signals are based on the z-score,..,a modified standard deviation metric.

Both models have EEM in a short status...BUT, ..look at the equity curves....these trades are currently in the red.

EEM did fall today but not nearly enough to fire our stop.

Both models have EEM in a short status...BUT, ..look at the equity curves....these trades are currently in the red.

EEM did fall today but not nearly enough to fire our stop.

Wednesday, January 25, 2017

EEM Prospects...01.25.17

Following previous posts on EEM (Emerging Markets ETF) here's the current Ponzo forecast as well as the M1 and VPM momentum models. All signals are positive and in synce on both models as we consider making EEM part of our permanent portfolio.. With most of the generals in overbought hyperspace we're actively searching for alternative ETF prospects that have the potential for long solid runs. EEM trades pretty much inverse to the dollar so if you think the strong dollar is overbought then this is something to consider.

Tuesday, January 24, 2017

Ponzo Updates....01.24.17

This week's Ponzo forecasts match the outlooks from last week so no new changes of momentum for now. We did see a SPY surge on Turnaround Tuesday today and TLT fell accordingly confounding the signal posted yesterday. It was a great day for delta neutral plays.

At this point the very near term is mixed but by the 2nd day of Feb we expect DOW to finally rip the 20K resistance....or tomorrow if the buy mood continues.

At this point the very near term is mixed but by the 2nd day of Feb we expect DOW to finally rip the 20K resistance....or tomorrow if the buy mood continues.

Monday, January 23, 2017

TLT Perspectives...01.23.17

The week is starting out with some selling pressure as volume picks up from last week's dribble.

Chatter continues to focus on the market uncertainties of a Trump administration but we just need to follow the trading plan to stay safe and sane.

Here are 2 M1 views of current TLT trade signals....the first showing the base momentum model and the second using a "Risk ON' model that is basically all in unless the pivot trend turns negative.

The net effect is that the filtering algorithms are somewhat different but the trade frequency and win/loss ratios are quite similar.

We're continuing refinements of the M1 models and the end of the month is still a possible timeline for delivery..

Chatter continues to focus on the market uncertainties of a Trump administration but we just need to follow the trading plan to stay safe and sane.

Here are 2 M1 views of current TLT trade signals....the first showing the base momentum model and the second using a "Risk ON' model that is basically all in unless the pivot trend turns negative.

The net effect is that the filtering algorithms are somewhat different but the trade frequency and win/loss ratios are quite similar.

We're continuing refinements of the M1 models and the end of the month is still a possible timeline for delivery..

Saturday, January 21, 2017

VDX Updates and Weekend Reading...01.21.17

This week's VDX charts suggest weakening in the SPY momentum while VIX and TLT remain firmly in a neutral bracket although TLT is fast approaching oversold levels.

Despite the ongoing distribution of treasuries which were cited in several posts earlier this week there are still a few credible voices arguing bonds are in store for a run up.

The technical outlook for next week is modestly bearish via our charts and the Trader's Outlook.

This scenario follows in lock step with the SPY Ponzo forecast published earlier in the week although if you check it out carefully it appears there's a high likelihood of a rally at month's end......the technical timing sweet spot where we would most expect it.

Despite the ongoing distribution of treasuries which were cited in several posts earlier this week there are still a few credible voices arguing bonds are in store for a run up.

The technical outlook for next week is modestly bearish via our charts and the Trader's Outlook.

This scenario follows in lock step with the SPY Ponzo forecast published earlier in the week although if you check it out carefully it appears there's a high likelihood of a rally at month's end......the technical timing sweet spot where we would most expect it.

Thursday, January 19, 2017

TLT Signal Updates...01.19.17

Following our previous notes on TLT here are the M1 and MVP signals for TLT action on Friday with the 2 Day ALERT signal filters turned on. The M1 ALERT is based on the trend of the pivot while the MVP ALERT is based on the trend of the Mosaic signal reliability.

These are two entirely different methodologies that we're researching as we move into 2017.

Prospects for TLT looked dim after the wave of selling but recovered somewhat into the close today although clearly under pressure.

These are two entirely different methodologies that we're researching as we move into 2017.

Prospects for TLT looked dim after the wave of selling but recovered somewhat into the close today although clearly under pressure.

Wednesday, January 18, 2017

Ponzo Updates...01.18.17

This week's Ponzo forecasts are noteworthy in that the SPY's composite outlook has turned bearish.

The VIX forecast is moderately elevated from last week also but we're not seeing the wild outlier scenarios like those in November and December. There is currently massive short interest on the VIX options, reflecting an optimistic tone at least short term, but a few bad earnings reports or a geo-political ripple could kick the HFTs into a selling mode and then all bets are off.

TLT has stabilized around the 121 level and despite historic short interest is maintaining some price stability as the yield curve flattens. However, just like the VIX, be prepared for the unexpected.

The FED is not expected to make another move until June and traders may be betting on that timeline.

The VIX forecast is moderately elevated from last week also but we're not seeing the wild outlier scenarios like those in November and December. There is currently massive short interest on the VIX options, reflecting an optimistic tone at least short term, but a few bad earnings reports or a geo-political ripple could kick the HFTs into a selling mode and then all bets are off.

TLT has stabilized around the 121 level and despite historic short interest is maintaining some price stability as the yield curve flattens. However, just like the VIX, be prepared for the unexpected.

The FED is not expected to make another move until June and traders may be betting on that timeline.

Tuesday, January 17, 2017

Current TLT Signals and Some Heavy Reading....01.17.17...

The current Treasuries situation is highly fluid with massive short interest being played against a rising tide of hesitation for a Spring rally.... as seen in today's 2% swoon in the financials...the sector that most market "gurus" agree is the one most likely to thrive in 2017.'

Einhorn also offers some selective investing perspectives for 2017 with compelling arguments.

TLT..one of our favorite trading ETFs is once again on a roll with the MVP platform set to the mean reversion mode. Note the performance metrics between the momentum and mean reversion modes as well as the relative positions of the 2 Day Alert in each case..

Following up on several reader queries...the 2 Day Alert has NO relation to price...it is a metric measuring the performance of recent MVP signals and is intended to detect and confirm alignment with the current trading paradigm.

These are the Alert active models..meaning signals are ONLY taken if the 2 Day Alert STOP line is above the Trend line.

Einhorn also offers some selective investing perspectives for 2017 with compelling arguments.

TLT..one of our favorite trading ETFs is once again on a roll with the MVP platform set to the mean reversion mode. Note the performance metrics between the momentum and mean reversion modes as well as the relative positions of the 2 Day Alert in each case..

Following up on several reader queries...the 2 Day Alert has NO relation to price...it is a metric measuring the performance of recent MVP signals and is intended to detect and confirm alignment with the current trading paradigm.

These are the Alert active models..meaning signals are ONLY taken if the 2 Day Alert STOP line is above the Trend line.

Sunday, January 15, 2017

VDX Updates and Weekend Reading...01.15.17

This week's VDX Updates suggest a slightly bearish outlook, in line with the Trader's Outlook, as the SPY topping pattern continues..... although the hedge fund consensus is now bullish,

VIX hits new 30 month lows and TLT looks to be coming off overbought levels, perhaps driven by renewed huge short selling .

For now out little portfolio is in a neutral position with the VDI +/- charts in a crossover status.

VIX hits new 30 month lows and TLT looks to be coming off overbought levels, perhaps driven by renewed huge short selling .

For now out little portfolio is in a neutral position with the VDI +/- charts in a crossover status.

Thursday, January 12, 2017

New M1 (beta) ....01.12.17

Following yesterday's post on developments in the M6 model we've refocused our research on the M1 models with some encouraging results. Below are shots of the current M1 and M1 with active Alert turned on (MMA). Note the significant improvement in net returns and risk/reward ratio. We've added a routine to the current signal line date to indicate if the signal is active or in STOP status.

Tomorrow we'll look at the mean regression version of M1.

Once testing is complete (hopefully by end of this month) current M1 license holders will receive updates at no charge.

Tomorrow we'll look at the mean regression version of M1.

Once testing is complete (hopefully by end of this month) current M1 license holders will receive updates at no charge.

Wednesday, January 11, 2017

New Beta Version of M6 ...01.11.17

These are screen shots of the newest version of M6 with both momentum and mean reversion modes.

The chief improvement has been the adoption of an active 2 Day Alert filter that cancels all signals when the Alert Stop line fails to make a 2 day rise. The win/loss ratios are greatly enhanced and the number of validated trades to achieve the results is greatly reduced. The net effect is tighter risk control and better trading odds. We're still putting finishing touches on the new M6 as well as new versions of M1 for single stock./ETF trading.

Over the next few days examples of these new formats will be explored.

The chief improvement has been the adoption of an active 2 Day Alert filter that cancels all signals when the Alert Stop line fails to make a 2 day rise. The win/loss ratios are greatly enhanced and the number of validated trades to achieve the results is greatly reduced. The net effect is tighter risk control and better trading odds. We're still putting finishing touches on the new M6 as well as new versions of M1 for single stock./ETF trading.

Over the next few days examples of these new formats will be explored.

Tuesday, January 10, 2017

Ponzo Updates...01.10.17

This week's Ponzo forecasts continue the theme from the past 5 weeks, positive momentum with relatively low volatility. The SPY outlook has become less optimistic for the next 2 months than previous views but we are not seeing the wild outlier scenarios in either SPY or the VIX that characterized the early December posts. There's talk of a post Inauguration sell off but little technical evidence to support such a case...at least not right now.

Monday, January 9, 2017

M6 Outlooks and Chart Pack Clips...01.09.17

A bit of a pullback today as we suggested over the weekend. The Qs are actually the strongest of the majors for now but the M6 outlooks are skewed to the downside based on a quick check of the 2 Day Alert Stop line positions on the momentum and mean reversion screenshots.

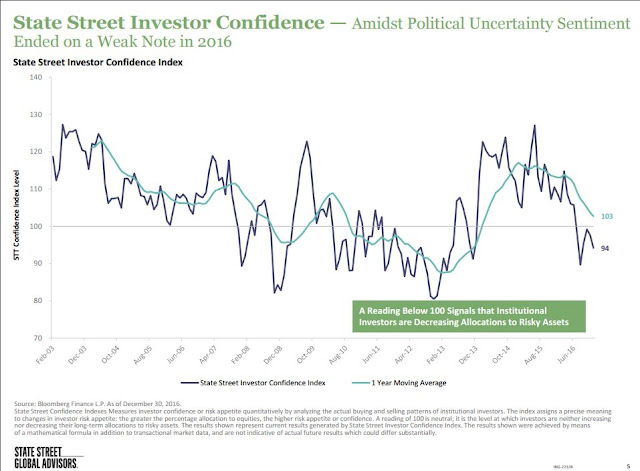

Meanwhile fro our friends sat State Street here are a couple interesting perspectives on current market sentiment and momentum.

Meanwhile fro our friends sat State Street here are a couple interesting perspectives on current market sentiment and momentum.

Saturday, January 7, 2017

VDX Updates, Trader's Outlook and Bond Prospects...01.07.17

One week into the new new and hope springs eternal. As the markets approach new highs and treasuries stage a recovery rally the trend remains bullish, although cautiously so, as we move towards Inauguration Day and what lies beyond. We did see a pullback in treasures on Friday and we'll see if that was a one off or the start of something bigger this coming week. That red day withstanding the TLT chart below shows the dramatic change in TLT sentiment (now overbought).

Despite the surge last week a closer look at the majors reveals considerable overhead resistance so the impact of earnings this quarter (now under way) may have more than the usual catalytic effect.....either up or down.

Despite the surge last week a closer look at the majors reveals considerable overhead resistance so the impact of earnings this quarter (now under way) may have more than the usual catalytic effect.....either up or down.

Thursday, January 5, 2017

M11 Follow Up...01.05.17

Following yesterday's M11 post here is an update of those files with the active 2 Day Alert filter plugged into the performance metrics. The strategy is quite simple...only take trades when the STOP line (purple) s above the Trend line (green). This tactic culls out the "maybe"trades and focuses the odds in favor of highly likely winners. It's basically a risk avoidance strategy, which is the fundamental goal of all Mosaic models.

Our premise yesterday that the mean reversion model was about to go vested based on the impending cross of the STOP line and the Trend line played out perfectly in today's action.

Compare the metrics from yesterday's post with today's to better see the advantage of the ALERT.

Our premise yesterday that the mean reversion model was about to go vested based on the impending cross of the STOP line and the Trend line played out perfectly in today's action.

Compare the metrics from yesterday's post with today's to better see the advantage of the ALERT.

Wednesday, January 4, 2017

M11 Market Perspectives...01.04.17

We're looking at an all clear for now as the VIX plunges and the major indices lurch forward.

So what could go wrong in 2017? Quite a few things as it turns out.

The current M11 market models...momentum and mean reversion .....indicate that the momentum paradigm is the current mode but a closer look at the 2 Day Alert in the mean reversion model suggests that momentum may be in danger as the mean reversion mode appears ready to kick in.

I've been running some studies over the holidays to demonstrate the value of the 2 Day Alert and tomorrow we'll look at just how valuable this little risk management tool may be to your bottom line.

So what could go wrong in 2017? Quite a few things as it turns out.

The current M11 market models...momentum and mean reversion .....indicate that the momentum paradigm is the current mode but a closer look at the 2 Day Alert in the mean reversion model suggests that momentum may be in danger as the mean reversion mode appears ready to kick in.

I've been running some studies over the holidays to demonstrate the value of the 2 Day Alert and tomorrow we'll look at just how valuable this little risk management tool may be to your bottom line.

Subscribe to:

Comments (Atom)