As we approach release of the T2 and VTV software here's a synopsis of what's included and what's not in the 2 programs.

Over the next day or 2 each subscriber will receive an email detailing ongoing subscription and software options. Since readers have started subscriptions at various times over the past year each case is calculated somewhat differently and that will be reflected in the pricing.

Subscription and software options:

1. Continue with subscription for duration of 1year term = $150 (you will receive a pro-rated credit based on the initial $250 fee) .

2. Cancel subscription and receive pro-rated rebate based on expired % of 1 year term @ $250.

3. Purchase T2 software= $ 100.

4. Purchase VTV software= $ 75

5. Purchase T2 and VTV= $ 150.

This pricing is for current subscribers only.

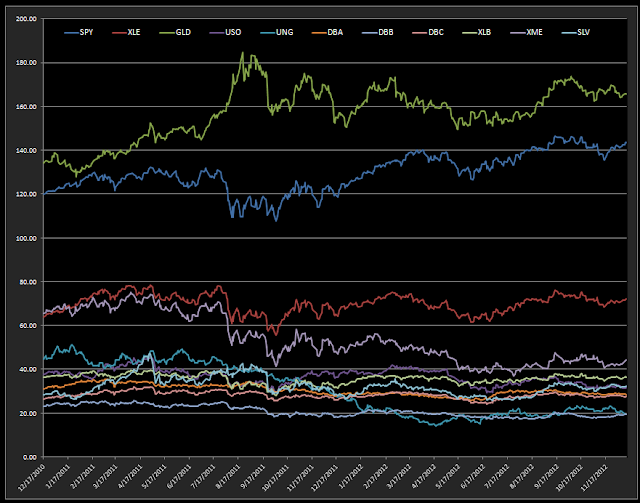

Going forward within the next 10 days the Newsletter format will change to approximately 3 times a week, focusing more on research ideas using the T2 and VTV software (and the LM and TAQK models). Adopting this new format and giving users the opportunity to explore T2 and VTV scenarios of their own design should allow users to gain better control of their investment options while at the same time reducing the wait time for me to update the files and examine the current momentum rankings and RSQ/P6 values.

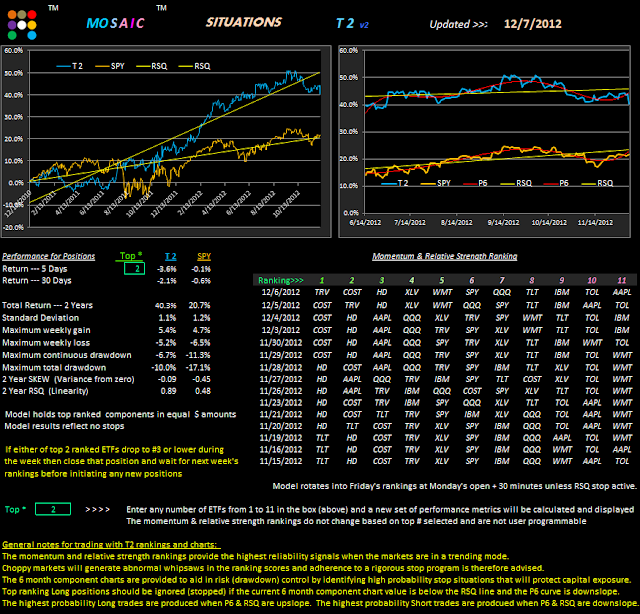

Each program (T2 and VTV) has 2 tabs...a Data tab where data inputs are loaded and a Results tab where either the T2 or VTV results are tabulated. The Ticker inputs for both programs can be either ETFs or NYSE/NASDAQ stocks and you can load up to 11 inputs in the T2 model and 6 inputs in the VTV model. Using the T2 model the user can mimic the T6, T9, Lazy Man or any other variations of the T2 strategy. You can select results for top 1,2,3,4,5, etc models without refreshing the Data update. The momentum rankings are calculated automatically in conjunction with the Data update.

Depending on the chip set spreed of your particular computer the processing time for Results once Data inputs are entered is approximately 15 seconds.

The DB, MRSI and GS2 Alerts are not part of the T2 program since they are generated through TradeStation and there is no functional link between the two programs. The side panel charts of the components with the RSQ and P6 (updated polynomial 5th degree to 6th degree function) indicators are intended to provide a baseline for creating your own risk control STOP policy.

T2...

Allows the user to use default portfolio or enter up to any 11 ETFs or NYSE/NASDAQ stocks. Smaller component portfolios such as the 6 ETF Lazy Man or other models having less than 11 components can be created and analyzed by simply entering only the number of components desired

Provides end of day historical data returns

Includes the same metrics panel as recent newsletter posts

Includes comparative charts of the benchmark and the composite T2 model for 2 years and 6 months

Includes 10 component charts to help analyze price behavior of each component stock or ETF and to gauge appropriate risk control stops based on RSQ and/or P6 (6th degree polynomial) values

What's not included:

Alerts based on DB, MRSI and GS2 TradeStation studies

Automatic stop signals

VTV...

VTV

is designed to help identify trading opportunities in QQQ and SH by analyzing the behavior of volatility related ETF/ETNs XIV and VXX as well as the high statistical inverse correlation of QQQ/SH and SPY/TLT. VTV displays a historical spectrum of the volatility skew as a means to gauge the probability of such trades. Different target pairs and benchmarks can be entered by the user. VTV uses a momentum algorithm that is faster than the T2 model in respect for the high beta values of XIV and VXX.

Allows the user to use default portfolio or enter up to any

6 ETFs

or NYSE/NASDAQ stocks. Smaller component portfolios such as the 6 ETF

Lazy Man or other models having less than 6 components can be created

and analyzed by simply entering only the number of components desired

Provides end of day historical data returns

Includes the same metrics panel as recent newsletter posts

Includes comparative charts of the benchmark and the composite VTV model for

6 months in both close up and macro views

Includes 6 component charts to help analyze price behavior of each component

stock or ETF and to gauge appropriate risk control stops based on RSQ

and/or P6 (6th degree polynomial) values

What's not included:

Automatic stop signals

Metrics performance reporting panel.

(Sample performance metrics will be posted over the next few weeks to illustrate the types of returns that can be achieved using the model rankings.)

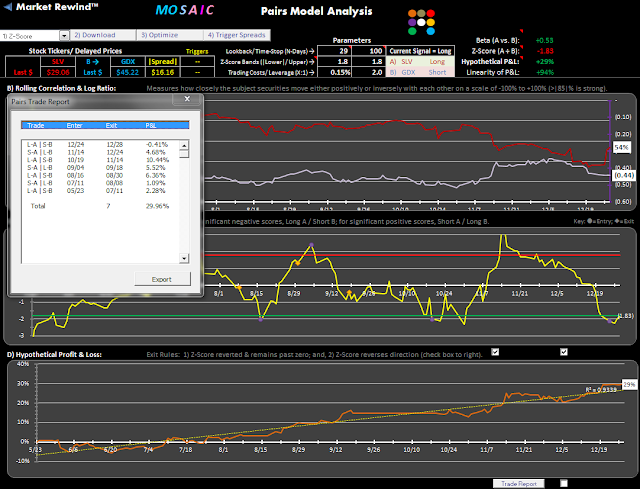

In the near future we also plan to offer the z-score based Pairs trading software so that users can further evaluate trading opportunities in any inversely or positively correlated pair of ETFs orNYSE/NASDAQ stocks .eg. QQQ vs SH, SPY vs. IWM, LOW vs. HD, etc. etc.

I'm also working on a lite version of the LM and TAQK variable allocation models that will distributed to holders of T2 and VTV. The current issue is that the program contains proprietary add-ins that I cannot redistribute gratis. In any event, the LM and TAQK (and other versions) will still be posted on a weekly basis. Since LM and TAQK are intended to be long term investment models and not trading instruments such periodic updates should not compromise the model results. Changes to RM status-- either Vested or Cash- will still be emailed to subscribers as Alerts.