Looking forward to 2013 there may be some tough going so we need to consider Plan B. Despite all the economy cheerleaders pounding the table that 2013 will be a go-go year there's a lot of evidence to support a contrarian viewpoint.

One way to work around the risk system is with a pairs approach...which is a hedging strategy with definable risks and predictable odds.

In the past we've mostly focused on inverse pairs such as QQQ / SH, which is essentially either a double long or a double short. In the coming weeks we'll look at more arbitrage based pairs where we are looking for the strongest, highest momentum side of a correlated pair.

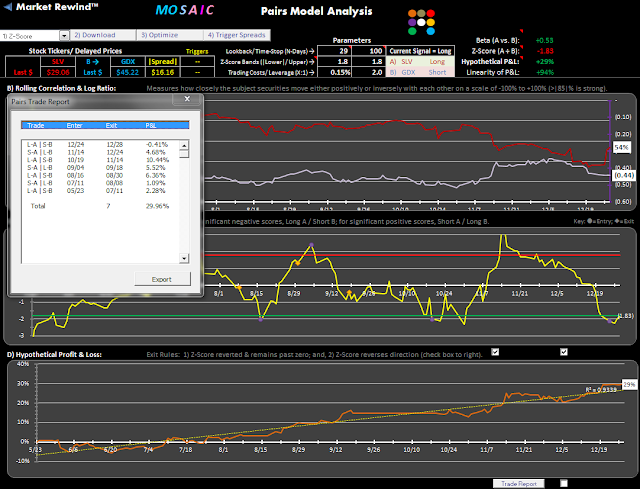

In the case above MO2 looks at the relationship between silver and the gold miners (SLV/ GDX). This is one of those boutique pairs that combine a fundamental relationship (metals) with technical price alignments in response to the world economies

The lookback is limited to 6 months but the results are a good example of the profile we're looking for...a solidly upslope equity curve (orange line) and a clear definition of trading thresholds (yellow line).

The duration of the average trade is 29 days, which means you may see some drawdown along the way.

Again, this is just an example. We'll look at some other compelling pairs in the New Year.