Today we check in on the Seeking Alpha portfolio mentioned several times in previous posts. This is a portfolio of stocks, not ETFs so we should expect greater volatility than the T2 default model.

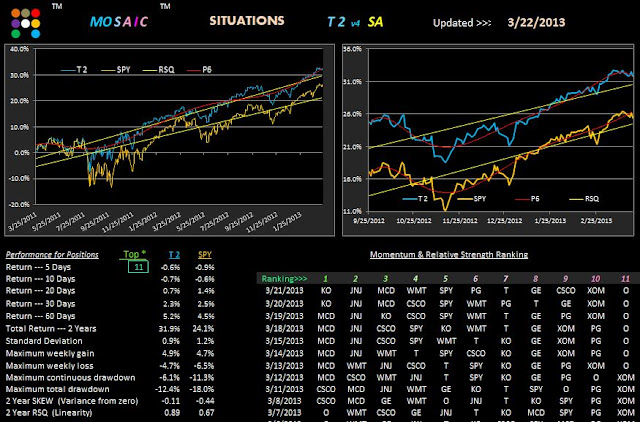

In fact, a top 2 sort of the portfolio actually reveals a better RSQ than SPY and a better drawdown profile.

Conclusion...the Seeking Alpha team has made some good picks longer term although short term the model has faltered when we only consider the top 2.

Another view using a top 11 sort...all in...shows returns more consistent with the SPY benchmark, and still displaying improved RSQ and lower drawdown.