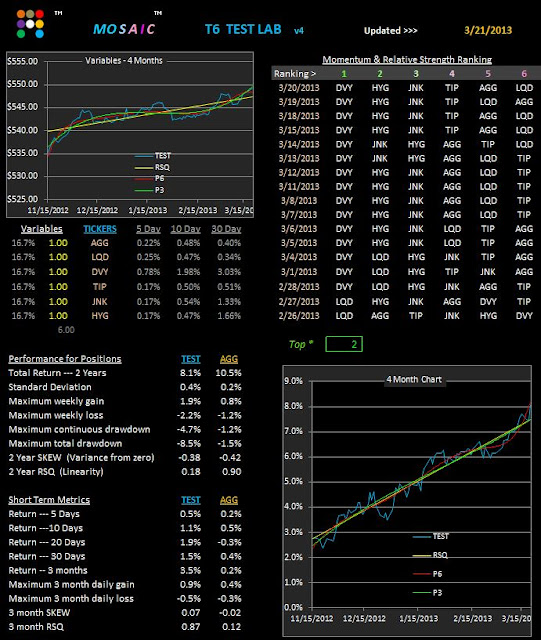

Checking the T6 neutral/bearish model shows DVY (the DOW dividend linked ETF) as the #1 ranked for most of our lookback. That may be about to change.

The real test of the equity markets will be when (and if) TIP and AGG slide closer to #1 slot. The high grade corporate and junk bond ETFs (HYG and JNK) have been riding the mid ranks....positions to be expected in a basically trending market. As trends stall or reverse we are likely to see these mid ranking persist while the #1,2,5 and 6 outliers switch positions. If the #3 and 4 slots also migrate to one extreme or the other of the rankings we may expect that a much more fundamental change is occurring or likely to occur soon.

Just something else to keep an eye on.