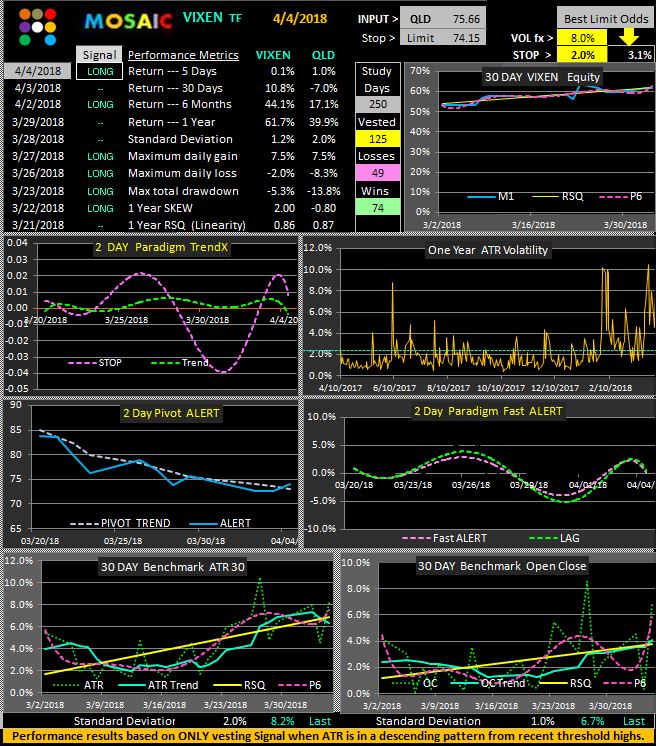

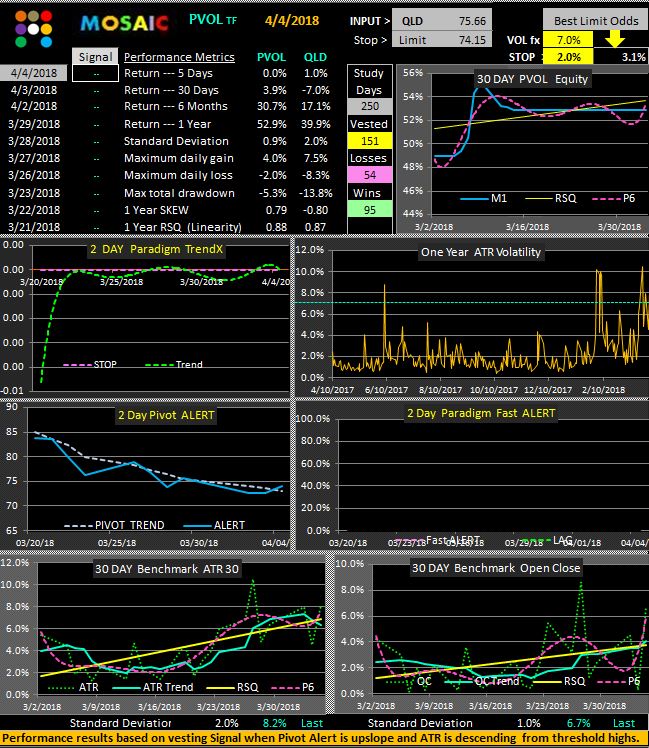

Despite today's huge turnaround from -500 to +200 Dow points the PVOL model remains conservatively in cash. The TF trend following volatility model is more bullish and has shown better returns (although lower odds) returns over the past year. I am concerned about the doenslope cross of the TrendX charts...both the 2 day and the Fast Alert and am scaling back position size accordingly. In the past this TrendX downslope crossing has been consistently correct in predicting trend behavior...which in this case is negative.... and being the risk adverse creature that I am my strategy is adjusted accordingly.