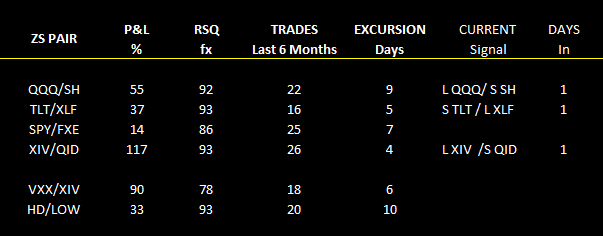

No new Alerts fired on Friday but the caution here can be seen in the current pairs signals shown below...the active signals are all Long equities and Short volatility.

Given this divergence of signal the STOPPED position of the model remains intact.

The pairs project is still scheduled for the end of the month. We'll focus on just 4 pairs QQQ/SH, TLT/XLF, XIV/QID and SPY/FXE and use the new Mosaic Pairs Analysis module. These trade signals can change quickly, with an average excursion of just 6 days and the current signals will be posted daily before the close.

Note that I've also included the HD/LOW pair trade..a classsic battle of the titans....Home Depot versus Lowes...with a great RSQ linearity.

The VXX/XIV pair is as wild as it gets and pits the VIX against its inverse. Each of these steroid driven ETFs can move 5 or 10 % per day under the right conditions so we use the pair (for now) as a barometer of market momentum only.

For those not familiar with all of these ETFs they represent the following market sectors:

SPY.. S&P 500

SH ...SPY inverse

FXE..Euro

QQQ...Nasdaq 100

QID..Nasdaq 100 inverse x2

TLT...20 year treasuries

XLF...Spyder sector financials

VXX..(actually an ETN, not ETF)..VIX proxy

XIV...VIX inverse