Here's an update of the "simple" T6 portfolio mentioned previously. There's no bear component in this mix save for a bit of safety in XLU (Utilities). This is a bull market portfolio and, as we shall see, it may be time to cut our position size or CASH outright. Short term the model has done well based on the XLE top slot with a little help from IWM and XLV. The landscape may be changing however.

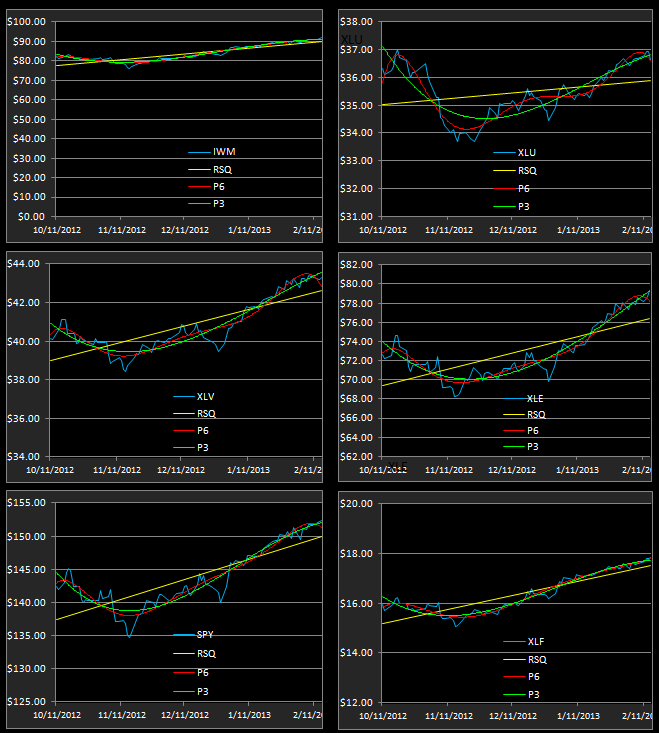

Below is a closer look at the component charts which you can see for yourself on your T6 platform.

Note what's going on with XLE and the P6 relative to the P3.

Keeping in mind our basic T6 risk management strategy.. P6 upslope= vested; P6 downsloope = cash,

it's time to pay close attention to our #1 slot and pocket some or all of the accrued gains.

We're seeing the same P6 downslope action on XLU, XLV and SPY.

On another note..I've mentioned the apparent consensus on CNBC that Treasuries are doomed this year but here's another point of view to consider from the FA money management world.

What ever comes down the pike we just have to be prepared to adapt and engage a portfolio mix that will keep our capital on the right side of the equity curve and, starting next Tuesday, I'll begin a series of posts to illustrate different ways to use the T6 to help accomplish this goal.