All registered users of T2 were sent the T6 software yesterday via email.

If you haven't received it please let me know.

Over the next week or 2 I'll explore in more detail what the Lab model can do, and can't do, as well as provide a few more sample portfolios for your consideration. I've added some short lists of the usual ETF suspects for various categories in the T6 Results tab margin...again just to provide some ideas.

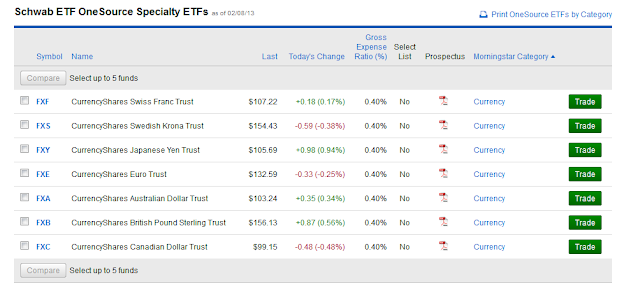

Schwab announced last week that they are now offering 105 commission free ETFs that cover quite a range of sectors and assets. I've put some screen shots up of those ETFs below and Schwab technical support told me there are no restrictions on holding times, so weekly rotation or more frequently seems to be no problem although there may be some minor fees from the original ETF aggregators (like State Street).

Other brokers are likely to follow Schwab's lead. Fidelity offers 30 commission free ETFs and that number may climb in the wake of Schwab's move.

The problem (there's always a problem) with the Schwab ETFs is that many of them have very low volume and spreads wider than a few pennies...so the liquidity and slippage factors must be considered. On the other hand the FX currency ETFs are the industry standards and going forward this week we'll see what type of a model T6 can deliver using these inputs.

(NOTE: As mentioned before, my display of T6 looks different that yours because I've reformatted the various windows to provide a more readable version on site).

Shown below is the "simple" T6 rotational model I profiled last week.

And now, some of the Schwab commission free ETFs.

You get the idea. Check out Schwab.com for the full listing.