Today looked an awful lot like yesterday and we may be seeing some further bullish action into next Monday if no ugly surprises develop. These final days of the month have an historical bullish edge, although the biggest gains are typically the actual last and first days of the month.

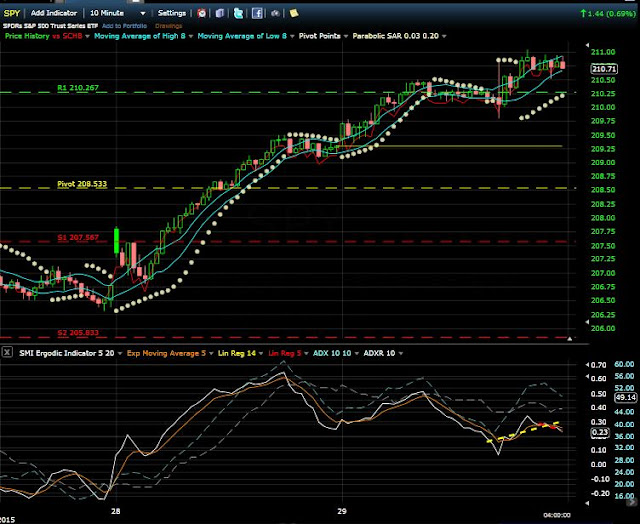

We can see from the SPY chart below for the past 2 days that the Ergodics have been in sync with the ADX, further indicating that the buying has been true accumulation not just HFT. The two day pivot chart shows SPY hitting R1, although in reality the SPY hit R2 based on today's range only.

We have a new and hopefully final refinement on the M3 dashboard, having replaced M4 with the Composite model reviwed in yesterday's post. With this addition the daily update includes 2 momentum, 2 mean reversion, 1 market neutral and 1 composite model...providing a multi-faceted view of current market odds.