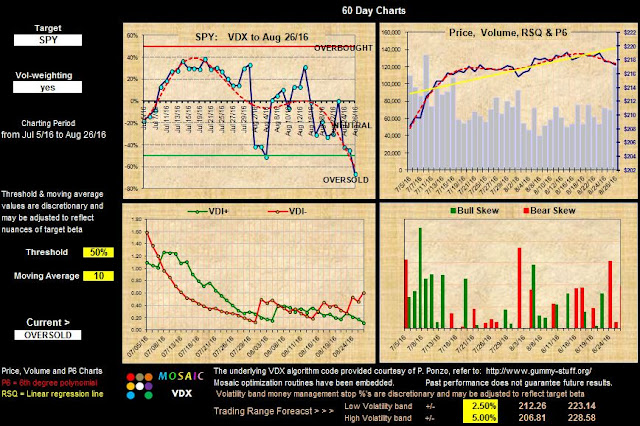

This week's VDX updates suggest volatility may become a bigger factor this week. The narrow range VDI+/- channels that we have followed for the past 3 weeks are showing signs of breakout.

With earnings season largely concluded and the FED doublespeak on Friday a distant memory in most traders minds the major market influences now are seasonality, the yield curve and the elusive X factor that drives intraday volatility.

The only significant data anomaly last week was Friday's volume...double that of the previous 4 days, accompanied by a severe FED inspired reversal....and a strong endorsement for trailing stops via our delta neutral model.

Next week is end of month, + Holiday = appx 80% odds for the bulls.....but anything can happen.

The new MVP is now available on M3. in the software section. There are quite a few links to recent MVP explorations or you can send me questions for more details. My posting focus will be on MVP for the next few weeks and then sales will likely be suspended per my earlier posting.

MVP is now configured as a complete stand alone product with no need for a M1 signal supplement.

I will continue with my previous "MVP Basket" study discussions next week and beyond.