The reaction to Friday's jobs report was a bit over the top considering that the bulk of the jobs were previously considering undesirable by the unemployed. Desperate times require desperate solutions.

Nevertheless, the numbers by themselves do not lend credence to an improving economy. It is important to realize that the employment numbers have little to do with the market other than to gauge the potential buying power of the public based on rising or falling income levels.

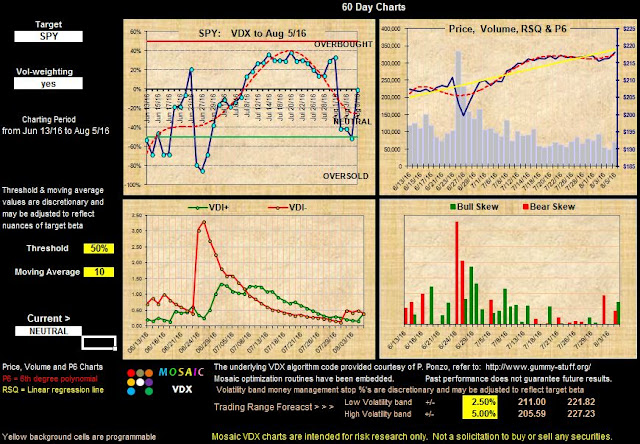

This week's VDX updates now have our 3 studies in breakout positions.

VIX is at a 3 year low while SPY is at an all time high and TLT is caught in a narrowing technical range as uncertainties about yields persist. Note the eroding volume action on SPY and TLT.

Despite Friday's run up these are dangerous times to be assuming new positions.

How to protect yourself until the trend becomes clearer?

Delta neutral is my go to solution and Friday was a picture perfect example of the SSO/SDS pair in action. The new M3 tab on delta neutral is now up and next week the DN model will be added to the M3 products offerings. You won't get rich quick trading DN but you can sleep peacefully at night knowing that big overnight moves can't hurt your account. That's worth a lot these days.