One of the fundamental concepts in a market neutral approach is the necessity to build a portfolio of non correlated or inversely correlated assets.. To accomplish that end virtually all our models use bond ETFs of some sort to provide the other side of the equities coin. What may be surprising is that all bonds do not behave in sync and, in fact, its not uncommon to have the various bond ETFs act contrary to one another at times.

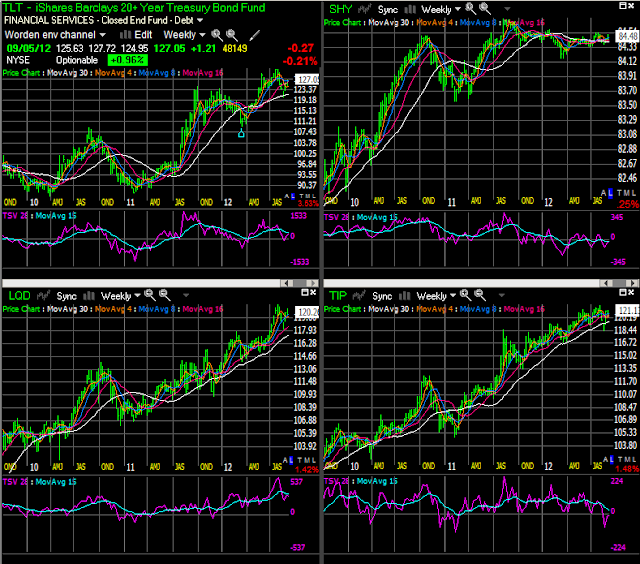

This is a quick look at 4 bond ETFs on weekly bars so we get about a 2 year lookback. The charts are shown on a Worden Bros. platform and the technical indicator in the lower panel of each chart is TSV, time segmented volume, an indicator that examines both volume and momentum at the same time.

TLT is the 20 year treasuries... the largest and most liquid bond ETF with robust options

SHY is the 1-3 year treasuries,,,typically half TLT volume and virtually no options

LQD is a basket of investment grade corporate bonds...low volume, few options

TIP is a basket of treasury notes with various expirations and rates...low volume few options

Each ETF seeks to embody the relative safety and returns of various sectors of the bond market.

Our goal is to create a blend of these various bond nuances and at the same time examine which bond ETFs are outperforming the others to take advantage of short term opportunities.It is for this reason that the T3 model includes 3 bond ETFs >>>IEF, AGG and TLT.

The matter then becomes one of juggling long term versus short term appreciation opportunities. One result of this study is that LQD turns out to be a better short term performer than IEF and further testing is now underway to determine if LQD should replace IEF in the T3 portfolio.We'll know by Friday.