This is an ALERT post.

Note that XLE and QQQ have new EXIT signals as of one hour in today. I have also posted the GLD Short signal although we typically don't post or track short signals and I am not going to continue to track the action on this signal other than to note that it fired.

The point is that we have several new signals this morning indicating a possible period of equity retracement.

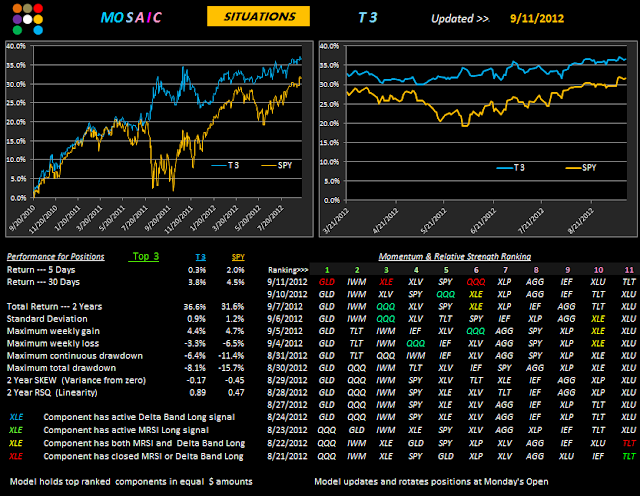

Just to avoid confusion.....the T3 format runs in EXCEL and updates at the end of day. The MRSI and DB color signals run on TradeStation in real time and are imported into the T3 EXCEL platform.

The momentum rankings shown today reflect yesterday's closing values.

The color signals reflect the TradeStation signals for MRSI and DB as of 7:30 am PST.

Of course everything could change tomorrow if the FED launches a QE3 program, which has been highly anticipated by the markets in the recent low volume build up. A new QE3 initiative would like send the markets soaring once again but since we're already at multi year highs it's hard to determine how far such a run could extend unless we start using Fibonacci lines or some other such technical forecaster. If the FEd disappoints then look out below for equities.

Since our goal is to minimize T3 capital exposure during periods of high volatility the safest course of action is simply to close any Longs and stand aside for the moment.

Interestingly, either scenario is likely to reverse the recent weakness in bonds, especially TLT.