Note a couple changes to T3: The RSQ (linearity) metric has been added to further define the reliability of the model. The higher the linearity value, the more consistent the equity curve. The Momentum rankings have been reduced from 18 to 15 days or 3 weeks. I think this provides a more than adequate view of the momentum dynamics and let's us integrate weekly bar models more effectively (jn the future).

Note that the Momentum rankings should now be adjusted on Monday's Open rather than Friday's close.

This decision is based on a recent look at how the markets have performed between Friday's Open and Monday's Close and it reflects a small edge that can be achieved by trading Monday's Open...which actually has been consistently lower than Friday's close during our lookback period.

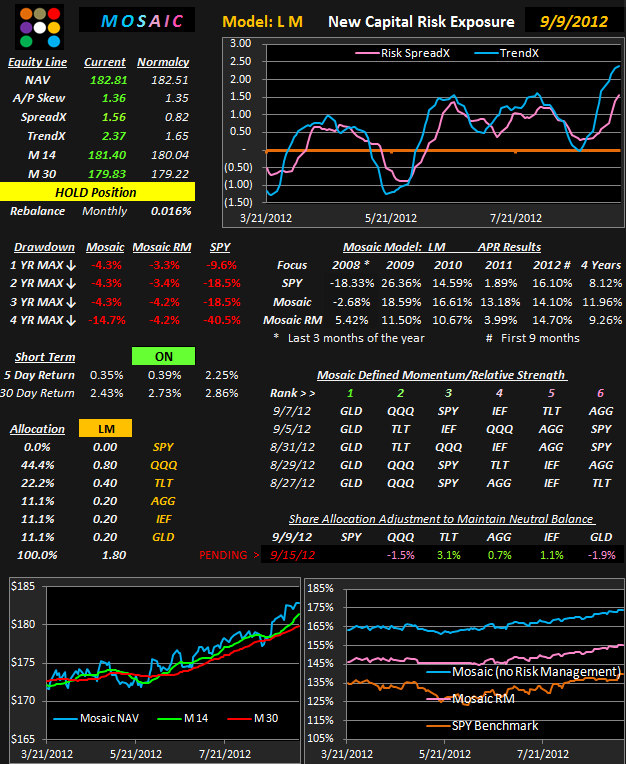

TIP has been replaced by IEF in the T 3 component mix. WHY?. Because now all the Lazy Man components are reflected to the T3 mix and there's no need to replicate (and confuse) readers with multiple views of the same data. That applies to the Situations version of the Lazy Man where all 6 components are held in equal dollar amounts and it also applies to the allocation version of Mosaic (shown below) that holds varying % of the capital account in each of the 6 components.