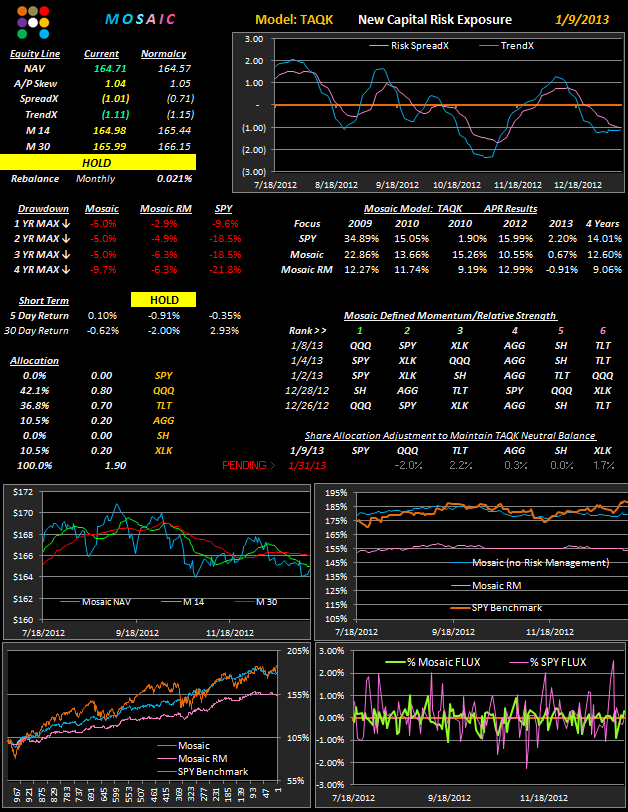

The LM and TAQK models have been under performing total returns lately although the risk profiles remain stable. Going forward into 2013 I'm planning to replace TAQK with a model like AB, which is a refined version of the TAQK concept.

We work off the premise that technology is the engine that drives the economy but that there are always technical and fundamental hiccups along the way that create bumps in our expectations for linear price appreciation (like earnings).

At the same time the bond sector has been on an unrelenting rise for years, prompting more than a few "smartest guys in the room" to predict an impended collapse in bond prices. If such a pattern reversal does occur it may not necessarily follow that equities will surge. We may, in fact, enter a period where both bonds and equities decline...hence the safety net of the RM versions.

TLT's extraordinary rise in late 2011 to 2012 can be traced in a large part to the FED's QE bond buying program, which may be scaled back in conjunction with likely debt ceiling reformulations.

When and if that happens a whole new set of bond dynamics are likely to develop with a more bullish focus on junk and corporation bonds and reduced returns from Treasuries. Municipal bonds should be a safe haven, but they have proven be to unreliable and volatile lately as more cities are going bankrupt or facing that prospect, losing their tax bases and grasping for new revenue sources. The situation is not likely to improve short term despite the talking heads in the media forecasting a rosy economy ahead.

We're not out of the woods yet...

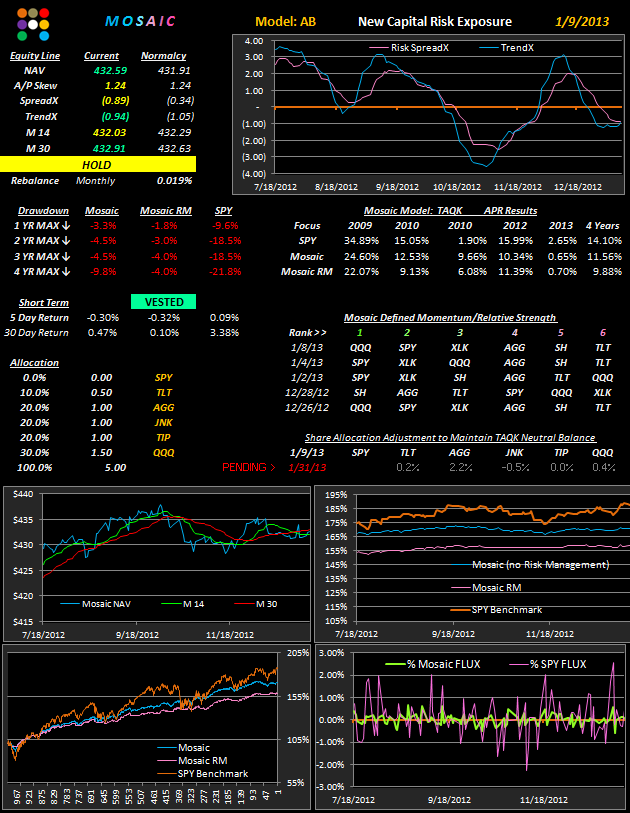

In trying to prepare for whatever bond/equity skew develops next the AB model looks like a better bet than TAQK as presently constituted. AB is a tentative model which will be refined over the next week or so before a more definitive version replaces TAQK. Until then here a first cut. Note the risk drawdown profile...especially for the RM version.

And, here are the weekly updates of the LM and TAQK models: