The study focuses on the variable risk/reward generated by using each of the 3 equities as a benchmark and as part of the T2 (top 2) tactics.

I'm giving you some homework to do at the end of the post using the T2 software so you can test your own ideas and perhaps improve on my study results:

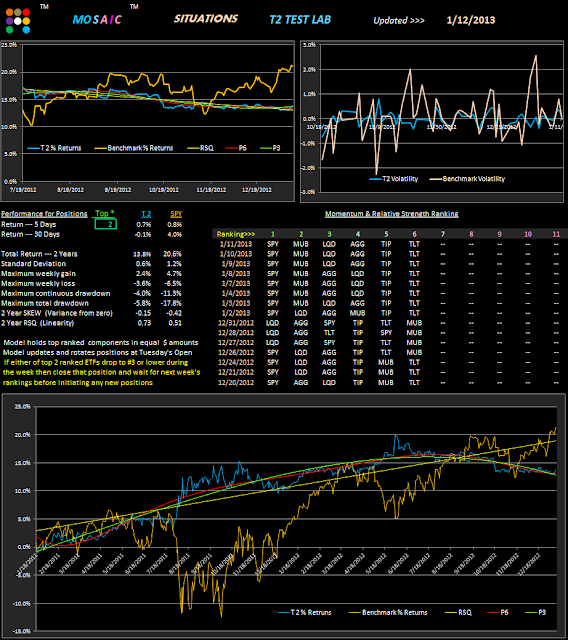

First...using SPY.......

Then QQQ....

And, finally IWM.....

A quick look at the 3 metric panels shows QQQ is a best bet when looking at a top 2 based mix of these ETFs over 2 years. RSQ is clearly higher as are net returns. What's lagging are the short term (30 day) returns. On that basis the IWM based model blows the doors off.

Based on those results..here's a look at the top 1 version of the IWM model:

This version using only the top 1 tactic shows several nice features. Good long and short term returns and the momentum tactic cuts the IWM benchmark risk profile in half. The RSQ is lower than the QQQ top2 version but there's no collapse off the RSQ like the Qs version displays.

You can check out other nuances of these 3 benchmarks yourself but this preliminary research indicates SPY is less attractive than either QQQ or IWM as a equity-side component in our models.