Here are 2 T6 Lab studies.

The first almost perfectly replicates the AB model by using XLK as an added component to the mix.

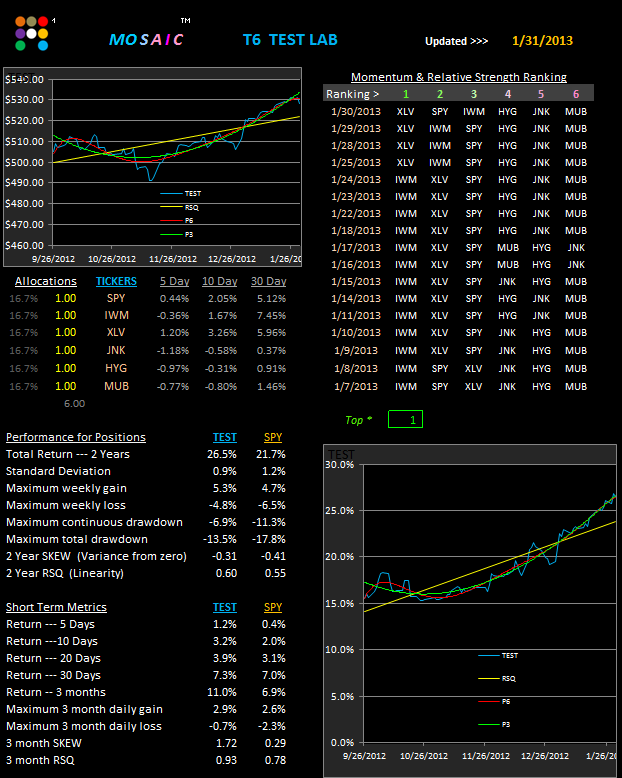

The advantage of using the T6 approach is that we can trade the top 1 or 2 momentum components while still deploying capital to the top 6 model for longer term returns. This approach also gives users a choice as to whether just pursue a top 1 or 2 tactic or divide capital into a number of pools.

This is my alternate AB model portfolio which include IWM and XLV which I have discussed previously as 2 issues likely to benefit from Obama's re-election. This model has a lot potential going forward, especially when actively traded...that is, on a weekly basis.

IWM and XLV have been clear leaders over the past month and the metrics panel shows it. On a 2 year lookback basis its no slacker either and this formulation is the most attractive mix so far as an AB portfolio.