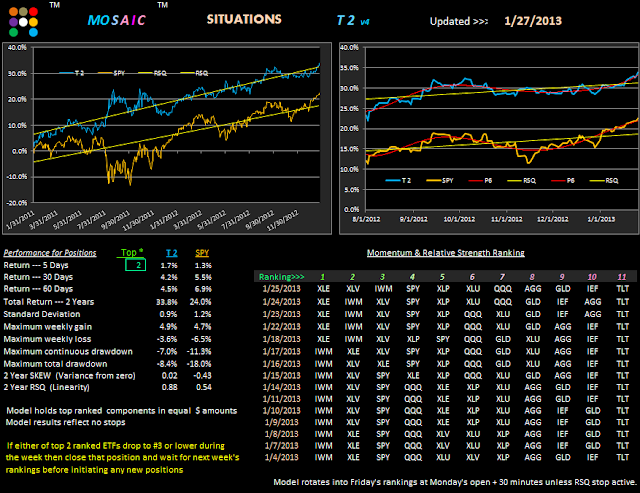

This is our default T2 model, which is holding it own against the SPY.

Since everyone has the T2 software you can monitor this model on a daily basis without my assistance.

Current momentum is clearly positive...we have been above the short term RSQ line for almost 2 weeks.

The significant change in the rankings was IWM, which has now moved in #3 after a very extended run as either #1 or #2.

Last weeks' recommendation, based on the VTV signal, to close the XIV position turned out to be a timely decision. Although the markets are considerably overbought past historical evidence suggests they could get stretched even further. The question you've got to ask yourself is (not "do I feel lucky") any further rewards are worth the risk. Apple has demonstrated what can happen when poor earnings and poor guidance coincide...the results can be dramatic. Luckily, with the T2 approach we are buffered against such volatility but careful monitoring of market momentum is still valuable in preserving our hard won gains.

Tomorrow we'll look at an interesting pair set up that is very low risk and which merges technicals and fundamentals.

I'll be on the road for a couple days and Wednesday's post will probably be quite late due to lack of web access.