The model kept us out of a good day for XIV today but the signal for tomorrow is vested. The Santa Claus rally so far has not been enthusiastic but the volume has been extremely low, which may be contributing to the lack of momo.

The M Chain model is a beta tester that incorporates some new algorithms that merge a variety of parameters, but not volume, which may be added in later iterations.

I have yet to resolve the Yahoo data feed problem and have resolved for the short term to just cut and paste the real time data from Yahoo Finance into the new model which is now formatted strictly in Excel with no VBA overlay.

I have also reformatted the data field display to make the metrics more legible on a 15.6 screen.

As always, Mosaic is a work in progress with the sole goal of finding a model that maximizes risk management while still generating an attractive win/loss ratio.

Thursday, December 28, 2017

Wednesday, December 27, 2017

M BlockChain @ XIV....12.27.17

Yesterdays' XIV signal was correct as XIV was ahead $ 1.65 in the morning session before retreating into negative territory. Lesson learned...don't let a winner become a loser...use a trailing stop.

Tonight's signal is --so we are in cash with XIV.

Tonight's signal is --so we are in cash with XIV.

Tuesday, December 26, 2017

Mosaic Blockchain model MVP7 Looks at XIV....12.26.17

A new year brings a new short term trading model. Similar to previous M models this one focuses on a single issue using a new algorithm merging volatility and momentum. We apply our standard metrics toolbox to high volume, narrow spread, low latency liquid ETFs in search of trading odds with at least 40% more wins than losses over a one year lookback period.

In the case of XIV shown below over 250 trading days the model was vested 131 days with 52 losses and 77 wins. As with previous M models an auto calculated limit stop is applied to all open orders.

In the case of XIV shown below over 250 trading days the model was vested 131 days with 52 losses and 77 wins. As with previous M models an auto calculated limit stop is applied to all open orders.

Sunday, November 19, 2017

Ponzo Updates and Trader's Outlook....11.19.17

This week's updates have only modest weakness readings versus the past 2 weeks.

As in the past, the TLT continues to be the narrow range, low risk money maker using option butterflies and iron condors. The only downside to this winning strategy is the low premium returns reflective of the continuing low volatility levels. Nevertheless, on a risk/reward basis this weekly options approach has seen 11 winners and 1 loss over the past 12 weeks.

Trader's Outlook is bullish on the trend but neutral on "cloudy" risk dynamics.

As in the past, the TLT continues to be the narrow range, low risk money maker using option butterflies and iron condors. The only downside to this winning strategy is the low premium returns reflective of the continuing low volatility levels. Nevertheless, on a risk/reward basis this weekly options approach has seen 11 winners and 1 loss over the past 12 weeks.

Trader's Outlook is bullish on the trend but neutral on "cloudy" risk dynamics.

Monday, November 6, 2017

Ponzo Updates and Trader's Outlook...11.06.17

The SPY forecast is deteriorating per this week's Ponzo outlook while QQQ maintains a bullish bias and TLT climbs back into out butterfly channel. As we move forward with a low volume, low volatility milieu (VIX hit 9.14 Friday) the primary trend remains neutral to bullish as the historically strongest months of the year kick in.

Tech continues to be the standout winner on above average volume, driven by the FANGs and semis.

Trader's Outlook maintains a bullish bias based on the number of new highs and the development of new overhead resistance in many of the indices.

Tech continues to be the standout winner on above average volume, driven by the FANGs and semis.

Trader's Outlook maintains a bullish bias based on the number of new highs and the development of new overhead resistance in many of the indices.

Monday, October 30, 2017

Ponzo Updates and Trader's Outlook....10.30.17

This week's forecast updates are almost a mirror image of last week. The one significant change is an expansion of the TLT bullish range, pushing the mid line of out butterfly channel up a bit but still keeping us in the sweet one of the trade.

Trader's Outlook is neutral for the week with a modest bullish edge.

Trader's Outlook is neutral for the week with a modest bullish edge.

Sunday, October 22, 2017

Ponzo Updates and Trader's Outlook...10.22.17

While this week's forecast updates remain essentially the same as last week's the short term odds on SPY have morphed to neutral, QQQ has accelerated to uber bullish and TLT has regressed to a lower level channel (although still comfortably within our target butterfly channel.)

Trader's Outlook remains bullish based on their trend following paradigm logic and most earnings reports so far have been met enthusiastically. Geo political risks have moved to the back burner and will likely stay there until the calm before the storm is erased.

Trader's Outlook remains bullish based on their trend following paradigm logic and most earnings reports so far have been met enthusiastically. Geo political risks have moved to the back burner and will likely stay there until the calm before the storm is erased.

Sunday, October 15, 2017

Ponzo Update and Trader's Outlook.....10.15.17

This week's updated forecasts reveal no divergence from last week's posts.

The TLT consolidation model using butterflies and/or iron condors still looks like the best odds situation as we plunge forward into earnings season and the unknown market perils of Iran and NOKO. QQQ maintains the highest positive scenario skew while SPY and TLT are running 50/50 bearish/bullish into the year's end

Trader's Outlook is modestly bullish, based strictly on a technical trend following perspective.

The TLT consolidation model using butterflies and/or iron condors still looks like the best odds situation as we plunge forward into earnings season and the unknown market perils of Iran and NOKO. QQQ maintains the highest positive scenario skew while SPY and TLT are running 50/50 bearish/bullish into the year's end

Trader's Outlook is modestly bullish, based strictly on a technical trend following perspective.

Monday, October 9, 2017

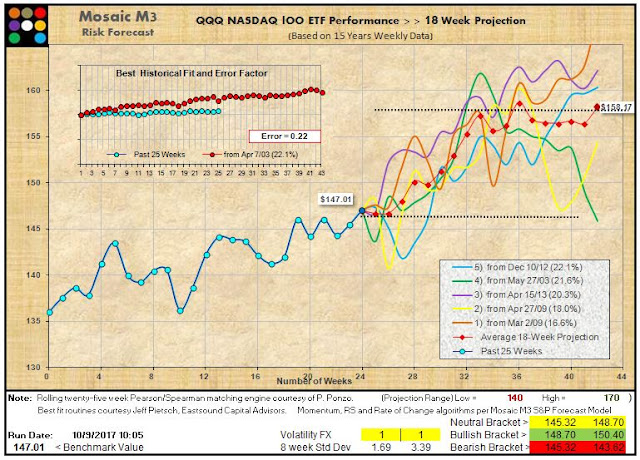

PONZO Updates and Trader's Outlook....10.09.17

Following last week's surge in SPY the new Ponzo forecast has reverted back to a bullish skew, improving modestly on last week's bearish outlook.

QQQ is an almost dead on repeat of last week's bullish outlook.

TLT has settled into a slightly bearish channel and the 124/125 butterfly still looks like a good bet.

Trader's Outlook is bullish for the week based on strong economic data and expectations for good earnings reports, which kick off this week.

QQQ is an almost dead on repeat of last week's bullish outlook.

TLT has settled into a slightly bearish channel and the 124/125 butterfly still looks like a good bet.

Trader's Outlook is bullish for the week based on strong economic data and expectations for good earnings reports, which kick off this week.

Sunday, October 1, 2017

Ponzo Updates & Trader's Outlook..10.01.17

The big change in this week's Ponzo forecasts is a significant deterioration in SPY. A general trading rule is "don't short new highs", which was the case this week and is now supported by the current technical view of Trader's Outlook . Once again consider what the Ponzo charts actually show...the odds that history will repeat itself based on a technical analysis of what happened in the past 25 weeks over the life of the stock or ETF. Dynamic exigent factors are constantly in play so the Ponzo outlooks might be considered of marginal utility. However, market patterns have proven to be remarkably consistent over time and the fact remains that the longer term Ponzo forecasts for SPY have been dead on since last October.

This week's QQQ and TLT forecasts are essentially unchanged from last week, with TLT hitting the lower band of the 6 month linear regression channel (support) and now poised for a bounce..

This week's QQQ and TLT forecasts are essentially unchanged from last week, with TLT hitting the lower band of the 6 month linear regression channel (support) and now poised for a bounce..

Wednesday, September 27, 2017

Apple and Amazon Ponzo Updates....09.27.17

Following up on last week's Apple/Amazon pair trade idea using the Ponzo forecasts here are the latest updates. Also included is an APPL chart with an AMZN overlay. Technical indicators are 10,20,50 SMAs and parabolics. The entire tech sector looks ripe for a dead cat bounce ( in progress) followed by a trap door down to longer term support levels.

Over the last week APPL/AMZN have traded in tandem, both up and down Wait for the divergence.

chart courtesy of Schwab SSEdge

Over the last week APPL/AMZN have traded in tandem, both up and down Wait for the divergence.

chart courtesy of Schwab SSEdge

Saturday, September 23, 2017

Ponzo Updates and Trader's Outlook....09.23.17

This week's Ponzo forecasts are little changed from last week. SPY moved only a few pennies from last week and the Qs dropped $2 but the forecasts remain essentially unchanged although the longer term QQQ projected highs have declined a few dollars. TLT remains a study in channel consolidation and still looks like a great butterfly/iron condor candidate although with the VIX in the 9s the premium payoffs are at historical lows.

The weekly Trader's Outlook is mildly bearish now that earnings season is mostly complete and traders are girding their loins for October's anticipated volatility surge and more potential threats from NOKO, and now Iran..

We'll review the Apple/Amazon ponzo charts on Wednesday.

The weekly Trader's Outlook is mildly bearish now that earnings season is mostly complete and traders are girding their loins for October's anticipated volatility surge and more potential threats from NOKO, and now Iran..

We'll review the Apple/Amazon ponzo charts on Wednesday.

Wednesday, September 20, 2017

APPLE and AMAZON Ponzo ALERTS........09.20.17

With today's swoon in AAPL we may be looking at a longer term trend in the making.

At the same time AMZN looks poised to jump forward in the aftermath of Harvey, Maria et al...and we're not done yet with hurricane season.

Assuming no NOKO nukes or other apocalyptic scenarios these are the risk forecasts for APPL and AMZN as of Monday. So far the Apple is playing out according to forecast.

Current odds favor a Long AMZN, short AAPL pair trade.

For those unfamiliar with the PONZO models, check here.

At the same time AMZN looks poised to jump forward in the aftermath of Harvey, Maria et al...and we're not done yet with hurricane season.

Assuming no NOKO nukes or other apocalyptic scenarios these are the risk forecasts for APPL and AMZN as of Monday. So far the Apple is playing out according to forecast.

Current odds favor a Long AMZN, short AAPL pair trade.

For those unfamiliar with the PONZO models, check here.

Saturday, September 16, 2017

Ponzo Updates and Trader's Outlook.....09.16.17

Forecasts are looking bullish...in fact wildly so for both SPY and QQQ, while TLT has hunkered down back into the sweet spot of our longer term buying channel (butterflies and iron condors).

VIX (not shown) has once again settled back into the 10s and the bulk of current premiums reflect a miserable risk/reward ratio.

If you believe the markets are uber overbought at this point just wait a few months for a truly frothy top that exceeds virtually all expectations from top market gurus at the beginning of 2017.

Trader's Outlook is optimistically bullish.

Hey! What could go wrong?

VIX (not shown) has once again settled back into the 10s and the bulk of current premiums reflect a miserable risk/reward ratio.

If you believe the markets are uber overbought at this point just wait a few months for a truly frothy top that exceeds virtually all expectations from top market gurus at the beginning of 2017.

Trader's Outlook is optimistically bullish.

Hey! What could go wrong?

Saturday, September 9, 2017

Ponzo Updates and Trader's Outlook....09.09.17

The new Ponzo forecasts for SPY and QQQ are trending into a neutral mode while TLT is once again pushing into overhead resistance ahead of a possible breakout......meaning that our hopeful scenario shown last week of a pullback to the mid linear regression channel remains unfilled and we are unvested in TLT at this time.

The effects of Harvey and Irma remain to be seen but with the level of devastation already evident in Houston and the rest of the Texas gulf coast mass destruction of the Miami environs could mean years of recovery ahead for both regions.

A 15 foot storm surge (up to 20' projected) will put the Everglades underwater releasing all those hungey gators and some 150,000 (est.) pythons into the waterways. That's a scary thought.

Meanwhile, the NOKO situation is not improving and the likely effect will be increased volatility as the uncertainty factors rise.

Trader's Outlook is short term neutral to bearish for the coming weak based on a modest deterioration in the technical indicators coupled with concerns for tax reform and weakening economic reports..

The effects of Harvey and Irma remain to be seen but with the level of devastation already evident in Houston and the rest of the Texas gulf coast mass destruction of the Miami environs could mean years of recovery ahead for both regions.

A 15 foot storm surge (up to 20' projected) will put the Everglades underwater releasing all those hungey gators and some 150,000 (est.) pythons into the waterways. That's a scary thought.

Meanwhile, the NOKO situation is not improving and the likely effect will be increased volatility as the uncertainty factors rise.

Trader's Outlook is short term neutral to bearish for the coming weak based on a modest deterioration in the technical indicators coupled with concerns for tax reform and weakening economic reports..

Saturday, September 2, 2017

Ponzo Updates and Trader's Outlook......09.02.17

New Ponzo forecasts continue uber bullish themes for SPY and QQQ while TLT remains in a relatively delta neutral longer term linear regression channel (see below) with butterflies and/or iron condors high odds options setups (when TLT gets back to mid channel).

As the talking heads continue to predict market Armageddon by mid October and a risk on strategy looks fraught with danger the market maintains a slow, low volume, bullish churn.

Volatility is pulling back (once again) leaving it difficult to find even modest premium payoff situations. Compounding this frustration is the rise of new algorithmic trading firms that account for more and more of daily market volume while confounding traditional technical analysis indicators. After over 30 years of trading I'm finding the current markets difficult to decipher and, more importantly, difficult to find a tradeable edge.

For my own risk tolerance a delta neutral approach provides the most comfort (I like TLT).

Trader's Outlook is once again bullish.

As the talking heads continue to predict market Armageddon by mid October and a risk on strategy looks fraught with danger the market maintains a slow, low volume, bullish churn.

Volatility is pulling back (once again) leaving it difficult to find even modest premium payoff situations. Compounding this frustration is the rise of new algorithmic trading firms that account for more and more of daily market volume while confounding traditional technical analysis indicators. After over 30 years of trading I'm finding the current markets difficult to decipher and, more importantly, difficult to find a tradeable edge.

For my own risk tolerance a delta neutral approach provides the most comfort (I like TLT).

Trader's Outlook is once again bullish.

Sunday, August 27, 2017

Ponzo Updates SPY, QQQ & TLT and Trader's Outlook...08.27.17

This week's Ponzo Updates have SPY and QQQ in a long term bullish trend. Short term scenarios suggest the possibility of pullbacks, the current mood of multiple market gurus and talking heads.

TLT has devolved over the past few weeks from being profoundly bullish to the current short term bearish forecast. Regular readers know TLT is one of my favorite trading vehicles and the stable narrow channel price range we witnessed in the past is now above the upper resistance band and the odds now favor a retracement back to the range midline or the bottom band. A butterfly option strategy still looks attractive for TLT although waiting until we get a pullback to the midline is necessary before deploying new setups.

Trader's Outlook is cautiously neutral. Keep in mind TO's outlook is focused on strictly technical indicators. If we consider the current multitude of geopolitical risk factors, current turmoil between Congress and POTUS, stock outflow patterns, questionable market momentum metrics and the FED's failure to follow a forward looking economic policy....then the wisdom of risk off investing is not a wise at this time.

TLT has devolved over the past few weeks from being profoundly bullish to the current short term bearish forecast. Regular readers know TLT is one of my favorite trading vehicles and the stable narrow channel price range we witnessed in the past is now above the upper resistance band and the odds now favor a retracement back to the range midline or the bottom band. A butterfly option strategy still looks attractive for TLT although waiting until we get a pullback to the midline is necessary before deploying new setups.

Trader's Outlook is cautiously neutral. Keep in mind TO's outlook is focused on strictly technical indicators. If we consider the current multitude of geopolitical risk factors, current turmoil between Congress and POTUS, stock outflow patterns, questionable market momentum metrics and the FED's failure to follow a forward looking economic policy....then the wisdom of risk off investing is not a wise at this time.

Sunday, August 20, 2017

Ponzo Updates for SPY, QQQ & TLT + Trader's Outlook......08.20.17

This week's forecasts have changed only slightly from recent outlooks. The SPY looks to be more susceptible to a pullback while the Qs remain bullish and TLT has adopted a wider range neutral stance. The instances of potential 5% + pullbacks have increased for SPY and QQQ.

An optimistic earnings season has managed to keep the markets in a buy the dip mood, BUT ...increasing tensions with China & NOKO internationally and a tide of anti-Trump attacks by the media may serve to destabilize an already tenuous political situation nationally.

Trader's Outlook has become cautious in anticipation of volatility rising....a reflection of the TLT forecast adjustment..

An optimistic earnings season has managed to keep the markets in a buy the dip mood, BUT ...increasing tensions with China & NOKO internationally and a tide of anti-Trump attacks by the media may serve to destabilize an already tenuous political situation nationally.

Trader's Outlook has become cautious in anticipation of volatility rising....a reflection of the TLT forecast adjustment..

Saturday, August 12, 2017

Ponzo Updates for SPY, QQQ and TLT plus Trader's Outlook....08.12.17

This week's Ponzo updates reflect some divergence from recent forecasts.

We now have a black swan type scenario on SPY, not imminent but still looming as geo political tensions ramp up and increasingly expected volatility pops in the Fall pose a risk for vested positions.

QQQ looks slightly less optimistic than recent posts although the downturn last week really didn't impact the index significantly. FANG stocks are increasingly at risk so keeping an eye on support levels in critical.

TLT has suddenly become significantly more bullish, moving out of its narrow range consolidation and despite numerous talking heads droning on about the impending collapse of the bond market.

Trader's Outlook is bullish and reflects the obvious....bull trend still intact but increasing risk makes the whole investment game a precarious undertaking.

Thursday saw the biggest daily volume (and volatility) since February. Friday's recovery was iffy both in terms of strength and volume with many likely holding their breath over the weekend waiting to see if NOKO is going to grace us with a nuclear winter or Yosemite delivers a blast to end civilization as we know it. (readers in the Dakotas take heart....you've got good odds for survival....the rest of us are toast).

We now have a black swan type scenario on SPY, not imminent but still looming as geo political tensions ramp up and increasingly expected volatility pops in the Fall pose a risk for vested positions.

QQQ looks slightly less optimistic than recent posts although the downturn last week really didn't impact the index significantly. FANG stocks are increasingly at risk so keeping an eye on support levels in critical.

TLT has suddenly become significantly more bullish, moving out of its narrow range consolidation and despite numerous talking heads droning on about the impending collapse of the bond market.

Trader's Outlook is bullish and reflects the obvious....bull trend still intact but increasing risk makes the whole investment game a precarious undertaking.

Thursday saw the biggest daily volume (and volatility) since February. Friday's recovery was iffy both in terms of strength and volume with many likely holding their breath over the weekend waiting to see if NOKO is going to grace us with a nuclear winter or Yosemite delivers a blast to end civilization as we know it. (readers in the Dakotas take heart....you've got good odds for survival....the rest of us are toast).

Subscribe to:

Posts (Atom)