Our cautionary note about Thursday's pop turned out to be precocious. VIX was up again today another 6% and now we may be considering the risk reward of either a XIV long position or a VIX long put play......strictly short term. The fizzle was evident right out of the gate as recent lows were retested and new lows were posted.

Utilities (XLU) were hot again today as well as MSFT....up almost a buck....as expectations turn rosy for a potential new CEO. The QQQ was actually green for a bit today and showed considerably better relative strength than SPY or the DOW. Emerging markets in EEM and SCHE displayed good strength also, perhaps developing a bottom after performing just plain dismally in January.

We'll take a little closer look at the VIX situation over the weekend and further assess the likely next trend following January's 5% decay and possible strategies to mitigate risk.

Friday, January 31, 2014

Thursday, January 30, 2014

An Overdue Bounce...1.30.14

A bit of a relief rally today with the NASDAQ QQQ beating SPY by a 2:1 margin. If you think the selling is over you may want to wait a day or two to see how this bounce plays out. Of particular concern is the action of the VIX, which, although it was down 6% at one point, managed to close almost flat...thereby suggesting there's still considerable short interest lurking out there.

Just something to be aware of.

A really good day for QQQ and XLU....XLE (energy) was that laggard in the VEGA model.

SPY closed flat on the momentum line today.... another cause for caution.

Just something to be aware of.

A really good day for QQQ and XLU....XLE (energy) was that laggard in the VEGA model.

SPY closed flat on the momentum line today.... another cause for caution.

Wednesday, January 29, 2014

FED Taper Plan Opens Trap Door...1.29.14

The FED's announcement of another $10 billion/month POMO reduction knocked the wind out of the markets today...the only good news being that we closed above the lows. Utilities (XLU) are showing resilience, (see VEGA model below), which is a modest cause for optimism as the end of the month approaches, although it's not at all clear that the typical last day of the month rally will ensue.

SPY is now at 1775, having solidly broken the 1800 line in the sand, and, as can be seen in the TrendX chart to the right>>>>>>>...the next support level is not clear.

Just to put things in perspective, here's the daily charts of M3 and Small World followed by the intraday charts of M3 and VEGA....

SPY is now at 1775, having solidly broken the 1800 line in the sand, and, as can be seen in the TrendX chart to the right>>>>>>>...the next support level is not clear.

Just to put things in perspective, here's the daily charts of M3 and Small World followed by the intraday charts of M3 and VEGA....

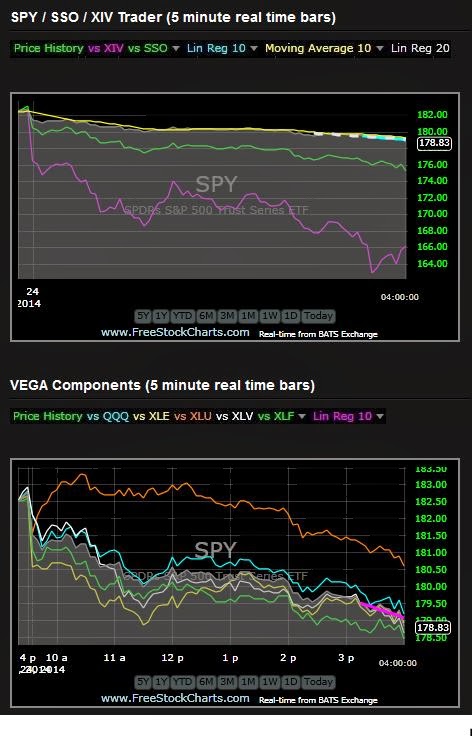

Friday, January 24, 2014

Market Collapse...1.24.14

Yesterday's cautionary note proved to be timely. Markets went from bad to worse, closing at the day's lows, with the DOW dropping 318 points to close below 16,000 and SPY below 180.

The VIX actually rose almost 31% today, the highest level in 3 months and the SPY TrendX (right side panel) is now sitting at a major support level.

How bad was it today? It was bad. One of the nifty tools that Schwab has on its EDGE platform is a real time advance/decline ticker for individual stocks and/or ETFs with a +1000 to -1000 scale.

For several 20 minute spans late in the afternoon SPY was reading -1000 in the red...meaning that NOBODY was buying a single share...that's selling as strong as it gets.

It would be reassuring to say the carnage is over but that's not clear at all.

Utilities (XLU) managed to stay in the green until midday when the selling began in earnest. XLU is generally regarded as a safe haven in times of market weakness but if XLU selling continues this will be a omen of more selling to come. Needless to say, M3 is in cash.

I'll be on the road next Monday and Tuesday and there will be no posts for those 2 days.

The VIX actually rose almost 31% today, the highest level in 3 months and the SPY TrendX (right side panel) is now sitting at a major support level.

How bad was it today? It was bad. One of the nifty tools that Schwab has on its EDGE platform is a real time advance/decline ticker for individual stocks and/or ETFs with a +1000 to -1000 scale.

For several 20 minute spans late in the afternoon SPY was reading -1000 in the red...meaning that NOBODY was buying a single share...that's selling as strong as it gets.

It would be reassuring to say the carnage is over but that's not clear at all.

Utilities (XLU) managed to stay in the green until midday when the selling began in earnest. XLU is generally regarded as a safe haven in times of market weakness but if XLU selling continues this will be a omen of more selling to come. Needless to say, M3 is in cash.

I'll be on the road next Monday and Tuesday and there will be no posts for those 2 days.

Thursday, January 23, 2014

Complete Reversal...1.23.14

The markets completely reversed yesterday's momentum on poor economic reports and continued uncertainty about the effects of a POMO taper.

The emerging markets, which were yesterday's big winner became today's the biggest loser and the financials were also hard hit...not a good omen for a market bounceback.

On day's like today its often instructive to see which stocks and ETFs retain their strength and which ones are the first to reverse up when the market trend starts looking bullish.

Although SPY closed with bullish momentum via the TrendX be aware that swoons like today have a bad habit of retesting recent lows, usually within a day or two, so it's way too early to say the decline is over.

The emerging markets, which were yesterday's big winner became today's the biggest loser and the financials were also hard hit...not a good omen for a market bounceback.

On day's like today its often instructive to see which stocks and ETFs retain their strength and which ones are the first to reverse up when the market trend starts looking bullish.

Although SPY closed with bullish momentum via the TrendX be aware that swoons like today have a bad habit of retesting recent lows, usually within a day or two, so it's way too early to say the decline is over.

Wednesday, January 22, 2014

Treading Water....1.22.14

Tech and utilities kept up momentum today...now joined by the emerging markets as seen in the Small World and Schwab models (EEM and SCHE).

Volatility continues to behave badly with both VIX and XIV positive for most of the day.

The volatility spring is wound tight at this level and we're likely to see a substantial breakout in the next day to so......which way remains a questions.

The fade down into the last 30 minutes reflects the market uncertainty .

Volatility continues to behave badly with both VIX and XIV positive for most of the day.

The volatility spring is wound tight at this level and we're likely to see a substantial breakout in the next day to so......which way remains a questions.

The fade down into the last 30 minutes reflects the market uncertainty .

Tuesday, January 21, 2014

Cautiously Optimistic...1.21.14

A wild ride today as early bullish momentum was crushed into the noon hour with a modest recovery into the close. Utilities, energy and the QQQs were the relative strength leaders today and SPY momentum closed slightly positive.

An astute reader pointed out that last week's short term alerts on M3 were not as displayed in the posts. This was a mistake on my part as the posts reflected the output of a beta version of M3 that uses different parameters than the version currently held by Mosaic users. I apologize for the error...the signals produced by the version of M3 in user hands were considerably more bearish than those posted and much more reflective of the true risk environment.

Below are tonight's correct signals for SPY and QQQ.

Finally, the VEGA model showing the various relative strengths today.....

An astute reader pointed out that last week's short term alerts on M3 were not as displayed in the posts. This was a mistake on my part as the posts reflected the output of a beta version of M3 that uses different parameters than the version currently held by Mosaic users. I apologize for the error...the signals produced by the version of M3 in user hands were considerably more bearish than those posted and much more reflective of the true risk environment.

Below are tonight's correct signals for SPY and QQQ.

Finally, the VEGA model showing the various relative strengths today.....

Sunday, January 19, 2014

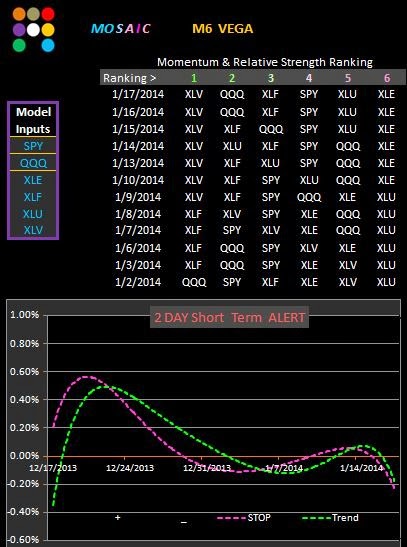

M6 Model Updates...1.19.14

With SPY essentially flat for the first 20 days of the new year here's a look at how the Schwab, Small World and Vega models have fared:

On a 20 day basis the Schwab model is slightly outperforming SPY, mostly due to a focus on the Schwab housing and foreign stock ETFs (SCHH and SCHF).. The good news...no commissions.

The short term ALERT signaled CASH on the 16th.

This model slight;y underperformed SPY and has been focused on VGK...the Vanguard total Europe ETF...recently superceded by EWG (Germany).

The short term ALERT signaled CASH on the 16th.

On a 20 day basis the Schwab model is slightly outperforming SPY, mostly due to a focus on the Schwab housing and foreign stock ETFs (SCHH and SCHF).. The good news...no commissions.

The short term ALERT signaled CASH on the 16th.

This model slight;y underperformed SPY and has been focused on VGK...the Vanguard total Europe ETF...recently superceded by EWG (Germany).

The short term ALERT signaled CASH on the 16th.

Vega has been the loser of the 3 models, having been in a downswoon since late December if a top 2 sort were used. I'm still analyzing exactly why the momentum and relative strength signals failed to produce a more favorable return but that;s a work in progress.

Had we used a top 6 sort the results look somewhat different but with the clarity of hindsight we can see that simply holding SPY would have achieved the same results..... so why bother?

Can we do better by simply applying strict risk management controls to a SPY position versus the diversified risk of a portfolio model? That's the question M3 was designed to answer.

Thursday, January 16, 2014

Volatility Seeks a Direction....1.16.14

A morning sell off was met with a late afternoon rally ...of sorts. Utilities really saw a bump today via the VEGA model and the day closed with SPY trending neutral. Retail (XRT) reversed course from yesterday and plunged thanks to bad earnings from Best Buy and a couple other disappointments.

Note that SSO is the # 1 ranked slot and XIV has been cancelled as a trade...no doubt the bizaaro behavior of the VIX and XIV over the past 10 days.

Also note the SPY TrendX chart in the right side panel....still plenty of upside potential if the markets decide to go for it.

Note that SSO is the # 1 ranked slot and XIV has been cancelled as a trade...no doubt the bizaaro behavior of the VIX and XIV over the past 10 days.

Also note the SPY TrendX chart in the right side panel....still plenty of upside potential if the markets decide to go for it.

Wednesday, January 15, 2014

VIX XIV Weirdness Resumes....1.15.14

For most of the day both the VIX and its ETF inverse XIV were red....hypothetically an impossible situation.... but it happened. meanwhile the DOW tacked on another 100 points and is likely to cross over the 16,500 line in the sand tomorrow.

Tech (QQQ) and the financials (XLF) considerably outperformed SPY today...you can see it clearly on the Vega model below. I've previously talked about the bullish implications when QQQ and XLF are the momentum leaders and we're clearly in that mode now...can Dow 17,000 be far away?...it could happen in a week if things get rolling with some hot earnings.

M3 continues to be bullish for SPY and QQQ.

FYI....today is the end of the M3 update special offer.

Tech (QQQ) and the financials (XLF) considerably outperformed SPY today...you can see it clearly on the Vega model below. I've previously talked about the bullish implications when QQQ and XLF are the momentum leaders and we're clearly in that mode now...can Dow 17,000 be far away?...it could happen in a week if things get rolling with some hot earnings.

M3 continues to be bullish for SPY and QQQ.

FYI....today is the end of the M3 update special offer.

Tuesday, January 14, 2014

Reversal....1.14.14

Today's bullish action virtually erased yesterday's bearish plunge, with the NASDAQ closed at new highs. While the VIXEN closed modestly downslope the TrendX was above the zero line..which is positive.

Amazingly, the price of near term out of the money VIX call options was actually less at the close today than at Monday's open reflecting a 2 day flux of approximately 100%, while the VIX index itself went up 10% yesterday and down 10% today.

Did I mention to expect volatility this week?

We still have earnings looming and a number of new stock downgrades but the markets may be starting a push back up to DOW 16500 . In addition, the emerging markets ETFS...EEM and SCHE..showed robust momentum today and may be starting a much delayed move up

M3 has once again reversed itself and is now in a full bull mode.....to say that the past 2 days have been a whipsaw would be a real understatement.

.

Amazingly, the price of near term out of the money VIX call options was actually less at the close today than at Monday's open reflecting a 2 day flux of approximately 100%, while the VIX index itself went up 10% yesterday and down 10% today.

Did I mention to expect volatility this week?

We still have earnings looming and a number of new stock downgrades but the markets may be starting a push back up to DOW 16500 . In addition, the emerging markets ETFS...EEM and SCHE..showed robust momentum today and may be starting a much delayed move up

M3 has once again reversed itself and is now in a full bull mode.....to say that the past 2 days have been a whipsaw would be a real understatement.

.

Monday, January 13, 2014

VIX Returns to Normalcy....UP...1.13.14

I mentioned the odd behavior in the VIX last week...that all changed today with the VIX rising 10% and the markets plunging. As we head into options expiration this Friday we may expect volatility to persist catalyzed by uncertainty at what upcoming earnings reports may reveal.

The markets are always climbing a wall of worry.....except when unbridled exuberance prevails.

M3 is clearly in cash as the TrendX showed a piddling recovery into the close. The energy sector XLE really felt the pain today although the damage spread across all sectors....retail (XRT) was just plain dismal.

I'm expecting a bounce into Tuesday's open...whether it will hold is more than a little uncertain.

The markets are always climbing a wall of worry.....except when unbridled exuberance prevails.

M3 is clearly in cash as the TrendX showed a piddling recovery into the close. The energy sector XLE really felt the pain today although the damage spread across all sectors....retail (XRT) was just plain dismal.

I'm expecting a bounce into Tuesday's open...whether it will hold is more than a little uncertain.

Friday, January 10, 2014

XLF Model Update...1.10.14

XLF (Financial SPDR sector ETF) has been on a tear lately as the robber barons have big plans for 2014 and potential windfalls from eased constraints so going into the new year seemed like a good time to review the model we profiled last year that was created in the spirit of the X sector model only in this case we just use XLF as the benchmark and use the top 10 XLF component stocks as the model inputs.

Note that the Yahoo symbol for Bershire has changed from BRK.B to BRK-B

Also note on the 2 year equity chart below that going to cash in late April of 2012 as the P6 turned down and then re-entering in August as the P6 went upslope would have produced an additional 10 % return.

Note that the Yahoo symbol for Bershire has changed from BRK.B to BRK-B

Also note on the 2 year equity chart below that going to cash in late April of 2012 as the P6 turned down and then re-entering in August as the P6 went upslope would have produced an additional 10 % return.

Thursday, January 9, 2014

Sideways Action Continues..1.9.14

The TrendX chart below tells the tale...down to sideways momentum with a closing in modest positive territory. Also check the SPY daily TrendX in the right panel >>>>>>>>>>>

SPY is currently at the momentum/relative strength level from which it reversed in November.

Adding to the confusion... XIV was actually green for part of the day although it didn't close that way, ultimately diverging from SPY momentum, and M3 is now in a wait and see mode.

Certainly not a washout the past few days.... the NYAD advance/decline line has never fallen to the sub teen level that characterize true selling. Time for a rebound?

Oil (XLE) was the weak sector in the Vega model today while health care (XLV) showed strong relative strength and looks poised for new highs..

SPY is currently at the momentum/relative strength level from which it reversed in November.

Adding to the confusion... XIV was actually green for part of the day although it didn't close that way, ultimately diverging from SPY momentum, and M3 is now in a wait and see mode.

Certainly not a washout the past few days.... the NYAD advance/decline line has never fallen to the sub teen level that characterize true selling. Time for a rebound?

Oil (XLE) was the weak sector in the Vega model today while health care (XLV) showed strong relative strength and looks poised for new highs..

Wednesday, January 8, 2014

Seeking Alpha with SPY...1.8.14

Alpha refers to the incremental value that can be added to a benchmark portfolio by engaging any variety of money management tools and tactics. For almost all of our tested models SPY has been used as that benchmark...generally the highest volume ETF on any given day and indicative of the performance of the the biggest 500 S&P companies measured by capitalization.

Its a hard act to follow, as they say, and the question is often asked..."why not just trade SPY?"

This question is, in fact, the underlying reason that the M3 platform was developed. Its momentum and relative strength algorithms are faster than the M6 platform and much faster than the M11/T11 platform. M3's pairs charts are configured somewhat differently than M6 and the overall time frame is just 6 months to reflect the trading versus investing intent of the platform.

While all the platforms benefit from close observation of money management stops, with M3 its absolutely critical to follow the signals....that's due in a large part to the increased volatility risk incurred by trading XIV and SSO. Caveat emptor!!!!

Here's the current report with the AUTO STOP turned on. Recent results have been stellar based largely on the almost bizarre behavior of XIV relative to SPY...but M3 successfully saw through the market fog and showed the path.

Its a hard act to follow, as they say, and the question is often asked..."why not just trade SPY?"

This question is, in fact, the underlying reason that the M3 platform was developed. Its momentum and relative strength algorithms are faster than the M6 platform and much faster than the M11/T11 platform. M3's pairs charts are configured somewhat differently than M6 and the overall time frame is just 6 months to reflect the trading versus investing intent of the platform.

While all the platforms benefit from close observation of money management stops, with M3 its absolutely critical to follow the signals....that's due in a large part to the increased volatility risk incurred by trading XIV and SSO. Caveat emptor!!!!

Here's the current report with the AUTO STOP turned on. Recent results have been stellar based largely on the almost bizarre behavior of XIV relative to SPY...but M3 successfully saw through the market fog and showed the path.

Tuesday, January 7, 2014

Cramer's 2014 Picks...1.7.14

Jim Cramer came out with a list of stocks he expects to excel in 2014 on January 2nd. Love him or hate him, Cramer does move the markets and has made some great calls. These are his top picks culled from a somewhat longer list and reduced to a basket of 10 stocks plus SPY as our benchmark.

Just for fun we'll periodically track the Cramer file through 2014 to review portfolio performance using a top 1 and top 2 sort as well as how the portfolio stacks up against SPY. You never know when you'll run across a real investment nugget....maybe this is one.

As a starting point and employing the advantage of hindsight I've included how the portfolio components fared in 2013 before their selection by Cramer.

Keep in mind these are stocks, not ETFs, so we should expect volatility to substantially exceed SPY.

Just for fun we'll periodically track the Cramer file through 2014 to review portfolio performance using a top 1 and top 2 sort as well as how the portfolio stacks up against SPY. You never know when you'll run across a real investment nugget....maybe this is one.

As a starting point and employing the advantage of hindsight I've included how the portfolio components fared in 2013 before their selection by Cramer.

Keep in mind these are stocks, not ETFs, so we should expect volatility to substantially exceed SPY.

Monday, January 6, 2014

VIX Falls with SPY....1.6.14

The VIX ran in parallel with the SPY today...both down. That's unusual to say the least, especially given the size of weakness in SPY. Regarding the VIX...here's an interesting piece of the rise in the trading of VIX related issues...which also translates to the VIX inverse XIV.

The divergence of SPY and XIV can be seen more clearly on the M3 SPY Trader.. Meanwhile SPY continues on a slow churn down with a failure of a late afternoon rally...leaving SPY in a distinctly negative zone.

The divergence of SPY and XIV can be seen more clearly on the M3 SPY Trader.. Meanwhile SPY continues on a slow churn down with a failure of a late afternoon rally...leaving SPY in a distinctly negative zone.

Subscribe to:

Posts (Atom)