Hey!...last day of the month is supposed to have bullish odds...what gives? Well, technical resistance for one thing and that pesky ole FED rate hike worry for another. A sure sign things were going to get volatile today ....at the open VIX was up 8% and the SPY was up .25%....and as usual the VIX trumps the SPY and the NYAD has crumbled from an opening 1.94 to the current .76 at the noon hour (West coast). VIX is now up 13% and SPY is down .5%. Still an unbalanced skew.

Both the MVP SPY and SH models are long for tomorrow, which means delta neutral for now.

Now this is something that may cause some concerns about the stability of the treasury market.

Bloomberg has this tale of the secret US/Saudi deal 40 years ago that is now coming home to roost.

The fallout could be considerable.

Meanwhile here's the MVP spin on XLE (the SPDR oil sector ETF) which has proven difficult to trade using momentum technicals, but which seems to respond well to the MVP volatility forensics.

Certainty a lot less drawdown risk with only 20% of days vested.

Tuesday, May 31, 2016

Sunday, May 29, 2016

VDX Updates as Low Volume Momentum Drives Rally...05.29.16

It was another R2 pivot day for SPY on Friday with volume less than 50M into the close. The nervousness over Yellen's Friday meeting produced a short lived sell off before noon but the markets quickly rebounded and we ended at the high of the day. Technically, we're overbought with the RSI2 at 98 but the VDX's view is slightly more optimistic for the bulls and the Sell in May crowd are getting punished badly. The Trader's Outlook shares this optimism, at least for now,...just keep in mind that market sell offs typically start from situations of high hope and market exuberance.

Note: ALL the VDX charts are suggesting bearish outcomes for the near term.

Starting Monday we'll post the daily MVP signal for SPY just to see how the model performs.

Some big changes are underway with Mosaic and LQB and details will be forthcoming next week.

Note: ALL the VDX charts are suggesting bearish outcomes for the near term.

Starting Monday we'll post the daily MVP signal for SPY just to see how the model performs.

Some big changes are underway with Mosaic and LQB and details will be forthcoming next week.

Thursday, May 26, 2016

The Outlook on Bonds (TLT).. 05.26.16.

As bear sentiment continues to grow in the bond sector based on expectations for a FED rate hike here are a few relevant links and the current outlook using the M1 Mean Reversion mode...the setting that has continually outperformed all other modes on both a short and long term basis. Based on the articles below there's clearly a divergence in opinion on the relative merit of bond investments for the near term and for now we'll just follow M1 guidance until proven wrong. The other alternative is the delta neutral model shown below which offers very low risk exposure and consistent returns.

Banks cutting bond traders.

Treasury auction is hot.

Buy a bond...NOT.

Close up view>

Banks cutting bond traders.

Treasury auction is hot.

Buy a bond...NOT.

Close up view>

Wednesday, May 25, 2016

PONZO Updates ...05.25.16

Another leg up today as market manipulators defy the Sell in May VIX call buyers that have piled into the market. What's surprising about this week's updates is the REALLY bullish tone of the SPY while VIX looks neutral and bonds maintain the modest bearish outlook seen for the past 2 weeks.

Contrary to Bob Pisani's piece on flat being the new up on the VIX, it looks like we might make the case that flat is the new down given current market behavior .

The FED's rate decision in June will produce some pumped volatility and the current odds for a rate hike are 38%, up from 8% only 3 weeks ago. Recent surge in the financials (XLF) suggest the bet is that the hike is a done deal.

Contrary to Bob Pisani's piece on flat being the new up on the VIX, it looks like we might make the case that flat is the new down given current market behavior .

The FED's rate decision in June will produce some pumped volatility and the current odds for a rate hike are 38%, up from 8% only 3 weeks ago. Recent surge in the financials (XLF) suggest the bet is that the hike is a done deal.

Tuesday, May 24, 2016

The Only 2 Charts You Need to Watch....05.24.16

Sounds arrogant? Well, I meant it tongue in cheek. But IF you could only look at 2 here are my picks using the MVP Long setup for XIV and the Short setup for VXX. The Long/Short algorithms are not the same but they are also not the inverse of each other. Each MVP model has a couple tweaks along the way that try to capture the idiosyncrasies of trading long versus trading short. Note the total number of exposed days..only 25-35% of the time and the results reflect an active limit stop.

I know everyone is tired of hearing this but a trailing stop in each model would have pushed total gains up over 15% in each case. I actually find the VXX model the more intriguing study as VXX is an intrinsically decaying asset that has lost over 90% of its net value since inception.

Click on each chart to enlarge.

Today's wildly bullish market action ON VERY LOW VOLUME looks like a lot of short covering as SPY and the majors kiss the R4 pivot (which only happens once in a blue moon) and we're likely to see a pullback off the SPY 208 upper resistance level back down to the 205 area.

Tomorrow we'll look at the new Ponzo updates...which are more than a little surprising.

I know everyone is tired of hearing this but a trailing stop in each model would have pushed total gains up over 15% in each case. I actually find the VXX model the more intriguing study as VXX is an intrinsically decaying asset that has lost over 90% of its net value since inception.

Click on each chart to enlarge.

Today's wildly bullish market action ON VERY LOW VOLUME looks like a lot of short covering as SPY and the majors kiss the R4 pivot (which only happens once in a blue moon) and we're likely to see a pullback off the SPY 208 upper resistance level back down to the 205 area.

Tomorrow we'll look at the new Ponzo updates...which are more than a little surprising.

Monday, May 23, 2016

MVP Short Studies and Traders Outlook....05.23.16

Its the usual nutso followup to options expiration with the VIX, TLT and SPY all green at the open. This is, of course, not sustainable and 2 hours in SPY and TLT have turned red and the NYAD has fallen suddenly to .87...well off the 1.60 high.

Here's Trader's Outlook for this week, suggesting a bearish bias.

AAPL is the star of the day after advising suppliers to ramp up for a major increase in i7 orders.

As promised over the weekend here are 2 MVP studies focused on the short side, SDS and QID.. inverse X2 ETFs for SPY and QQQ.. The time exposure is quite low in each case and as always the yellow arrows highlight situation where a trailing stop would have preserved previous gains.

Here's Trader's Outlook for this week, suggesting a bearish bias.

AAPL is the star of the day after advising suppliers to ramp up for a major increase in i7 orders.

As promised over the weekend here are 2 MVP studies focused on the short side, SDS and QID.. inverse X2 ETFs for SPY and QQQ.. The time exposure is quite low in each case and as always the yellow arrows highlight situation where a trailing stop would have preserved previous gains.

Saturday, May 21, 2016

VDX Updates and New M3 INSIGHT...05.21.16

Regarding the Sell in May jitters...it turns out that May weakness doesn't typically kick in until the second half of the month which then carries over to the downside in June. That's the way Traders Almanac reports on the May sell, but then past performance is no guarantee of future returns.

Nevertheless hedge funds are selling and market gurus are struggling to make sense of recent VIX behavior. CNBC is not a venue I frequent, but I've met Bob Pisani a couple times and talked with him about the markets and I've always found him to be genuine and very astute so I pay attention when he offers his opinions.

There's a new, extensive post of MVP studies on M3 Insight, hope you find it interesting.

Next week we'll turn the MVP upside down and use it to predict short setups.

In the meantime here are the latest VDX studies....looking neutral, which means there's likely a break in the near future (up or down remains to be seen). It looks like bullish odds, but we've been fooled badly before and the PONZO short term forecast is bearish..

Nevertheless hedge funds are selling and market gurus are struggling to make sense of recent VIX behavior. CNBC is not a venue I frequent, but I've met Bob Pisani a couple times and talked with him about the markets and I've always found him to be genuine and very astute so I pay attention when he offers his opinions.

There's a new, extensive post of MVP studies on M3 Insight, hope you find it interesting.

Next week we'll turn the MVP upside down and use it to predict short setups.

In the meantime here are the latest VDX studies....looking neutral, which means there's likely a break in the near future (up or down remains to be seen). It looks like bullish odds, but we've been fooled badly before and the PONZO short term forecast is bearish..

Thursday, May 19, 2016

Crosswinds of Uncertainty Prevail....05.19.16

Are we arriving or departing from the "new" volatility paradigm? Time will tell but in the meantime swing traders are scratching their heads trying to find an edge, as are some big bank trading desks..

Re yesterday's comment on archaic fund regs, here's a background article on the topic. Personally I would NEVER buy another mutual fund, the buy/sell constraints are just too high risk and the management fees are often far in excess of ETFs with similar portfolios. IMHO.

Here are the MVP studies for QQQ and QLD (the x2 leveraged QQQ ETF). We'll be looking at a whole basket of stocks and ETFs this weekend and the more I play with this concept the more appealing it looks...vested less than 50% of the time, highly correlated comparative studies to confirm the volatility skew, a limit stop to control whipsaws and a trailing stop to preserve gains.

SO...based on the 2 models shown below, which would you trade? This weekend we'll discuss it.

Click once on each chart to enlarge and then ESC key to revert.

Re yesterday's comment on archaic fund regs, here's a background article on the topic. Personally I would NEVER buy another mutual fund, the buy/sell constraints are just too high risk and the management fees are often far in excess of ETFs with similar portfolios. IMHO.

Here are the MVP studies for QQQ and QLD (the x2 leveraged QQQ ETF). We'll be looking at a whole basket of stocks and ETFs this weekend and the more I play with this concept the more appealing it looks...vested less than 50% of the time, highly correlated comparative studies to confirm the volatility skew, a limit stop to control whipsaws and a trailing stop to preserve gains.

SO...based on the 2 models shown below, which would you trade? This weekend we'll discuss it.

Click once on each chart to enlarge and then ESC key to revert.

Wednesday, May 18, 2016

Another Day, Another Whipsaw.....05.18.16

Another wild ride today as traders are once again hedging bets on a June rate increase by the FED.

Keep in mind that the markets are under manipulation greater than usual by the HFTs and we are now operating in an environment where bearish sentiment is rising in both equities and bonds with the anticipation of a washout that will sink all ships. This sentiment follows the recent Ponzo chart updates showing the decoupling of the normally divergent equity/bond relationship and just in case you haven't been through once of these volatility churns before, they tend to end badly for the bulls.

While delta neutral remains our Plan A for navigating the present risky milieu, MVP is our emerging Plan B and work continues to make the model robust and highly linear.

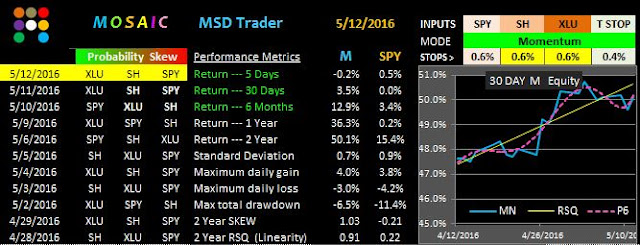

Below is MVP's view of XLU as of today's close.

Keep in mind that risk containment is our primary objective and this weekend we'll post a basket of MVP studies examining where it's strong and where it's weak.

Keep in mind that the markets are under manipulation greater than usual by the HFTs and we are now operating in an environment where bearish sentiment is rising in both equities and bonds with the anticipation of a washout that will sink all ships. This sentiment follows the recent Ponzo chart updates showing the decoupling of the normally divergent equity/bond relationship and just in case you haven't been through once of these volatility churns before, they tend to end badly for the bulls.

While delta neutral remains our Plan A for navigating the present risky milieu, MVP is our emerging Plan B and work continues to make the model robust and highly linear.

Below is MVP's view of XLU as of today's close.

Keep in mind that risk containment is our primary objective and this weekend we'll post a basket of MVP studies examining where it's strong and where it's weak.

Tuesday, May 17, 2016

PONZO Updates Before Today's Reversal....05.17.16

Welcome to the whipsaw. Yesterday's gains were completely reversed midway through today's session although the close was in a modest recovery mode...not bullish just off the lows. With Goldman, Soros and Icahn now massively bearish / defensive the consensus mood appears to be following the Sell in May mantra as good earnings (HD) are met with negative reactions.

The Ponzo updates continue last week's theme of weakness in both SPY and TLT with the VIX trading in a fairly narrow range. This could all change in a heartbeat if volume picks up and pent up short interest via the VIX takes hold. The Ponzo 8 week VIX outlook is 20, the number forecast by the November VIX futures.

The Ponzo updates continue last week's theme of weakness in both SPY and TLT with the VIX trading in a fairly narrow range. This could all change in a heartbeat if volume picks up and pent up short interest via the VIX takes hold. The Ponzo 8 week VIX outlook is 20, the number forecast by the November VIX futures.

Monday, May 16, 2016

Rally on low volume = ?....05.16.16

The market 's on steroids today...the only concern is volume, which is abnormally low. Buffett's newly disclosed stake in Apple has it up over 4% while at the same time making the Qs the index star of the day.

Less we get too giddy with the anticipation of new highs all around there are a couple voices of gloom and doom to ponder. Barron's noted Carl Icahn's huge bet on a market crash (short 149%) and Goldman, whose recommendations are always suspicious as most likely self serving, are clearly in the bear camp. Today's action has all the hallmarks of a short covering rally although archaic rules covering mutual fund buys and sells may drive the markets higher into Tuesday, possibly back up to strong overhead resistance at 208.....where we expect a stall.

There's a new posting on M3 Insight with details on how the MVP setup trades XIV. The file was too large visually to post on the daily newsletter but is archived now for future reference. FYI.

This is a distinctly different way to trade XIV than using momentum or mean reversion but the results warrant a closer look.

Less we get too giddy with the anticipation of new highs all around there are a couple voices of gloom and doom to ponder. Barron's noted Carl Icahn's huge bet on a market crash (short 149%) and Goldman, whose recommendations are always suspicious as most likely self serving, are clearly in the bear camp. Today's action has all the hallmarks of a short covering rally although archaic rules covering mutual fund buys and sells may drive the markets higher into Tuesday, possibly back up to strong overhead resistance at 208.....where we expect a stall.

There's a new posting on M3 Insight with details on how the MVP setup trades XIV. The file was too large visually to post on the daily newsletter but is archived now for future reference. FYI.

This is a distinctly different way to trade XIV than using momentum or mean reversion but the results warrant a closer look.

Saturday, May 14, 2016

VDX Updates as Market Weakens.....05.14.16

The technicals suggest TLT wildly overbought and SPY on a precarious ledge of support. Note that I've turned off the volume weighting component for SPY and TLT for this week.

Schwab's outlook echoes the precarious theme as we enter an historically weak couple of weeks before the usual first of the month expected pop. Options expiration this month could be particularly volatile now that earnings season is almost over and the funds re-position their hedges.

Volume has been muted for the past week, another symptom of the summer doldrums although if volume does pick up the odds are it will be to the downside. This is the type of uncertain environment where delta neutral setups can have superior returns versus news driven whipsaw days....IMHO.

Note the SPY volatility charts following the VDXs....we're on an upswing = caution for Longs..

Schwab's outlook echoes the precarious theme as we enter an historically weak couple of weeks before the usual first of the month expected pop. Options expiration this month could be particularly volatile now that earnings season is almost over and the funds re-position their hedges.

Volume has been muted for the past week, another symptom of the summer doldrums although if volume does pick up the odds are it will be to the downside. This is the type of uncertain environment where delta neutral setups can have superior returns versus news driven whipsaw days....IMHO.

Note the SPY volatility charts following the VDXs....we're on an upswing = caution for Longs..

SPY volatility charts shown above.

Thursday, May 12, 2016

M3 Study Updates.....05.12.16

While our recent efforts have been focused on the trading possibilities of using the ATR and PCL as viable timing indicators the default M3 models...delta neutral, mean reversion and momentum have all managed to hold up in the face of recent volatility swings periods when it seemed technical analysis could provide little guidance for making money. Delta neutral continues to rank among my favorite models....no loss of sleep overnight...and as long as a trailing stop program is followed there is almost no risk of cumulative losses. DN also has the best linearity returns, as should be expected.

Wednesday, May 11, 2016

Bear Mood Increases and more MVP Studies.....05.11.16

Half hour till the close and so far we're looking at an ugly reversal of yesterday's surge with discretionaries (XLY) taking the biggest sector hit. I came across this Bloomberg piece on the rise of the bears which goes hand in hand with previous links to the massive increase in VIX calls in anticipation of the Sell in May herd mentality that will likely drive the markets lower for a bit....perhaps through June, which is historically a weak month anyway..

The VIX is up over 6% today and the pause below 14 was short lived, to say the least.

Continuing the MVP studies here are the MVP trades only using the ATR and PCL versions.

For ease of study the 2 year unstopped benchmark price and the MVP trade results are shown on the same chart.

At least 2 observations should be clear.

1.The ATR returns could be substantially improved by use of a trailing stop (see yellow arrows on the equity chart). Giving back 2-4 % after a nice gain is not necessary with simple stop controls.

2. The PCL returns are much better than the ATR returns and it all has to do with the relative value of the PCL algorithm versus the ATR. Note that we do not have the trailing stop issue with the PCL trades in the same manner at the ATR.

The green dotted vertical lines designate the actual trades in the ATR and PCL models. They are not the same....and again demonstrate the relative attractiveness of the PCL approach.

While the MVP remains a work in progress we can now see how only a few very high probability trades can produce decent returns while keeping capital securely in cash the vast majority of time.

The VIX is up over 6% today and the pause below 14 was short lived, to say the least.

Continuing the MVP studies here are the MVP trades only using the ATR and PCL versions.

For ease of study the 2 year unstopped benchmark price and the MVP trade results are shown on the same chart.

At least 2 observations should be clear.

1.The ATR returns could be substantially improved by use of a trailing stop (see yellow arrows on the equity chart). Giving back 2-4 % after a nice gain is not necessary with simple stop controls.

2. The PCL returns are much better than the ATR returns and it all has to do with the relative value of the PCL algorithm versus the ATR. Note that we do not have the trailing stop issue with the PCL trades in the same manner at the ATR.

The green dotted vertical lines designate the actual trades in the ATR and PCL models. They are not the same....and again demonstrate the relative attractiveness of the PCL approach.

While the MVP remains a work in progress we can now see how only a few very high probability trades can produce decent returns while keeping capital securely in cash the vast majority of time.

Tuesday, May 10, 2016

PONZO Updates + More...05.10.16.

This week's PONZO updates have reversed the previous bullish outlook for SPY and set a more defensive to neutral forecast at least short term. That's pretty much the case with TLT also, continuing the divergent decoupling that we normally expect from this pair.. The VIX outlook remains benign and with today's close we're back below 14..a situation we forecast over the weekend. Just for amusement here's a piece from Bloomberg on more Chinese market insanity.

Will traders never learn from the monumental mistakes of the past?

Will traders never learn from the monumental mistakes of the past?

Monday, May 9, 2016

MVP Prelim Studies....05.09.16

My initial MVP study models using the ATR and PCL as buy triggers are shown below using the M1 platform . Just as a starting point for further research I've simply replaced the short term momentum and mean reversion filters with either an ATR or PCL threshold reversal. The reaction is similar to that of a mean reversion filter....that is.. the signal looks for a 2 day pullback form a high threshold and then triggers. I've made the threshold adjustable according to near term volatility so we get more signals than just the 11 that would be expected based solely on threshold level violations shown last week.

This is just one example of how we can use the ATR and PCL effectively to mitigate risk and raise returns above a buy and hold strategy. Later this week I'll profile a couple variations of this theme.

The best returns are likely to be achieved by trading short once a ATR or PCL threshold trigger is violated to the upside, but that's difficult to test using the M1 platform....for now..

The PCL version performed somewhat better than the ATR in this study but in both cases the unstopped raw price pattern of SPY is much improved using either filter and the drawdown dips are significantly minimized as detailed on the 2 year MVP Equity chart (ATR study shown)...

This is just one example of how we can use the ATR and PCL effectively to mitigate risk and raise returns above a buy and hold strategy. Later this week I'll profile a couple variations of this theme.

The best returns are likely to be achieved by trading short once a ATR or PCL threshold trigger is violated to the upside, but that's difficult to test using the M1 platform....for now..

The PCL version performed somewhat better than the ATR in this study but in both cases the unstopped raw price pattern of SPY is much improved using either filter and the drawdown dips are significantly minimized as detailed on the 2 year MVP Equity chart (ATR study shown)...

Sunday, May 8, 2016

VDX Updates & Weekend Reading...05.08.16

This week's VDX updates suggest SPY in an oversold condition and TLT approaching overbought. Finding a trend has been difficult lately as earnings reports have created the usual surge of volatility associated with earnings uncertainty. The VIX has been particularly squirrely, as noted in the Bloomberg article link above, and, discounting significant negative news, is likely to retrace back to the 14s within the next 2 weeks as the Sell in May VIX premium pop mentioned earlier in this week's Barron's post is adjusted back to a neutral skew.

Going forward we'll continue to explore less traditional technical signal parameters such as the PCL asnd ATR in an effort to constraint risk exposure in the face of deteriorating global economics.

Monday we'll present the latest performance metric studies of the ATR/PCL indicators, which now include a limit stop function.

There's still considerable work to compete before these platforms are ready for prime time but the prelim results are more than encouraging.

Going forward we'll continue to explore less traditional technical signal parameters such as the PCL asnd ATR in an effort to constraint risk exposure in the face of deteriorating global economics.

Monday we'll present the latest performance metric studies of the ATR/PCL indicators, which now include a limit stop function.

There's still considerable work to compete before these platforms are ready for prime time but the prelim results are more than encouraging.

Thursday, May 5, 2016

MVP Charts, a Mixed Bag....05.05.16

Today we continue the MVP studies, including XIV, the VIX inverse ETF, that's been difficult to trade this year for those that have relied on a strong XIV/SPY correlation.

As mentioned yesterday the MVP is a different way of looking at integrated price and volatility dynamics and although the frequency of trades may only be a half dozen a year, the reliability of the signals is very attractive and the rest of the time capital is in cash..

Note that the different ETFs have different trigger dates and frequency of trades.

Best to click on each chart to see detail better.

If you're trying to mimic the ATR and PCL charts by tweaking the M1 platform be advised that the "Trend" algorithms are not just simple moving averages, but more elaborate constructs, so your signal intersects may not match those shown below..

July 4th weekend the MVP platform will be available to Mosaic subscribers.

And, finally XIV >>> Note that the trigger thresholds are up at 6%+, reflecting the high beta of XIV relative to SPY and the other index ETFs. The ATR/PCL offset is also greater than the other low beta ETF studies to compensate for the resultant higher lag between the 2 indicators.

As mentioned yesterday the MVP is a different way of looking at integrated price and volatility dynamics and although the frequency of trades may only be a half dozen a year, the reliability of the signals is very attractive and the rest of the time capital is in cash..

Note that the different ETFs have different trigger dates and frequency of trades.

Best to click on each chart to see detail better.

If you're trying to mimic the ATR and PCL charts by tweaking the M1 platform be advised that the "Trend" algorithms are not just simple moving averages, but more elaborate constructs, so your signal intersects may not match those shown below..

July 4th weekend the MVP platform will be available to Mosaic subscribers.

And, finally XIV >>> Note that the trigger thresholds are up at 6%+, reflecting the high beta of XIV relative to SPY and the other index ETFs. The ATR/PCL offset is also greater than the other low beta ETF studies to compensate for the resultant higher lag between the 2 indicators.

Wednesday, May 4, 2016

MVP Forecasting Refinements....05.04.16

As the VIX heads towards 17 today and into overbought territory our work continues on the MVP (Mosaic Volatility/Price charts. Some of the recent refinements are shown below in a study of DIA (DOW30 proxy ETF). Although it theoretically reflects DOW price dynamics the DIA is actually an anemic little ETF with only marginal daily volume and more surprisingly perhaps not one member firm of HedgeCo, (a consortium of some 1400 hedge funds) owns a single share of DIA.. They own plenty of SPY, IWM and QQQ but regarding DIA...nada.! Why DIA is shunned by most funds is a story in itself but suffice to say that since it includes only 30 stocks it is the target of massive intraday manipulation by large prop shops...both domestic and foreign and therefore generally hated by risk managers, Nevertheless, if we play the long game using MVP it is clear that there are occasional high odds vesting situations when the ATR and PCL volatility peaks achieve signal threshold levels. The MVP approach is completely different from the standard M1/M3 ranked rotation methodology and the MVP signals can be few and far between, depending on the ETF or stock under study. When generated, however, the signals are consistently reliable, which is what makes them attractive.

Note that the green dashed vertical tracking line is NOT vertical...it is offset by 4 days from the ATR to the PCL to accommodate the leading/lagging behavior of the 2 signals..

Tomorrow we analyze various volatility/price correlations in more detail.

Note that the green dashed vertical tracking line is NOT vertical...it is offset by 4 days from the ATR to the PCL to accommodate the leading/lagging behavior of the 2 signals..

Tomorrow we analyze various volatility/price correlations in more detail.

Tuesday, May 3, 2016

Ponzo Updates as Global Growth Fears Shiver the Markets...05.03.16

Another day, another worrisome flurry of economic reports that do not bode well for the markets.

After a first day of the month rally that looked like it might have some legs sour IMF reports dropped the markets overnight and the selling continued into US market hours.

Bonds were the big winner as flight to safety became job one for risk managers. TLT is the best performing of our M11 bond basket followed by TIP....both ETFs have good volume but serious bond traders should keep an eye on JNK and HYG, which look ready for a possible breakout and have volume interest 2 to 4 times that of TLT..

The Ponzo updates this week closely mirror last week's updates so no new trend forecast changes at this time.

After digesting 6 separate well argued articles on the Sell in May thesis the best conclusion I can come up as a risk manager is that May to October is not necessarily bearish...it's just not bullish.

After a first day of the month rally that looked like it might have some legs sour IMF reports dropped the markets overnight and the selling continued into US market hours.

Bonds were the big winner as flight to safety became job one for risk managers. TLT is the best performing of our M11 bond basket followed by TIP....both ETFs have good volume but serious bond traders should keep an eye on JNK and HYG, which look ready for a possible breakout and have volume interest 2 to 4 times that of TLT..

The Ponzo updates this week closely mirror last week's updates so no new trend forecast changes at this time.

After digesting 6 separate well argued articles on the Sell in May thesis the best conclusion I can come up as a risk manager is that May to October is not necessarily bearish...it's just not bullish.

Subscribe to:

Posts (Atom)