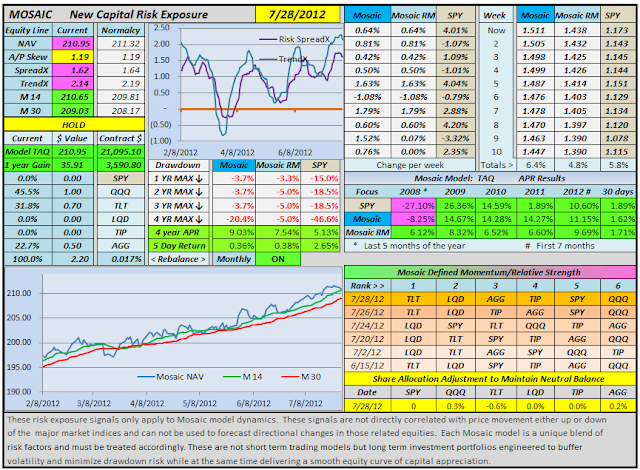

We're sticking with the TAQ model for now...just 3 components but the equity curve continues to provide the defensive posture that is our goal. Both the SpreadX and TrendX have turned negative so the HOLD recommendation for new capital remains in effect.

The SPY made huge gains the last 3 days of last week, turning the previous 5 day return results on its head.

On the other hand, the 30 day performance metrics are holding strong.

It's a bit surprising that the Mosaic Ranking of Momentum/RS is still heavily skewed to the bond side but that could turn out to be a precocious signal if things turn sour next week.

Although LQD and TIP are not in the current model we are keeping them in the Ranking matrix in order to monitor their price pattern and re-evaluate their utility in rejoining the model.

Monthly rebalancing is coming up but we're recommending delaying that until August 6th to pickup the dividend. We've mentioned this nuance before and more details will be supplied next week regarding the yield capture issue.

The relative flux tracking of Mosaic and SPY shows how well the model has maintained neutrality while the SPY has spiked wildly recently. It really all about the news, which continues to give mixed signals about the likely prospects for the future, but our model is effectively shielded from the need to successfully forecast market direction.

A quick look at the TLT VIXEN in the right hand side bar hints that the bulls may be gaining an edge and with the end of the month (typically bullish) the odds are stacked that way...which savvy traders know counts for absolutely nothing.

A new TLT VIXEN signal doesn't kick in until we get a cross of the VIXEN pivot (yellow line) and that still looks a ways off.

We'll look at the MRSI Situations updates on Monday.