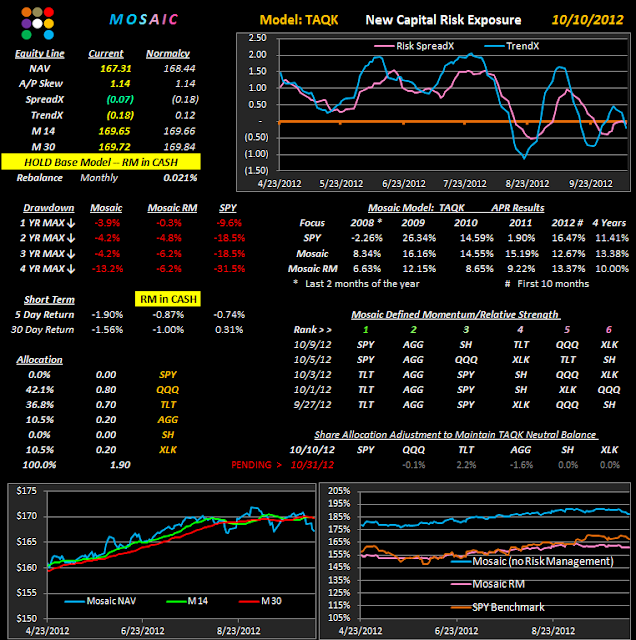

Here are the weekly updates for the fixed allocation models. The RM versions for both models remain in cash since Oct 5th, accounting for their 0 % returns short range. In both models the RM version is currently outpacing the active Mosaic models and in the case of the LM model the RM version is actually ahead of SPY by 1% for the year.The cross of the M14 and M30 did a great job of forecasting further declines and we're looking for a new cross up before the RM versions take positions.

Today is our designated rebalance day for the month. Using the Rebalance Calculator emailed to subscribers last month just enter today's prices and your test model account value to calculate the correct position sizing for each ETF.

The momentum rankings are very bearish currently...SH is the inverse of SPY...which is as bearish as out model will allow. This could all change quickly if the typical end of month buying kicks in, but as of this post (8:00 AM PST) the markets are in a slow grind down with Apple losing over 2 %. Gold is strong and holding...usually a bad sign for the equity markets. Volume is paper thin so expect higher volatility than normal and reduced reliability of the technicals.

Wednesday, October 31, 2012

Tuesday, October 30, 2012

T 9..An Aside...10.30.12

Just for fun here's a rotation model using 9 ETFs and it rotates into the top 7 on each Monday. The model is based on weekly bars and what's attractive in this version is the total drawdown numbers...almost too good to be true...max continuous drawdown = 3.9% !!!.

T9 only returns 25% over the past 4 years, basically equal to SPY but it been a whole different investment experience than holding the volatile SPY.

These models are vest suited for IRAs and other capital appreciation accounts where risk management is a primary concern...still...the returns are about 10X better than the average CD.

To save you some time figuring it out, I've culled XLE and IWM from the T3 mix to come up with the T9 components.

Although both XLE and IWM have had extended runs in the top 3 slots at T3, that comes with a price...volatility... that can turn into a double edge sword when the markets get bearish or when news drives XLE wildly up or down. The T9 portfolio just calms things down a bit.

T9 only returns 25% over the past 4 years, basically equal to SPY but it been a whole different investment experience than holding the volatile SPY.

These models are vest suited for IRAs and other capital appreciation accounts where risk management is a primary concern...still...the returns are about 10X better than the average CD.

To save you some time figuring it out, I've culled XLE and IWM from the T3 mix to come up with the T9 components.

Although both XLE and IWM have had extended runs in the top 3 slots at T3, that comes with a price...volatility... that can turn into a double edge sword when the markets get bearish or when news drives XLE wildly up or down. The T9 portfolio just calms things down a bit.

Monday, October 29, 2012

TLT / XLF Pair Trade - Part III

This is the XLF / TLT pair trade displayed in Market Rewind metrics. Those of you who have subscriptions to Market Rewind Pro can tweak the model parameters but this version is about as good as it gets. This program only looks back 6 months whereas our TradeStation models examine a 16 month rolling lookback period. But here's some confidence building news.. the same settings work in either time frame. What's important to note is that these trades have a definite duration...in this case 5 days. The impressive results are based on that excursion length and virtually all failed trades can be traced to holding positions too long.

For the technically oriented-----All these pair trades are based on the the z-score, a log ratio examination of the relationship between the current standard deviations of the pair components. One of the criteria that makes an ideal pair trade is when the thresholds of the z-score reversals are clearly defined. Using a topographic analysis of all the trades over the past 6 months shows that this is clearly the case with the TLT/XLF trades. In fact, if you apply this type of analysis to most the popular pair trades only a very few will show this type of isolated "sweet spot".

For the technically oriented-----All these pair trades are based on the the z-score, a log ratio examination of the relationship between the current standard deviations of the pair components. One of the criteria that makes an ideal pair trade is when the thresholds of the z-score reversals are clearly defined. Using a topographic analysis of all the trades over the past 6 months shows that this is clearly the case with the TLT/XLF trades. In fact, if you apply this type of analysis to most the popular pair trades only a very few will show this type of isolated "sweet spot".

Saturday, October 27, 2012

T 3 Update +T2..10.27.12

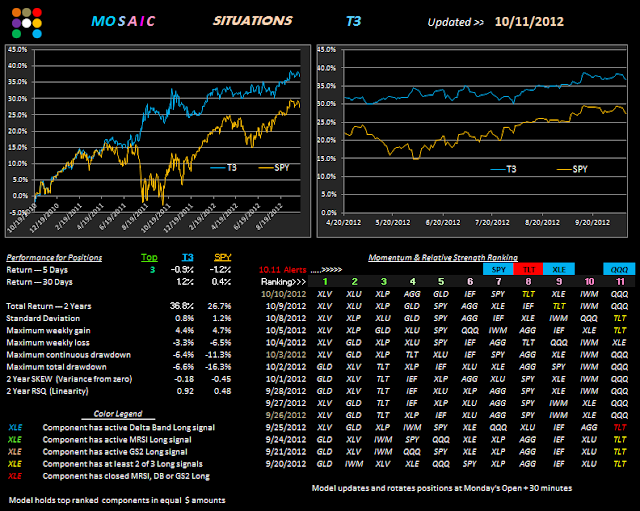

T3 is now firmly in the bond camp with all 3 top slots in bonds and XLU (Spyder Utilities), a favorite hedging ETF, in slot #4. This is the first time we have seen this alignment in the 2 year T3 momentum study and it should definitely be a cause for some concern for Long equity positions.

Technically, the markets are substantially oversold but nothing says they can't get a lot more oversold before a rally kicks in. In any attempt of pick a bottom the I've always found it better to wait for the hairy bottom set up pattern (that is , actually see a bottoming pattern develop) and then ride the rally up.

The RM models remain in cash and that where I'm sitting for the time being.

The T3 signals have been a little late in detecting relative strength in the various components lately, which has cost the model a few percentage points.

To resolve this problem and improve odds I've sped up the momentum algorithm a bit, kicked XLP from the mix and added FXE (the Euro). This new model is shown below as T2 because it only takes positions in the top 2 ranked ETFs and if either of them fall out of rank during the week then those positions are closed.

In the near future I'll make the T2 software package available to subscribers only for a modest one time fee.

You will be able to build your own portfolio of 1 to 11 ETFs and then set the momentum rankings to focus on the top # of ETFs of your choosing. The program has an end of day data feed built in.

Alerts will not be included in the program as those are calculated on TradeStation and imported into the Mosaic platform within a different time frame.

We'll flush out more details on T2 later in the week as the final version gets set to go. I'll also post a few examples of what you can do with this platform to create a blend of portfolios to further insulate your risk.

Technically, the markets are substantially oversold but nothing says they can't get a lot more oversold before a rally kicks in. In any attempt of pick a bottom the I've always found it better to wait for the hairy bottom set up pattern (that is , actually see a bottoming pattern develop) and then ride the rally up.

The RM models remain in cash and that where I'm sitting for the time being.

The T3 signals have been a little late in detecting relative strength in the various components lately, which has cost the model a few percentage points.

To resolve this problem and improve odds I've sped up the momentum algorithm a bit, kicked XLP from the mix and added FXE (the Euro). This new model is shown below as T2 because it only takes positions in the top 2 ranked ETFs and if either of them fall out of rank during the week then those positions are closed.

In the near future I'll make the T2 software package available to subscribers only for a modest one time fee.

You will be able to build your own portfolio of 1 to 11 ETFs and then set the momentum rankings to focus on the top # of ETFs of your choosing. The program has an end of day data feed built in.

Alerts will not be included in the program as those are calculated on TradeStation and imported into the Mosaic platform within a different time frame.

We'll flush out more details on T2 later in the week as the final version gets set to go. I'll also post a few examples of what you can do with this platform to create a blend of portfolios to further insulate your risk.

Friday, October 26, 2012

T 3 Update ..10.26.12

We're basically in a holding pattern at this point waiting for ?. Apple was the big unknown until last night and with that bullet apparently dodged the election appears to be the next impending market catalyst, although the effect is likely to be on select sectors only....such as health care and financials.

Based on the today's early gains in both bonds and equities it will be interesting to see how the momentum rankings unfold for Saturday's update, which will include the new T2 model.

There are no new alerts this morning and ...being Friday... the closing bais is to the downside for equities.

The TLT/XLF pair trade is currently in cash with no new signal this morning.

Based on the today's early gains in both bonds and equities it will be interesting to see how the momentum rankings unfold for Saturday's update, which will include the new T2 model.

There are no new alerts this morning and ...being Friday... the closing bais is to the downside for equities.

The TLT/XLF pair trade is currently in cash with no new signal this morning.

Thursday, October 25, 2012

T 3 Update.. 10.25.12

T3 is managing to keep pace with the SPY drawdown, but it's failure to shine a little better is a cause for ongoing ways to increase net returns. As daily volatility increases the momentum algorithm may have to be speeded up to reflect this reflect this volatility and prevent the whipsaws that will otherwise negatively impact our equity curve.

I mentioned this the other day but note the break of the SPY TrendX in the right hand panel (this is running in real time). Today's dramatic reversal of the NYAD from an opening value of 6.35 to the current level of .98 is a classic "pop and drop" gap failure...typically with bearish implications.

Given the rising instability in the markets I'm following the lead of the Mosaic RM models and adopting a 75% cash position with the Situations until structural alignments in the markets (equities vs. bonds) regain a balance. This means closing the my Situations position from 10.12.12 (TLT, XLU,AGG) this morning at 8:30 AM.

For shorter term situations the current DB, GS2 and MRSI signals are distinctly negative and since our stated policy is not to publish short signals any new Long Alerts have been absent for the past week.

This weekend I hope to present a new T2 model with risk control stops to help avoid the recent drawdowns we've experienced recently. It's still a work in progress, but that's the goal.

I mentioned this the other day but note the break of the SPY TrendX in the right hand panel (this is running in real time). Today's dramatic reversal of the NYAD from an opening value of 6.35 to the current level of .98 is a classic "pop and drop" gap failure...typically with bearish implications.

Given the rising instability in the markets I'm following the lead of the Mosaic RM models and adopting a 75% cash position with the Situations until structural alignments in the markets (equities vs. bonds) regain a balance. This means closing the my Situations position from 10.12.12 (TLT, XLU,AGG) this morning at 8:30 AM.

For shorter term situations the current DB, GS2 and MRSI signals are distinctly negative and since our stated policy is not to publish short signals any new Long Alerts have been absent for the past week.

This weekend I hope to present a new T2 model with risk control stops to help avoid the recent drawdowns we've experienced recently. It's still a work in progress, but that's the goal.

Wednesday, October 24, 2012

TAQK and LM Updates...10.24/12

As expected, the correction is cutting into our previous gains in both models. The LM model equity line has moved back to mid August levels, while the TAQK model equity line has moved back to mid July levels.

The current winner is the RM version of the LM model, which went to cash on 10.5.12, the same day the TAQK RM version went to cash.

The present momentum rankings are all skewed to bonds and SH (the SPY inverse) as the markets do a little "pop and drop" at today's open. For now cash is looking like a smart position until we see whether this is just a "correction" or the beginning of a major slide...which will experience periodic rallies of hope (and market manipulation) along the way down.

The XLF/TLT pairs trade (both sides) was exited at yesterday's close and we'll look at the results of that trade on Monday when we continue a more thorough study of the pair dynamics. This turned out to be an abbreviated trade, only 4 days, whereas our expected excursion was 5 days but you take what you can get in this game and the exit signal turned out to be precocious in light of today's TLT retreat.

I'm working on a small portfolio of high probability pair trades that I hope to include in future daily Newsletter posts. If the markets do start a slide then these short term boutique type trades are one place to nickel and dime up the equity line with minimal risk exposure.

The current winner is the RM version of the LM model, which went to cash on 10.5.12, the same day the TAQK RM version went to cash.

The present momentum rankings are all skewed to bonds and SH (the SPY inverse) as the markets do a little "pop and drop" at today's open. For now cash is looking like a smart position until we see whether this is just a "correction" or the beginning of a major slide...which will experience periodic rallies of hope (and market manipulation) along the way down.

The XLF/TLT pairs trade (both sides) was exited at yesterday's close and we'll look at the results of that trade on Monday when we continue a more thorough study of the pair dynamics. This turned out to be an abbreviated trade, only 4 days, whereas our expected excursion was 5 days but you take what you can get in this game and the exit signal turned out to be precocious in light of today's TLT retreat.

I'm working on a small portfolio of high probability pair trades that I hope to include in future daily Newsletter posts. If the markets do start a slide then these short term boutique type trades are one place to nickel and dime up the equity line with minimal risk exposure.

Tuesday, October 23, 2012

T 3 Update..10.23.12

This is the view as of Monday's close. Today's early action is bearish and getting more so in early going and bottom fishing is not recommended. From a technical standpoint the NYSE adance/declime line is currently flat at .14 (1.00 is a neutral market...equal sellers and buyers) and reversals from sell offs of this magnitude typically require bearish readings of < .10 before true recovery rallies occur. These selling capitulations only happen on about 1% of trading days but they can get truly ugly as a bottom is fathomed.

Just as an aside,,,,based on my 25 years + sitting in front of the screens I'd say without reservation that the NYSE advance/decline line (typical symbol $NYAD) is the most reliable indicator of market momentum you can monitor and I always have a real time chart of it active....why? because it's one of the few technical market metrics that high frequency traders and order masking algorithms can't distort (at least not too much).

OK...back to T3..

On Saturday I noted my skepticism about the top 3 picks for this week and, as a result, I'm still holding the 10.12.12 lineup, (TLT, XLU, AGG) supported by the Long TLT/XLF pair trade we've profiled over the past week. Nothing says you've got to follow the signals and cash is always an option in my mind, which we will see the results of with tomorrow's update of the fixed allocation TAQK and LM models.

Apple was the catalyst for QQQ's + momentum yesterday...all eyes are on their earnings report on the 25th and the sentiment is distinctly bullish. That being said, if we do run up against prolonged selling in the major markets Apple is going to have a tough road not to follow the herd downward.

As a final dismal observation, note the real time TrendX chart of the SPY in the right panel. It's there for a reason. SPY is now sitting at TrendX support and a break below this level will not bode well for equities and the safety of cash will become much more attractive unless you want to play the short side.

Just as an aside,,,,based on my 25 years + sitting in front of the screens I'd say without reservation that the NYSE advance/decline line (typical symbol $NYAD) is the most reliable indicator of market momentum you can monitor and I always have a real time chart of it active....why? because it's one of the few technical market metrics that high frequency traders and order masking algorithms can't distort (at least not too much).

OK...back to T3..

On Saturday I noted my skepticism about the top 3 picks for this week and, as a result, I'm still holding the 10.12.12 lineup, (TLT, XLU, AGG) supported by the Long TLT/XLF pair trade we've profiled over the past week. Nothing says you've got to follow the signals and cash is always an option in my mind, which we will see the results of with tomorrow's update of the fixed allocation TAQK and LM models.

Apple was the catalyst for QQQ's + momentum yesterday...all eyes are on their earnings report on the 25th and the sentiment is distinctly bullish. That being said, if we do run up against prolonged selling in the major markets Apple is going to have a tough road not to follow the herd downward.

As a final dismal observation, note the real time TrendX chart of the SPY in the right panel. It's there for a reason. SPY is now sitting at TrendX support and a break below this level will not bode well for equities and the safety of cash will become much more attractive unless you want to play the short side.

Monday, October 22, 2012

TLT/ XLF Pair Trade - Part II...10.22.12

In our example from last week and this week we are looking at the same date...10.15.12..so as to clarify that the signals do align with considerable precision. Last Friday morning's signal of a new XLF/TLT position caught the bull break in TLT and ..frankly...ran further than I had expected. Based on the TradeStation Report, the average duration of the TLT side of the trade is 5 days and I'll be looking to exit on or before that time.

It's often said that anyone can enter a trade...it's how you exit that defines you as a trader.

One of my favorite prop shops, Bright Trading....out of Las Vegas, routinely use a 1/3 ATR8 (8 period average trading range) to exit positions with great documented success. Of course Bright only daytrades so that must be considered in any attempt to mimic their safety net..

Next Monday we'll conclude the XLF/TLT setup with a simplified version compliments of ETF Prophet.

If there's sufficient interest I'll post the daily status of the XLF/TLT trades in conjunction with the upcoming revised Situations format, which will be based on a revised T2 model with new money management tactics.

Saturday, October 20, 2012

T 3 Update ..10.20.12

I've posted select portions of the Friday close Worden Report FYI....it highlights the need for caution next week. We had a slew of doozey negatives, Google, IBM. the jobs report, etc. and selling seems the pattern for now.

The RM models found a good time to seek the safety of cash, although cash can't really be classified as a strategy...that's just a risk management/capital preservation tool.

And then there's the T3 Friday close lineup:

I've got to say that this momentum forecast is more than a little suspect in my mind given Friday's widespread selling and I intend to hold off making any adjustments in my T3 account until after Monday's close.

Selling tends to beget selling (recall the 3 day pattern) and although the equity markets are now sitting on tenuous support levels.

QQQ has really broken down in the last week and both AAPL and GOOG could each see another 100 point decline if selling takes holds. That would be reminiscent of Fall 2008....not a happy time.. when the markets cratered almost 50%.

Looking at the daily charts of this week's top 3 confirms that they look robust compared to the rest of the field. Whether or not that momentum will hold remains to be seen.

The GS2 signal to close the Long QQQ Situation trade on 10.17 was a timely call, to say the least.

The RM models found a good time to seek the safety of cash, although cash can't really be classified as a strategy...that's just a risk management/capital preservation tool.

And then there's the T3 Friday close lineup:

I've got to say that this momentum forecast is more than a little suspect in my mind given Friday's widespread selling and I intend to hold off making any adjustments in my T3 account until after Monday's close.

Selling tends to beget selling (recall the 3 day pattern) and although the equity markets are now sitting on tenuous support levels.

QQQ has really broken down in the last week and both AAPL and GOOG could each see another 100 point decline if selling takes holds. That would be reminiscent of Fall 2008....not a happy time.. when the markets cratered almost 50%.

Looking at the daily charts of this week's top 3 confirms that they look robust compared to the rest of the field. Whether or not that momentum will hold remains to be seen.

The GS2 signal to close the Long QQQ Situation trade on 10.17 was a timely call, to say the least.

Friday, October 19, 2012

T 3 Update...10.19.12

No new ALERTS this morning as of 8:00 AM PST, although the XLF/TLT pair trade that we posted on Monday is now Long TLT and Short XLF. Since this pair signal is not part of the Alerts program, it is not noted in today's updates.

TLT has proven to be like a greased pig, sliding from one side of the ranking scale to the other...going from #11 to #1 and back to #11 in 8 days. Currently up .7% for the day, it may still revisit yesterdays lows (119.87) before chugging up, so buyer beware. Technically, TLT is now oversold to August support levels and we should expect some momentum back up to 124.50...although that plan could get detailed quickly.

There's still a lot of bullish expectation for equity appreciation driven by QE3 although the jobs report and less that stellar earnings reports have dampened enthusiasm a bit. Apple has been stumbling lately and Google's 8% loss yesterday didn't provide any encouragement...net effect...QQQ is likely to stay low in the rankings for a while.

The T3 XLU # 2 position has been the big winner this week, offsetting much of the TLT weakness. Our goal is not to get all the picks right, just enough to keep ahead of the equity curve and minimize our risk.

Coming soon...a new iteration of T3.

Tomorrow we'll post the T3 lineup for next week with a new risk control measure.

Monday we'll look at the other side of the XLF/TLT pair trade.

TLT has proven to be like a greased pig, sliding from one side of the ranking scale to the other...going from #11 to #1 and back to #11 in 8 days. Currently up .7% for the day, it may still revisit yesterdays lows (119.87) before chugging up, so buyer beware. Technically, TLT is now oversold to August support levels and we should expect some momentum back up to 124.50...although that plan could get detailed quickly.

There's still a lot of bullish expectation for equity appreciation driven by QE3 although the jobs report and less that stellar earnings reports have dampened enthusiasm a bit. Apple has been stumbling lately and Google's 8% loss yesterday didn't provide any encouragement...net effect...QQQ is likely to stay low in the rankings for a while.

The T3 XLU # 2 position has been the big winner this week, offsetting much of the TLT weakness. Our goal is not to get all the picks right, just enough to keep ahead of the equity curve and minimize our risk.

Coming soon...a new iteration of T3.

Tomorrow we'll post the T3 lineup for next week with a new risk control measure.

Monday we'll look at the other side of the XLF/TLT pair trade.

Thursday, October 18, 2012

T3 Update..10.18.12

Note the EXIT Long QQQ Situations ALERT this morning. Since we entered at 10.11 @ $ 66.71 this trade hasn't been a big money maker, yielding about 1% gain to today's exit signal.

GLD has been the big momentum loser recently and today's selling reinforces that weakness.

XLE has been making a move to the left with only moderate weakness today.

TLT (and AGG) need to pick up the pace soon to avoid a weekly net loss in this week's top 3 picks...so far momentum has been waning but that could change quickly with any whiff of bad news.

GLD has been the big momentum loser recently and today's selling reinforces that weakness.

XLE has been making a move to the left with only moderate weakness today.

TLT (and AGG) need to pick up the pace soon to avoid a weekly net loss in this week's top 3 picks...so far momentum has been waning but that could change quickly with any whiff of bad news.

These ALERTS are provided to you as a means to help track the performance

of the Mosaic investments models only and are in no way intended as a

solicitation to buy or sell any securities which may be mentioned in

these Alerts.

ETF Mosaic makes no warranty as to the reliability of these trading signals, either actual or implied.

Wednesday, October 17, 2012

LM and TAQK Updates...10.17.12

The fixed allocation models are not performing well this week as evidenced by the fact that both RM versions of the models remain in cash. The bond ETFs have reached oversold levels which have typically produced a bounce. The momentum rankings mirror the SITUATIONS rankings to the extent that TLT is holding #1 slot, perhaps a bit of a mystery but the rankings are based on 7 day momentum so we're playing catch up at this point.

QQQ is suffering from the APPLE malaise with similar results in XLK. With the holiday season approaching, the release of the mini and great expectations for consumer spending, the odds are in APPLE's favor going forward unless they stumble with another Foxconn type blooper.

Volume has been very low so far this week as we approach options expiration this Friday.

GLD is once again looking toppy but its participation in the fixed allocation models is relatively small so downside risk to the portfolio is limited. The covered call GLD hedge mentioned in previous posts is my current tactic.

QQQ is suffering from the APPLE malaise with similar results in XLK. With the holiday season approaching, the release of the mini and great expectations for consumer spending, the odds are in APPLE's favor going forward unless they stumble with another Foxconn type blooper.

Volume has been very low so far this week as we approach options expiration this Friday.

GLD is once again looking toppy but its participation in the fixed allocation models is relatively small so downside risk to the portfolio is limited. The covered call GLD hedge mentioned in previous posts is my current tactic.

Tuesday, October 16, 2012

T3 Update..10.16.12

We have tentative EXITs on the current SPY and XLE Longs as of 8:00 am PST. We've seen these signals cancel by the end of the day in past triggers and if that happens an ALERT update will be posted about 12:45 PST.

The SPY, XLE and QQQ Long signals looked pretty far fetched when they fired but as of today's action SPY and QQQ are up about 1% and XLE is up 1.3%.

TLT has so far not proven to be a great pick for Monday's top 3 rotation although it made up ground on Monday but is faltering badly today.

On a performance basis the T3 model is neck and neck with SPY on a 5 and 30 day lookback.

These ALERTS are provided to you as a means to help track the performance

of the Mosaic investments models only and are in no way intended as a

solicitation to buy or sell any securities which may be mentioned in

these Alerts.

ETF Mosaic makes no warranty as to the reliability of these trading signals, either actual or implied.

Monday, October 15, 2012

The TLT / XLF Pair Trade

Regular long time readers are well aware of Project Z, a BZB research project that has extended over several years and which endeavors to capitalize on the relative change in variance between pairs of stocks and ETFs that have a positive correlation. Clicking the link will show a list of approximately 40 Project Z related posts.

Without getting too technical... Project Z examines the log ratio of each side of a pair's standard deviation from a norm...with the expectancy that underlying forces will tend to drive price in each stock or ETF return to the norm. The actual algorithm that drives Project Z is rather complex so I won't delve into its various nuances. However, the TradeStation 2000i performance reports of both sides of the TLT/XLF pair trade (in Excel format) are available to readers upon request (15 pages each).

Why am I even talking about this? Because pair trading reflects the true essence of market neutral trading and investing and...it may surprise you to learn... some of the biggest proprietary trading shops make most of their money with this strategy.

I'm going to devote today and next Monday to explore the TLT / XLF setup. There's a lot of information to examine within this trade and its important to understand the dynamics behind why this pair is unique.

One thing that's different about this version is that it uses the TrendX price in lieu of the daily close. The TrendX is simply a floating pivot value (High+Low+Close/3) that typically reveals an intrinsic momentum factor not apparent when simply looking at raw closing prices.

To get a full picture of ways to manage a pairs trade we need to examine each side of the trade independent of the other. This week we're looking at the XLF side because there's nothing that says you have to trade both sides of the pair simultaneously/ Let's just find where the sweet spot of the pair trade resides and try and farm those easy dollars.

The returns for the XLF side are pretty impressive given that XLF is notoriously difficult to forecast with most traditional technical indicators. There are an equal number of long and short trades and both sides of the trade yield the 92.86% profitability. The maximum consecutive loser trades at 1 makes this an attractive setup in my book.

These returns are based on a 16 month lookback and the design parameters are only marginally optimized. For backtesting and performance updating I use a floating 16 month test period, updated monthly. This procedure helps to identify when a system is losing its efficacy and either needs rethinking or discard. The TLT/XLF trade has seen periods of stagnancy during the past 16 months but the seldom falls below the equity line.

Next Monday we'll look at the TLT side of the trade.

Without getting too technical... Project Z examines the log ratio of each side of a pair's standard deviation from a norm...with the expectancy that underlying forces will tend to drive price in each stock or ETF return to the norm. The actual algorithm that drives Project Z is rather complex so I won't delve into its various nuances. However, the TradeStation 2000i performance reports of both sides of the TLT/XLF pair trade (in Excel format) are available to readers upon request (15 pages each).

Why am I even talking about this? Because pair trading reflects the true essence of market neutral trading and investing and...it may surprise you to learn... some of the biggest proprietary trading shops make most of their money with this strategy.

I'm going to devote today and next Monday to explore the TLT / XLF setup. There's a lot of information to examine within this trade and its important to understand the dynamics behind why this pair is unique.

One thing that's different about this version is that it uses the TrendX price in lieu of the daily close. The TrendX is simply a floating pivot value (High+Low+Close/3) that typically reveals an intrinsic momentum factor not apparent when simply looking at raw closing prices.

To get a full picture of ways to manage a pairs trade we need to examine each side of the trade independent of the other. This week we're looking at the XLF side because there's nothing that says you have to trade both sides of the pair simultaneously/ Let's just find where the sweet spot of the pair trade resides and try and farm those easy dollars.

The returns for the XLF side are pretty impressive given that XLF is notoriously difficult to forecast with most traditional technical indicators. There are an equal number of long and short trades and both sides of the trade yield the 92.86% profitability. The maximum consecutive loser trades at 1 makes this an attractive setup in my book.

These returns are based on a 16 month lookback and the design parameters are only marginally optimized. For backtesting and performance updating I use a floating 16 month test period, updated monthly. This procedure helps to identify when a system is losing its efficacy and either needs rethinking or discard. The TLT/XLF trade has seen periods of stagnancy during the past 16 months but the seldom falls below the equity line.

Next Monday we'll look at the TLT side of the trade.

Saturday, October 13, 2012

T3 Update.. 10.13.12

Above are some excerpts from Friday evenings Worden Bros report TC2000). It helps to put the week's action in perspective and affirms my cautionary outlook going forward.

And here's the T 3 update for Monday's rebalance:

Note that we have a whole new top 3 from last Friday's close with a heavy empahsis on bonds and the safety of XLU (utilities). This skew is emphasized by the #4 slot, which is also bonds. Equities and gold are clearly showing selling pressure and the DB long signals in SPY, XLE and QQQ are highly suspect at this point and likely driven by the Thursday early market pop based on employment figures (which did not hold into the close).

TLT has now risen to #1 slot, completing a taverse from #11 to #1 in just 4 days...about as fast as it gets. As mentioned in yesterday's post, TLT still has open Long signals with the MRSI and GS2 systems so the DB exit signal was not a happy situation although the 10.5 - 10.11 trade did book $.74 or about .6%... the open TLT position is ahead about $ 2.63 or 2.2%.

And here's the T 3 update for Monday's rebalance:

Note that we have a whole new top 3 from last Friday's close with a heavy empahsis on bonds and the safety of XLU (utilities). This skew is emphasized by the #4 slot, which is also bonds. Equities and gold are clearly showing selling pressure and the DB long signals in SPY, XLE and QQQ are highly suspect at this point and likely driven by the Thursday early market pop based on employment figures (which did not hold into the close).

TLT has now risen to #1 slot, completing a taverse from #11 to #1 in just 4 days...about as fast as it gets. As mentioned in yesterday's post, TLT still has open Long signals with the MRSI and GS2 systems so the DB exit signal was not a happy situation although the 10.5 - 10.11 trade did book $.74 or about .6%... the open TLT position is ahead about $ 2.63 or 2.2%.

Friday, October 12, 2012

T3 Update..10.12.12

TLT continues to play a bait and switch game with our signals. With a Long Exit firing on the Delta Bands yesterday, the other TLT signals are still strongly positive.

Based on the TLT signals divergence I hedged my bets somewhat and closed one third of my TLT short term trading position at yesterday's close.

As of yesterday's close the top 3 components have kicked XLP and added TLT. Tomorrow we'll post the new top 3 lineup for next week.. Mondays have had a negative bias lately, meaning sell offs are likely before the 'Tuesday turn-around", a popular misnomer among traders. If we don't see some buying momentum kick in by Tuesday then the outlook for equities gets a lot murkier. This is mid month and, as we have examined in earlier posts, this is typically a period of reduced volatility although option expiration is next Friday, which tends to pump volatility....(and you thought trading was easy). We're still mid earnings season and those reports and guidance are adding another ingredient to the volatility soup so caution is the watchword for short term traders.

Monday we'll look at the TLT / XLF pair trade, a surprisingly reliable setup when entered with guidance from the TrendX indicator.

Based on the TLT signals divergence I hedged my bets somewhat and closed one third of my TLT short term trading position at yesterday's close.

As of yesterday's close the top 3 components have kicked XLP and added TLT. Tomorrow we'll post the new top 3 lineup for next week.. Mondays have had a negative bias lately, meaning sell offs are likely before the 'Tuesday turn-around", a popular misnomer among traders. If we don't see some buying momentum kick in by Tuesday then the outlook for equities gets a lot murkier. This is mid month and, as we have examined in earlier posts, this is typically a period of reduced volatility although option expiration is next Friday, which tends to pump volatility....(and you thought trading was easy). We're still mid earnings season and those reports and guidance are adding another ingredient to the volatility soup so caution is the watchword for short term traders.

Monday we'll look at the TLT / XLF pair trade, a surprisingly reliable setup when entered with guidance from the TrendX indicator.

Thursday, October 11, 2012

T3 Updates ...10.11.12

A number of Alerts were set off off this morning at 8:00 am PST..all on the DB (delta band) signal which, you will recall, is based on the relative % change of an ETF versus it's "normal" range of change. These signals tend to be the most sensitive of our triggers..DB. MRSI and GS2..and it would be more comforting for me to have a second confirmation signal before actually betting on the the DB Alerts.

TLT still has active MRSI and GS2 Long signals so closing the position based on the DB signal is not a clear choice.

Traders and investors that have been in this game for a while know that what we may be seeing is a little relief rally before a bigger drop in the equities markets. It's happened before..big time.. and those that lived through the late 2008-early 2009 50% decline in the market know this pattern only too well.

Statistically speaking, one of the most reliable short term patterns for swing traders has been 3 wide range days up (or down), a consolidation or marginal rally for a day or two and then a surge forward in the direction of the previous trend. Candlestick traders refer to this market behavior as "3 black crows" and we definitely don't want to be on the wrong side of equity/bond fulcrum if this is what is developing now.

As mentioned in previous posts, this is a time for extreme caution in my opinion. The 2 RM Mosaic models switch to cash has been a good tell for impending market declines in the past and I'm paying close attention to how that active safety net pans out.

TLT still has active MRSI and GS2 Long signals so closing the position based on the DB signal is not a clear choice.

Traders and investors that have been in this game for a while know that what we may be seeing is a little relief rally before a bigger drop in the equities markets. It's happened before..big time.. and those that lived through the late 2008-early 2009 50% decline in the market know this pattern only too well.

Statistically speaking, one of the most reliable short term patterns for swing traders has been 3 wide range days up (or down), a consolidation or marginal rally for a day or two and then a surge forward in the direction of the previous trend. Candlestick traders refer to this market behavior as "3 black crows" and we definitely don't want to be on the wrong side of equity/bond fulcrum if this is what is developing now.

As mentioned in previous posts, this is a time for extreme caution in my opinion. The 2 RM Mosaic models switch to cash has been a good tell for impending market declines in the past and I'm paying close attention to how that active safety net pans out.

These ALERTS are provided to you as a means to help track the performance

of the Mosaic investments models only and are in no way intended as a

solicitation to buy or sell any securities which may be mentioned in

these Alerts.

ETF Mosaic makes no warranty as to the reliability of these trading signals, either actual or implied.

Wednesday, October 10, 2012

LM and TAQK Updates.. 10.10.12

Here's 3 cheery articles that may have you wondering about the safety of your investments.

Mark Hulbert, a pretty respected market technician, also has an interesting historical lookback while CNBC notes how algo trading is still causing havoc in the markets.

And, here are the updates for the fixed portfolio models TAQK and LM as of 7:30 am PST today........

Both models are under short term pressure, largely due to the contrarian behavior of the bond sector, which stubbornly refuses to gain strength even in the face of declining equities.

Yesterday's swoon pushed the RM (Risk Managed) versions of both TAQK and LM into cash so we'll have a chance to see out the performance of the RM versus the base models plays out in real time.

In early Wednesday market action a rally is attempting to gain traction with GLD and QQQ (largely driven by APPL) showing positive gains.

Mark Hulbert, a pretty respected market technician, also has an interesting historical lookback while CNBC notes how algo trading is still causing havoc in the markets.

And, here are the updates for the fixed portfolio models TAQK and LM as of 7:30 am PST today........

Both models are under short term pressure, largely due to the contrarian behavior of the bond sector, which stubbornly refuses to gain strength even in the face of declining equities.

Yesterday's swoon pushed the RM (Risk Managed) versions of both TAQK and LM into cash so we'll have a chance to see out the performance of the RM versus the base models plays out in real time.

In early Wednesday market action a rally is attempting to gain traction with GLD and QQQ (largely driven by APPL) showing positive gains.

Tuesday, October 9, 2012

RM version of TAQK and LM Now in CASH

As of the end of day today the RM version of TAQK and LM have both violated their short term retracement thresholds, have closed all positions and are now in cash.

T 3 Update..10.9.12

This thing with TLT is getting to be confusing although Friday's signal to sell TLT out of the top 3 on Monday's open + a few minutes turned out to be a good one. On the other hand, we still have a Long signal on both the MRSI and GS2 systems and that position is actually a about $.35 to the good at post time.

XLV is looking tired after a long uphill run since June although the technicals are still positive as it continues to book new all time highs.

XLU has now moved into the top 3 slot, which typically heralds a decline in equities as money shifts to the safety of the utilities sector which, unfortunately, has few opportunities for option players since the premiums are so thin.

As of yesterday's close GLD has moved to #4 slot, continuing it's slow decline in momentum. It too has had a stellar run and is due for a rest.

In the big picture T3 continues to excel the S&P although the last couple days have been rocky.

Momentum is likely to be earnings driven for the next couple weeks as well as forward guidance provided by those reporting. This is typically a period of pumped volatility as the uncertainty factor becomes more muddled as traders and money managers hedge their positions.

As a trader. my strategy during earnings season is usually to stand back or trade small.

Past experience has shown me that this is not a time to get risky with capital.

XLV is looking tired after a long uphill run since June although the technicals are still positive as it continues to book new all time highs.

XLU has now moved into the top 3 slot, which typically heralds a decline in equities as money shifts to the safety of the utilities sector which, unfortunately, has few opportunities for option players since the premiums are so thin.

As of yesterday's close GLD has moved to #4 slot, continuing it's slow decline in momentum. It too has had a stellar run and is due for a rest.

In the big picture T3 continues to excel the S&P although the last couple days have been rocky.

Momentum is likely to be earnings driven for the next couple weeks as well as forward guidance provided by those reporting. This is typically a period of pumped volatility as the uncertainty factor becomes more muddled as traders and money managers hedge their positions.

As a trader. my strategy during earnings season is usually to stand back or trade small.

Past experience has shown me that this is not a time to get risky with capital.

Monday, October 8, 2012

Another TLT System...10.8.12

This is a continuation of our study of non-correlated technical studies that can be used to forecast momentum in TLT. This is the Lazy Man TradeStation system for TLT. Its a spin off of the 3 Finger Lead system that I have posted on extensively.

A simple trend follower, the Lazy Man looks at the momentum in SPY, QQQ and XIV ( VIX inverse ETF) and when those 3 ETFs reach threshold overbought levels the system buys TLT. The same argument is applied to the short side for TLT....threshold oversold on the SPY, QQQ and XIV triggers a Sell on TLT.

The dotted white lines tracking price action are the PSAR parabolics, a confirming momentum indicator that can be found on virtually every trading platform.

A simple trend follower, the Lazy Man looks at the momentum in SPY, QQQ and XIV ( VIX inverse ETF) and when those 3 ETFs reach threshold overbought levels the system buys TLT. The same argument is applied to the short side for TLT....threshold oversold on the SPY, QQQ and XIV triggers a Sell on TLT.

The dotted white lines tracking price action are the PSAR parabolics, a confirming momentum indicator that can be found on virtually every trading platform.

Saturday, October 6, 2012

T3 & T2 Updates..10.6.12

Per reader requests I've added the performance metrics for the T2 (top 2) model for the Saturday posts.

The TLT Alert that fired Friday morning looked more and more suspicious as Friday progressed, but that's the way they fired. All things being equal TLT should have closed in the green given the swoon in equities but more than a few fortunes have been lost using the "should have" mentality, so we'll just have to wait this signal out. On the 5 day lookback TLT in slot #3 has caused the most damage for the T3 model and we're looking to refine the algorithm that drives the momentum rankings to improve its forecasting ability.

For Monday, last week's T3 top 3 ranked have kicked TLT and XLP has been added for this week.

The T2 model, which focuses on the top 2 momentum ETFs, is turning out to be a better risk model in all time frames within our 2 year lookback period.

Per our caution earlier this week GLD is looking tired and due for a pullback. It's move on Friday to #3 ranking may be a forewarning of further weakness to come.

Friday, October 5, 2012

T 3 Update ...10.5.12

Note two updates per Friday's prices as of 7:30 AM PST.

The 2 changes to the matrix appear to be contradictory so some caution is advised at this point.

First, XLP has migrated to the #3 ranking, following a steady migration to the left of the matrix.

Second, Long signals for TLT triggered this morning in the DB and GS2 systems.

If the equities markets do take today's job's report as a catalyst to spring forward, then the TLT Long is not going to fare well. On the other hand, if ongoing concerns about the financial cliff and poor earnings with lowered guidance drive equities lower than the TLT will turn out with a much happier result.

From a strictly technical standpoint TLT is now sitting exactly where it was in mid August before it rallied to 127.5 in the last 2 weeks of the month. The difference is that TLT displayed a distinct bottming pattern at that time whereas the current position may be prone to further decay before beginning a recovery.

The ranking alignment for Monday will be posted Saturday, as usual.

The 2 changes to the matrix appear to be contradictory so some caution is advised at this point.

First, XLP has migrated to the #3 ranking, following a steady migration to the left of the matrix.

Second, Long signals for TLT triggered this morning in the DB and GS2 systems.

If the equities markets do take today's job's report as a catalyst to spring forward, then the TLT Long is not going to fare well. On the other hand, if ongoing concerns about the financial cliff and poor earnings with lowered guidance drive equities lower than the TLT will turn out with a much happier result.

From a strictly technical standpoint TLT is now sitting exactly where it was in mid August before it rallied to 127.5 in the last 2 weeks of the month. The difference is that TLT displayed a distinct bottming pattern at that time whereas the current position may be prone to further decay before beginning a recovery.

The ranking alignment for Monday will be posted Saturday, as usual.

Periodic Alerts are posted as a means to help track the performance of the ETF Mosaic

investment models only and are in no way intended as a solicitation to

buy or sell any securities which may be mentioned in these Alerts.

ETF Mosaic makes no warranty as to the reliability of these trading signals, either actual or implied.

Thursday, October 4, 2012

T3 Update..10.4.12

A bit surprising but we have no new ALERTS as of 8:00 am PST today. As noted yesterday we did see a minor realignment of the top 3 rankings and TLT is sticking in there, holding the equity line down in the face of GLD and XLV's continued strength. We may see some shift Friday, which will then dictate Monday's lineup.

Despite the apparent strength in equities GLD and the gold miners (GDX) are holding strong. Once ( and if) that momentum leader starts to falter the bond funds are likely move quickly to the high rankings.

Of all the systems and indicators that ETF Mosaic follows those focused on TLT are some of the most robust and reliable. Monday's research will examine one such momentum following TLT system based on the BZB's tried and true 3 Finger Lead system developed several years ago. If you go to the site and run 3 Finger Lead in the Search engine you will notice upwards of 20 posts on the 3FL and some variations.

Despite the apparent strength in equities GLD and the gold miners (GDX) are holding strong. Once ( and if) that momentum leader starts to falter the bond funds are likely move quickly to the high rankings.

Of all the systems and indicators that ETF Mosaic follows those focused on TLT are some of the most robust and reliable. Monday's research will examine one such momentum following TLT system based on the BZB's tried and true 3 Finger Lead system developed several years ago. If you go to the site and run 3 Finger Lead in the Search engine you will notice upwards of 20 posts on the 3FL and some variations.

Wednesday, October 3, 2012

TAQK and LM Updates..10.3.12

GLD is the continuing money maker for the LM model. The momentum rankings are clearly showing strength in bonds although we have yet to see that reflected in the equity curve. LM is holding its own with the SPY on a daily basis but is lagging at the 30 day level.

The TAQK model is currently under performing the SPY in both 5 and 30 day returns, although that scenario could change quickly if equities turn down.

As of 8:00 AM PST there are no new Long Alerts on the SITUATIONS matrix and although there is no change in the the top 3 ranked ETFs, XLV has now moved to slot #1 and GLD has moved to slot # 2.

The TAQK model is currently under performing the SPY in both 5 and 30 day returns, although that scenario could change quickly if equities turn down.

As of 8:00 AM PST there are no new Long Alerts on the SITUATIONS matrix and although there is no change in the the top 3 ranked ETFs, XLV has now moved to slot #1 and GLD has moved to slot # 2.

Tuesday, October 2, 2012

T3 Update... 10.2.12

Keep in mind when you're looking at T3 that the other versions such as T2 offer different levels of risk exposure. We focus on T3 as it tends to provide a more balanced view of the equity/bond risk spread and helps to see the "noise" in between the inevitable swings in that balance.

Following yesterday's post we've added the GS2 to the signal portfolio. For the time being the GS2 signal will be limited to SPY, QQQ, TLT, XLE, IWM and GLD. The other portfolio components are less cyclical in their behavior and do not produce acceptable risk/reward opportunities (in my opinion) using the GS2.

Experienced technical traders and investors know that the last day and first day of the month are typically bullish as mutual fund money gets pumped into the markets. That cusp has now pasted and we're ready to see how October unfolds.

GLD and XLV continue to hold strong although the bond components..TLT, IEF and AGG... are slowly migrating to the left of the matrix and stronger ranking so the current balance in the top3 looks like a safe bet.

Following yesterday's post we've added the GS2 to the signal portfolio. For the time being the GS2 signal will be limited to SPY, QQQ, TLT, XLE, IWM and GLD. The other portfolio components are less cyclical in their behavior and do not produce acceptable risk/reward opportunities (in my opinion) using the GS2.

Experienced technical traders and investors know that the last day and first day of the month are typically bullish as mutual fund money gets pumped into the markets. That cusp has now pasted and we're ready to see how October unfolds.

GLD and XLV continue to hold strong although the bond components..TLT, IEF and AGG... are slowly migrating to the left of the matrix and stronger ranking so the current balance in the top3 looks like a safe bet.

Monday, October 1, 2012

GS2 Added to the SITUATiONS SIgnals..10.1.12

You can view the actual code (TradeStation 2000i) and original posting for the Grand Slam 2 here.

Note that I published the system back in 2008 and, somewhat amazingly those original settings are still producing respectable returns. The current settings are tweaked a bit but the basic nut is the same.

If you would like to receive (via email) the full performance report of the GS2 system for SPY and TLT in Excel format send me an email at ETFMosaic@aol.com. Each report is 15 pages and covers most of the commonly asked questions about system robustness. One thing I like about the system is the equal number of long and short trades...this tends to indicate a robustness in variable market conditions and not just a system for Bull or Bear markets.

As with the MRSI and DB systems SITUATIONS will only post Long signals for the GS2.

Note that I published the system back in 2008 and, somewhat amazingly those original settings are still producing respectable returns. The current settings are tweaked a bit but the basic nut is the same.

If you would like to receive (via email) the full performance report of the GS2 system for SPY and TLT in Excel format send me an email at ETFMosaic@aol.com. Each report is 15 pages and covers most of the commonly asked questions about system robustness. One thing I like about the system is the equal number of long and short trades...this tends to indicate a robustness in variable market conditions and not just a system for Bull or Bear markets.

As with the MRSI and DB systems SITUATIONS will only post Long signals for the GS2.

Subscribe to:

Posts (Atom)