Yesterday's post on the T /T delta neutral model was timely as we saw a nice gain today with a picture perfect example of the delta neutral model in action. We handily made up for our little stop loss on Wednesday and gained a bit of traction today to boot. For now the technical signals all look favorable for further gains but the beauty of the DN model is that even if things reverse we will most likely still see capital appreciation. Friday's have been bullish lately (with a possible modest selloff into the close) so a trailing stop is advisable.

Thursday, July 11, 2019

Wednesday, July 10, 2019

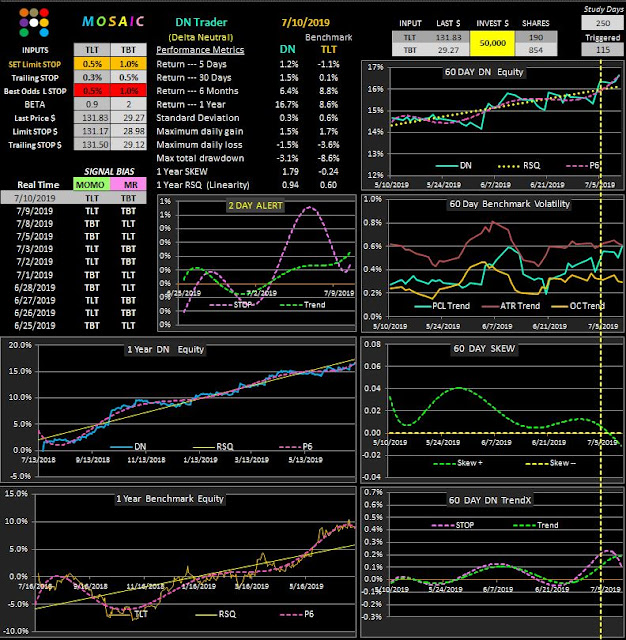

The Low Risk TLT Delta Neutral model Update.....07.10.2019

Our caution about the FED day conflict with the long VXX signal turned out to be well founded and we were able to close our small position at the indicated limit stop, saving us a potential $.30 loss beyond our stop. Below is an update of the TLT / TBT 20 year Treasuries model. It doesn't scream returns like VXX and QLD but it plugs along in a nice, predictable and consistent pattern with great linearity and very low risk. As we mentioned before the TBT (TLT inverse) actually is an ultra short ETF meaning its beta is 2 so we have to adjust our limit stop accordingly.

Note thaat the model only triggered 115 out of 259 trading days...another nice risk feature.

Note thaat the model only triggered 115 out of 259 trading days...another nice risk feature.

Tuesday, July 9, 2019

Scalping the VXX... 2 Strategies.......07.09.2019

Following this weekend's post here are 2 similar approaches to trading the VXX volatility ETN.

In the first case we use the PVOL momentum model which combines momentum as measured by price action of the pivot combined with a confirmation signal that the ATR is in a descending pattern.

The second model TFATR1 ignores price action and focuses solely on the behavior of the ATR metrics. As might be expected the combo PVOL model requiring a confirmation signal has a lower net drawdown and a lower net return over our 1 year lookback. The less discriminate TFATR1 model kicks out a better return at the cost of increased risk exposure. TFATR1 also trades 20% more frequently and has a better win/loss ratio than the combo model. That's the tradeoff.

Both models are long VXX for tomorrow....but keep in mind Wednesday is FED day and the historical odds favor a negative VXX behavior 72% of the time so longs should be ready to bail if things turn ugly. Observe the limit stop.

In the first case we use the PVOL momentum model which combines momentum as measured by price action of the pivot combined with a confirmation signal that the ATR is in a descending pattern.

The second model TFATR1 ignores price action and focuses solely on the behavior of the ATR metrics. As might be expected the combo PVOL model requiring a confirmation signal has a lower net drawdown and a lower net return over our 1 year lookback. The less discriminate TFATR1 model kicks out a better return at the cost of increased risk exposure. TFATR1 also trades 20% more frequently and has a better win/loss ratio than the combo model. That's the tradeoff.

Both models are long VXX for tomorrow....but keep in mind Wednesday is FED day and the historical odds favor a negative VXX behavior 72% of the time so longs should be ready to bail if things turn ugly. Observe the limit stop.

Sunday, July 7, 2019

Model Updates with Various Strategies......07.07.2019

Going forward into the second half of the year the general consensus is that things may get a bit rough as earnings expectations and guidance are down, auto sale are terrible, home sales are stagnant and the political environment is explosive, to say the least. Here then are some examples of how our diversified risk managed portfolio has fared so far.

First, the benchmark default delta neutral model has lagged the last six months.

While the momentum based VIXEN (based solely on volatility, not price) has done well with a rather amazing 95% linearity and a much happier drawdown than the benchmark buy and hold QLD..

Then there's our old friend VXX, the VIX proxy ETN that has come back like a zombie from it former depise and replacement by VXXB only to be reincarnated again as VXX. I still consider this the greatest trade of all time when I advised shorting this guaranteed loser when it was at 900.

We're using the VIXEN momentum model with this toad and the results are actually quite good.

Finally, my hands down favorite low risk no brainer easy money trade. The risk adjusted SPY proxy ETF SPLV using our MR3 (3 day pullback) mean reversion model has a drawdown and win/loss ratio that should make this little nugget of trading gold part of every portfolio...IMHO.

First, the benchmark default delta neutral model has lagged the last six months.

While the momentum based VIXEN (based solely on volatility, not price) has done well with a rather amazing 95% linearity and a much happier drawdown than the benchmark buy and hold QLD..

Then there's our old friend VXX, the VIX proxy ETN that has come back like a zombie from it former depise and replacement by VXXB only to be reincarnated again as VXX. I still consider this the greatest trade of all time when I advised shorting this guaranteed loser when it was at 900.

We're using the VIXEN momentum model with this toad and the results are actually quite good.

Finally, my hands down favorite low risk no brainer easy money trade. The risk adjusted SPY proxy ETF SPLV using our MR3 (3 day pullback) mean reversion model has a drawdown and win/loss ratio that should make this little nugget of trading gold part of every portfolio...IMHO.

Subscribe to:

Posts (Atom)