Mosaic M3 subscribers will be receiving a little survey this weekend in an effort to better serve your investment goals and objectives. Within the survey there will be a chance to voice your preference for the models that will be posted henceforth. In the past we've tried to provide a spectrum of risk models using volatility and price. Based on recent performance most are aware that the markets are in the middle of a paradigm shift in volatility that has adversely affected M3 returns.

What shall we do going forward in 2015?

I will provide several models for your consideration this weekend.

Creating daily subscription posts does require more than a few minutes and one of my goals is to keep subscription prices down so I'm going to continue to post 2 models each day...which 2 is the question. Much of my trading day is spent coaching my daytrading students and simply trading my own managed accounts. My intent is to get back to the initial Mosaic goals of low drawdown and low turnover. The M3 model has not met my expectations recently as it has been characterized by high turnover and lack of traction. Not to make excuses but it should have been clear from my many posts that M3 is a trend following model and the bottom line is that we haven't seen a tradable trend for several months. This gets me back to the question above: what shall we do going forward in 2015?

When you receive the survey please take a few minutes to look it over and send me your preference and any comments.

User feedback is always appreciated to help keep my efforts in sync with your goals.

Here then is the REALLY simple Lazy Man. (no short side.....only vested SPY or cash)

Thursday, January 29, 2015

Wednesday, January 28, 2015

SIGMA - Part 2....01.28.15

Watching the markets' recent volatility can be more than a little stressful unless you're in cash and since we're always in search of a better trading edge here's the latest on the SIGMA model revealed to readers Monday.

The thinking is that the major bullish indices SPY,QQQ and IWM are always in horse race type of momentum flux, while XLU acts as a neutral risk hedge and TLT provides one of the most widely traded bond hedges.

XLV is added to the mix as one of the most stable (linear) positive momentum issues in the past 5 years, although it may be surprising to learn that it is the rotational leader only 10% of the time.

In typical fashion we looked at a simple returns model with only the AUTO-STOP feature turned on and then examined the returns using the same .7% limit stop integral to the Mosaic Lazy Man model.

Now the same ranking model but with a .7% limit stop>>>>>>>

The limit stop improves the RSQ considerably, lowers the standard deviation and increases net gains across the time frames.This is a simple model to execute and the results are clearly better than a simple buy and hold SPY approach.

The thinking is that the major bullish indices SPY,QQQ and IWM are always in horse race type of momentum flux, while XLU acts as a neutral risk hedge and TLT provides one of the most widely traded bond hedges.

XLV is added to the mix as one of the most stable (linear) positive momentum issues in the past 5 years, although it may be surprising to learn that it is the rotational leader only 10% of the time.

In typical fashion we looked at a simple returns model with only the AUTO-STOP feature turned on and then examined the returns using the same .7% limit stop integral to the Mosaic Lazy Man model.

Now the same ranking model but with a .7% limit stop>>>>>>>

The limit stop improves the RSQ considerably, lowers the standard deviation and increases net gains across the time frames.This is a simple model to execute and the results are clearly better than a simple buy and hold SPY approach.

Tuesday, January 27, 2015

A True Trap Door...01.27.15

SPY opened at the S3 pivot, a situation we encounter on less than 1% of trading days, and the situation deteriorated throughout the day on supernormal volume. We were able to close our SPY positions at the limit stop, which turned out to be only a few pennies from the high of the day.

The closing BUZZ looks pretty grim although we've seen dramatic reversals before so nothing's off the table. We're coming up on the end of the month also, which is bullish over 70% of the time.

The closing BUZZ looks pretty grim although we've seen dramatic reversals before so nothing's off the table. We're coming up on the end of the month also, which is bullish over 70% of the time.

Monday, January 26, 2015

SIGMA...Looking for Index Leaders...01.26.15

Here's a look at SIGMA, a version of M3 that looks at SPY, QQQ, IWM, DIA, XLU, and TLT on a rotational basis. We all know that the major indices have their own unique ebb and flow patterns and this model seeks to capitalize on those vagaries. Turns out there is an advantage in trading the top momentum index using a simple .7% daily money management stop. I'm always looking for simple models to help gain an edge and this one looks like it might be useful if only for sheer ease of use,

The other attractive feature of this model is the containment of drawdown (50% of an unfiltered SPY)

The other attractive feature of this model is the containment of drawdown (50% of an unfiltered SPY)

Saturday, January 24, 2015

One Step Back...01.23.15

Did I mention that the markets are fickle? Just when you think we've got some momentum going things start to go sideways. Indicators are still positive for Monday and earnings are on deck for MSFT, APPL and a few other big names that will determine the near term course of QQQ.

Just for entertainment here the new Ponzo 6 month risk profiles for QQQ and IWM.

The Ponzo models have done a great job of alerting us to impending volatility periods so fat this year, and using these benchmarks it would appear that IWM is a more attractive risk bet than QQQ but, as always, things can change dramatically given the right catalysts.

Just for entertainment here the new Ponzo 6 month risk profiles for QQQ and IWM.

The Ponzo models have done a great job of alerting us to impending volatility periods so fat this year, and using these benchmarks it would appear that IWM is a more attractive risk bet than QQQ but, as always, things can change dramatically given the right catalysts.

Thursday, January 22, 2015

The Bull Roars....01.22.15

After a little stumble out of the gate this morning the markets were buoyed by an expanded ECB QE program and climbed steadily throughout the day thereafter.

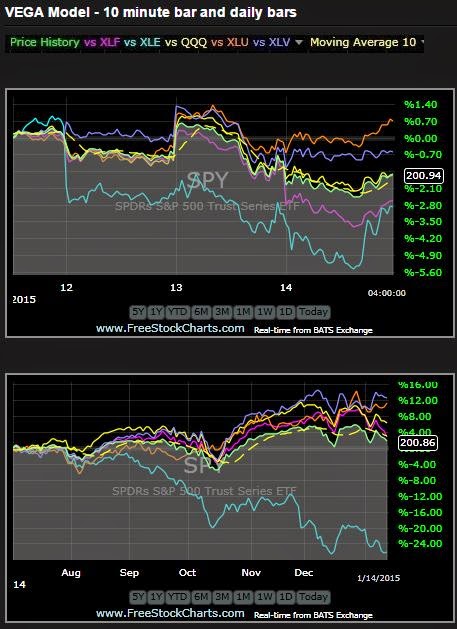

Bull market runs are typically led by QQQ and XLF and both issues were the top leaders in our market benchmark VEGA model (below),

In addition, the XIV (inverse VIX ETN) is finally coming back into sync with its expected beta performance realtive to SPY and this should be regarded as another positive for the bull case.

Per the SPY TrendX chart, right side panel, SPY still has good prospects for more gains before hitting upper resistance levels....unless some bad news derails the run.

Bull market runs are typically led by QQQ and XLF and both issues were the top leaders in our market benchmark VEGA model (below),

In addition, the XIV (inverse VIX ETN) is finally coming back into sync with its expected beta performance realtive to SPY and this should be regarded as another positive for the bull case.

Per the SPY TrendX chart, right side panel, SPY still has good prospects for more gains before hitting upper resistance levels....unless some bad news derails the run.

Wednesday, January 21, 2015

Ponzo Update....01.21.15

Here's a look at the updated Ponzo risk chart for SPY for the next 6 months. Since our last update the odds have consolidated even more towards a neutral stance although the short term odds are slightly bearish, Just something to keep in mind going forward,

Tuesday, January 20, 2015

On a Bullish Cusp....01.20.15

There was modest positive momentum and the volatility divergence between XIV and VXX is starting to reconcile, suggesting the beginnings of a tradable trend in the near future (maybe tomorrow). XLE continues to muddy the waters, but stepping back for a longer term view the SPY TrrendX is now in a potential bounce mode back up to resistance ....see right side panel.

Sunday, January 18, 2015

OP EX Volatility....01.16.15

Another wild ride Friday as the markets reversed historical patterns for weak Friday closes, especially on Op EX Friday's. The rebound was widespread and the advance/decline line saw significant improvement after an early morning swoon so all eyes are on Tuesday's action to see if there will be a follow through to the upside.

One suspicious tell is that utilities are still leading momentum (see VEGA below),

One suspicious tell is that utilities are still leading momentum (see VEGA below),

Thursday, January 15, 2015

More of the Same + a new BUZZ.....01.15.15

We revisited many of yesterday's lows today, as the market commonly does during periods of persistent selling. Options expiration tomorrow and statistically the odds favor a weak close although we may see strength at the open. It's only noon so we may see some buying into the last hour but earnings reports are still what's driving prices and there's still a lot of them to report so the froth could continue for a while.

Meanwhile I've revised the morning BUZZ link to more fully reflect the bigger picture of market dynamics, The link is free, of course, and is provided courtesy of Worden Bros, at 7 AM PST each morning. See the legend on the site for column descriptions. I've included the current short interest ratio for each component as a additional measure of sentiment (and risk).

Meanwhile I've revised the morning BUZZ link to more fully reflect the bigger picture of market dynamics, The link is free, of course, and is provided courtesy of Worden Bros, at 7 AM PST each morning. See the legend on the site for column descriptions. I've included the current short interest ratio for each component as a additional measure of sentiment (and risk).

Wednesday, January 14, 2015

VIX Moves to Overbought Levels...01.14.15

Bad earnings by JPM whacked the financial sector hard while weak retail data dropped the big boxes,

The DOW was off 350 at one point on accelerating volume although there was recovery into the last hour and in the after hours session. As I mentioned yesterday's M3 post its all about earnings for the next week or so and options expiration this Friday will only exacerbate the current volatility,

Best recommendation for now,,,trade small or be willing to accept above normal risk,

Not surprisingly, XLU (utilities) was the strongest sector intraday (see Vega below)

The DOW was off 350 at one point on accelerating volume although there was recovery into the last hour and in the after hours session. As I mentioned yesterday's M3 post its all about earnings for the next week or so and options expiration this Friday will only exacerbate the current volatility,

Best recommendation for now,,,trade small or be willing to accept above normal risk,

Not surprisingly, XLU (utilities) was the strongest sector intraday (see Vega below)

Tuesday, January 13, 2015

Volatility...word for the day...01.13.15

That was one for the books as the NYAD range today was .39 to 5.39 with the DOW up 280 points at one point only to plummet to down 140 points. The SPY TrendX in the right side panel is basically in stasis and both M3 and LM are safely in cash.

There was a bit of buying after hours today but its way too early to get bullishly enthusiastic,

Today;s BUZZ signal on the M3 site was the high of the day ,,,,it got messy from then on,

There was a bit of buying after hours today but its way too early to get bullishly enthusiastic,

Today;s BUZZ signal on the M3 site was the high of the day ,,,,it got messy from then on,

Monday, January 12, 2015

Here we go again...01.12.15

The markets bottomed within the first 30 minutes and spent the rest of the day going sideways.

The SPY TrendX signal is not encouraging for the bulls. Earnings season is upon us so expect day to day volatility to increase. Is a paradigm shift close at hand? We'll find out soon.

The SPY TrendX signal is not encouraging for the bulls. Earnings season is upon us so expect day to day volatility to increase. Is a paradigm shift close at hand? We'll find out soon.

Sunday, January 11, 2015

Paradigm Shifts...01.11.15

This is important!. The markets are fickle. Murphy's Law is alive and well in the NYSE and NASDAQ and those who've been in the trading trenches for a more than a few years know all about the unexpected curve balls and spit balls the market can pitch us. Trying to catch many of those pitches is iffy...trying to read them for a base hit is even harder.

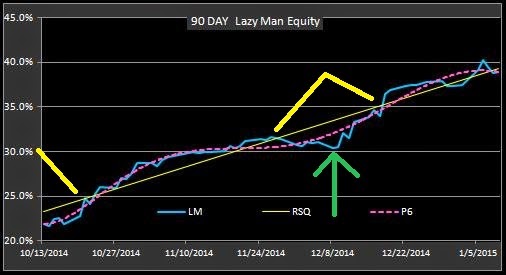

I've spoken of "paradigm shifts" in the markets before and here's a little study of the Lazy Man (LM) model illustrating the repetitive and fractal nature of those shifts. The LM of course is just like putting on a set of special goggles to examine market dynamics. M3 looks at the markets differently than LM and there are thousands upon thousands of other technical goggles or templates that are available to perform alternate views. What's important is recognizing periods when the markets are not "in focus" with the technical goggles we are using and being ready to act when that focus returns.

I'm not going to spend pages digressing about why the markets behave this way...suffice to say, after watching and trading them for almost 30 years, they do.

Below are a 90 day and 2 year chart of LM. The paradigm shifts are defined by the yellow calipers and the beginning of the re-focus is indicated by the green arrows (and the upslope behavior of P6.

Alternate templates would likely reveal alternate paradigm shifts.....but being alert to when the markets are behaving out of sync with our analysis format (or another) can avoid unnecessary drawdowns and headaches by engaging simply money management practices such as scaling back positions or simply standing back in cash.

I've spoken of "paradigm shifts" in the markets before and here's a little study of the Lazy Man (LM) model illustrating the repetitive and fractal nature of those shifts. The LM of course is just like putting on a set of special goggles to examine market dynamics. M3 looks at the markets differently than LM and there are thousands upon thousands of other technical goggles or templates that are available to perform alternate views. What's important is recognizing periods when the markets are not "in focus" with the technical goggles we are using and being ready to act when that focus returns.

I'm not going to spend pages digressing about why the markets behave this way...suffice to say, after watching and trading them for almost 30 years, they do.

Below are a 90 day and 2 year chart of LM. The paradigm shifts are defined by the yellow calipers and the beginning of the re-focus is indicated by the green arrows (and the upslope behavior of P6.

Alternate templates would likely reveal alternate paradigm shifts.....but being alert to when the markets are behaving out of sync with our analysis format (or another) can avoid unnecessary drawdowns and headaches by engaging simply money management practices such as scaling back positions or simply standing back in cash.

Thursday, January 8, 2015

Follow Through...01.08.15

The markets continue to run up and have now gone from oversold to almost overbought in 2 days, Keep in mind the caveat of Friday's negative bias as we look for a tradable trend.

Here's a look at SPY, XIV and VXX on 90 day charts and we can see that XIV has really failed to perform in the Beta+ manner we have witnessed in the past. This lack of SPY/XIV correlation tends to create suspicion about any new XIV longs until that correlation is re=established.

Also note below a new free access tab that will be added to the Mosaic M3 site....the 7 AM BUZZ, a quick snapshot of M3 component dynamics and the NYAD as of 7 AM PST each day....just a little thumbnail reference to set the pace for the upcoming day's action.

Here's a look at SPY, XIV and VXX on 90 day charts and we can see that XIV has really failed to perform in the Beta+ manner we have witnessed in the past. This lack of SPY/XIV correlation tends to create suspicion about any new XIV longs until that correlation is re=established.

Also note below a new free access tab that will be added to the Mosaic M3 site....the 7 AM BUZZ, a quick snapshot of M3 component dynamics and the NYAD as of 7 AM PST each day....just a little thumbnail reference to set the pace for the upcoming day's action.

Wednesday, January 7, 2015

Tentative Bounce....01 07.15

We got the bounce suspected at yesterday;s close on the M3 site and are now looking for confirmation of a possible new bullish trend. Recent lows do tend to get revisited so we are now in cash to avoid that potential trap door (see below). Volume was not confirming today.

For non-M3 subscribers here's a link to the new Mosaic format (Monday's post) and an update sample.

M3 rates are going up to $50/ month as of Jan 15th,

NAAIM members will be able to subscribe at the current $30/month rate.

For non-M3 subscribers here's a link to the new Mosaic format (Monday's post) and an update sample.

M3 rates are going up to $50/ month as of Jan 15th,

NAAIM members will be able to subscribe at the current $30/month rate.

Tuesday, January 6, 2015

Ponzo Update....1.06.15

In response to a number of requests here's the latest Ponzo Time Machine odds for the next 6 months.

The forecast has actually become a bit more neutral than our previously downside skewed view.

The forecast has actually become a bit more neutral than our previously downside skewed view.

Monday, January 5, 2015

From Bad to Worse....1.05.15

So much for Friday's bullish close. The VIXEN's jaws opened wide today (see below) and XIV dropped over 7%...once again resolving to the downside.

Per the TrendX on the right side panel the potential for further downside is looming and the bearish version of the Ponzo Time Machine could be upon us for a bit.

We have a new version of M3 for 2015 as a result of 10 hours of work this weekend with a friend's programming assistance to backtest various risk parameters. M3 is now substantially improved from a risk standpoint (total 6 month drawdown cut to less than 7%) and I'll post today's M3 update on Wednesday on the M3 site.

We'll also take a look at "paradigm shift" later this week... a concept I've mentioned often and which is critical in assessing forward looking risk.

Per the TrendX on the right side panel the potential for further downside is looming and the bearish version of the Ponzo Time Machine could be upon us for a bit.

We have a new version of M3 for 2015 as a result of 10 hours of work this weekend with a friend's programming assistance to backtest various risk parameters. M3 is now substantially improved from a risk standpoint (total 6 month drawdown cut to less than 7%) and I'll post today's M3 update on Wednesday on the M3 site.

We'll also take a look at "paradigm shift" later this week... a concept I've mentioned often and which is critical in assessing forward looking risk.

Sunday, January 4, 2015

Volatility Skew Continues to Frustrate....1.04.15

While the markets try to stabilize and find at least a short term trend volatility continues to be a wild card, defying both fundamental and technical indicators. Here's a look at the beta spectrum using FreeStockCharts (FSC), including several outlier volatility issues that we normally don't examine but their inclusion helps to formulate something of a group consensus.

For those unfamiliar with FSC the most bullish column is Xu2 avg, which means price is crossing up thru the 2 day moving average. Abv2 avg means price is above 2 moving average, etc. Xd2 avg means crossing down thru the 2 day movng average.

Now what's weird here is that the 2 most bullish short term signals are SH and XIV, while the most bearish longer term (7 day) issues are SPY, SSO and XIV...for which we would expect a positive correlation.

What's the bottom line?. Well, for risk adverse old timers like myself it means scaling back any new positions in M3 until the signals get in sync, as mentioned in the Friday M3 post. This little study is just a confirmation that, for whatever reasons, volatility trends are not clear at the present time.

BTW, Friday's closing action was bullish for Monday, per the SPY VIXEN below..

For those unfamiliar with FSC the most bullish column is Xu2 avg, which means price is crossing up thru the 2 day moving average. Abv2 avg means price is above 2 moving average, etc. Xd2 avg means crossing down thru the 2 day movng average.

Now what's weird here is that the 2 most bullish short term signals are SH and XIV, while the most bearish longer term (7 day) issues are SPY, SSO and XIV...for which we would expect a positive correlation.

What's the bottom line?. Well, for risk adverse old timers like myself it means scaling back any new positions in M3 until the signals get in sync, as mentioned in the Friday M3 post. This little study is just a confirmation that, for whatever reasons, volatility trends are not clear at the present time.

BTW, Friday's closing action was bullish for Monday, per the SPY VIXEN below..

Thursday, January 1, 2015

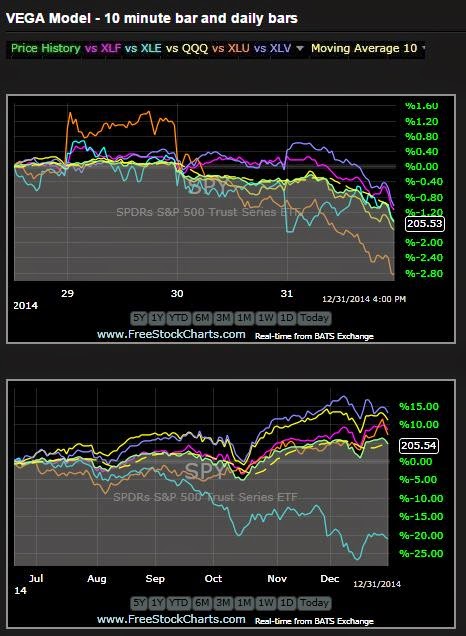

Last Day of the Year Tumble....12.31.14

The Santa Claus rally pooped out of the last day of the year with selling accelerating into the close and the VIX up over 20%. Going forward into 2015 there's a number of issues that may catalyze the market momentum and we'll look at a few of those in the coming week.

For now the historical record favors a bullish move on Friday, the first trading day of the new year and we have somewhat divergent signals between our M3 and LM models....VXX vs cash,,, so tomorrow's open will hopefully provide a better idea of how that will resolve.

The SPY TrendX is bearish and both model dashboards are bearish.....we just have to prepared for whatever the markets deliver and the new simple fixed limit stops on both models should help protect incremental capital appreciation.

For now the historical record favors a bullish move on Friday, the first trading day of the new year and we have somewhat divergent signals between our M3 and LM models....VXX vs cash,,, so tomorrow's open will hopefully provide a better idea of how that will resolve.

The SPY TrendX is bearish and both model dashboards are bearish.....we just have to prepared for whatever the markets deliver and the new simple fixed limit stops on both models should help protect incremental capital appreciation.

Subscribe to:

Posts (Atom)