Another day, another couple points up. Friday's a short sesssion and expect uber low volume.

The thing with such days, however, is that small traders who normally really can't effect market momentum often do manage to pump up stocks on days like Friday when the big traders are on holiday. Coupled with the end of the month bullish thing Friday could be surprisingly strong.

We shall see.

Info on the new SPY Trader has been added to the Mosaic homesite. Just scroll down on the page until the SPY Trader panes are visible. I'm adding a few final tweaks this weekend and then next week the platform will be released. Pricing will be modest.

At the same time that bullish signals are seemingly everywhere we are seeing cracks in XIV momentum, usually a telltale that the underlying SPY is weakening. Once again this may be the product of the low volume holidays, or perhaps something more threatening.

For now we have a cautiously neutral posture with the TrendX closing dead on the zero line.

And below is clear evidence that the XIV is sinking, meaning the VIX is rising = caution flag.

Finally, just as a heads up....the TrendX 2 day ALERT STOP has now crossed down through the trend line and the equity curve has also turned slightly down in the past 2 days...suggesting the risk/reward profile is weakening ......adding fuel to our cautious stance.

Wednesday, November 27, 2013

Monday, November 25, 2013

M3 SPY Trader...11.25.13

Equities went up and then went down today, resulting in a narrow range day. For tomorrow we still have the end of month and seasonal bullish bias. which is historically most exaggerated on the day after Thanksgiving.

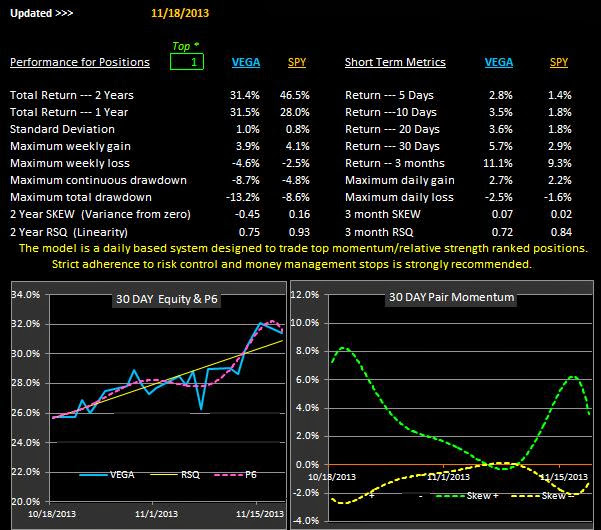

The SPY Trader remains bullish and the recent performance metrics are attached.

There will be no post Tuesday but a detailed breakdown of all the new SPY Trader components will be posted on Wednesday along with an explanation of the SPY/SSO and SPY/VIX 5 %change pair charts.

The SPY Trader remains bullish and the recent performance metrics are attached.

There will be no post Tuesday but a detailed breakdown of all the new SPY Trader components will be posted on Wednesday along with an explanation of the SPY/SSO and SPY/VIX 5 %change pair charts.

Saturday, November 23, 2013

TrendX Points Higher...11.23.13

Today's post will conclude our little study of the TrendX charts site and the implications of the charts signals.

Next week we'll look at what the % change pairs studies show relative to the TrendX and the P6.

The following week (after Thanksgiving) we'll finally release the new M6 models and the SPY Trader.

Approaching next week the TrendX signals are bullish and, coupled with traditional bullish seasonality before turkey day and the end of month typical bullish bump, can Dow 17000 be a possibility?

We are technically overbought but that hasn't dimmed market enthusiasm before so for now we just take it one day at a time.

Although the SPY VIXEN was in full bull mode all day long the TrendX was a bit more iffy, especially in afternoon trading, and at the close we were actually close to the zero line IN MOMENTUM...while price was still rising.

This was an unusual divergence between the VIXEN and the TrendX and illustrates the utility of looking at a third conforming chart pattern....the SPY,SSO,XIV Trader chart. Shown below....

The SPY, SSO XIV Trader was clearly bullish all day..displaying the picture perfect relationship of the 3 ETFs that basically guarantee rising prices. As long as we don't see a significant divergence from the XIV/SSO alignment then price will continue to follow the slope of the price bars. This works in inverse also...when the 3 ETfs are all pointing downslope its best to seek cash.

Finally, here's a quick look at the SCHWAB model and what's interesting here is the pop in SCHE, the emerging markets ETF. On Friday morning a number of analysts argued that the emerging markets have lagged the other indices and are due for a good run... This may be a harbinger of that pop.

Meanwhile, SCHH (housing) looks awful.

Next week we'll look at what the % change pairs studies show relative to the TrendX and the P6.

The following week (after Thanksgiving) we'll finally release the new M6 models and the SPY Trader.

Approaching next week the TrendX signals are bullish and, coupled with traditional bullish seasonality before turkey day and the end of month typical bullish bump, can Dow 17000 be a possibility?

We are technically overbought but that hasn't dimmed market enthusiasm before so for now we just take it one day at a time.

Although the SPY VIXEN was in full bull mode all day long the TrendX was a bit more iffy, especially in afternoon trading, and at the close we were actually close to the zero line IN MOMENTUM...while price was still rising.

This was an unusual divergence between the VIXEN and the TrendX and illustrates the utility of looking at a third conforming chart pattern....the SPY,SSO,XIV Trader chart. Shown below....

The SPY, SSO XIV Trader was clearly bullish all day..displaying the picture perfect relationship of the 3 ETFs that basically guarantee rising prices. As long as we don't see a significant divergence from the XIV/SSO alignment then price will continue to follow the slope of the price bars. This works in inverse also...when the 3 ETfs are all pointing downslope its best to seek cash.

Finally, here's a quick look at the SCHWAB model and what's interesting here is the pop in SCHE, the emerging markets ETF. On Friday morning a number of analysts argued that the emerging markets have lagged the other indices and are due for a good run... This may be a harbinger of that pop.

Meanwhile, SCHH (housing) looks awful.

Thursday, November 21, 2013

Back to 16,000...11.21.13

Neutral turned bullish after an early morning stall and now the DOW is back to the 16,000 benchmark.

Financials led the rally today apparently minimizing the FED fear factor of yestesday.

The markets are fickle.

Once again the TrendX showed the path of least resistance.

Some readers have asked why I bother to detail the TrendX dynamics since most are concerned with longer term investment horizons.

The answer is simple...when opening or closing positions there are intraday timing opportunities that can be taken advantage of to help sell at high points and buy at low points....why not spend the time and explore the possibilities?

Note the midday (2:17 PM EST timestamp) Vixen break to the upside, which was confirmed by the 5 minute SPY TrendX.

The freestockcharts site is all free and I use it all day long on one of my screens to keep track of the various 6 ETF portfolios.

Here's today's action on the SCHWAB no fee model. Unfortunately. I can't download the technical templates and copy to another computer so users are left to recreate them on their own screens.

Like I said...its free and its real time...and well worth the effort in my opinion.

In today's action the Schwab broad market based ETF SCHB actually outperformed the SPY...a behavior not seen during the past month.

What your looking at here is the SPY (shaded area chart) with line chart overlays of the SCHWAB ETFs, but you can input any stocks or other ETFs of your choosing.

Then we have a modified Coppock Curve and a 30 period linear regression line laid on top of the SPY price.

Just to help identify impending turns in the market trend a 10 period linear regression line (yellow) has been laid on top of the Coppock Curve.

The chart below is shown on 10 minute bars but with the click of a mouse you can look at 2 minute, 30 minute, hourly, daily, weekly bars, etc.

Did I mention this was all free?

Financials led the rally today apparently minimizing the FED fear factor of yestesday.

The markets are fickle.

Once again the TrendX showed the path of least resistance.

Some readers have asked why I bother to detail the TrendX dynamics since most are concerned with longer term investment horizons.

The answer is simple...when opening or closing positions there are intraday timing opportunities that can be taken advantage of to help sell at high points and buy at low points....why not spend the time and explore the possibilities?

Note the midday (2:17 PM EST timestamp) Vixen break to the upside, which was confirmed by the 5 minute SPY TrendX.

The freestockcharts site is all free and I use it all day long on one of my screens to keep track of the various 6 ETF portfolios.

Here's today's action on the SCHWAB no fee model. Unfortunately. I can't download the technical templates and copy to another computer so users are left to recreate them on their own screens.

Like I said...its free and its real time...and well worth the effort in my opinion.

In today's action the Schwab broad market based ETF SCHB actually outperformed the SPY...a behavior not seen during the past month.

What your looking at here is the SPY (shaded area chart) with line chart overlays of the SCHWAB ETFs, but you can input any stocks or other ETFs of your choosing.

Then we have a modified Coppock Curve and a 30 period linear regression line laid on top of the SPY price.

Just to help identify impending turns in the market trend a 10 period linear regression line (yellow) has been laid on top of the Coppock Curve.

The chart below is shown on 10 minute bars but with the click of a mouse you can look at 2 minute, 30 minute, hourly, daily, weekly bars, etc.

Did I mention this was all free?

Wednesday, November 20, 2013

Watching the TrendX..11.20.13

Today's action was negative, as suspected yesterday.

In early going it looked like we were going to get some green but the FED's comments about a possible Spring taper of QE really put the damper on any positive momentum.

Its actually pretty frightening and illustrative of how fragile this "recovery" is that some nebulous remarks by a couple FED directors can crater the markets so dramatically.

Kind of makes you wonder if the whole thing is just a house of cards.

Meanwhile the real time TrendX charts did a great job of keeping us on the right side of the trade.

The upper VIXEN chart went to SELL (intersection of SPY and SH) about 2 hours preclose and it was a great signal to get out or go short. The supplemental 3 minute SPY TrendX dithered around the zero line in early going before the breakdown at about the same time. The TrendX also did a good job of signalling the last hour rally. Although SPY ended down for the day momentum retraced back to the zero line by the close...leaving us now in a neutral posture for Thursday.

On the SPY/SSO/XIV Trader chart volatility dropped in early action (remember XIV is the VIX inverse) but then the XIV crashed and the SPY was right behind it.

Volatility often precedes price action (supposedly the venue of 'Big Money") and changes in the slope of the XIV should be tracked closely by short term traders.

This argument is supported by the default VEGA model when we observe the SH (red line) rise above SPY (shaded area) just about 2 hours before the close.

Laying these price charts on top of one another is a great way to confirm underlying price action. Unfortunately, using XIV as a component tends to skew the X (vertical) axis of the chart since it is so volatile...you just have to look a bit closer to discern what's going on....its often worth the effort.

In early going it looked like we were going to get some green but the FED's comments about a possible Spring taper of QE really put the damper on any positive momentum.

Its actually pretty frightening and illustrative of how fragile this "recovery" is that some nebulous remarks by a couple FED directors can crater the markets so dramatically.

Kind of makes you wonder if the whole thing is just a house of cards.

Meanwhile the real time TrendX charts did a great job of keeping us on the right side of the trade.

The upper VIXEN chart went to SELL (intersection of SPY and SH) about 2 hours preclose and it was a great signal to get out or go short. The supplemental 3 minute SPY TrendX dithered around the zero line in early going before the breakdown at about the same time. The TrendX also did a good job of signalling the last hour rally. Although SPY ended down for the day momentum retraced back to the zero line by the close...leaving us now in a neutral posture for Thursday.

On the SPY/SSO/XIV Trader chart volatility dropped in early action (remember XIV is the VIX inverse) but then the XIV crashed and the SPY was right behind it.

Volatility often precedes price action (supposedly the venue of 'Big Money") and changes in the slope of the XIV should be tracked closely by short term traders.

This argument is supported by the default VEGA model when we observe the SH (red line) rise above SPY (shaded area) just about 2 hours before the close.

Laying these price charts on top of one another is a great way to confirm underlying price action. Unfortunately, using XIV as a component tends to skew the X (vertical) axis of the chart since it is so volatile...you just have to look a bit closer to discern what's going on....its often worth the effort.

Tuesday, November 19, 2013

TrendX at Risk..11.19.13

Checking in with the various TrendX charts reveals the kind of ambivalence the markets displayed today. These intraday sine curve price patterns are loved by daytraders and trading robots...for longer term investors its more like watching paint dry.

To try and gain some insight into which direction the break is likely to take its often helpful to stand back and look at the longer term TrendX display which, in this case, looks like its flattening.

This argument is supported by yesterday's look at the convergence of the SPY/SSO price volatility... a trend which continued today.

For now CASH looks like the place to be.

On the SPY/SSO/XIV Trader chart below we see the type of perfect alignment of the three issues based on beta values that confirmed that the markets were in a sustained downtrend for the day

To try and gain some insight into which direction the break is likely to take its often helpful to stand back and look at the longer term TrendX display which, in this case, looks like its flattening.

This argument is supported by yesterday's look at the convergence of the SPY/SSO price volatility... a trend which continued today.

For now CASH looks like the place to be.

On the SPY/SSO/XIV Trader chart below we see the type of perfect alignment of the three issues based on beta values that confirmed that the markets were in a sustained downtrend for the day

Monday, November 18, 2013

VEGA Update... 11.18.13

We hit 16000 DOW and 180 on the SPY.....as I suggested last week the markets love whole numbers and these meaningless technical benchmarks are often critical support and resistance levels. That may be the case here as we saw a midday reversal im momentum, although all transpiring in a low volume backdrop.

This version of VEGA, without the hyper volatile XIV, and using a top 1 sort has now turned to CASH.

This is the same algorithm as the T6 model so inputting these ETFS should yield the same results.

The new M6 models are still in development based on a recent and major change in the algorithms.

We're seeing a contraction of the % change divergence between SPY and SSO, the SPY ultra bull, and when (and if) the skew converges at the zero line we will be in true bear territory.

This version of VEGA, without the hyper volatile XIV, and using a top 1 sort has now turned to CASH.

This is the same algorithm as the T6 model so inputting these ETFS should yield the same results.

The new M6 models are still in development based on a recent and major change in the algorithms.

We're seeing a contraction of the % change divergence between SPY and SSO, the SPY ultra bull, and when (and if) the skew converges at the zero line we will be in true bear territory.

Saturday, November 16, 2013

X Sector Update...11.16.13

The SPDR sector ETF model has moved XRT and XLY into the top slots as the holiday buying season gets under way and the prospects for the retail sector rise based on MACY's blow out earnings report and despite WalMart's lackluster report.

As long as consumer confidence continues to hold we're likely to see a continuation of these rankings for the weeks ahead and up to the new year. Dow 16,000 is inevitable at this point...the markets love round numbers...but most of the seasoned market gurus predict the days of easy money are coming to a close and 2014 may be more of an uphill climb than 2013.

For now it looks like clear sailing...subject to the usual caveats.....although the technical signals are once again showing overbought conditions so we may see a little selling next week after we blow through the 16,000 mark.

As long as consumer confidence continues to hold we're likely to see a continuation of these rankings for the weeks ahead and up to the new year. Dow 16,000 is inevitable at this point...the markets love round numbers...but most of the seasoned market gurus predict the days of easy money are coming to a close and 2014 may be more of an uphill climb than 2013.

For now it looks like clear sailing...subject to the usual caveats.....although the technical signals are once again showing overbought conditions so we may see a little selling next week after we blow through the 16,000 mark.

Thursday, November 14, 2013

SPY Leads Small World...11.14.13

Checking in with SMALL WORLD its clear that SPY has been leading the way against the foreign and emerging markets. The model has been able to keep pace with SPY on the 3 month level although for the past 2 weeks momentum has been muted.

Sometimes its useful to check out the current short interest levels in a portfolio and here's the breakdown for SMALL WORLD.

The free data is courtesy of freestockcharts.com, a site I've profiled before and a great source for all kings of performance metrics, much of which can be retrieved in streaming real time format.

EWG short interest is extremely high (bearish) while SPY and EEM are equally bearish.

The problem for the bears with EWG, which has outperfomed all the other portfolio components on a 90 day lookback basis, is that any bullish runs effectively lead to more buying as short are forced to buy the ETF in order to cover their positions.

Short interest is worth tracking when uber high levels such as these develop.

Sometimes its useful to check out the current short interest levels in a portfolio and here's the breakdown for SMALL WORLD.

The free data is courtesy of freestockcharts.com, a site I've profiled before and a great source for all kings of performance metrics, much of which can be retrieved in streaming real time format.

EWG short interest is extremely high (bearish) while SPY and EEM are equally bearish.

The problem for the bears with EWG, which has outperfomed all the other portfolio components on a 90 day lookback basis, is that any bullish runs effectively lead to more buying as short are forced to buy the ETF in order to cover their positions.

Short interest is worth tracking when uber high levels such as these develop.

Wednesday, November 13, 2013

Bullish Reversal Day....11.13.13

Another high volatility day that saw early weakness overpowered by bullish buying. There's probably a portion of that pop that could be attributed to short covering but the afternoon session turned into a pig pile as traders rushed in to chase momentum leaders.

The VIX has now become highly oversold (bullish) so risk loving traders could do worse than pick up a few December out of the money VIX calls. Another quick bearish swoon and gains could be substantial.

Upcoming we have the widely anticipated Santa Claus rally which traditionally kicks in about 5 weeks before Xmas. To thicken the soup earnings season in also ramping up and Macy's (M) blow out results pushed the XRT (retail index) into the wide blue yonder.

All eyes are now on Walmart's Thursday report. If good, expect another substantial uptick.

Still looking for DOW 16,000, it seems just a matter of time.

The SPY model is positive........

The VIX has now become highly oversold (bullish) so risk loving traders could do worse than pick up a few December out of the money VIX calls. Another quick bearish swoon and gains could be substantial.

Upcoming we have the widely anticipated Santa Claus rally which traditionally kicks in about 5 weeks before Xmas. To thicken the soup earnings season in also ramping up and Macy's (M) blow out results pushed the XRT (retail index) into the wide blue yonder.

All eyes are now on Walmart's Thursday report. If good, expect another substantial uptick.

Still looking for DOW 16,000, it seems just a matter of time.

The SPY model is positive........

Tuesday, November 12, 2013

Changes to TrendX site....11.12.13

Technical problems prevented last night's post but after several hours of effort everything seems to be back on track.

There have been some changes (hopefully improvements) over on the linked Mosaic TrendX and Vixen site. A new TrendXsingle line chart derived from a Coppock Curve smooths out much of the chop and makes the emerging trend easier to see.

In 25 years of trading I had never heard of the Coppock Curve and only accidentally discovered its existence yesterday. It's further amazing that the developer of the formula ran a company called TrendeX Research....and all this time I thought I had an original idea when I was apparently just channeling Coppock.

Needless to say I've tweaked Coppock's formula a bit to generate the current displays. The charts are also supplemented with a 10 period linear regression line to further help identify momentum.

Yesterday was an inside day with marginal volume and little momentum.

Today's action at midday is decidedly bearish as can be seen in the 6 component models also tracked on the TrendX site.

I find these live charts extremely useful for monitoring daily market activity and the best part is that they are completely free.

There have been some changes (hopefully improvements) over on the linked Mosaic TrendX and Vixen site. A new TrendXsingle line chart derived from a Coppock Curve smooths out much of the chop and makes the emerging trend easier to see.

In 25 years of trading I had never heard of the Coppock Curve and only accidentally discovered its existence yesterday. It's further amazing that the developer of the formula ran a company called TrendeX Research....and all this time I thought I had an original idea when I was apparently just channeling Coppock.

Needless to say I've tweaked Coppock's formula a bit to generate the current displays. The charts are also supplemented with a 10 period linear regression line to further help identify momentum.

Yesterday was an inside day with marginal volume and little momentum.

Today's action at midday is decidedly bearish as can be seen in the 6 component models also tracked on the TrendX site.

I find these live charts extremely useful for monitoring daily market activity and the best part is that they are completely free.

Sunday, November 10, 2013

Weekly Update..11.10.13

Volatility is the name of the game as the SPY whipsaws up and down 100+ points on a daily basis.

Our safety net of CASH left some money on the table Friday as the markets surged closer to the DOW 16,000 target but technical overbought signals are widely in evidence so we may see a pullback into options expiration and the end of this coming week.

Every pullback has been a buying opportunity as long as the markets continue to chug upwards.

The problem is the paradigm could change quickly and dramatically so investors should be content to follow the money management stops and not try to outguess the markets.

On the Small World model its clear that the SPY is the place to be as foreign markets come under weakness. How long this disconnect can continue remains to be seen. Based on a top 2 sort the model remains in cash.

The SCHWAB no fee model is faring about the same although the model is more bullish than Small World. The low volatility version of SPY (SPLV) has been the recent top ranked using a top 2 sort, and although the short term have not kept pace with SPY, the 3 month net returns shine and the frequency of trading has been minimal.

Over on the beta version of the XIV trader the signals are distinctly bullish....except on the short term alert...so there's that note of caution...basically reflecting the overbought situation of the XIV, not necessarily the SPY.

More on the nuances of the new XIV model next week as we approach release of this volatility trader.

Our safety net of CASH left some money on the table Friday as the markets surged closer to the DOW 16,000 target but technical overbought signals are widely in evidence so we may see a pullback into options expiration and the end of this coming week.

Every pullback has been a buying opportunity as long as the markets continue to chug upwards.

The problem is the paradigm could change quickly and dramatically so investors should be content to follow the money management stops and not try to outguess the markets.

On the Small World model its clear that the SPY is the place to be as foreign markets come under weakness. How long this disconnect can continue remains to be seen. Based on a top 2 sort the model remains in cash.

The SCHWAB no fee model is faring about the same although the model is more bullish than Small World. The low volatility version of SPY (SPLV) has been the recent top ranked using a top 2 sort, and although the short term have not kept pace with SPY, the 3 month net returns shine and the frequency of trading has been minimal.

Over on the beta version of the XIV trader the signals are distinctly bullish....except on the short term alert...so there's that note of caution...basically reflecting the overbought situation of the XIV, not necessarily the SPY.

More on the nuances of the new XIV model next week as we approach release of this volatility trader.

Thursday, November 7, 2013

Safety of CASH pays Off...11.7.13

Following yesterday's lament about missing the big upside break due to our CASH status, the model redeemed itself today avoiding the market wide swoon to the downside.

Lacking a positive confirmation to yesterday's modest bullish indication all signals are now distinctly negative and supportive of the current CASH mode.

As mentioned previously SHY (short term bonds) is essentially the same as cash so its current ranking in the #1 slot is a strong argument for cash.

Here's the VIXEN Update:

Lacking a positive confirmation to yesterday's modest bullish indication all signals are now distinctly negative and supportive of the current CASH mode.

As mentioned previously SHY (short term bonds) is essentially the same as cash so its current ranking in the #1 slot is a strong argument for cash.

Here's the VIXEN Update:

Wednesday, November 6, 2013

Missing the Break...10.6.13

Today resolved the recent narrow band consolidation that had predicted a big move.

Unfortunately, all the models except the new short term SPY and Vixen models were indicating cash positions for today's open.

A closer look at today's results shows a disparity of returns. Despite Microsoft's huge upward

surge the Nasdaq actually ended up in negative territory along with many other big names that one would have expected to end in the green on today's pop.

Expecting a pullback, if only short term, before more upward gains.

However, we're now within easy striking distance of DOW 16,000 and given the typical strong seasonality of the markets and few fundamental obstacles the prospects of hitting that target seem strong at this point.

Here's a look at how the VIXEN model has fared recently...keeping in mind the model is based on a maximum 6 month lookback and that the goal is maximizing short term gains.

The signals are now bullish based on the short term SPY / XIV skew (pair dynamics) but still negative using the P6 stops so we don't have an all clear risk on signal yet..

Unfortunately, all the models except the new short term SPY and Vixen models were indicating cash positions for today's open.

A closer look at today's results shows a disparity of returns. Despite Microsoft's huge upward

surge the Nasdaq actually ended up in negative territory along with many other big names that one would have expected to end in the green on today's pop.

Expecting a pullback, if only short term, before more upward gains.

However, we're now within easy striking distance of DOW 16,000 and given the typical strong seasonality of the markets and few fundamental obstacles the prospects of hitting that target seem strong at this point.

Here's a look at how the VIXEN model has fared recently...keeping in mind the model is based on a maximum 6 month lookback and that the goal is maximizing short term gains.

The signals are now bullish based on the short term SPY / XIV skew (pair dynamics) but still negative using the P6 stops so we don't have an all clear risk on signal yet..

Tuesday, November 5, 2013

SCHWAB 6 Update...11.5.13

Checking in with the SCHWAB 6 model illustrates the current ambivalence of the markets.

Reflecting exposure to the broad equity markets, foreign companies, emerging markets and real estate the current leader is the low volatility of the broad market (SPLV) and even that has produced only a modest return over recent days.

On the short term ALERT we see a modest uptick signal. The other indicators are negative.

As the markets continue to see-saw between the zero line the odds increase for a big break...whether it will be up or down remains to be seen but for now all the 6 ETF portfolio models are in cash..

Reflecting exposure to the broad equity markets, foreign companies, emerging markets and real estate the current leader is the low volatility of the broad market (SPLV) and even that has produced only a modest return over recent days.

On the short term ALERT we see a modest uptick signal. The other indicators are negative.

As the markets continue to see-saw between the zero line the odds increase for a big break...whether it will be up or down remains to be seen but for now all the 6 ETF portfolio models are in cash..

Monday, November 4, 2013

X Sector Update...11.4.13

The X Sector model has been getting whipsawed in and out of cash as the equity line has basically flat lined for the past 2 weeks.

Today's action was like watching paint dry but at the end of the day we saw some evidence of positive momentum. The X Sector short term ALERT is also suggesting more upside for the model momentum leaders but there are a number of counter factors that may sidetrack that movement.

With earnings in and the govt. stalemate at least temporarily resolved its unclear what the next catalyst will be that drives the markets up or down.

Expect a big move soon.

Today's action was like watching paint dry but at the end of the day we saw some evidence of positive momentum. The X Sector short term ALERT is also suggesting more upside for the model momentum leaders but there are a number of counter factors that may sidetrack that movement.

With earnings in and the govt. stalemate at least temporarily resolved its unclear what the next catalyst will be that drives the markets up or down.

Expect a big move soon.

Sunday, November 3, 2013

M5 Refinements....11.3.13

The new accelerated platform is still a week from release as final adjustments are being implemented and tested.

The goal of this new approach is to use both timing and volatility indicators to keep on the right side of the SPY's momentum.

To increase potential gains the M5 models are designed to trade only XIV or SSO (the SPY ultra bull ETF) on a daily basis, although ranked positions may beheld for a week or more when market trending is in effect.

The accelerated momentum algorithms are formulated to detect changes in momentum faster than the previous T11 and T6 models. Since we are effectively buying more risk by trading XIV and SSO ...which have substantially higher beta values than SPY....we need to be a little quicker on the trigger to execute money management stops.

The metrics on the models only run out 6 months as the focus of attention should be on the short term.

With this model we digress from the concept of portfolio management and move to the concept of simply trying to improve SPY returns by selective timing. The cyclical behavior of the SPY can be seen in the lower 6 month equity chart.

Our goal is to identify likely thresholds in the peaks and the valleys and act accordingly.

The M5 platform is a response to users who have requested a shorter time frame model that can supplement the various portfolio models.

The goal of this new approach is to use both timing and volatility indicators to keep on the right side of the SPY's momentum.

To increase potential gains the M5 models are designed to trade only XIV or SSO (the SPY ultra bull ETF) on a daily basis, although ranked positions may beheld for a week or more when market trending is in effect.

The accelerated momentum algorithms are formulated to detect changes in momentum faster than the previous T11 and T6 models. Since we are effectively buying more risk by trading XIV and SSO ...which have substantially higher beta values than SPY....we need to be a little quicker on the trigger to execute money management stops.

The metrics on the models only run out 6 months as the focus of attention should be on the short term.

With this model we digress from the concept of portfolio management and move to the concept of simply trying to improve SPY returns by selective timing. The cyclical behavior of the SPY can be seen in the lower 6 month equity chart.

Our goal is to identify likely thresholds in the peaks and the valleys and act accordingly.

The M5 platform is a response to users who have requested a shorter time frame model that can supplement the various portfolio models.

Subscribe to:

Posts (Atom)