This started out as a client project and then took on a life of its own. M11 is the next generation of the old T11 program and it has several new features including discretionary benchmarks, programmable limit stops and the momentum/mean reversion ON/OFF switch. Its actually been a fun project and I think it has a lot of utility especially for building model portfolios. M11 has an end of day feed... the idea being that you let the algorithms determine the best odds scenarios and then load the top 6 inputs into M6 or the top 3 inputs into M3 for real time analysis of the top ranked positions. M11 will be added to the software options at the end of the week.

Click once on chart to expand. (this is just part of the actual file.

Monday, November 30, 2015

Saturday, November 28, 2015

VDX Updates and Site Changes....11.28.15

The response to the Mosaic software offerings has been great.

I hope there's something in the mix that will help boost your bottom line and limit your risk exposure regardless of how or what you trade.

VDX has been the most popular file, followed by the M3 SPY. which can easily be converted to a delta neutral platform.

Thanks to all for the support. Going forward the Newsletter will focus much more on the nuances of the various Mosaic software platforms and less on general market dynamics.

This week's VDX updates reveal some weakness in index momentum. We're looking forward to Monday's Ponzo update to provide some guidance going forward.

The relatively good news is that IWM (Russell)(not shown) is outperforming both SPY and QQQ although it could be argued that's just momentum catch-up. Barron's is skeptical about IWM's resilience in this week's edition but only time will tell.

Thanksgiving week is historically bullish and some high profile signal services found themselves on the wrong end of Wednesday's and Friday's trades.

China (FXI) took a big hit end of this week and utilities (XLU) are once again kissing oversold levels.We're keeping a close eye on the transports (IYT). If they fall off the ledge again it does not bode well for the overall market.

I hope there's something in the mix that will help boost your bottom line and limit your risk exposure regardless of how or what you trade.

VDX has been the most popular file, followed by the M3 SPY. which can easily be converted to a delta neutral platform.

Thanks to all for the support. Going forward the Newsletter will focus much more on the nuances of the various Mosaic software platforms and less on general market dynamics.

This week's VDX updates reveal some weakness in index momentum. We're looking forward to Monday's Ponzo update to provide some guidance going forward.

The relatively good news is that IWM (Russell)(not shown) is outperforming both SPY and QQQ although it could be argued that's just momentum catch-up. Barron's is skeptical about IWM's resilience in this week's edition but only time will tell.

Thanksgiving week is historically bullish and some high profile signal services found themselves on the wrong end of Wednesday's and Friday's trades.

China (FXI) took a big hit end of this week and utilities (XLU) are once again kissing oversold levels.We're keeping a close eye on the transports (IYT). If they fall off the ledge again it does not bode well for the overall market.

Wednesday, November 25, 2015

M6 Real Time Special.....11.25.2015

The format of the M3 site will change starting next week so I can devote more time to managing the LQB hedge fund as well as fulfilling programming requests from various retail and professional traders.

The Newsletter will continue going forward and in response to requests from current readers I'm making several of the Mosaic software formats available for a limited time.

In observance of Black Friday we'll offer the brand new M6 real time model for $ 350...which will include a free copy of the MoDX (VDX) platform.

If you already own M6 end of day the upgrade to real time plus the MoDX file is $80.

The M6 RT and upgrade store buttons will appear starting tomorrow and are good for 10 days only.

Click once on the dashboards below to expand views.

Above is the real time momentum model..Below is the mean reversion version.

Inputs are at user discretion. A simple 2 click process allows users to switch between the 2 versions.

.

The Newsletter will continue going forward and in response to requests from current readers I'm making several of the Mosaic software formats available for a limited time.

In observance of Black Friday we'll offer the brand new M6 real time model for $ 350...which will include a free copy of the MoDX (VDX) platform.

If you already own M6 end of day the upgrade to real time plus the MoDX file is $80.

The M6 RT and upgrade store buttons will appear starting tomorrow and are good for 10 days only.

Click once on the dashboards below to expand views.

Above is the real time momentum model..Below is the mean reversion version.

Inputs are at user discretion. A simple 2 click process allows users to switch between the 2 versions.

.

Tuesday, November 24, 2015

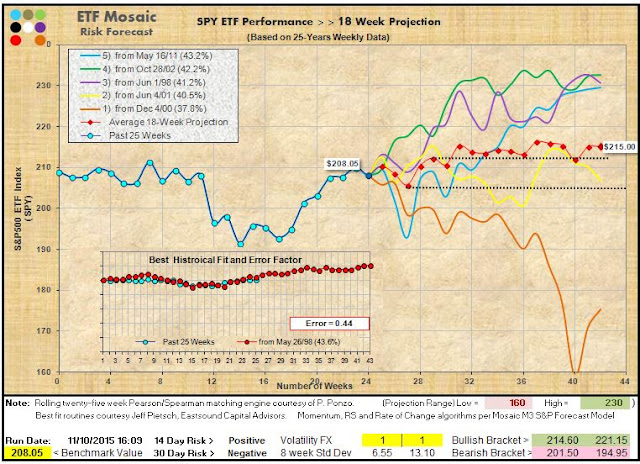

SPY Ponzo Update...11.24.15

This week's SPY forecast update has produced a positive skew into year's end (week 30). The mood seems welcoming to a rate hike, especially the financials. We are in the most bullish time of year and notwithstanding some major calamity the odds favor the bulls till year's end.

This is also the time of year when the Russell (IWM) is typically strong and normally outperforms SPY.

Tomorrow we'll see how IWM is doing and is likely to do going forward.

Don't forget the Mosaic software sale... limited time only.

This is also the time of year when the Russell (IWM) is typically strong and normally outperforms SPY.

Tomorrow we'll see how IWM is doing and is likely to do going forward.

Don't forget the Mosaic software sale... limited time only.

Monday, November 23, 2015

Changes to Mosaic format and Products...11.23.15

Recent discussions with my major fund investors have led to the decision to scale back future internet postings and instead focus on managing our hedge fund.

In response to the many inquiries about access to the software that drives these Mosaic posts we are making various programs available to users for a limited time. Periodic updates will be included with all products as will technical support via either email, phone or Skype for international users.

The current Mosaic product lineup is shown here.

For the real time M3 platform we have included a TLT (30 year treasuries) benchmarked version as an option for those that prefer to trader the fixed income realm.

Got questions? Drop me a line and I'll try and answer them.

For now here's The weekend update of the TLT VDX chart. With a rate hike all but guaranteed in December TLT and its 2X inverse TBT may be a fountain of opportunity.

Here's what the actual M3 TLT platform looks like. Easy toggle between MN and MR modes.

In response to the many inquiries about access to the software that drives these Mosaic posts we are making various programs available to users for a limited time. Periodic updates will be included with all products as will technical support via either email, phone or Skype for international users.

The current Mosaic product lineup is shown here.

For the real time M3 platform we have included a TLT (30 year treasuries) benchmarked version as an option for those that prefer to trader the fixed income realm.

Got questions? Drop me a line and I'll try and answer them.

For now here's The weekend update of the TLT VDX chart. With a rate hike all but guaranteed in December TLT and its 2X inverse TBT may be a fountain of opportunity.

Here's what the actual M3 TLT platform looks like. Easy toggle between MN and MR modes.

Saturday, November 21, 2015

VDX Updates for SPY, XLU, FXI and AGG....11.21.15

This week's VDX updates confirm the generally neutral tone of the markets in the short term.

The VDX charts from last week all resolved in the direction we forecast. SPY had a great run as did the seriously undersold XLU and AGG (total bonds).

Next week we can expect low volume and potentially higher volatility as Thanksgiving looms. Holiday season low volume days often produce higher ATRs (average trading range) than normal since the liquidity of market forces may not be available to play the counter-trend.

HFT's love those kind of days so be wary of attempting to buck the trend.

The VDX charts from last week all resolved in the direction we forecast. SPY had a great run as did the seriously undersold XLU and AGG (total bonds).

Next week we can expect low volume and potentially higher volatility as Thanksgiving looms. Holiday season low volume days often produce higher ATRs (average trading range) than normal since the liquidity of market forces may not be available to play the counter-trend.

HFT's love those kind of days so be wary of attempting to buck the trend.

Thursday, November 19, 2015

Momentum versus Mean Reversion,,Part 3....11.19.15

These screen shots look a lot like yesterday's, in fact they are taken from the same data...the difference is that in yesterday's post the results of each model reflect daily rotation into the top 2 ranked positions in equal dollar amounts.

Today's results reflect returns based on daily rotation into the top 1 ranked position only.

When the portfolio of inputs includes both market neutral issues such as XLU and negative beta issues such as SH (SPY inverse) the net results are consistently more attractive and risk buffered when the top 2 inputs are traded.

Today's results reflect returns based on daily rotation into the top 1 ranked position only.

When the portfolio of inputs includes both market neutral issues such as XLU and negative beta issues such as SH (SPY inverse) the net results are consistently more attractive and risk buffered when the top 2 inputs are traded.

Wednesday, November 18, 2015

Momentum Versus Mean Reversion..Part 2...11.18.15

Here's a slightly different spin on the MN versus MR theme, this time avoiding the volatility ETNs XIV and VXX. Surprisingly perhaps but both models do a good job of staying ahead of SPY in risk/reward with similar returns, linearity and maximum drawdowns.

I'm going to make this pair of models available for purchase to readers with an integrated real time data feed right after Thanksgiving....kind of a Black Friday Special.

I'm going to make this pair of models available for purchase to readers with an integrated real time data feed right after Thanksgiving....kind of a Black Friday Special.

Tuesday, November 17, 2015

Momentum Versus Mean Reversion Update....11.17.15

This week's update of the M6 momentum versus mean reversion models shows a dramatic difference in both total risk exposure and net returns.

Which one is best? Depends on your risk comfort level and long term investment goals.

My tactic.....rotate into the strongest model based on whether the technicals are in or out of paradigm.

Note: we are currently in paradigm with the MR model...

Which one is best? Depends on your risk comfort level and long term investment goals.

My tactic.....rotate into the strongest model based on whether the technicals are in or out of paradigm.

Note: we are currently in paradigm with the MR model...

Monday, November 16, 2015

SPY Ponzo Gets Volatile....11.16.15

This week's update of the SPY Ponzo forecast is unusual in the high degree of non-linearity (equals uncertainty). This is the jumpiest forecast we have seen in 2 years of monitoring SPY and it corresponds with the recent failure of the markets to conform to typical tracking metrics.

The M3 low latency approach has held up well over the past 2 months especially in the area of risk management, which is our avowed prime directive.

Going forward we're still forecasting negative for the year end.

.

The M3 low latency approach has held up well over the past 2 months especially in the area of risk management, which is our avowed prime directive.

Going forward we're still forecasting negative for the year end.

Sunday, November 15, 2015

VDX Updates for SPY, XLU, FXI...11.14.15

This week's VDX updates reveal the oversold levels in SPY, XLU and FXI.

The events in Paris on Friday may cause further decline but the fact that only one terrorist escaped may also mute the fear factor.

The events in Paris on Friday may cause further decline but the fact that only one terrorist escaped may also mute the fear factor.

Thursday, November 12, 2015

Wednesday, November 11, 2015

XLU Ponzo Update...11.11.15

Since 2 of our 3 default models include XLU as a component here's the current status of the XLU forecast...still positive and currently on a strong rebound after Friday's job's report swoon.

Tuesday, November 10, 2015

Mosaic Ponzo Charts for SPY and AGG.....11.10.15

This week we're showing both the SPY and AGG (total bond) ETF Ponzo-derived forecast charts.

Both forecasts remain positive from this point through year's end although AGG enthusiasm has dwindled a bit since last week's look,

AGG. which we have been tracking for a while waiting for a bottoming level, finally took a solid bounce this morning and continued strong into the close...a potential buy at this level.

Both forecasts remain positive from this point through year's end although AGG enthusiasm has dwindled a bit since last week's look,

AGG. which we have been tracking for a while waiting for a bottoming level, finally took a solid bounce this morning and continued strong into the close...a potential buy at this level.

Monday, November 9, 2015

Looking at Market Trends Through the M6 Lens...11.08.15

As the markets sell off today in the wake of poor China data and the expectation of a December rate hike (last week's good news becomes this week's bad news) I though I'd share a comparison of the M6 momentum (MM) versus mean regression (MR) models when looking at the broader market indices.

The portfolios are identical...SPY, QQQ, IWM, XLF, XLU and SH...the usual suspects in our market study models. Our goal today is simple to determine whether a momentum or mean reversion tactic (buy the 3 day high or buy the 3 day low) provides any advantage in terms of risk/reward.

We apply the usual .7% daily limit stop to all positions and we rotate into equal dollar amounts of the top 2 ranked positions at the end of each day.

Both models have superior linearity to the benchmark SPY as well as muck lower drawdowns.

Want to cover your bases? Here's an idea....trade both models simultaneously.

Tomorrow we'll look at the larger metrics panels of each model to help assess "in paradigm" versus "out of paradigm" conditions.

Things are continuing to evolve here and Mosaic and I will be offering the actual M6 software to regular readers in the near future so they can explore investment themes using the MM/MR skew to test their own ideas with alternate inputs.

The portfolios are identical...SPY, QQQ, IWM, XLF, XLU and SH...the usual suspects in our market study models. Our goal today is simple to determine whether a momentum or mean reversion tactic (buy the 3 day high or buy the 3 day low) provides any advantage in terms of risk/reward.

We apply the usual .7% daily limit stop to all positions and we rotate into equal dollar amounts of the top 2 ranked positions at the end of each day.

Both models have superior linearity to the benchmark SPY as well as muck lower drawdowns.

Want to cover your bases? Here's an idea....trade both models simultaneously.

Tomorrow we'll look at the larger metrics panels of each model to help assess "in paradigm" versus "out of paradigm" conditions.

Things are continuing to evolve here and Mosaic and I will be offering the actual M6 software to regular readers in the near future so they can explore investment themes using the MM/MR skew to test their own ideas with alternate inputs.

Saturday, November 7, 2015

VDX Updates for SPY, XLU, FXI and XLF...11.07.15

This week's VDX updates show that SPY is still overbought, XLU has crashed to long term support levels (down 3.5% on Friday) as a result of heightened expectations that the FED's will raise rates in December (now 70% per the CBOE Fed fund tracker). FXI is or is not on a verge of a breakout, and I've included XLF (SPYDR Financials) to further support expectations for a rate hike. Virtually all the large financials opened up 1% or more on Friday based on the bullish employment reports and the banks are savoring a rate hike that they can pass on to the public to help pump their bottom lines.

Thursday, November 5, 2015

M3 Signal Review....11.05.15

A bit of a momentum setback today although volume was very low and the general consensus is concern over Friday's job's report. The Fed Fund expectation of a rate hike in December has risen substantially in the past week based on hawkish comments by Yellen and other Fed governors.

Most technical analysts believe a .25% hike would have little or no longer term effect on the markets. In fact, the impact of a rate hike would most likely be bullish as it would reflect FED confidence in the economy's strength.

The M3 technical panel on the MN (momentum model) is now turning negative. Keep in mind that these declining signals (ALERT, Skew and TrendX) do not mean the markets are trending bearish ...rather it means the reliability of the signals is declining and positions should be scaled back or put in hiatus until the signal lines become more upslope.

Most technical analysts believe a .25% hike would have little or no longer term effect on the markets. In fact, the impact of a rate hike would most likely be bullish as it would reflect FED confidence in the economy's strength.

The M3 technical panel on the MN (momentum model) is now turning negative. Keep in mind that these declining signals (ALERT, Skew and TrendX) do not mean the markets are trending bearish ...rather it means the reliability of the signals is declining and positions should be scaled back or put in hiatus until the signal lines become more upslope.

Wednesday, November 4, 2015

Checking the AGG Ponzo Chart......11.04.15

We mentioned the long term bullish trend of the AGG total bond ETF a couple weeks ago. That was premised on relative weakness in the equities market and uncertainty about the FED's direction. Obviously we are in the modest of a roaring bull run and bonds have suffered as a result. Turns out that this scenario has played out before and the Ponzo forensics are forecasting some more movement to the downside before the next leg up. So far that's what we are seeing but once a hairy bottom pattern sets up on the 130 minute bars AGG may be in a nice ride up.

Tuesday, November 3, 2015

XLU Ponzo Forecast....11.03.15

As promised yesterday here's the 18 week outlook for XLU (SPYDR Utilities). This is one of the best looking bullish forecasts I've run recently and since its an integral component of several Mosaic M3 models I tend to focus considerable time and energy analyzing potential scenarios.

Monday, November 2, 2015

SPY Ponzo Turns Positive...11.02.15

This week's update of the Mosaic/Ponzo chart has a much improved best historical fit.

The average of best fit scenarios (red line) remains negative going into year's end (week 32) and with the current uber overbought status of both SPY and QQQ we are looking for some measure of pullback before initiating any new at-the-money positions.

Tomorrow we'll look at the XLU Ponzo chart.. Our longer term portfolio has initiated an accumulation mode on XLU and there's some strong technical arguments to support that decision.

The average of best fit scenarios (red line) remains negative going into year's end (week 32) and with the current uber overbought status of both SPY and QQQ we are looking for some measure of pullback before initiating any new at-the-money positions.

Tomorrow we'll look at the XLU Ponzo chart.. Our longer term portfolio has initiated an accumulation mode on XLU and there's some strong technical arguments to support that decision.

Sunday, November 1, 2015

VDX Updates for SPY, XLU, FXI.....11.01.15

SPY is working off overbought status while XLU has now retraced back down to oversold levels after an impressive run up. FXI is net neutral at this point although BABA (not shown) has been a powerhouse of bullish momentum. As earnings continue to report we are now entering the historically best bullish 5 months of the year. Tech (QQQ) is clearly outperforming SPY, which is typically a bullish indicator. The skew is therefore positive near term.

Subscribe to:

Posts (Atom)