Peter Ponzo is an interesting financial academician that most traders have never heard of. Nevertheless he has produced a huge body of market research over many years of tenure and the Time machine is one of his most provocative studies. It looks back X years and searches for price patterns that match a current time increment. For example, looking at the recent 25 week price pattern what are the likelihoods of price patterns for the next 25 weeks based on what's happened previously when the current 25 week pattern has presented. Huh?

Just read that over a couple times and you'll get the idea.

We looked at SPY the other day and here's the view for QQQ.>>. Note the odds for each scenario.

The Time Machine doesn't tell you which scenario is going to transpire but simply provides a "what if" odds snapshot of volatility and timing.

Thursday, October 30, 2014

Wednesday, October 29, 2014

A Strategy for Buying the Close......10.29.14

The M3 platform performance is based on buying or selling the close when rankings shift.

Below is a setup I have used for years when trying to find a good buy point (we'll discuss exits in a later post). This setup frequently presents itself and helps to navigate the Market on Close order flow and also plays off a commonly used tactic of prop shops to pump and dump into the close of uptrending days.

The signals lines are an 8 period high and an 8 period low based on 3 minute bars. Virtually any trading platform has the ability to create this simple template. We then simply watch price action on this channel for the last 15 minutes of the day, Our alert comes when price falls below the lower channel line and the buy signal triggers when price moves up into the channel.

There's not a big window of opportunity here, especially on high volume days when things are moving quickly but this simple little tool can frequently save $ in lieu of a market on close order.

In the example of XIV shown below the signal allowed a buy at $34.64 instead of the MOC price of 34.97...a savings of .33 or almost 1%. Every penny counts in this game and a little attention to time of day and the 3 minute 8/8 channel may put a few more pennies in your pocket than the other guy's.

Below is a setup I have used for years when trying to find a good buy point (we'll discuss exits in a later post). This setup frequently presents itself and helps to navigate the Market on Close order flow and also plays off a commonly used tactic of prop shops to pump and dump into the close of uptrending days.

The signals lines are an 8 period high and an 8 period low based on 3 minute bars. Virtually any trading platform has the ability to create this simple template. We then simply watch price action on this channel for the last 15 minutes of the day, Our alert comes when price falls below the lower channel line and the buy signal triggers when price moves up into the channel.

There's not a big window of opportunity here, especially on high volume days when things are moving quickly but this simple little tool can frequently save $ in lieu of a market on close order.

In the example of XIV shown below the signal allowed a buy at $34.64 instead of the MOC price of 34.97...a savings of .33 or almost 1%. Every penny counts in this game and a little attention to time of day and the 3 minute 8/8 channel may put a few more pennies in your pocket than the other guy's.

Tuesday, October 28, 2014

What's Next?...Ask Ponzo.....10.28.14

The high volatility markets have given me a few new grey hairs recently so I thought it best to consult the Ponzo Time Machine to see what might be in store for SPY since my main money maker M3 is based on a beta spectrum of SPY.

The previous post of the Time Machine showed an 11% chance of an October decline to 182, which turned out to be dead on. Here's the current prognostication>>>>.

A close look at the crystal ball suggests a 25% chance of a return to previous October lows in the near term and a 20% chance longer term.

Now these are just odds based of what's happened over the past 50 years when the current 25 week pattern presents itself. What's interesting to me is the lack of a market collapse scenario, the prospects of which are becoming more frequent.

M3 went to XIV today in support of a near term bullish mood. The FOMC could derail that tomorrow but in the balance the odds favor the bulls....just keep those stops ready to fire.

The previous post of the Time Machine showed an 11% chance of an October decline to 182, which turned out to be dead on. Here's the current prognostication>>>>.

A close look at the crystal ball suggests a 25% chance of a return to previous October lows in the near term and a 20% chance longer term.

Now these are just odds based of what's happened over the past 50 years when the current 25 week pattern presents itself. What's interesting to me is the lack of a market collapse scenario, the prospects of which are becoming more frequent.

M3 went to XIV today in support of a near term bullish mood. The FOMC could derail that tomorrow but in the balance the odds favor the bulls....just keep those stops ready to fire.

Monday, October 27, 2014

Waiting on FOMC....10.27.14

It was a technically weak day with subdued volume. The Dow and QQQ managed to eke out small gains, while SPY finished down. The NYAD range was narrow and bearish in the face of a number of high profile market analysts' forecasts for a surge in the US dollar and the collapse of oil prices and emerging markets equity. The first catalyst for such a scenario would be cessation of the FED's QE program, which has already been radically curtailed this year. In this regard there's likely to be a lot more interest in this Wednesday's FOMC meeting than usual. On the other side of the coin we're coming up on the end of the month and the typical bullish rebalancing that accompanies that time frame. The continued volatility in the markets can be unnerving and frustrating and in such times its often best to just stick with a pre-formed plan for risk management and diligently exercise money management stops when hit.

Friday, October 24, 2014

Controlling Risk with Stops....10.24.14

Most traders (and investors) hate to give back recent market gains and at the same time want some sort of hedge against the drawdowns accompanying the recent market mini-crash. Option spreads is one approach to this end but in the M3 model we use both an Auto-Stop, which filters out trades with a low probability of follow through, and discretionary stop-loss stops which seek to retain gains and mitigate significant losses. We could also add a trailing stop but that feature is really most appropriate for day traders. The discretionary stops that we use are simply to establish a risk benchmark and, since we are not investment advisors, are shown simply as one example of a risk containment strategy. In live market conditions traders can apply the posted discretionary stops, modify or ignore them completely. Actual trading returns will vary accordingly. The Auto-Stop feature is turned on by default and its filter will always be factored into the posted model returns.

Here are the 3 month returns for various M3 risk models>>>>>>>

Also see previous post on this subject.

Returns with both Auto-Stop and discretionary stops exercised.

Returns with only Auto-Stop on.

Returns with no Auto-Stop and no discretionary stops,

Here are the 3 month returns for various M3 risk models>>>>>>>

Also see previous post on this subject.

Returns with both Auto-Stop and discretionary stops exercised.

Returns with only Auto-Stop on.

Returns with no Auto-Stop and no discretionary stops,

Thursday, October 23, 2014

Back UP..Again...10.23.14

The famous volatility of October lives on. Down 153 yesterday, up 253 today. Hopes for revival of the European markets and good earnings from CAT and MMM propelled the markets up although we closed near the lows of the day. Trying to tactically play this market means either being whipsawed more than usual or accepting a relatively high level of risk if the Trap Door opens again.

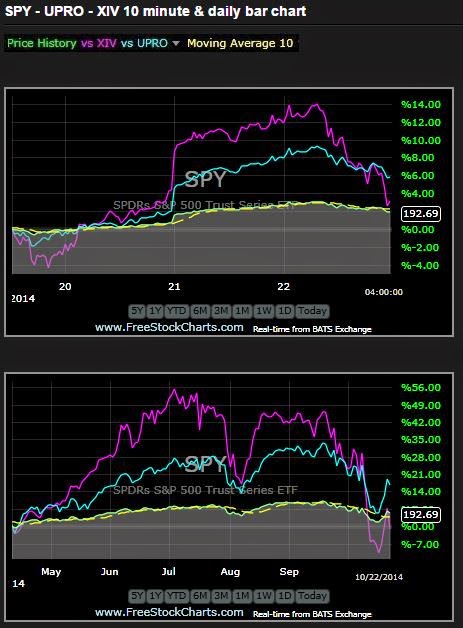

Interestingly, UPRO has better relative strength and momentum than XIV as can be seen from the charts below. M3 has ranked it higher than XIV for the past 3 days.

Interestingly, UPRO has better relative strength and momentum than XIV as can be seen from the charts below. M3 has ranked it higher than XIV for the past 3 days.

Wednesday, October 22, 2014

? Resolved Today....10.22.14

The apparent clear sailing markets we saw yesterday reversed back to a selling mode with the Dow giving up a53 points and the VIX spiking 11%. Yahoo was the big winner today and managed to hold much of its gains into the close. Other issues weren't as fortunate.

M3 is back in cash after our UPRO position was stopped out fpr a .75% loss. We're still holding onto nice gains for the month however and patience is the watchword. We're looking for things to stabilize and improve as we approach month's end....only a week away...as long as some big names don't deliver really awful earnings reports.

M3 is back in cash after our UPRO position was stopped out fpr a .75% loss. We're still holding onto nice gains for the month however and patience is the watchword. We're looking for things to stabilize and improve as we approach month's end....only a week away...as long as some big names don't deliver really awful earnings reports.

Tuesday, October 21, 2014

Clear Sailing?...10.21.14

M3 is liking this market for bullish momentum. Per the SPY TrendX there's still plenty of potential upside left and a revisit of the previous highs is not out of the question as long as earnings keep coming in like Apple's, Schwab and and GE. A few party poopers like IBM, MCD, NFLX, etc. could spoil the party but those results appear to be the exception rather than the rule. If the Europeans get moving with a stimulus package then EEM and EFA will be the place to be...at least short term.

For now XLE is making up lost ground quickly and the Qs are surging ahead (see VEGA below).

For now XLE is making up lost ground quickly and the Qs are surging ahead (see VEGA below).

Monday, October 20, 2014

Signals are Green...10.20.14

Despite the weight of IBM's miss on the Dow the markest were in a positive mood and based on Apple's glowing after hours earnings report the odds are for a full press forward tomorrow.

Given the apparent discounting of geo-political news the markets are going to be fickle as earnings trickle out. We've still got 10 days left in October so the fun may not be over yet but for now it appears that SPY has bounced from the lows and is headed back up.

The Vixen chart below illustrates the change in momentum over the past 3 days.

Given the apparent discounting of geo-political news the markets are going to be fickle as earnings trickle out. We've still got 10 days left in October so the fun may not be over yet but for now it appears that SPY has bounced from the lows and is headed back up.

The Vixen chart below illustrates the change in momentum over the past 3 days.

Friday, October 17, 2014

Earnings Catalyze Bounce...10.17.14

Good earnings from GE and UNH helped propel the markets higher. There were a few waves of selling mid session but the NYAD closed at a bullish 2.00 and the VIX tumbled over 12%.

Monday we'll see how much of today's action was short covering driven as APPLE and IBM report.

The SPY Vixen chart below doesn't really reflect the scale of today's 263 point (1.6%) DOW move...that's because the range moves over the past few days have been so far above normal.

The TrendX chart on the right side panel now looks optimistic for SPY....just keep those earnings coming in upbeat...or else..

M3 goes live this weekend.

Subscribers will receive the login password via email before the Monday open.

Monday we'll see how much of today's action was short covering driven as APPLE and IBM report.

The SPY Vixen chart below doesn't really reflect the scale of today's 263 point (1.6%) DOW move...that's because the range moves over the past few days have been so far above normal.

The TrendX chart on the right side panel now looks optimistic for SPY....just keep those earnings coming in upbeat...or else..

M3 goes live this weekend.

Subscribers will receive the login password via email before the Monday open.

Thursday, October 16, 2014

A Pause, Maybe a Bottom....10.16.14

The markets started out ugly with the NYAD at .08, the lowest level in 8 months and usually a level associated with exhaustion selling...unless we're in a bear market and then all bets are off.

The SPY was struggling to make up ground today and 10 minutes pre-close it was in the green. It didn't hold and there was a usual mini-selloff in the last 30 minutes.....although the NYAD was actually rising.

All sorts of technical conflicts in the current market milieu make forecasting a tough game. For now we'll just follow the M3 signals...VXX was stopped out yesterday at 41.90 and we're now in cash although the M3 signal is bearish. A lot of earnings tomorrow before the bell, including GE. Those reports will likely set the tone for the day and perhaps into next week.

The SPY was struggling to make up ground today and 10 minutes pre-close it was in the green. It didn't hold and there was a usual mini-selloff in the last 30 minutes.....although the NYAD was actually rising.

All sorts of technical conflicts in the current market milieu make forecasting a tough game. For now we'll just follow the M3 signals...VXX was stopped out yesterday at 41.90 and we're now in cash although the M3 signal is bearish. A lot of earnings tomorrow before the bell, including GE. Those reports will likely set the tone for the day and perhaps into next week.

Wednesday, October 15, 2014

Second Trap Door Opens...10.15.14

Dow down 400, VIX up 34%...that was the scenario in early going this morning. NOW everyone's worried about Ebola? No faith in the CDC? Or maybe the rubber finally hit the road for the risk intolerant as volume ballooned and the advance /decline line retreated to the sub teen levels.

There was considerable recovery into the close although all the major indices closed in the red.

Is the worst over? I suspect the slew of upcoming earnings reports may answer that question.

Meanwhile, the M3 site has just about been revamped to reflect the 6 input Long/short format and we're about to go active this weekend after some final testing. It was a wild ride with VXX today (described on the M3 site update today) and we've managed to book some nice gains with little risk.

There was considerable recovery into the close although all the major indices closed in the red.

Is the worst over? I suspect the slew of upcoming earnings reports may answer that question.

Meanwhile, the M3 site has just about been revamped to reflect the 6 input Long/short format and we're about to go active this weekend after some final testing. It was a wild ride with VXX today (described on the M3 site update today) and we've managed to book some nice gains with little risk.

Tuesday, October 14, 2014

A Little Recovery....10.14.14

We had a little relief from the selling although oil continues to slide.

Looking at the TrendX chart in the right side panel shows where we are vis-a-vis critical support. Technically the next leg should be up and there haven't been a lot of earnings report to derail that prognosis. That being said....we could could go anywhere at this point and once the markets get rolling we'll either see a return to SPY 200 or a collapse to the sub 180 levels....Sorry, not much help at this point.

M3 did a great job to catching the Monday 10% pump in VXX and hit the target exit stop today at 39.36, so the model is back in cash.

We continue to see an afternoon high volume accelerating meltdown in the markets and until that subsides the trend will remain in a negative mood. One day at a time and watch the stops.

Looking at the TrendX chart in the right side panel shows where we are vis-a-vis critical support. Technically the next leg should be up and there haven't been a lot of earnings report to derail that prognosis. That being said....we could could go anywhere at this point and once the markets get rolling we'll either see a return to SPY 200 or a collapse to the sub 180 levels....Sorry, not much help at this point.

M3 did a great job to catching the Monday 10% pump in VXX and hit the target exit stop today at 39.36, so the model is back in cash.

We continue to see an afternoon high volume accelerating meltdown in the markets and until that subsides the trend will remain in a negative mood. One day at a time and watch the stops.

Monday, October 13, 2014

Another Leg Down...10.13.14

We did get a VXX confirmation buy signal this morning on M3 and ended up entering at Friday's closing price. The VXX subsequently rose over 10% today as SPY broke technical support at 190 and picked up downside momentum into the close. The SPY/SH Vixen chart says it all (below).

The VIX was up 9% 15 minutes before the close today and then literally melted up an amazing 7+% in the last 12 minutes to ultimately close up almost 17% for the day.

We're in a no-man's land technically right now although I'm looking for a possible reversal around SPY 185...whether that will hold is anybody's guess. M3 has VXX in #1 slot.

The VIX was up 9% 15 minutes before the close today and then literally melted up an amazing 7+% in the last 12 minutes to ultimately close up almost 17% for the day.

We're in a no-man's land technically right now although I'm looking for a possible reversal around SPY 185...whether that will hold is anybody's guess. M3 has VXX in #1 slot.

Friday, October 10, 2014

Thursday, October 9, 2014

Yikes! - Part 2....10.9.14

Yesterday happy face became a real sour puss today as the Dow tumbled 334 points and the VIX rose 24% reaching the highest level since February. Worries over instability in the Eurozone were supposedly the catalyst for the selloff and XLE took a particularly big hit.

The Beta model has been merged into M3 to produce a new M3 platform that is a true Long/Short model. Today's update in the new format is posted on the M3 site, Login Tab.

The lack of a Long signal yesterday turned out to be a good thing today and...no surprise...the model is remaining in cash for tomorrow.

M3 site tabs will also be updated in the upcoming week or so to reflect the new 6 ETF/ETN mix.

The Beta model has been merged into M3 to produce a new M3 platform that is a true Long/Short model. Today's update in the new format is posted on the M3 site, Login Tab.

The lack of a Long signal yesterday turned out to be a good thing today and...no surprise...the model is remaining in cash for tomorrow.

M3 site tabs will also be updated in the upcoming week or so to reflect the new 6 ETF/ETN mix.

Wednesday, October 8, 2014

FOMC Speaks...Market Reacts...10.8.14

A boomerang day after the market dropped sharply at the open then rallied like a runner on steroids right into the close. Tomorrow we'll get a better perspective on how much of today's pop was short covering protection.

I'm working on the final integration of the Beta and M3 models to produce a new version of M3 that will be a true Long/Short model...without ever having to actually assume a short position. The new M3 will be both simpler and more sophisticated than the previous version.

Here's today's closing view of the main panel>>>>>

I'm working on the final integration of the Beta and M3 models to produce a new version of M3 that will be a true Long/Short model...without ever having to actually assume a short position. The new M3 will be both simpler and more sophisticated than the previous version.

Here's today's closing view of the main panel>>>>>

Tuesday, October 7, 2014

Yikes!...10.7.14

Not a good day as the indices all fell at least 1.25% and cratered into the close on accelerating volume, There's pretty good evidence that we're in a sustained downtrend and are currently on a critical ledge of support. A breakdown beyond these levels could take SPY down to 185 (10 points away) so this is not a time to get frisky with false bottoms.

Monday, October 6, 2014

Follow Through Fails.....10.6.14

A nasty pop and drop at the open and ended the day with all the major indices in the red.

The markets seem unable to shake off the blahs and the small caps (as in IWM) are showing particular weakness.

The Beta STOPS post was posted on Sunday. Scroll down to check it out.

Beta did flash a Buy based on the rankings at the open (as did M3), but. following the posted comments on the M3 site this morning XIV maintained a steady downslope all day long and never evidenced a positive buying signal other than the rankings. All the other dashboard metrics were red.

The markets seem unable to shake off the blahs and the small caps (as in IWM) are showing particular weakness.

The Beta STOPS post was posted on Sunday. Scroll down to check it out.

Beta did flash a Buy based on the rankings at the open (as did M3), but. following the posted comments on the M3 site this morning XIV maintained a steady downslope all day long and never evidenced a positive buying signal other than the rankings. All the other dashboard metrics were red.

Sunday, October 5, 2014

The Power of Stops.....10.5.14

Here's a quick look at alternative 90 day outcomes for the new Beta model using various levels of stops.

Left to right...Auto-Stop & Cash stops ON; Auto-Stop only and No stops, just the rankings.

The impact of using active stops becomes quite apparent in this light.

What to do if you're around in during market hours to monitor price breakdown to stop levels?

Most trading platform have an ALERT or conditional order feature that lets you set a stop price for auto-execution if hit.

Are there opportunity costs involved?

There have been in the past and it depends on your risk profile. I'm in the capital preservation/drawdown mitigation camp and for me stops provide a margin of safety that I feel comfortable with.

Will stops sometimes get blown through?

On dramatic news days it can happen and has. Using the rankings as a guide helps provide a perspective on underlying market momentum and, as we saw last week, we were able to use the cash stop to exit VXX for a 1% loss ahead of the day it declined over 6%.

How are stops calculated?

The Auto-Stop is based on a 2 day versus 5 day Coppock curve.

The cash stops are based on a 70% 5 day ATR (average trading range) calculation times a volatility factor based on the VIX premium (not the XIV premium).

Left to right...Auto-Stop & Cash stops ON; Auto-Stop only and No stops, just the rankings.

The impact of using active stops becomes quite apparent in this light.

What to do if you're around in during market hours to monitor price breakdown to stop levels?

Most trading platform have an ALERT or conditional order feature that lets you set a stop price for auto-execution if hit.

Are there opportunity costs involved?

There have been in the past and it depends on your risk profile. I'm in the capital preservation/drawdown mitigation camp and for me stops provide a margin of safety that I feel comfortable with.

Will stops sometimes get blown through?

On dramatic news days it can happen and has. Using the rankings as a guide helps provide a perspective on underlying market momentum and, as we saw last week, we were able to use the cash stop to exit VXX for a 1% loss ahead of the day it declined over 6%.

How are stops calculated?

The Auto-Stop is based on a 2 day versus 5 day Coppock curve.

The cash stops are based on a 70% 5 day ATR (average trading range) calculation times a volatility factor based on the VIX premium (not the XIV premium).

Friday, October 3, 2014

Moving On Up.....10.3.14

Substantial technical improvement in the markets today and a bounce off our TrendX support line (see right side panel).

Beta is looking at cash for Monday having been stopped out of VXX yesterday for a 1% loss...BUT avoiding the 6% drop in VXX today. The stops have made a tremendous difference in total return and this weekend we'll look at performance with and without the cash stops and the auto-stop in place. It may make you a believer.

Beta is looking at cash for Monday having been stopped out of VXX yesterday for a 1% loss...BUT avoiding the 6% drop in VXX today. The stops have made a tremendous difference in total return and this weekend we'll look at performance with and without the cash stops and the auto-stop in place. It may make you a believer.

Thursday, October 2, 2014

Is it Over?.......10.2.14

Well, maybe. Here we are 5 minutes before the close. The indices are green, but only a few cents each and the NYAD is holding at 1.10, much better than we've seen for days.

The SPY-X has been renamed "Beta" to better reflect its inherent strategy and, encouraging for the bulls, our VXX position was stopped out at the target 31.57....generating a 1% loss for the day and putting us in cash until we either get a re-entry signal on the VXX or some other element of the model pops into first slot.

Despite today's loss Beta has done exceptionally well over the past few weeks while M3 has dithered in cash. Going forward the decision I'm faced with is whether or not to simply abandon M3 and focus on Beta. The use of the inverse ETFs,ETNs in Beta does give it the ability to be used in IRA and trust accounts where short positions are not permitted so there is a clear advantage and potential increased profitability if we simply adopt the Beta format. I'm still working on it.

The SPY-X has been renamed "Beta" to better reflect its inherent strategy and, encouraging for the bulls, our VXX position was stopped out at the target 31.57....generating a 1% loss for the day and putting us in cash until we either get a re-entry signal on the VXX or some other element of the model pops into first slot.

Despite today's loss Beta has done exceptionally well over the past few weeks while M3 has dithered in cash. Going forward the decision I'm faced with is whether or not to simply abandon M3 and focus on Beta. The use of the inverse ETFs,ETNs in Beta does give it the ability to be used in IRA and trust accounts where short positions are not permitted so there is a clear advantage and potential increased profitability if we simply adopt the Beta format. I'm still working on it.

Wednesday, October 1, 2014

JAWS Pattern and SPY-X Update....10.1.14

A truly ugly first day of the month contrary to the technical forecasts of some well respected quants.

The JAWS pattern on the SPY/SH Vixen chart below was a dramatic reflection of the day's bearish action which saw the DOW plummet 238 points and the other indices display proportional weakness.

We're now solidly in oversold territory but the close was weak and its not clear what the impetus might be to pull the markets out of the current funk.

While M3 has been sitting quietly in cash throughout the slide the new SPY-X model has been booking some nice gains and we continue to refine the capabilities of the platform to retain our gains and not dibble them away to the whip-saw drawdowns. The stated cash stops have fired on several occasions and, combined with the re-entry stops, have delivered (or saved) a 4.5% short term gain.

The JAWS pattern on the SPY/SH Vixen chart below was a dramatic reflection of the day's bearish action which saw the DOW plummet 238 points and the other indices display proportional weakness.

We're now solidly in oversold territory but the close was weak and its not clear what the impetus might be to pull the markets out of the current funk.

While M3 has been sitting quietly in cash throughout the slide the new SPY-X model has been booking some nice gains and we continue to refine the capabilities of the platform to retain our gains and not dibble them away to the whip-saw drawdowns. The stated cash stops have fired on several occasions and, combined with the re-entry stops, have delivered (or saved) a 4.5% short term gain.

Subscribe to:

Posts (Atom)