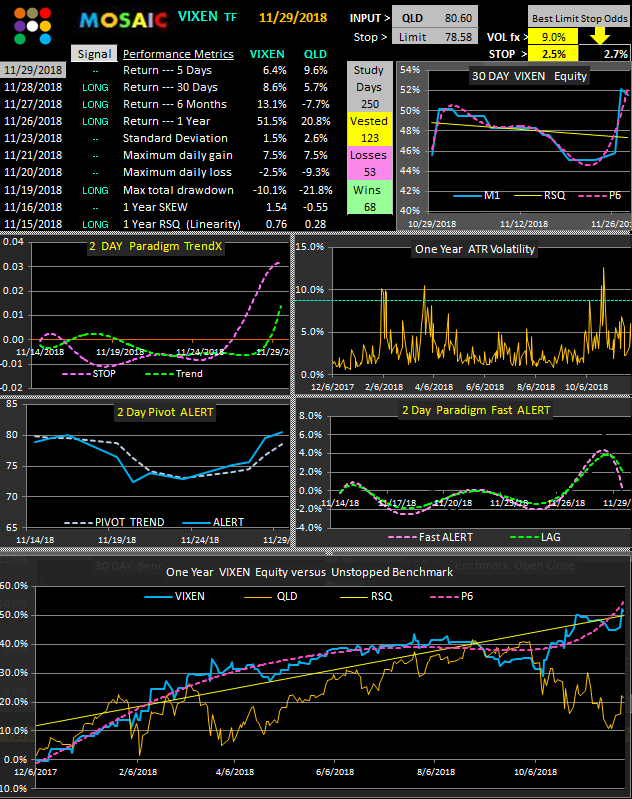

Delta Neutral keeps chugging along although we did not get filled today. In the meantime here's a look (below) at the VIXEN version of trading QLD (the bullish side of our DN model). Returns are similar to the DN model but drawdowns and linearity are lower. So why buy the risk of a directional VIXEN trade when you can make similar returns with much less risk exposure using the DN ?

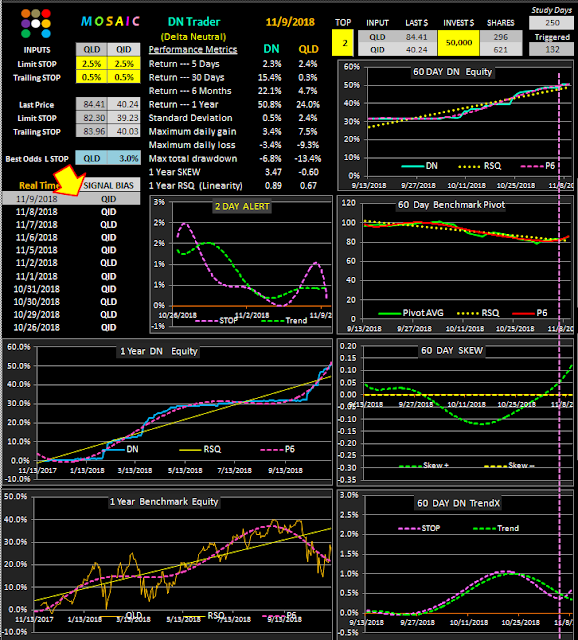

Note that the 2 Day Alert and TrendX have gone divergent in the DN model while the skew has blown through resistance. We are looking for a near term paradigm shift as a result.

DN signal bias has shifted to QID.

Thursday, November 29, 2018

Wednesday, November 28, 2018

Delta Neutral Update....& Yesterday's metrics......11.28.18

Yesterday's post was a test to see who was paying attention. Robert, Keith, Sam and a few others noted the apparently huge gains relative to the historical equity curve shown over the last few years.

And that's because I turned the TOP # from 2 (delta neutral) to 1 (trading only the bias signal...either QLD or QID, not both simultaneously). Yes...the delta neutral model has had a very good run with the QLD/QID bias trade...it doesn't fare as well with the SPY, Russell or Diamonds x2 ETFs.

Nevertheless, hindsight is a great teacher and the delta neutral bias algorithm, which is a multi variable filter based on rate of change, pivot momentum and the SMI Ergodic signal (resident on the Freestockcharts.com site) has done well although there are significant lull periods and stops have to be carefully executed.

For tonight we return to the Lazy Man delta neutral model and metrics. No excitement here.

And that's because I turned the TOP # from 2 (delta neutral) to 1 (trading only the bias signal...either QLD or QID, not both simultaneously). Yes...the delta neutral model has had a very good run with the QLD/QID bias trade...it doesn't fare as well with the SPY, Russell or Diamonds x2 ETFs.

Nevertheless, hindsight is a great teacher and the delta neutral bias algorithm, which is a multi variable filter based on rate of change, pivot momentum and the SMI Ergodic signal (resident on the Freestockcharts.com site) has done well although there are significant lull periods and stops have to be carefully executed.

For tonight we return to the Lazy Man delta neutral model and metrics. No excitement here.

Tuesday, November 27, 2018

Delta Neutral Update.....11.27.18

Despite the market's gyrations and volatility swings the delta neutral model has performed well.

Regular Mosaic users know that this is strictly a rules based data driven strategy that actually works best in periods of elevated volatility such as we are currently experiencing. It doesn't do well in periods when the VIX is in the 10-12 range, but we take what it gives us with obvious risk considerations.

Regular Mosaic users know that this is strictly a rules based data driven strategy that actually works best in periods of elevated volatility such as we are currently experiencing. It doesn't do well in periods when the VIX is in the 10-12 range, but we take what it gives us with obvious risk considerations.

Thursday, November 15, 2018

Delta Neutral Update....11.15.18

An intra day turnaround turned out well for our DN model. We did not get stopped out in the long side in the morning session as the market dropped but did get stopped out on the short side in the afternoon session and were able to book a net .5% gain for the day. Volatility continues to decline per the ATR and Open//Close skew.

Wednesday, November 14, 2018

Delta Neutral Update....11.14.18

We're seeing a little divergence in the TrendX signal so volatility mat taper off for a bit. We've also see this in the best odds limit stop which is auto calculated based on the ATR and open/close spread, among other metrics. This value has sunk from 3.2 to 2.8 over the past 7 days.

Once again, a strong open led to a gradual price erosion throughout the day and Maxine Waters threats to current financial regs singularly led to the reversal in the financials today. Definitely a rampant risk environment and we're sticking with the Lazy Man delta neutral model for now.

Once again, a strong open led to a gradual price erosion throughout the day and Maxine Waters threats to current financial regs singularly led to the reversal in the financials today. Definitely a rampant risk environment and we're sticking with the Lazy Man delta neutral model for now.

Tuesday, November 13, 2018

Delta Neutral Update....11.13.18

A little lull in volatility today as traders evaluate the risk environment and a possible pullback to recent lows...or worst.

Delta Neutral still looks like an easy way to book some coin and still sleep at night without worry of overnight big moves.

Yes...there are opportunity costs that may be lost but our prime directive is risk management and capital preservation and out QLD/QID model has worked out well so far.

.

Delta Neutral still looks like an easy way to book some coin and still sleep at night without worry of overnight big moves.

Yes...there are opportunity costs that may be lost but our prime directive is risk management and capital preservation and out QLD/QID model has worked out well so far.

.

Monday, November 12, 2018

Delta Neutral Update....11.12.18

And that was a perfect delta neutral day!!!! No risk and a nice one day pop.

Looks like more to come based on the TrendX and Skew.

Looks like more to come based on the TrendX and Skew.

Sunday, November 11, 2018

Delta Neutral looks best for now....11.11.18

This week could get squirrelly as earnings are not showing a lot of promise. Our QQQ leveraged long/short ETFs have so far provided us with a nice linear equity curve with only modest risk exposure and for the short term this is our default trading venue.

Thursday, November 8, 2018

QLD in cash....11.08.18

We followed our own advice re the downslope TrendX and avoided today's swoon. In the market's typical bizarro behavior both the SPY and the VXX were red today, reflecting most probably the changing paradigm in the current VIX term structure and the overdue inherent decay function of VXX. Should have been short...I know....just can't win em all.

Wednesday, November 7, 2018

Tuesday, November 6, 2018

VXX signal still long....11.06.18

The VIXEN is still long the VXX and it really all hinges on the election results so best to hedge our bets and just stand aside on this one as the technicals embedded in the signal are essentially meaningless for tomorrow.

As mentioned yesterday the TrendX is not supportive of the current signal and old time VIXEN watchers know that means trade small or not at all.

As mentioned yesterday the TrendX is not supportive of the current signal and old time VIXEN watchers know that means trade small or not at all.

Monday, November 5, 2018

VXX signal......11.05.18

We bailed on VXX today when it crossed the zero line in anticipation of market strength ahead of the elections tomorrow. Wednesday morning will be interesting to say the least.

We're trading small for now until the TrendX turns more promising.

We're trading small for now until the TrendX turns more promising.

Sunday, November 4, 2018

VXX signal + SPLV Lazy Man signal...11.02.18

Pre-election jitters and the break down of Chinese trade talks may have been the catalyst for Friday's weakness, which the VXX Vixen predicted. Here's the outlook for Monday...........

Also below note the little Lazy Man ultra low risk model using SPLV (the SPY low volatiity ETF). Only 96 trades over the last 250 trading days but an impressive win/loss ratio. You can sleep at night with this one and a big component of my own IRA account.. Note that this is a mean reversion model since we are actually tracking the volatility component of the ETF.

Also below note the little Lazy Man ultra low risk model using SPLV (the SPY low volatiity ETF). Only 96 trades over the last 250 trading days but an impressive win/loss ratio. You can sleep at night with this one and a big component of my own IRA account.. Note that this is a mean reversion model since we are actually tracking the volatility component of the ETF.

Thursday, November 1, 2018

VXX has new Long signal....11.01.18

After a tepid market rally over the last 2 days Apple's poor showing may return us to the downside. At the close VXX was signalling long and is now up 1.5% in after hours trading.

The paradigm TrendX is turning up both medium and fast formats so the odds look favorable.

The paradigm TrendX is turning up both medium and fast formats so the odds look favorable.

Subscribe to:

Posts (Atom)