Friday in end of the quarter and has been down 14 of the last 18 years. Just a footnote for tomorrow.

Se readers wanted more on XLE so here's Zero Hedges link to the Goldman fiasco and the current 65 minute bar chart with Bollinger Bands and the current signal via VPR for tomorrow.(OUT).

For those who want to venture into the world of oil X3 ETFs ...here's the DN report on DIG versus DUG which was sent to me by a Mosaic DN user who only trades the energy markets.

Before you pile into this one be aware that daily volume is limited...and VOLATILE.!!

Thursday, September 29, 2016

Wednesday, September 28, 2016

XLE Blows UP...09.28.16

I've made some comments recently about how news is proving to be a contrarian indicator. Case in point XLE (the SPDR Energy sector ETF) which was widely panned yesterday as having virtually no chance of positive momentum into the Fall. All that changed in a flash midday today when OPEC announced a tentative agreement to curb production beginning in November. That news had the effect to pump XLE up 4.5% on massive volume as short sellers scrambled to cover.

What's the takeaway?

As a friend Lee Bohl says, "Ignore the news and follow the charts".

And in that regard what I find interesting is that the MVP mean regression model VPR. which has XLE as one of its focus ETFs, did a fine job of directing us into that trade last night.

Below note the following charts>>

MVP study of XLE (double 9.28 dates are a result of updating after hours)

130 minute bar chart of XLE with Bollinger Bands, RSI2 and MACD histogram.

VDX study as of today's close

Note: Delta Neutral update file is only available until the end of the month.

What's the takeaway?

As a friend Lee Bohl says, "Ignore the news and follow the charts".

And in that regard what I find interesting is that the MVP mean regression model VPR. which has XLE as one of its focus ETFs, did a fine job of directing us into that trade last night.

Below note the following charts>>

MVP study of XLE (double 9.28 dates are a result of updating after hours)

130 minute bar chart of XLE with Bollinger Bands, RSI2 and MACD histogram.

VDX study as of today's close

Note: Delta Neutral update file is only available until the end of the month.

Tuesday, September 27, 2016

SPY vs QQQ Possibilities....09.27.16

As a likely bullish trend emerges this might be a good time to look at SPY vs QQQ.

QQQ is at new highs and is leading the SPY in relative momentum....which is characteristic of true rallies. We can further delve into the momentum forecast by looking at the current returns of our DN delta neutral platform using SSO/SDS versus QLD/QID. Interestingly, both have the same limit stop values but given the performance metrics...which one would you trade?

OK...the DN approach is the lazy man's trading strategy and SPY does have a couple % greater potential drawdown than QQQ but...QQQ has superior equity linearity and a edge in the near term.

QQQ is at new highs and is leading the SPY in relative momentum....which is characteristic of true rallies. We can further delve into the momentum forecast by looking at the current returns of our DN delta neutral platform using SSO/SDS versus QLD/QID. Interestingly, both have the same limit stop values but given the performance metrics...which one would you trade?

OK...the DN approach is the lazy man's trading strategy and SPY does have a couple % greater potential drawdown than QQQ but...QQQ has superior equity linearity and a edge in the near term.

Monday, September 26, 2016

Ponzo Updates...09.27.16

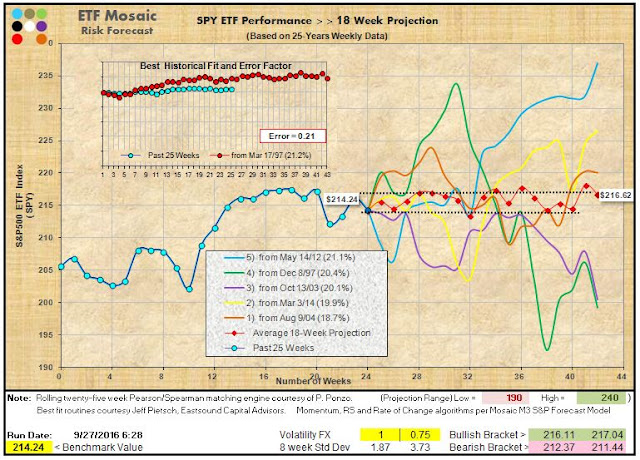

This weeek's Ponzo updates display a much lower volatility forecast for both the SPY and VIX while TLT has adopted a bearish edge farther out..

As the end of the month approaches expect a bullish edge at least into the first week of October.

As the end of the month approaches expect a bullish edge at least into the first week of October.

Saturday, September 24, 2016

VDX Updates Argue for Renewed Volatility...09.24.16

Monday's Presidential Debate is predicted to be most heavily watched TV event in history. I hope they have a good half time show to break up the excitement..In the meantime the VDX momentum skew is geared to neutral with a downside edge while volatility (VIX) is poised to rise once again.

Trader's Outlook has a similar view based on somewhat different criteria.

On the other hand...we are approaching the end of the month (85% bullish) and the Fall season, which has historically included the strongest months of the year. That bet hasn't worked 100% of the time and there have been a few notable exceptions but for now the advance/decline line continues to rise and although the FED meets in November there will be no press conference or minutes release...so no repeat of last Wednesday's fun.....we'll just have to wait until December for more rate hike gyrations.

.

Trader's Outlook has a similar view based on somewhat different criteria.

On the other hand...we are approaching the end of the month (85% bullish) and the Fall season, which has historically included the strongest months of the year. That bet hasn't worked 100% of the time and there have been a few notable exceptions but for now the advance/decline line continues to rise and although the FED meets in November there will be no press conference or minutes release...so no repeat of last Wednesday's fun.....we'll just have to wait until December for more rate hike gyrations.

.

Thursday, September 22, 2016

QQQ Delta Neutral....09.22.16

Here's the latest metrics on the QQQ x2 delta neutral model using QLD and QID (Proshares ultralong and ultra short ETFs). The Qs have been leading the markets up and are outperformingthe SPY in relative momentum. Strong rallies are typiocally accompanied by strong financial sector like XLF (SPDR sector Financials ETFs). That run up has failed to materialize so far.

The DN Upgrade program is available through the end of the month only.

The DN Upgrade program is available through the end of the month only.

Wednesday, September 21, 2016

PONZO Updates as FED Gooses the Markets...09.21.16

A solid rally day as the FED held tight once again although 3 Governors wanted to hike.

Maybe next time will be the turning point.

Looking back on the last 2 posts with Bloomberg arguing for shorts in bonds and gold...perhaps these news items should be viewed as contrarian signals based on the 2 day jump in both bonds and gold.

Here's the latest Ponzo updates with a bullish outlook near term.

Maybe next time will be the turning point.

Looking back on the last 2 posts with Bloomberg arguing for shorts in bonds and gold...perhaps these news items should be viewed as contrarian signals based on the 2 day jump in both bonds and gold.

Here's the latest Ponzo updates with a bullish outlook near term.

Tuesday, September 20, 2016

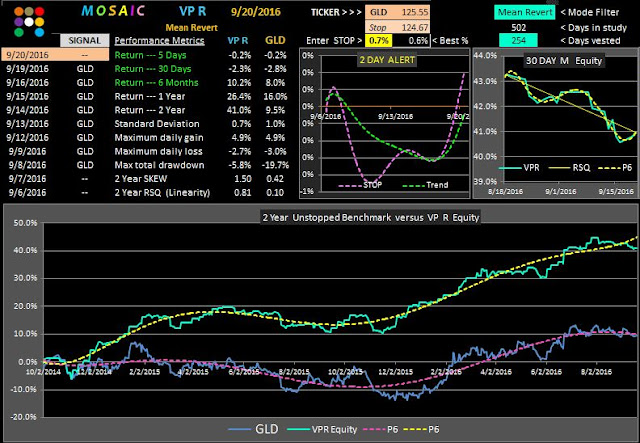

All That Glitters......09.20.16

Gold is losing its glitter after a nice run up. We saw a little pause today but beware the Trap Door setup wherein it appears the downtrend is complete only to be continued with a vengeance after a minor retracement.

Below are the MVP mean regression model outlooks for GLD ( SPDR Gold Shares ETF) with the volatility filter turned OFF and ON. Note the drawdown metrics and divergent signals.

Since both models have current 30 Day downslope equity curves GLD should be avoided using MVP.

Below are the MVP mean regression model outlooks for GLD ( SPDR Gold Shares ETF) with the volatility filter turned OFF and ON. Note the drawdown metrics and divergent signals.

Since both models have current 30 Day downslope equity curves GLD should be avoided using MVP.

Monday, September 19, 2016

Second Mouse Gets the Cheese on GE and More....09.19.16

I've made a number of posts on my GE bracket trade and here's the current status. The green/red arrows indicate when the trade was entered and the yellow lines point to a recurring pattern that occurs across the entire spectrum of stocks and ETFs....the second mouse gets the cheese principle.

The idea is simple....traders test the bracket support and resistance and initially appear to make a break (in this case ...breakdown) But then the market makers, prop shops and HFTs drive price back into the channel leaving short positions with a loss. Now the breakdown happens again...this time on a huge engulfing bar and the tone is set for further decline as the usual price manipulation suspects can't recovery price above the lower bracket. The parabolics indicator also did a great job of keeping us on the right side of this trade. Keep in mind these are 130 minute bars.

Watch for this pattern...its very reliable.

All eyes, ears and trigger fingers are poised for Wednesday's FED pronouncement. Current options skews are bullish as is the FED Fund rate probability but we've seen crazy reactions to past FED announcements so stay tuned. By the way.. don't neglect cash an as option until the smoke clears.

And, for the risk adverse...the delta neutral DN model update is available here.

130 minute chart courtesy of Schwab SS Edge

The idea is simple....traders test the bracket support and resistance and initially appear to make a break (in this case ...breakdown) But then the market makers, prop shops and HFTs drive price back into the channel leaving short positions with a loss. Now the breakdown happens again...this time on a huge engulfing bar and the tone is set for further decline as the usual price manipulation suspects can't recovery price above the lower bracket. The parabolics indicator also did a great job of keeping us on the right side of this trade. Keep in mind these are 130 minute bars.

Watch for this pattern...its very reliable.

All eyes, ears and trigger fingers are poised for Wednesday's FED pronouncement. Current options skews are bullish as is the FED Fund rate probability but we've seen crazy reactions to past FED announcements so stay tuned. By the way.. don't neglect cash an as option until the smoke clears.

And, for the risk adverse...the delta neutral DN model update is available here.

130 minute chart courtesy of Schwab SS Edge

Saturday, September 17, 2016

VDX Updates, Trader's Oulook , EWG and DN Upgrade....09.17.16

The VDX updates this week reveal the divergences in the VDI (Least in SPY) and suggest a bullish, less volatile screnario ahead....after Wednesday's long awaited FED pronouncement of course...which will be volatile. TLT remains unstable as factors discussed last week continue to percolate.

Trader's Outlook shares this view although Randy's take is more volatile. And to be fair, we typically do take a couple days to shake off the FED days as traders on the wrong side of the markets on FED day try to recoup losses and winners tend to expand their bets.

Below the VDX charts a note from the Schwab options desk on Friday regarding a huge new put position on EWG (Germany ETF). The MVP screen for EWG.is shown below that....not a big money maker but clearly a risk mitigator.

Responding to a number of inquiries I've added an option to get the full new DN delta neutral platform for $80 if you're already a Mosaic user. This is good until the end of the month.

Trader's Outlook shares this view although Randy's take is more volatile. And to be fair, we typically do take a couple days to shake off the FED days as traders on the wrong side of the markets on FED day try to recoup losses and winners tend to expand their bets.

Below the VDX charts a note from the Schwab options desk on Friday regarding a huge new put position on EWG (Germany ETF). The MVP screen for EWG.is shown below that....not a big money maker but clearly a risk mitigator.

Responding to a number of inquiries I've added an option to get the full new DN delta neutral platform for $80 if you're already a Mosaic user. This is good until the end of the month.

Thursday, September 15, 2016

Bonds Become Precarious...09.15.16

The bond market is flashing a Sell signal, the first in 9 months.

Also be aware that money market funds NAV will soon become floating.

Also be aware that money market funds NAV will soon become floating.

Wednesday, September 14, 2016

Financials..Momentum or Mean Reversion?....09.14.16

Thinking today about the state of the financials I checked the latest sorts of the M11 components of XLF.(SPDR Financial Sector ETF) ... looking at the results and current equity curve and Stop Alerts for the mean reversion versus momentum modes. Below are the results.

Now if rates are really going to rise then the financials should be one of the prime beneficiaries as they'll be able to gouge the public with even higher interest rates than presently. So why have the financials been just stumbling along? Maybe the whole rate scare is just a ploy to drive volatility. Next Wednesday we'll watch the markets go through the usual wild gyrations as the FED either announces or hints at their intentions and until then expect the financials to stay volatile.

Note that thiese are top 2 sorts with 0.7% is set as the limit stop on all inputs and...here's the surprise....BAC and JPM come up #1 and #2 in both mean reversion and momentum modes.

Now if rates are really going to rise then the financials should be one of the prime beneficiaries as they'll be able to gouge the public with even higher interest rates than presently. So why have the financials been just stumbling along? Maybe the whole rate scare is just a ploy to drive volatility. Next Wednesday we'll watch the markets go through the usual wild gyrations as the FED either announces or hints at their intentions and until then expect the financials to stay volatile.

Note that thiese are top 2 sorts with 0.7% is set as the limit stop on all inputs and...here's the surprise....BAC and JPM come up #1 and #2 in both mean reversion and momentum modes.

Tuesday, September 13, 2016

MVP on HYG ....09.13.16

HYG (IShares high yield corporate bonds ETF) is one of the MVP study ETFs using VPM (momentum mode). One of the key features of MVP is its ability to identify periods of high probability to be vested and just as importantly..when NOT to be vested.

Below is a look at the VPM screens with the PCL filter tuned OFF and ON.

For trading purposes we use VPM with the filter OFF but the signal status with the filter ON is routinely checked to gauge the odds.

Note the note from the Schwab Options desk this afternoon regarding HYG.

Check the blue line of HYG (buy and hold track) on both charts and you may appreciate the thinking behind this option play.

NOTE: MVP introductory price ends this weekend.

Below is a look at the VPM screens with the PCL filter tuned OFF and ON.

For trading purposes we use VPM with the filter OFF but the signal status with the filter ON is routinely checked to gauge the odds.

Note the note from the Schwab Options desk this afternoon regarding HYG.

Check the blue line of HYG (buy and hold track) on both charts and you may appreciate the thinking behind this option play.

NOTE: MVP introductory price ends this weekend.

Monday, September 12, 2016

PONZO Updates .....09.12.16

Looking back on last Wednesday VIX Ponzo chart....that green outlier line proven frightfully correct, only missing the peak by 2%. But now. cooler heads have apparently prevailed as undercurrent comments from the FED portray a likely dovish stance in September and the markets responded accordingly. Going forward the SPY outlook has turned bullish, the VIX looks poised to fall back into a narrow channel and TLT...well, TLT is a bit of a problem child, torn between the effects of rising yields versus the HUGE international positions anxious to protect their investment.

As a result, the TLT trend is the most difficult of our little basket to project technically. Maybe next week will shed a better light on TLT's prospects which saw massive swings in today's trading.

As a result, the TLT trend is the most difficult of our little basket to project technically. Maybe next week will shed a better light on TLT's prospects which saw massive swings in today's trading.

Saturday, September 10, 2016

Rollover on FED Fears....09.10.16

YIKES!!!.. a little hawkish blather from the FED and the market plunges on 4x normal volume as VIX rises 35% in a single day. Just recall when I suggested buying some VIX calls to guard against such a scenario...but hindsight doesn't pay the bills....but it is instructive..

OK...now what? Good question. The historical September weakness is normally greatest in the last 10 days of the month but that's only a benchmark and not a rule.

The Trader's Outlook is at a tipping point with a bearish edge...meaning things could go either way next week and Randy's normal compilation of technical indicators is absent in this week's update...which was written before the closing bell...thereby missing the high volume selling surge at the end of day.

From a strictly technical viewpoint the markets are extremely overbought and COULD see a bounce on Monday. More likely Monday will be a volatile day with traders evaluating the odds and then Tuesday (aka Turnaround Tuesday) will see the bigger move.

OK...now what? Good question. The historical September weakness is normally greatest in the last 10 days of the month but that's only a benchmark and not a rule.

The Trader's Outlook is at a tipping point with a bearish edge...meaning things could go either way next week and Randy's normal compilation of technical indicators is absent in this week's update...which was written before the closing bell...thereby missing the high volume selling surge at the end of day.

From a strictly technical viewpoint the markets are extremely overbought and COULD see a bounce on Monday. More likely Monday will be a volatile day with traders evaluating the odds and then Tuesday (aka Turnaround Tuesday) will see the bigger move.

Thursday, September 8, 2016

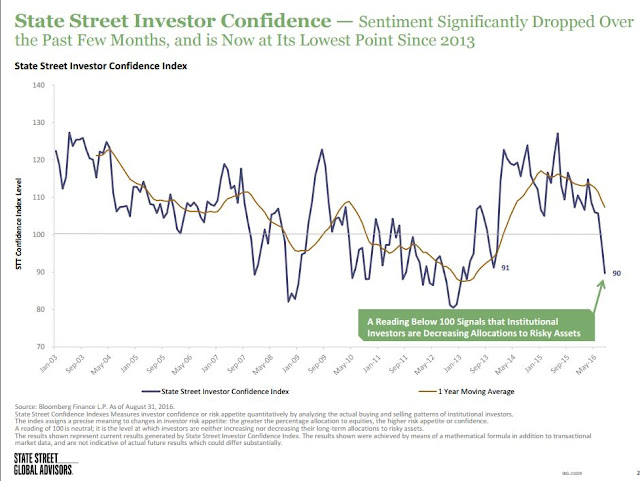

Trader Confidence and Volatility profiles....09.08.16

Courtesy of my friends at State Street here are this month's confidence and volatility profiles...both of which would lead one to a near term bearish outlook. Today's selling was modest in the indices but much more pronounced in select stocks and bonds in particular, which saw a sustained S3 pivot collapse as the odds for increasing yields developed.

Friday should be instructive for gauging next week's trading. Statistically we expect Friday to be down (72% odds) but many indices and 20 year Treasuries (TLT) are at or below the lower Bollinger Band....which has most frequently produced a tradeable reversal within a day.

Friday should be instructive for gauging next week's trading. Statistically we expect Friday to be down (72% odds) but many indices and 20 year Treasuries (TLT) are at or below the lower Bollinger Band....which has most frequently produced a tradeable reversal within a day.

Wednesday, September 7, 2016

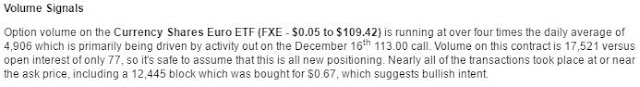

PONZO Updates, FXE Spot Check and MVP info....09.07.16

This week's Ponzo updates are modestly more bullish than last week. As we venture forth into September international factors are coming into play as odds for a FED rate hike continue to rise.

I've attached the FXE (EURO) Ponzo chart following an alert on the Schwab trading desk today on unusual FXE option trades (blow). The Ponzo outlook for FXE is in contrast with the noted trade but one man's buy is another man's sell so we'll just keep an eye on the EURO, which has become a recent focus of our MVP studies.

Speaking of the MVP ...I've turned on the new Schwab MVP tab to highlight the possibilities in 10 different Schwab no fee ETFs setups. These studies are part of my ongoing work with the local Schwab user group as we seek to develop a robotic trading model using the no fee ETFs.

Note: The MVP introductory price of $250 will increase to $350 on September 15th.

I've attached the FXE (EURO) Ponzo chart following an alert on the Schwab trading desk today on unusual FXE option trades (blow). The Ponzo outlook for FXE is in contrast with the noted trade but one man's buy is another man's sell so we'll just keep an eye on the EURO, which has become a recent focus of our MVP studies.

Speaking of the MVP ...I've turned on the new Schwab MVP tab to highlight the possibilities in 10 different Schwab no fee ETFs setups. These studies are part of my ongoing work with the local Schwab user group as we seek to develop a robotic trading model using the no fee ETFs.

Note: The MVP introductory price of $250 will increase to $350 on September 15th.

Tuesday, September 6, 2016

Dollar Down, Bonds Up...09.06.16

Sector rotation kicked in today with the dollar down and bonds, gold, oil and utilities up. It may smell like a breakout but we're still locked midstream of the narrow range channel that's been the market's stomping ground for the past 5 weeks.

Are we ready for a change? Maybe, but as usual the FED's dithering logic and double speak can only contribute to keeping the markets wary of any consensus.

All this market intraday volatility has forced me to adhere to a short time trading frame as in the case of TLT which we went Long on Friday's first hour and closed today as it rolled off the R3 pivot in the afternoon.....which looks like a good trade right now but tomorrow will be the test of that decision.

65 minute TLT bars shown below.

Are we ready for a change? Maybe, but as usual the FED's dithering logic and double speak can only contribute to keeping the markets wary of any consensus.

All this market intraday volatility has forced me to adhere to a short time trading frame as in the case of TLT which we went Long on Friday's first hour and closed today as it rolled off the R3 pivot in the afternoon.....which looks like a good trade right now but tomorrow will be the test of that decision.

65 minute TLT bars shown below.

Sunday, September 4, 2016

VDX Updates, Trader Outlook and More....09.04.16

September is upon us and historical performance has been weak as shown below. Still, the catalysts for a breakout or breakdown from the narrow range August remain elusive and each attempted break has been met with a retreat all month. Traders Outlook is modestly bearish in this context.

The VDX charts appear to be confirming this malaise as the VDI +/- divergence we witnessed last week appears to be reversing in all three charts. For short term traders a breakout in the VIX appears to be a high odds play when VIX falls to the 11s....just don't hang around too long.

We've been active with the MVP currency and country ETFs where the risk/reward dynamics are, for the present, more favorable than US equity indices and we'll look at the latest setups next week.

.

The VDX charts appear to be confirming this malaise as the VDI +/- divergence we witnessed last week appears to be reversing in all three charts. For short term traders a breakout in the VIX appears to be a high odds play when VIX falls to the 11s....just don't hang around too long.

We've been active with the MVP currency and country ETFs where the risk/reward dynamics are, for the present, more favorable than US equity indices and we'll look at the latest setups next week.

.

Subscribe to:

Posts (Atom)