The VIX / XIV correlation divergence noted yesterday got resolved in favor of VIX today.

Despite low volume and a narrow advance/decline line the current M3 / LM indicators are bearish for tomorrow.

The revised M3 home site is now complete and details about the new M3/LM product can be viewed there. New subscriptions after Jan 10th will be $50/month. Current subscribers will receive the current rate,

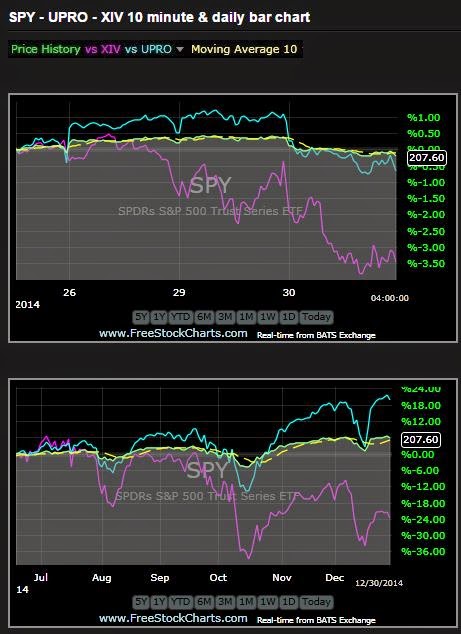

XIV should be at old highs given SPY strength but it continues to falter relative to the VIX (see chart below) and the TrendX chart (right side panel) is suggesting we may be in for a pullback. We've seen this type of stepback off new highs before, which may extend for several days.

On the other hand here we are again at month's end (typically bullish) so the pullback may just be a gaming play by some big players to create a more attractive buying environment.

Tuesday, December 30, 2014

Monday, December 29, 2014

A Look at M3 2015....12.29.14

Here's a screen shot of today's M3 post just for those thinking about subscribing. We've got a new look and some new display graphics. The Lazy Man is now part of the model providing an array of risk/reard options that can be exercised according to individual trading goals. The models are now greatly simplified from the original iterations but the graphics and metrics provide a solid foundation for evaluating the current odds environment.

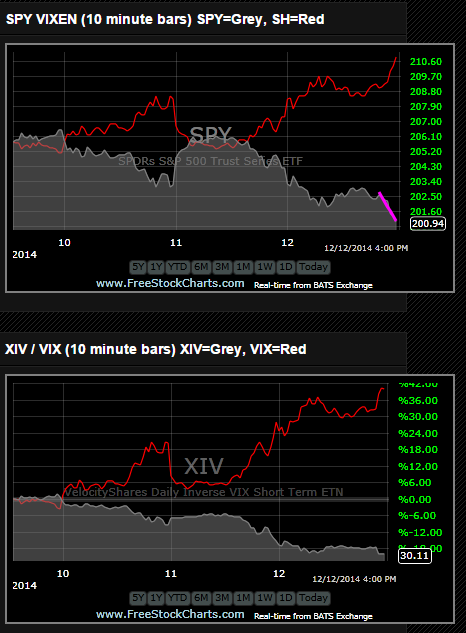

Also of note, the VIX and XIV divergent correlation has completely fallen apart. The VIX was up 6% today while XIV was up .75%. See the XIV/VIX chart below. Seems impossible but we've seen this before and the current instability will not last long. How it will be resolved is a big question.

Also of note, the VIX and XIV divergent correlation has completely fallen apart. The VIX was up 6% today while XIV was up .75%. See the XIV/VIX chart below. Seems impossible but we've seen this before and the current instability will not last long. How it will be resolved is a big question.

Sunday, December 28, 2014

New Lazy Man - SPY version....12.27.14

This is a new version of the Lazy Man model and on a scale of 1 to 10 it's about a 9 for outright laziness. Lazy Man (LM) can be used as a companion to M3 and in fact it will become a daily feature in the new M3 format to be rolled out in 2015...only a couple days away.

This is a floating 6 month lookback but I'll post the latest 2 year results tomorrow or Tuesday.

Here are some performance stats using a .7% limit stop for the following day based on the close.

% of positive returns = 67.

Of the 45 losing days 21 sustained drawdown of 2% or less and 15 were stopped out at .7%.

There's only 3 inputs SPY, its inverse SH and SHY...out long term proxy for cash. On a risk scale this model offers very low drawdown (compare to SPY on metrics panel) , few potential surprises, narrow spreads on a robust options chain and no worries about execution of the limit stops.

Since we're only concerned with the # 1 ranked position, that's the only one shown. The ALERT and PIVOT Trend in conjunction with the P6 and RSQ help gauge the likely odds of the current rankings.

This is a floating 6 month lookback but I'll post the latest 2 year results tomorrow or Tuesday.

Here are some performance stats using a .7% limit stop for the following day based on the close.

% of positive returns = 67.

Of the 45 losing days 21 sustained drawdown of 2% or less and 15 were stopped out at .7%.

There's only 3 inputs SPY, its inverse SH and SHY...out long term proxy for cash. On a risk scale this model offers very low drawdown (compare to SPY on metrics panel) , few potential surprises, narrow spreads on a robust options chain and no worries about execution of the limit stops.

Since we're only concerned with the # 1 ranked position, that's the only one shown. The ALERT and PIVOT Trend in conjunction with the P6 and RSQ help gauge the likely odds of the current rankings.

Tuesday, December 23, 2014

New Highs...12.23.44

DOW 18000 and the SPY and IWM roll on. Weakness in XIV was surprising after yesterday's pop but the lack of sellers may reverse next weak and this may be a prelude. We remain in a seasonally

bullish mode while volatility is still looking for some traction.

Note the SPY TrendX in the right side panel. We're getting to resistance levels on the TrendX and for the past 2 years the model has always bounced on of off the TrendX thresholds...just something to keep in the back of your mind as you overindulge in food and drink over the next few celebratory days. Have a Great Holiday.

bullish mode while volatility is still looking for some traction.

Note the SPY TrendX in the right side panel. We're getting to resistance levels on the TrendX and for the past 2 years the model has always bounced on of off the TrendX thresholds...just something to keep in the back of your mind as you overindulge in food and drink over the next few celebratory days. Have a Great Holiday.

Monday, December 22, 2014

Nuances of M3...12.22.14

Today was the first posting of the new M3 / M3R models. Yes there are no performance improvements and the RSQ, P6 and associated equity curves look different (improved) from the previous version. This is part of M3's evolution and refinement and adaptive nature.

I trade this model daily for multiple accounts and other family members do as well so I have a vested interest in making M3 a success. Long time Mosaic followers know that I'm very risk adverse and always follow a mantra of capital preservation. The new M3 models embody these goals.

It may be surprising, but most of the model performance improvement derives from an in depth analysis of alternate stops and the decision to go forward with the simple 2 and 1.5 % limit stops.

These stops are wider than the previous ATR calculated stops but it turns out that giving the model "room to breathe" during daily volatility swings actually pays off handsomely in the end.

The other variable is in the rankings and the desire to decrease "lag" or the delay in moving out of a waning momentum position and into a rising momentum position. The new M3 momentum algorithm has been very modestly accelerated...in fact over the rolling backtest of 120 trading days (2 years lookback) the average number of accelerated position rankings was 4, slightly more than 3%.

Again, it was the decision to adopt a wider stop spread than really added juice to the returns.

As stated in the M3 disclaimer all posted stops are strictly for the purposes of establishing performance benchmarks. I'm not a financial adviser and you alone are responsible for when and if you decide to pull the trading trigger. Any stops posted as well as any rankings are strictly for the purposes of discussion and education. Each trader can, and is encouraged to, develop their own risk management program according to his or her personal risk tolerance. M3 is simply a reflection of what I' doing on a day to day basis. I've discussed the various types of stops in a previous post and the limit stop is what I prefer and what is utilized in calculating the performance metrics of the models.

A very wise trader once told me "Anybody can get into a trade, it's when you exit that determines how successful you are". I've learned the painful truth of that statement over several decades.

Note that both M3 and M3R look at 6 inputs on a daily basis but only the top 3 are displayed.

Here then are the recent 6 month equity charts for M3 and M3R>>>>>

I trade this model daily for multiple accounts and other family members do as well so I have a vested interest in making M3 a success. Long time Mosaic followers know that I'm very risk adverse and always follow a mantra of capital preservation. The new M3 models embody these goals.

It may be surprising, but most of the model performance improvement derives from an in depth analysis of alternate stops and the decision to go forward with the simple 2 and 1.5 % limit stops.

These stops are wider than the previous ATR calculated stops but it turns out that giving the model "room to breathe" during daily volatility swings actually pays off handsomely in the end.

The other variable is in the rankings and the desire to decrease "lag" or the delay in moving out of a waning momentum position and into a rising momentum position. The new M3 momentum algorithm has been very modestly accelerated...in fact over the rolling backtest of 120 trading days (2 years lookback) the average number of accelerated position rankings was 4, slightly more than 3%.

Again, it was the decision to adopt a wider stop spread than really added juice to the returns.

As stated in the M3 disclaimer all posted stops are strictly for the purposes of establishing performance benchmarks. I'm not a financial adviser and you alone are responsible for when and if you decide to pull the trading trigger. Any stops posted as well as any rankings are strictly for the purposes of discussion and education. Each trader can, and is encouraged to, develop their own risk management program according to his or her personal risk tolerance. M3 is simply a reflection of what I' doing on a day to day basis. I've discussed the various types of stops in a previous post and the limit stop is what I prefer and what is utilized in calculating the performance metrics of the models.

A very wise trader once told me "Anybody can get into a trade, it's when you exit that determines how successful you are". I've learned the painful truth of that statement over several decades.

Note that both M3 and M3R look at 6 inputs on a daily basis but only the top 3 are displayed.

Here then are the recent 6 month equity charts for M3 and M3R>>>>>

Saturday, December 20, 2014

XIV's Stability in Question AND a NEW M3.....12.20.14

While the markets have enjoyed a tremendous surge XIV has faltered badly in comparison and the chart below shows the price/volatility disconnect that I've mentioned several times before.

Since M3 is designed to be adaptable I'm rolling out new versions of M3 now, one with volatility ETNs and one without. Both models will be posted on a daily basis on the M3 site with limit stop values posted after the close.

These new versions of M3 embody considerable testing and retesting and are designed to be simple to implement both in terms of execution and money management.

The layout are also simplified and contain all the essential metrics and charts necessary to understand the current model rankings. There's no second guessing the models...just enter the appropriate stops.

Here's a comparison of the M3 and M3R models using the limit stops of 2 and 1.5% respectively.

Starting in 2015 subscription rates for new subscribers will rise to $50/month.

Current subscribers' rate will remain at $30/month.

Since M3 is designed to be adaptable I'm rolling out new versions of M3 now, one with volatility ETNs and one without. Both models will be posted on a daily basis on the M3 site with limit stop values posted after the close.

These new versions of M3 embody considerable testing and retesting and are designed to be simple to implement both in terms of execution and money management.

The layout are also simplified and contain all the essential metrics and charts necessary to understand the current model rankings. There's no second guessing the models...just enter the appropriate stops.

Here's a comparison of the M3 and M3R models using the limit stops of 2 and 1.5% respectively.

Starting in 2015 subscription rates for new subscribers will rise to $50/month.

Current subscribers' rate will remain at $30/month.

Thursday, December 18, 2014

Blockbuster Day....but....12.18.14

It was a blow-out day with the DOW up 438 points, the biggest one day point gainer in 2014.

While we may be on our way to new highs all around (IWM is already back to its highs) I thought it might be fun to run the recent swoon through the Ponzo time machine. Here, for your entertainment enjoyment, is the not so merry multiple scenario forecast for SPY . . . note that the net average of projected equity paths has deteriorated from our last Ponzo update.

While we may be on our way to new highs all around (IWM is already back to its highs) I thought it might be fun to run the recent swoon through the Ponzo time machine. Here, for your entertainment enjoyment, is the not so merry multiple scenario forecast for SPY . . . note that the net average of projected equity paths has deteriorated from our last Ponzo update.

Wednesday, December 17, 2014

Looking for Mr. Goodbar- Part 2....12.17.14

Following up on yesterday presentation's of the M3 R model here's a look at the 6 month equity curves for M3 and M3R. The R version is clearly more volatile since no stops are used but what we're seeing is a result of putting faith in the model's (R version) ability to correctly forecast the next day's bullish or bearish bias while disregarding the consequences of error. This is the real cost of risk....,

If we turn off all the stops in M3 (not shown) the equity curve would get quite hairy since the volatility issues XIV and VXX are part of the mix and 6-9 % daily swings in net gain or loss will be considerably more than in the R model.

If we turn off all the stops in M3 (not shown) the equity curve would get quite hairy since the volatility issues XIV and VXX are part of the mix and 6-9 % daily swings in net gain or loss will be considerably more than in the R model.

Tuesday, December 16, 2014

Looking for Mr. Goodbar....12.16.14

It looked like a turnaround Tuesday, but then it turned around again. We're probably not done with the volatility disconnect. This pattern is more like a spinning top than a trending market as SPY has fallen to the 200 support level and daily swings of 100-220 points are common.

Beware the Trap Door.

Following up on yesterday's post and my ongoing endeavor to find a reliable beta based trading model from now on the M3 daily update will include 2 signals . . one from the classic M3 volatility/price model with risk parameters embedded in the performance metrics (risk OFF), and one with only price components termed M 3 R (risk ON) with no money management stops and the momentum AUTO-STOP turned off. Money management stops are provided with M3R but their application is NOT factored into the performance metrics.

M3 users now have 2 fully defined systems to consider as trading models and each has its own pros and cons, which will reviewed in greater detail in future posts. The component technical panels have been reduced to 6 in each model to help simplify the presentation.

(SPY performance value vary between models as these screen shots were taken over an hour apart)

Monday, December 15, 2014

M3 R...M3 companion....12.15.14

M3 subscribers know I'm always looking for ways to improve the model and increase reliability.

Going forward the nightly M3 model will be supplemented with the M3 R model which contains no volatility components but is a true SPY beta spectrum from UPRO to SDS with SHY (cash) to help define neutral trading environments.

Why the new model?

Quite simply...volatility has decoupled from price...a potential development we expressed concern about over 6 weeks ago. Now, here it is.

By engaging the perspective of M3 R we gain a clearer picture of underlying bull/bear momentum, which should help to confirm or negate XIV and VXX signals that M3 may generate.

The AUTO-STOP function has been turned off in M3 R so we see the full lineup all the time. Waning momentum components are not shown as -- like the M3 model but,perhaps surprisingly the net return short term are pretty impressive. These results DO NOT reflect the use of ANY money management stops but the net drawdown doesn't exceed the M3 model simply because the uber beta XIV and VXX are not included in the portfolio mix.

As an alternative game plan M3 R can simply be traded all by itself until the volatility/price correlation comes back into balance.

Going forward the nightly M3 model will be supplemented with the M3 R model which contains no volatility components but is a true SPY beta spectrum from UPRO to SDS with SHY (cash) to help define neutral trading environments.

Why the new model?

Quite simply...volatility has decoupled from price...a potential development we expressed concern about over 6 weeks ago. Now, here it is.

By engaging the perspective of M3 R we gain a clearer picture of underlying bull/bear momentum, which should help to confirm or negate XIV and VXX signals that M3 may generate.

The AUTO-STOP function has been turned off in M3 R so we see the full lineup all the time. Waning momentum components are not shown as -- like the M3 model but,perhaps surprisingly the net return short term are pretty impressive. These results DO NOT reflect the use of ANY money management stops but the net drawdown doesn't exceed the M3 model simply because the uber beta XIV and VXX are not included in the portfolio mix.

As an alternative game plan M3 R can simply be traded all by itself until the volatility/price correlation comes back into balance.

Saturday, December 13, 2014

VIX at Long Term Resistance....12.12.14

While volatility has shown no indication of slowing down I thought it might be useful to look at a long term weekly chart of VIX (134 weeks), which suggests we might be reaching an exhaustion level for this week's drop. The XIV/VXX skew has been completely out of balance all week (in favor of VXX) but XIV is approaching an exhaustion level down to support and both the UPRO and XIV premiums are close to zero. It's been unusual to see so many days with the NYAD (advance decline line) down in the teens since those levels themselves are usually strong indicators of impending reversals. Nevertheless, here we are and although some gloom and doomers are predicting VIX at 40 (remember December 2008) both economical fundamentals and seasonal history argue for a return to previous highs. When the turn does come it's likely to be explosive, fueled by rampant buying fever and short covering. It looked like we had a shot at that scenario earlier in the week and then the selling took over with a vengeance. Caution and patience are the watchwords and always recall the trading strategy that "the second mouse gets the cheese".

Thursday, December 11, 2014

Massive XIV / SPY Disparity...12.11.14

The markets continue wild gyrations with massive volatility swings. The VIX finished up 8% for the day, up 5% in the last 15 minutes and completely reversed from its early session -11% status.

At one point midsession SPY was up over 1% and VXX was up 3%....hypothetically impossible but the markets never fail to confound even the most battle scarred traders and today was one for the books. After hours XIV was down a buck and VXX was up a similar amount while SPY, DIA. QQQ and IWM were all down +/- .50. Tomorrow could be ugly as the XIV premium chart has gone deep into the red. On the optimistic (bullish) side the SPY TrendX (right side panel) is at oversold levels.

Just remember capital preservation is job one.

At one point midsession SPY was up over 1% and VXX was up 3%....hypothetically impossible but the markets never fail to confound even the most battle scarred traders and today was one for the books. After hours XIV was down a buck and VXX was up a similar amount while SPY, DIA. QQQ and IWM were all down +/- .50. Tomorrow could be ugly as the XIV premium chart has gone deep into the red. On the optimistic (bullish) side the SPY TrendX (right side panel) is at oversold levels.

Just remember capital preservation is job one.

Wednesday, December 10, 2014

Trap Door Opens...12.10.14

What looked like a possible recovery day turned into a free fall decline with the VIX up another 20% and now at overhead resistance as oil in the form of XLE takes another big hit.

There's some odd technical disparity between UPRO and XIV (see chart below) and based on past such swoons it's highly likely that the drop has not yet exhausted.

There's some odd technical disparity between UPRO and XIV (see chart below) and based on past such swoons it's highly likely that the drop has not yet exhausted.

Tuesday, December 9, 2014

Ponzo Updates....12.09.14

Chinese credit tightening created a massive overseas sell off overnight and we'e seeing the spillover today although as of midday the markets have shrugged off almost all of the selling pressure and many issues including QQQ and IWM are in the green.

Going forward for the next couple months there's a curious disparity in potential volatility between SPY and QQQ and while I'm still trying to figure out why the bottom line is that the risk profile of SPY looks much more attractive than QQQ.

Going forward for the next couple months there's a curious disparity in potential volatility between SPY and QQQ and while I'm still trying to figure out why the bottom line is that the risk profile of SPY looks much more attractive than QQQ.

Monday, December 8, 2014

Always Use Limit Orders....12.08.14

Tomorrow we'll take a look at the Ponzo forecast for SPY vs. QQQ volatility for the next 4 months.

But first, a little reminder that our favorite topic....risk....can be controlled to a large extent through careful application of order types, especially stops.

I personally have not entered a market order in 15 years...always defaulting to a limit order to either buy or sell. In after hours trading you can only enter limit orders on most platforms.

Regarding stops I generally prefer a stop limit order to an outright stop, especially for over night orders in order to avoid prop shop driven volatility at market opens.

Review the various order types below: (please note>>>the Trailing Stops link is not active.)

But first, a little reminder that our favorite topic....risk....can be controlled to a large extent through careful application of order types, especially stops.

I personally have not entered a market order in 15 years...always defaulting to a limit order to either buy or sell. In after hours trading you can only enter limit orders on most platforms.

Regarding stops I generally prefer a stop limit order to an outright stop, especially for over night orders in order to avoid prop shop driven volatility at market opens.

Review the various order types below: (please note>>>the Trailing Stops link is not active.)

Saturday, December 6, 2014

Slack Momentum....12.05.14

The markets are going up and hitting new highs but momentum is clearly non-committal. The Qs are lagging the other indices and we know from past studies that QQQ and XLF lead rallies. XLF has been keeping up its part of the bargain but the Qs are due for a boost.

The talking heads have noticed this disparity also and are pretty solid in their consensus that the NAZ will hit 5000 again before year end. Since the Qs typically lead the wider NAZ market it should follow that the Qs offer a relatively attractive risk reward profile.....assuming the markets keep climbing. And, just because XLE has been hitting new lows lately does not mean it's a great buy (see daily VEGA chart below).

The talking heads have noticed this disparity also and are pretty solid in their consensus that the NAZ will hit 5000 again before year end. Since the Qs typically lead the wider NAZ market it should follow that the Qs offer a relatively attractive risk reward profile.....assuming the markets keep climbing. And, just because XLE has been hitting new lows lately does not mean it's a great buy (see daily VEGA chart below).

Friday, December 5, 2014

The Game....12.05.14

Here's one more from the archives.

There will be a more extensive review of the the day's action posted later tonight.

There will be a more extensive review of the the day's action posted later tonight.

Thursday, December 4, 2014

Risk.....12.04.14

Wednesday, December 3, 2014

Some Stop Ideas....12.03.14

The use of money management stops can significantly reduce risk exposure,especially in volatile market conditions where there is no clear trend....like now.

There are also many kinds of stops...stop loss, trailing, conditional, etc. and deciding how to balance risk against potential reward can be a daunting task for even the most experienced trader.

I am an advocate for using pivot points as stops for the large caps and indices. Low volume issues and those with limited option chains tend NOT to conform to pivot behavior, but once you start monitoring price action on a daily basis with a pivot overlay (available on almost every trading platform) you'll quickly see the almost eerie reliability of pivot as support/resistance ,,,and stop....levels. Most of that behavior is a holdover from the days when floor traders dominated the exchanges and they needed a relatively simple way to calculate lines in the sand to determine buy and sell thresholds. They still work brilliantly today and are easy to calculate.

I've added a link to one free pivot site under User Resources in the right side panel.>>>>>

All you have to do is enter the appropriate values from your platform into the calcs panel at the end of the day and the pivot values are displayed for the next day.

You have to put up with a few ads but that the deal with many free sites.

The beauty of the pivots is that you can see what many of the pros are looking at for support and resistance and place stops accordingly. For M3 we use a slight variation of S1 as a fixed stop.

There are also many kinds of stops...stop loss, trailing, conditional, etc. and deciding how to balance risk against potential reward can be a daunting task for even the most experienced trader.

I am an advocate for using pivot points as stops for the large caps and indices. Low volume issues and those with limited option chains tend NOT to conform to pivot behavior, but once you start monitoring price action on a daily basis with a pivot overlay (available on almost every trading platform) you'll quickly see the almost eerie reliability of pivot as support/resistance ,,,and stop....levels. Most of that behavior is a holdover from the days when floor traders dominated the exchanges and they needed a relatively simple way to calculate lines in the sand to determine buy and sell thresholds. They still work brilliantly today and are easy to calculate.

I've added a link to one free pivot site under User Resources in the right side panel.>>>>>

All you have to do is enter the appropriate values from your platform into the calcs panel at the end of the day and the pivot values are displayed for the next day.

You have to put up with a few ads but that the deal with many free sites.

The beauty of the pivots is that you can see what many of the pros are looking at for support and resistance and place stops accordingly. For M3 we use a slight variation of S1 as a fixed stop.

Tuesday, December 2, 2014

Complete Reversal....12.02.14

The markets did a 180 today changing from a full blown bear to a full blown bull. Now we need to have some follow through to confirm the expected bull run in the December.

On the worry side...consider yesterday's action in Apple which lost 3% or $28 billion worth of net worth by the end of the day. What's worrisome is the early morning program trading glitch where Apple lost an additional 3% in the course of 2 minutes ( that happened on 16.5 million shares of Apple trading within 2 minutes). If this type of carnage can occur in just Apple imagine the fallout if this volatility spread across the markets for an hour or so, now imagine a day of such chaos.

Keep in mind that over 75% of typical daily trading volume is auto execution, high frequency trading with no one at the controls.

On days like yesterday that percentage jumps a few points as the trading robots go into hype drive.

Sleep well my friends.

On the worry side...consider yesterday's action in Apple which lost 3% or $28 billion worth of net worth by the end of the day. What's worrisome is the early morning program trading glitch where Apple lost an additional 3% in the course of 2 minutes ( that happened on 16.5 million shares of Apple trading within 2 minutes). If this type of carnage can occur in just Apple imagine the fallout if this volatility spread across the markets for an hour or so, now imagine a day of such chaos.

Keep in mind that over 75% of typical daily trading volume is auto execution, high frequency trading with no one at the controls.

On days like yesterday that percentage jumps a few points as the trading robots go into hype drive.

Sleep well my friends.

Monday, December 1, 2014

Rollover....12.01.14

See the TrendX chart in the right side panel>>>.

A pretty dramatic reversal today thanks to China and uncertainty about Europe's prospects.

Some early program trading gliches (remember the Knight's Tale post) sent Apple down 6% early on and down 3% in the course of a minute as program trading went into meltdown mode.

Retail and tech got the worst of it today as silver and gold recovered all of their 6% losses on Friday. A wild ride to say the least and we are now positioned on M3 to capitalize on a follow through move,

Friday's late flash crash of the XIV was a strong telltale that today's bear trap was about to spring.

A pretty dramatic reversal today thanks to China and uncertainty about Europe's prospects.

Some early program trading gliches (remember the Knight's Tale post) sent Apple down 6% early on and down 3% in the course of a minute as program trading went into meltdown mode.

Retail and tech got the worst of it today as silver and gold recovered all of their 6% losses on Friday. A wild ride to say the least and we are now positioned on M3 to capitalize on a follow through move,

Friday's late flash crash of the XIV was a strong telltale that today's bear trap was about to spring.

Friday, November 28, 2014

XIV Crumbles....11.28.14

Friday was a low volume, shortened, mixed day with OPEC sponsored weakness in oil (XLE) which suffered the biggest one day loss in 3 years. Silver and gold were hit similarly with 6%+ declines,

The XIV, which had enjoyed a little run on M3 was stopped out, but still produced a net positive gain for the week. The dramatic reversal in XIV can be seen below and may be an omen for further index declines although the general market guru consensus remains bullish and plummeting oil prices are typically a leading indicator for positive market returns. Maybe.

The XIV, which had enjoyed a little run on M3 was stopped out, but still produced a net positive gain for the week. The dramatic reversal in XIV can be seen below and may be an omen for further index declines although the general market guru consensus remains bullish and plummeting oil prices are typically a leading indicator for positive market returns. Maybe.

Wednesday, November 26, 2014

Again....11.26.14

Despite a number of poor economic reports the markets closed on a new set of highs today on 40% normal volume, fulfilling our day by day forecast for the week.

XIV made a handsome 1.7% gain today following the M3 rankings.

Friday is a shortened trading day and we're not expecting any selling momentum to develop until next week. Keep in mind that Monday will be the first trading day of the month (typically bullish) so we may not see any weakness until Tuesday (otherwise known by long term traders as "Turnaround Tuesday").

We shall see. In the meantime we're tightening our stop on XIV and loosening our belt, preparing for an afternoon nap tomorrow after gorging on turkey, stuffing and other holiday feasting.

Have a great Thanksgiving.

XIV made a handsome 1.7% gain today following the M3 rankings.

Friday is a shortened trading day and we're not expecting any selling momentum to develop until next week. Keep in mind that Monday will be the first trading day of the month (typically bullish) so we may not see any weakness until Tuesday (otherwise known by long term traders as "Turnaround Tuesday").

We shall see. In the meantime we're tightening our stop on XIV and loosening our belt, preparing for an afternoon nap tomorrow after gorging on turkey, stuffing and other holiday feasting.

Have a great Thanksgiving.

Tuesday, November 25, 2014

Losing Steam....11.25.14

Despite the strong seasonal skew we saw a classic pop and drop in today's action as traders pulled risk out of the equation and went to cash. At the same time the M3 model moved up the ranking of XIV, which has been slowly migrating up the rankings scale for the past few days.

XLE (oil) has taken a nasty turn down the past 2 days but silver (SLV) and gold (GLD) have extended their mini rally and look to have another possible leg up ahead,

The situation with selling premium continues to be ludicrous....there simply isn't any and buy write skews that were happily paying out 1.5 to 2% returns for 30-45 day holds are now lucky to yield .5%.

The markets make daily new highs but in reality it's a tough market to make money in.

By the way, SPY and DIA closed in the red today while QQQ squeaked out a small gain.

The new XIV position is a bit suspect in the face of today's late selloff.

XLE (oil) has taken a nasty turn down the past 2 days but silver (SLV) and gold (GLD) have extended their mini rally and look to have another possible leg up ahead,

The situation with selling premium continues to be ludicrous....there simply isn't any and buy write skews that were happily paying out 1.5 to 2% returns for 30-45 day holds are now lucky to yield .5%.

The markets make daily new highs but in reality it's a tough market to make money in.

By the way, SPY and DIA closed in the red today while QQQ squeaked out a small gain.

The new XIV position is a bit suspect in the face of today's late selloff.

Monday, November 24, 2014

New Highs....Again...11.24.14

Marginal new highs again today on somewhat subdued volume and a more normal NYAD range than Friday's over the top range. Historically, Tuesdays before Thxgiving day are bearish and Wed and Friday are bullish. Today's after market session was bullish.

UPRO continues to lead the M3 rankings although XIV is clearly picking up momentum.

UPRO continues to lead the M3 rankings although XIV is clearly picking up momentum.

Saturday, November 22, 2014

New Highs...11.21.14

New highs on normal volume characterized Friday's op-ex session. It was an opening pop to a NYAD value of 13.32....completely over the top and the NYAD proceeded to dribble down for the rest of the day, closing at 2.25. The fade down actually worked off a lot of the overbought technical signals but we're still hugging that resistance ledge. Indicators are still bullish and M3 's UPRO position booked a few $ on Friday with the rankings still aligned.

Despite the bullish tidal wave VXX (VIX ETN proxy) has actually been holding up pretty well and contrarians might consider an exploratory position with an actively enforced stop loss.

SLV and XLE are perking up nicely and a slightly OTM December silver covered call will yield 4%,

a potential return we have nut seen for a while

Despite the bullish tidal wave VXX (VIX ETN proxy) has actually been holding up pretty well and contrarians might consider an exploratory position with an actively enforced stop loss.

SLV and XLE are perking up nicely and a slightly OTM December silver covered call will yield 4%,

a potential return we have nut seen for a while

Thursday, November 20, 2014

Riding the Ledge...11.20.14

The indices continue to hug overhead resistance with various sectors alternately ebbing and flowing above and below that ledge. With Thanksgiving coming up next shortened trading week we can historically expect low volume and a bullish push as the professional short sellers typically take time off. Then we have the end of month push the following week, so from a purely momentum perspective the odds favor the bulls.....maybe not a big surge but the odds for a significant fade down are low.....unless a new Israeli war, ISIS gets really feisty, Putin invades the Ukraine, etc.... news will trump the pacifying effect of turkey endorphins.

For now M3 still loves UPRO (expecting a possible switch to XIV) and everything is rosy.

For now M3 still loves UPRO (expecting a possible switch to XIV) and everything is rosy.

Wednesday, November 19, 2014

A Knight's Tale...11.19.14

There was a little giveback today from yesterday's big push and all 3 indices closed in the red...although modesty so. The NYAD was particularly weak and the SPY was buoyed mostly by the retail sector.

The close was bearish and our UPRO position was stopped out for a net gain over the past 2 days.

Here's a tale that you will probably find unbelievable but its real, it happened and reads better than most Hollywood scripts....

The close was bearish and our UPRO position was stopped out for a net gain over the past 2 days.

Here's a tale that you will probably find unbelievable but its real, it happened and reads better than most Hollywood scripts....

Tuesday, November 18, 2014

Upside Breakout....11.18.14

We got the expected big move today and it was bullish. The NYAD hit the highest level in 2 weeks and ushered in new highs all around. We're now officially overbought with the index ETFs all reading 99%+ RSI2 and we've tightened our stop on UPRO for tomorrow's M3 play.

In the continuing head scratcher between XIV and UPRO, although XIV has a higher beta than UPRO the later once again managed to best XIV for intraday gains and M3 did a stellar job of detecting the nuance at yesterday's close.

I'm slowly learning not to second guess the M3 algorithms. Sometimes its less confusing to just play the signal, enforce your stops and ignore my subjective cautionary risk assessments.

In the continuing head scratcher between XIV and UPRO, although XIV has a higher beta than UPRO the later once again managed to best XIV for intraday gains and M3 did a stellar job of detecting the nuance at yesterday's close.

I'm slowly learning not to second guess the M3 algorithms. Sometimes its less confusing to just play the signal, enforce your stops and ignore my subjective cautionary risk assessments.

Monday, November 17, 2014

Ponzo Gets More Bearish....11.17.14

Here's Ponzo's update for the SPY this week. We have a new bearish outlier...not a scary possibility, more like a reversion back to the near term S&P 1800 level, but definitely a deterioration from the previous bullish forecasts.

Saturday, November 15, 2014

One Step at a Time.....11.15.14

We continue to see a daily ebb and flow of momentum reflecting lack of commitment and general uncertainty. Geopolitics have (for now) taken a back seat in driving prices and the new catalyst (up or down) remains to be seen.

The TrendX continues to sit on an overhead resistance ledge and the daily NYAD (NYSE advance/decline) range has been abnormally narrow concluding may sessions close to the 1.00 or neutral point. Friday's session was odd in that both VXX and UPRO closed in the green....hypothetically impossible but that's the market for you. The VIX dropped 2.5% in the last 3 minutes....bullish....but not supported by most other indicators.

We have a new signal for Monday on M3 and its a low probability bet ...but if it pans out the gains will be worth the gamble.

Hey! Who said trading was easy?

XIV continues to act strangely, M3 booked some nice gains on it last Monday but the position was stopped out on Tuesday to preserve those gains. The lower chart shows XIV's lackluster behavior.

The TrendX continues to sit on an overhead resistance ledge and the daily NYAD (NYSE advance/decline) range has been abnormally narrow concluding may sessions close to the 1.00 or neutral point. Friday's session was odd in that both VXX and UPRO closed in the green....hypothetically impossible but that's the market for you. The VIX dropped 2.5% in the last 3 minutes....bullish....but not supported by most other indicators.

We have a new signal for Monday on M3 and its a low probability bet ...but if it pans out the gains will be worth the gamble.

Hey! Who said trading was easy?

XIV continues to act strangely, M3 booked some nice gains on it last Monday but the position was stopped out on Tuesday to preserve those gains. The lower chart shows XIV's lackluster behavior.

Subscribe to:

Posts (Atom)