Friday was a low volume, shortened, mixed day with OPEC sponsored weakness in oil (XLE) which suffered the biggest one day loss in 3 years. Silver and gold were hit similarly with 6%+ declines,

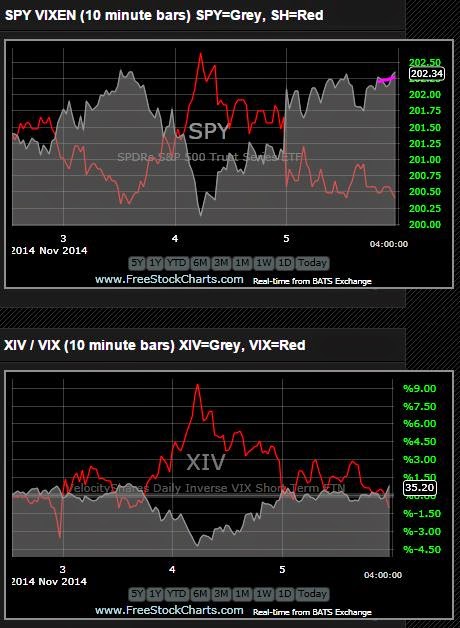

The XIV, which had enjoyed a little run on M3 was stopped out, but still produced a net positive gain for the week. The dramatic reversal in XIV can be seen below and may be an omen for further index declines although the general market guru consensus remains bullish and plummeting oil prices are typically a leading indicator for positive market returns. Maybe.

Friday, November 28, 2014

Wednesday, November 26, 2014

Again....11.26.14

Despite a number of poor economic reports the markets closed on a new set of highs today on 40% normal volume, fulfilling our day by day forecast for the week.

XIV made a handsome 1.7% gain today following the M3 rankings.

Friday is a shortened trading day and we're not expecting any selling momentum to develop until next week. Keep in mind that Monday will be the first trading day of the month (typically bullish) so we may not see any weakness until Tuesday (otherwise known by long term traders as "Turnaround Tuesday").

We shall see. In the meantime we're tightening our stop on XIV and loosening our belt, preparing for an afternoon nap tomorrow after gorging on turkey, stuffing and other holiday feasting.

Have a great Thanksgiving.

XIV made a handsome 1.7% gain today following the M3 rankings.

Friday is a shortened trading day and we're not expecting any selling momentum to develop until next week. Keep in mind that Monday will be the first trading day of the month (typically bullish) so we may not see any weakness until Tuesday (otherwise known by long term traders as "Turnaround Tuesday").

We shall see. In the meantime we're tightening our stop on XIV and loosening our belt, preparing for an afternoon nap tomorrow after gorging on turkey, stuffing and other holiday feasting.

Have a great Thanksgiving.

Tuesday, November 25, 2014

Losing Steam....11.25.14

Despite the strong seasonal skew we saw a classic pop and drop in today's action as traders pulled risk out of the equation and went to cash. At the same time the M3 model moved up the ranking of XIV, which has been slowly migrating up the rankings scale for the past few days.

XLE (oil) has taken a nasty turn down the past 2 days but silver (SLV) and gold (GLD) have extended their mini rally and look to have another possible leg up ahead,

The situation with selling premium continues to be ludicrous....there simply isn't any and buy write skews that were happily paying out 1.5 to 2% returns for 30-45 day holds are now lucky to yield .5%.

The markets make daily new highs but in reality it's a tough market to make money in.

By the way, SPY and DIA closed in the red today while QQQ squeaked out a small gain.

The new XIV position is a bit suspect in the face of today's late selloff.

XLE (oil) has taken a nasty turn down the past 2 days but silver (SLV) and gold (GLD) have extended their mini rally and look to have another possible leg up ahead,

The situation with selling premium continues to be ludicrous....there simply isn't any and buy write skews that were happily paying out 1.5 to 2% returns for 30-45 day holds are now lucky to yield .5%.

The markets make daily new highs but in reality it's a tough market to make money in.

By the way, SPY and DIA closed in the red today while QQQ squeaked out a small gain.

The new XIV position is a bit suspect in the face of today's late selloff.

Monday, November 24, 2014

New Highs....Again...11.24.14

Marginal new highs again today on somewhat subdued volume and a more normal NYAD range than Friday's over the top range. Historically, Tuesdays before Thxgiving day are bearish and Wed and Friday are bullish. Today's after market session was bullish.

UPRO continues to lead the M3 rankings although XIV is clearly picking up momentum.

UPRO continues to lead the M3 rankings although XIV is clearly picking up momentum.

Saturday, November 22, 2014

New Highs...11.21.14

New highs on normal volume characterized Friday's op-ex session. It was an opening pop to a NYAD value of 13.32....completely over the top and the NYAD proceeded to dribble down for the rest of the day, closing at 2.25. The fade down actually worked off a lot of the overbought technical signals but we're still hugging that resistance ledge. Indicators are still bullish and M3 's UPRO position booked a few $ on Friday with the rankings still aligned.

Despite the bullish tidal wave VXX (VIX ETN proxy) has actually been holding up pretty well and contrarians might consider an exploratory position with an actively enforced stop loss.

SLV and XLE are perking up nicely and a slightly OTM December silver covered call will yield 4%,

a potential return we have nut seen for a while

Despite the bullish tidal wave VXX (VIX ETN proxy) has actually been holding up pretty well and contrarians might consider an exploratory position with an actively enforced stop loss.

SLV and XLE are perking up nicely and a slightly OTM December silver covered call will yield 4%,

a potential return we have nut seen for a while

Thursday, November 20, 2014

Riding the Ledge...11.20.14

The indices continue to hug overhead resistance with various sectors alternately ebbing and flowing above and below that ledge. With Thanksgiving coming up next shortened trading week we can historically expect low volume and a bullish push as the professional short sellers typically take time off. Then we have the end of month push the following week, so from a purely momentum perspective the odds favor the bulls.....maybe not a big surge but the odds for a significant fade down are low.....unless a new Israeli war, ISIS gets really feisty, Putin invades the Ukraine, etc.... news will trump the pacifying effect of turkey endorphins.

For now M3 still loves UPRO (expecting a possible switch to XIV) and everything is rosy.

For now M3 still loves UPRO (expecting a possible switch to XIV) and everything is rosy.

Wednesday, November 19, 2014

A Knight's Tale...11.19.14

There was a little giveback today from yesterday's big push and all 3 indices closed in the red...although modesty so. The NYAD was particularly weak and the SPY was buoyed mostly by the retail sector.

The close was bearish and our UPRO position was stopped out for a net gain over the past 2 days.

Here's a tale that you will probably find unbelievable but its real, it happened and reads better than most Hollywood scripts....

The close was bearish and our UPRO position was stopped out for a net gain over the past 2 days.

Here's a tale that you will probably find unbelievable but its real, it happened and reads better than most Hollywood scripts....

Tuesday, November 18, 2014

Upside Breakout....11.18.14

We got the expected big move today and it was bullish. The NYAD hit the highest level in 2 weeks and ushered in new highs all around. We're now officially overbought with the index ETFs all reading 99%+ RSI2 and we've tightened our stop on UPRO for tomorrow's M3 play.

In the continuing head scratcher between XIV and UPRO, although XIV has a higher beta than UPRO the later once again managed to best XIV for intraday gains and M3 did a stellar job of detecting the nuance at yesterday's close.

I'm slowly learning not to second guess the M3 algorithms. Sometimes its less confusing to just play the signal, enforce your stops and ignore my subjective cautionary risk assessments.

In the continuing head scratcher between XIV and UPRO, although XIV has a higher beta than UPRO the later once again managed to best XIV for intraday gains and M3 did a stellar job of detecting the nuance at yesterday's close.

I'm slowly learning not to second guess the M3 algorithms. Sometimes its less confusing to just play the signal, enforce your stops and ignore my subjective cautionary risk assessments.

Monday, November 17, 2014

Ponzo Gets More Bearish....11.17.14

Here's Ponzo's update for the SPY this week. We have a new bearish outlier...not a scary possibility, more like a reversion back to the near term S&P 1800 level, but definitely a deterioration from the previous bullish forecasts.

Saturday, November 15, 2014

One Step at a Time.....11.15.14

We continue to see a daily ebb and flow of momentum reflecting lack of commitment and general uncertainty. Geopolitics have (for now) taken a back seat in driving prices and the new catalyst (up or down) remains to be seen.

The TrendX continues to sit on an overhead resistance ledge and the daily NYAD (NYSE advance/decline) range has been abnormally narrow concluding may sessions close to the 1.00 or neutral point. Friday's session was odd in that both VXX and UPRO closed in the green....hypothetically impossible but that's the market for you. The VIX dropped 2.5% in the last 3 minutes....bullish....but not supported by most other indicators.

We have a new signal for Monday on M3 and its a low probability bet ...but if it pans out the gains will be worth the gamble.

Hey! Who said trading was easy?

XIV continues to act strangely, M3 booked some nice gains on it last Monday but the position was stopped out on Tuesday to preserve those gains. The lower chart shows XIV's lackluster behavior.

The TrendX continues to sit on an overhead resistance ledge and the daily NYAD (NYSE advance/decline) range has been abnormally narrow concluding may sessions close to the 1.00 or neutral point. Friday's session was odd in that both VXX and UPRO closed in the green....hypothetically impossible but that's the market for you. The VIX dropped 2.5% in the last 3 minutes....bullish....but not supported by most other indicators.

We have a new signal for Monday on M3 and its a low probability bet ...but if it pans out the gains will be worth the gamble.

Hey! Who said trading was easy?

XIV continues to act strangely, M3 booked some nice gains on it last Monday but the position was stopped out on Tuesday to preserve those gains. The lower chart shows XIV's lackluster behavior.

Thursday, November 13, 2014

A Phantom Up Day.....11.13.14

A very odd day that looked bullish but the underpinning were clearly bearish. WMT, CSCO, MSFT, APPL and INTC basically held the markets in the green while rampant selling ensued elsewhere and across the board. Following yesterday's bearish comment on XLE, it proceeds to open and fall through a trap door pattern, although recovering somewhat in the late afternoon. BABA also got a solid whack on the head. dropping 3% and very heavy volume.

The close was especially exciting with UPRO actually running up into the green while XIV refused to relinquish it bearish character.

The SPY TrendX on the right side panel is looking more and more like a rollover setup and Friday, being a down day 70% of the time, may provide the juice for the next big move.

Caution is advised.

The close was especially exciting with UPRO actually running up into the green while XIV refused to relinquish it bearish character.

The SPY TrendX on the right side panel is looking more and more like a rollover setup and Friday, being a down day 70% of the time, may provide the juice for the next big move.

Caution is advised.

Wednesday, November 12, 2014

Chop, chop...11.12.14

Another narrow range day as the momentum spring continues to coil in preparation for the next big move. Some interesting developments in the various put/call ratios, which are often considered a barometer of what the "smart" money is thinking.

Of the indices today IWM was the leader, QQQ was lagging and SPY was in the red.....all with marginal flux.

SLV's p/c ratio looks bullish; XLE looks scary and XLU and XLV look uber bearish.

XIV and NYAD have no p/c ratios. Why? They have no option chains.

Here are the current ratios from one of my daily watchlists >>>>>>>

Of the indices today IWM was the leader, QQQ was lagging and SPY was in the red.....all with marginal flux.

SLV's p/c ratio looks bullish; XLE looks scary and XLU and XLV look uber bearish.

XIV and NYAD have no p/c ratios. Why? They have no option chains.

Here are the current ratios from one of my daily watchlists >>>>>>>

Tuesday, November 11, 2014

Closing Surge...11.11.14

It was a pretty ho-hum day with a modest early pullback that was overrun by a last minute (last 15 minute) run up across the boards. The surge did not continue after hours, which makes it a bit suspicious and we're still in overbought territory. We're looking for an upside target for XIV around 40-42 pn M3 but for now we're waiting for a better entry position.

Energy in the form of XLE continues to ping-pong from green to red on a regular basis, reflecting the continuing uncertainty about both the near and longer term prospects for the energy sector as US shale oil gains a stronger foothold in the markets. Silver (SLV) also made a nice move today, looking much improved from the depths of despair it recently displayed.

Energy in the form of XLE continues to ping-pong from green to red on a regular basis, reflecting the continuing uncertainty about both the near and longer term prospects for the energy sector as US shale oil gains a stronger foothold in the markets. Silver (SLV) also made a nice move today, looking much improved from the depths of despair it recently displayed.

Monday, November 10, 2014

Ready for a Pause?.....11.10.14

Another up day for the markets and a lot of the majors (now including XIV) have hit RSI@ high 90's readings...a cautionary indicator we've discussed before. The SPY TrendX...right side panel>> is looking extended to the upside and we may be in store for a little sideways action to calm things down a bit and gain some bullish traction.

Our new M3 position in XIV initiated at Friday's close zoomed up like a rocket today (see chart below) gaining 4.5% for the day. XIV has been badly lagging UPRO in the momentum game but it looks poised to make up lost ground if the technicals can hold together.

Our new M3 position in XIV initiated at Friday's close zoomed up like a rocket today (see chart below) gaining 4.5% for the day. XIV has been badly lagging UPRO in the momentum game but it looks poised to make up lost ground if the technicals can hold together.

Saturday, November 8, 2014

Prospects Improve....11.8.14

Everything is beautiful...at least for today. M3 has punched the previously lagging XIV into #1 slot and there's some good upside potential there. The Ponzo Time machine's risk profile for SPY has also improved significantly since our last look.

Thursday, November 6, 2014

New Highs...11.6.14

Another new high day led by GE and pushed by XLE. There was an early stumble 60 minutes in but buyers stepped in dominated the rest of the day...closing on the highs. The NYAD wasn't really that bullish...closing at 1.28 and volume was middling so we're climbing further and further into overbought territory and technical resistance as each new green day develops.

XIV had a little bullish breakdown today and this may be a signal of the emerging paradigm for the rest of the year.

XIV had a little bullish breakdown today and this may be a signal of the emerging paradigm for the rest of the year.

Wednesday, November 5, 2014

Tentative Strength Continues...11.5.14

The behavior of XIV continues to be worrisome as it is woefully underperforming UPRO and even SPY. The last 10 minutes saw a bullish volume surge, putting QQQ in the green (having been red all day) and finally giving a boost to XIV The NYAD closed near the lows of the day.

Energy stocks were the big winners, silver was the big loser.

The VIX dropped almost 5 % and prices are up marginally in after hours trading.

Energy stocks were the big winners, silver was the big loser.

The VIX dropped almost 5 % and prices are up marginally in after hours trading.

Tuesday, November 4, 2014

Waiting on the Election....11.4.14

Red for SPY and QQQ, green for DIA. and in a surprise move XIV actually moved into the green today after a long hiatus in the red. M3 is in cash having been stopped put yesterday for no loss.

The oddsmakers are projecting a &%% win rate for the GOP and statistically speaking, having a Democratic President and Republican Congress has been a bullish winner and we are now in the historically most bullish months of the year so the odds look stacked to move the markets higher...at least until year end. That being said we are already at new all time highs and although we may see a surge up past previous resistance we are in fact technically overbought (see the TrendX in the right panel). We've talked about paradigm changes before, when the left side of the chart essentially becomes little help in forecasting the emerging right side of the chart and we have to be alert to the fact that such an event may be upon us now.

The oddsmakers are projecting a &%% win rate for the GOP and statistically speaking, having a Democratic President and Republican Congress has been a bullish winner and we are now in the historically most bullish months of the year so the odds look stacked to move the markets higher...at least until year end. That being said we are already at new all time highs and although we may see a surge up past previous resistance we are in fact technically overbought (see the TrendX in the right panel). We've talked about paradigm changes before, when the left side of the chart essentially becomes little help in forecasting the emerging right side of the chart and we have to be alert to the fact that such an event may be upon us now.

Monday, November 3, 2014

Pop and Fade...11.3.14

New highs early in the session were followed by a gradual slow meltdown for the remainder of the day leaving the VIX 6.5 % up the major indices closed basically neutral.

Friday's surge was a hard act to follow and with all the markets at long term resistance the technical odds favor a pullback. Refer to the Ponzo charts posted last week to get a flavor for possible near term scenarios. The elections tomorrow may further roil the markets so we're in a wait and see mode.

We stopped out of UPRO today on a special intraday update for no loss.

XIV is failing to gain traction and has been kicked from the M3 roster at today's close.

Friday's surge was a hard act to follow and with all the markets at long term resistance the technical odds favor a pullback. Refer to the Ponzo charts posted last week to get a flavor for possible near term scenarios. The elections tomorrow may further roil the markets so we're in a wait and see mode.

We stopped out of UPRO today on a special intraday update for no loss.

XIV is failing to gain traction and has been kicked from the M3 roster at today's close.

Saturday, November 1, 2014

Japan Changes the Game....11.1.14

At Thursday's close it looked like Friday might be a neutral day and then Bank of Japan announced a massive QE program overnight and a buying party ensued. Although the TrendX (side panel) looks to be topping out the BOJ plan could be a game changer, at least for a while, as we have now broken through to new highs on all the major indices. What's interesting about the BOJ plan is the strategy of buying both bonds and stocks outright. We'll have to see exactly how that affects liquidity (should improve it) and the actual schedule of buying to better judge possible impacts on the markets but for now the prospects are all bullish.

Over at M3 we've booked some nice gains with UPRO, which has been outperforming XIV lately (see charts below).

Also a bit of a head scratcher, the VIX was only down 1% at 15 minutes pre-close Friday and then dropped another 2.3% to finish the day down 3.37%......a piddling drop in the face of Friday's massive and across the board buying.

Over at M3 we've booked some nice gains with UPRO, which has been outperforming XIV lately (see charts below).

Also a bit of a head scratcher, the VIX was only down 1% at 15 minutes pre-close Friday and then dropped another 2.3% to finish the day down 3.37%......a piddling drop in the face of Friday's massive and across the board buying.

Subscribe to:

Posts (Atom)