This week's forecast updates are almost a mirror image of last week. The one significant change is an expansion of the TLT bullish range, pushing the mid line of out butterfly channel up a bit but still keeping us in the sweet one of the trade.

Trader's Outlook is neutral for the week with a modest bullish edge.

Monday, October 30, 2017

Sunday, October 22, 2017

Ponzo Updates and Trader's Outlook...10.22.17

While this week's forecast updates remain essentially the same as last week's the short term odds on SPY have morphed to neutral, QQQ has accelerated to uber bullish and TLT has regressed to a lower level channel (although still comfortably within our target butterfly channel.)

Trader's Outlook remains bullish based on their trend following paradigm logic and most earnings reports so far have been met enthusiastically. Geo political risks have moved to the back burner and will likely stay there until the calm before the storm is erased.

Trader's Outlook remains bullish based on their trend following paradigm logic and most earnings reports so far have been met enthusiastically. Geo political risks have moved to the back burner and will likely stay there until the calm before the storm is erased.

Sunday, October 15, 2017

Ponzo Update and Trader's Outlook.....10.15.17

This week's updated forecasts reveal no divergence from last week's posts.

The TLT consolidation model using butterflies and/or iron condors still looks like the best odds situation as we plunge forward into earnings season and the unknown market perils of Iran and NOKO. QQQ maintains the highest positive scenario skew while SPY and TLT are running 50/50 bearish/bullish into the year's end

Trader's Outlook is modestly bullish, based strictly on a technical trend following perspective.

The TLT consolidation model using butterflies and/or iron condors still looks like the best odds situation as we plunge forward into earnings season and the unknown market perils of Iran and NOKO. QQQ maintains the highest positive scenario skew while SPY and TLT are running 50/50 bearish/bullish into the year's end

Trader's Outlook is modestly bullish, based strictly on a technical trend following perspective.

Monday, October 9, 2017

PONZO Updates and Trader's Outlook....10.09.17

Following last week's surge in SPY the new Ponzo forecast has reverted back to a bullish skew, improving modestly on last week's bearish outlook.

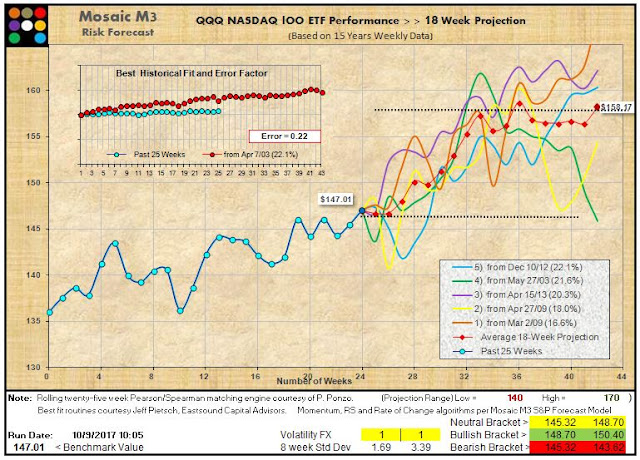

QQQ is an almost dead on repeat of last week's bullish outlook.

TLT has settled into a slightly bearish channel and the 124/125 butterfly still looks like a good bet.

Trader's Outlook is bullish for the week based on strong economic data and expectations for good earnings reports, which kick off this week.

QQQ is an almost dead on repeat of last week's bullish outlook.

TLT has settled into a slightly bearish channel and the 124/125 butterfly still looks like a good bet.

Trader's Outlook is bullish for the week based on strong economic data and expectations for good earnings reports, which kick off this week.

Sunday, October 1, 2017

Ponzo Updates & Trader's Outlook..10.01.17

The big change in this week's Ponzo forecasts is a significant deterioration in SPY. A general trading rule is "don't short new highs", which was the case this week and is now supported by the current technical view of Trader's Outlook . Once again consider what the Ponzo charts actually show...the odds that history will repeat itself based on a technical analysis of what happened in the past 25 weeks over the life of the stock or ETF. Dynamic exigent factors are constantly in play so the Ponzo outlooks might be considered of marginal utility. However, market patterns have proven to be remarkably consistent over time and the fact remains that the longer term Ponzo forecasts for SPY have been dead on since last October.

This week's QQQ and TLT forecasts are essentially unchanged from last week, with TLT hitting the lower band of the 6 month linear regression channel (support) and now poised for a bounce..

This week's QQQ and TLT forecasts are essentially unchanged from last week, with TLT hitting the lower band of the 6 month linear regression channel (support) and now poised for a bounce..

Subscribe to:

Posts (Atom)