Bank of England made some encouraging moves overnight and we had another up day (+235). Historically tomorrow has 85% odds of being bullish as the first trading day of the month.

SPY is at RSI2 of 99%+ so the odds of a turnaround are building quickly, coupled with increasing prospects of a recession economy and renewed concerns about the health of the global markets.

The VIX has been imploding at an unusual pace and is most likely to pause before settling down to our target 14 level in the next month or so.

The technical analytics of M3/M6 are again displaying positive equity lines and thereby indicating their utility in projecting long/short odds. Below are current the Momentum and Mean Reversion modes for the default M6 market cross sectional portfolio.

Thursday, June 30, 2016

Wednesday, June 29, 2016

Euro, Dollar, Pound...06.29.16

Another big up day as worries over BREXIT start to subside as analysts presented arguments today supporting US equities as the risk adjusted place to be. As a result TLT was crushed along with the inverse ETFs. Its end of the month going into Friday and the bulls still have the edge. My wife the Forex trader uses Bollinger Bands on multiple time frames to help enter and exit trades and she happily showed me the the current Euro dollar and Pound/dollar charts to inform me "I told you so." when she predicted a major turnaround Monday night.

Charts courtesy of OANDA.

Charts courtesy of OANDA.

Tuesday, June 28, 2016

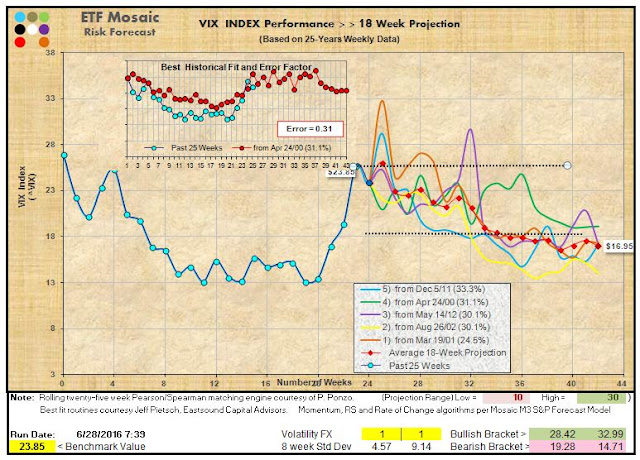

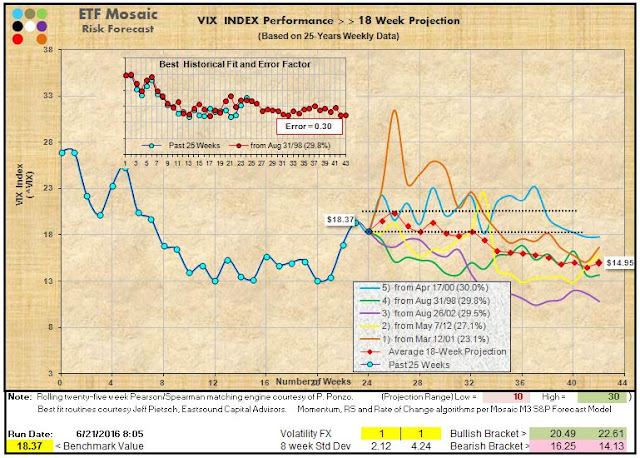

PONZO Updates..06.28.16

Turnaround Tuesday produced a 1% reversal to the upside for equities but its early in the day (2 hours in) and the markets have been selling down since the open so where we close is anyone's guess.

The PONZO updates show that we've hit the outlier scenarios and are now most likely to flat line for the near term. The VIX in particular looks like the downside is the best odds and today's 17% retreat may signal a movement back down to the 12-14 levels.

The PONZO updates show that we've hit the outlier scenarios and are now most likely to flat line for the near term. The VIX in particular looks like the downside is the best odds and today's 17% retreat may signal a movement back down to the 12-14 levels.

Monday, June 27, 2016

BB Indicators SIgnal Likely Turn...06.27.16

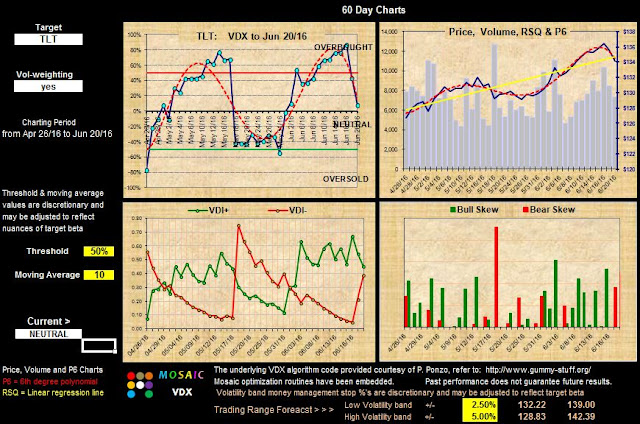

The Bollinger Band Indicator is now fully overextended by 2 standard deviations on our 3 input study group...SPY, VIX and TLT (130 minute bar charts shown below) and the odds for a imminent bullish move are increasing. TLT did hit a new all time high today jumping a whopping 2.5% to close at 139.50. The proverbial Turnaround Tuesday is upon us tomorrow although the markets remain skittish in the face of uncertainty over what the BREXIT will actually mean. If you were positioned on the wrong side of the BREXIT vote you are not alone. George Soros who made a cool $ billion dollars in 1992 and broke the Bank of England in the process was in the BREMAIN camp, but he's still got a few billions laying around to recover down the road..

Sunday, June 26, 2016

VDX Updates...06.26.16

After the week that was and one that will go in history the VDX charts are clearly overextended in all directions. And it may not be over yet as traders brace for collateral damage from Friday's selloff.

Ripple effects are likely to be felt for weeks, if not months and and current FED fund forecast is no rate increase until at least 2017. We'll look at the odds for dip buying tomorrow and then I'm on the road for a couple days for a pair trading seminar. Here's a link to Mauldin's latest thinking about possible things to come.....it's long, but well argued and filled with a few surprises.

In the meantime technical analysis should be considered a risky basis for timing investments.

Ripple effects are likely to be felt for weeks, if not months and and current FED fund forecast is no rate increase until at least 2017. We'll look at the odds for dip buying tomorrow and then I'm on the road for a couple days for a pair trading seminar. Here's a link to Mauldin's latest thinking about possible things to come.....it's long, but well argued and filled with a few surprises.

In the meantime technical analysis should be considered a risky basis for timing investments.

Thursday, June 23, 2016

Still Iffy on the BREXIT...06.23.16

The markets surged up right into the close and then further in after hours in anticipation of a REMAIN vote. Current polling results (7 PM PST) indicate that's not a sure thing and the markets have reversed course to the downside. There's still a few hours to go ahead of official results so stay tuned. If REMAIN is the choice we may still see a sell the news reaction as many talking heads suggest a positive vote has already been fully priced into the EFA and the SPY.

Meanwhile, here's the current cross market M6 momentum model and the latest signal.

We exited our Friday straddles and butterflies at the close today...all positive thanks to the closing runup.

Meanwhile, here's the current cross market M6 momentum model and the latest signal.

We exited our Friday straddles and butterflies at the close today...all positive thanks to the closing runup.

Wednesday, June 22, 2016

The State of EFA..06.22.16

Continuing the countdown to the BREXIT vote on the 23rd EFA is maintaining positive momentum.

Looking at the chart today it looks like a gap down but this reflects the semi-annual ex-div today of $.51, which makes it appear that ETF is down when in fact its up.

The current thinking is that the odds are stacked with the Remain camp and EFA has been moving accordingly. IF that choice prevails the previously anticipated major jump in the Euro related equities may be more tepid since much of the pop has already been priced in.

If the BREXIT succeeds then there will be a much more volatile outcome.

US traders should know the BREXIT outcome approx. 4 AM PST on Friday

In the meantime here are the 130 minute and daily bar Bollinger band charts of the EFA indicating that the action could go either way.

Looking at the chart today it looks like a gap down but this reflects the semi-annual ex-div today of $.51, which makes it appear that ETF is down when in fact its up.

The current thinking is that the odds are stacked with the Remain camp and EFA has been moving accordingly. IF that choice prevails the previously anticipated major jump in the Euro related equities may be more tepid since much of the pop has already been priced in.

If the BREXIT succeeds then there will be a much more volatile outcome.

US traders should know the BREXIT outcome approx. 4 AM PST on Friday

In the meantime here are the 130 minute and daily bar Bollinger band charts of the EFA indicating that the action could go either way.

Tuesday, June 21, 2016

AN EFA BREXIT setup and PONZO Updates....06.21.16

Two days until the vote and sentiment continues to favor REMAIN.

EFA (EURO 900 ETF) is up 1%+ and climbing into the afternoon session. Yellen spoke today but it appears nobody cares since the odds of a near term FED rate hike are zero.

Here's an EFA butterfly in the spirit of the weekend post with an attractive (to me) risk/reward.

Following the butterfly setup the Ponzo updates forecast and lower VIX and bullish bonds.

All bets however are on the vote. Fundamentals trump technicals but news trumps fundamentals.

Ponzo retains the outlier scenario of a short term explosion in VIX and TLT so caution is advised.

EFA (EURO 900 ETF) is up 1%+ and climbing into the afternoon session. Yellen spoke today but it appears nobody cares since the odds of a near term FED rate hike are zero.

Here's an EFA butterfly in the spirit of the weekend post with an attractive (to me) risk/reward.

Following the butterfly setup the Ponzo updates forecast and lower VIX and bullish bonds.

All bets however are on the vote. Fundamentals trump technicals but news trumps fundamentals.

Ponzo retains the outlier scenario of a short term explosion in VIX and TLT so caution is advised.

Monday, June 20, 2016

Monday VDX Updates...06.20.16

With the odds for a BREXIT yes vote steadily eroding over the weekend global markets pulled a switcheroo and pumped the NYAD to +5 levels most of the day. There are still a lot of hedges out there and our Friday butterfly is already in the green a few cents.....which could (and probably will) all change dramatically by Thursday.

Looking at the VDX updates as of Monday's close you'd think that the US markets could care less about the BREXIT. Volume was slow coming out of the gate and finished at 80% par.....most of the action being on the late selling side.

For now everything is neutral ...but in motion. This is NOT a stagnant, consolidating market and IMHO the setups presented over the weekend updated for Wednesday's close are the best odds plays.

One reader wondered why the delta neutral setups for XIV/VXX or SSO/SDS wouldn't be on my favored list and the answer is simple...I expect volatility (short term) to be extreme on Thursday morning and the likelihood is that the limit stops would be blown through at the outset, never to be revisited for the remainder of the day. Delta neutral players know that means at the end of the day you have neither made or loss money....you've simply missed a whopper opportunity.

Looking at the VDX updates as of Monday's close you'd think that the US markets could care less about the BREXIT. Volume was slow coming out of the gate and finished at 80% par.....most of the action being on the late selling side.

For now everything is neutral ...but in motion. This is NOT a stagnant, consolidating market and IMHO the setups presented over the weekend updated for Wednesday's close are the best odds plays.

One reader wondered why the delta neutral setups for XIV/VXX or SSO/SDS wouldn't be on my favored list and the answer is simple...I expect volatility (short term) to be extreme on Thursday morning and the likelihood is that the limit stops would be blown through at the outset, never to be revisited for the remainder of the day. Delta neutral players know that means at the end of the day you have neither made or loss money....you've simply missed a whopper opportunity.

Saturday, June 18, 2016

BREXIT Setups.....06.18.16

First of all, a disclaimer. THIS IS NOT INVESTMENT ADVICE. These two setups are just strategies you might consider to gain an edge from the upcoming BREXIT/BREMAIN vote coming later this week. The vote could go either way and the talking heads are all over the map trying to decide if this is going to be another Y2K non-event or whether a BREXIT yes vote will create a domino effect of EU defections that will produce an unstable Europe filled with significant economic uncertainties.

Either way we can expect extreme volatility on the 24th and here are 2 simple option setups, a straddle and a butterfly. These are short term options, set to expire on the 24th so the decay factor really doesn't factor into the equation.

These setups focus on the SPY. If you look at the same setups for EFA (ETF of Europe's largest 900 companies) you'll quickly see that the odds skew is clearly bearish, which makes perfect sense since a yes vote will slam Europe more (relatively) than the US.

First the straddle>>>> easy to set up, lots of liquidity and unlimited profit potential if things take off.

The butterfly is a credit spread and your profit potential is restricted at the outset. Randy describes a short call 1:2:1 butterfly and this is one spread using that symmetry. Note that the breakeven bracket is narrower on the butterfly than the straddle. The narrower the spread the lower the net credit so we have to open up the spread a bit to allow for a reasonable risk/reward. The Brexit vote IMHO offers a unique high odds wide spread opportunity.

Either way we can expect extreme volatility on the 24th and here are 2 simple option setups, a straddle and a butterfly. These are short term options, set to expire on the 24th so the decay factor really doesn't factor into the equation.

These setups focus on the SPY. If you look at the same setups for EFA (ETF of Europe's largest 900 companies) you'll quickly see that the odds skew is clearly bearish, which makes perfect sense since a yes vote will slam Europe more (relatively) than the US.

First the straddle>>>> easy to set up, lots of liquidity and unlimited profit potential if things take off.

The butterfly is a credit spread and your profit potential is restricted at the outset. Randy describes a short call 1:2:1 butterfly and this is one spread using that symmetry. Note that the breakeven bracket is narrower on the butterfly than the straddle. The narrower the spread the lower the net credit so we have to open up the spread a bit to allow for a reasonable risk/reward. The Brexit vote IMHO offers a unique high odds wide spread opportunity.

Thursday, June 16, 2016

BREXIT, BREXIT, BREXIT, etc.....06.16.16

Did I mention that the BREXIT has captured the market's momentum? British opinion polls vacillate about odds for an IN or OUT vote....check with your local London bookie for the latest skew.

To my cadre of British Mosaic users...please clue me in on the current BREXIT pulse so I can adjust my bets accordingly. Current odds TODAY favor a REMAIN vote, prompting the markets to reverse from a widely based global sell momentum.

Meanwhile...the current market undercurrent is still in a sell mode prompted by China and Russia, which we mentioned earlier in the week. The FED has also revised its hawkish babble and we're now likely to see none or only one rate hikes in 2016.

Following yesterday's post...below are the 130 minute bar charts for VIX and SPY with the 2 standard deviation Bollinger Band studies set to a 14 day moving average. Today's action was a technical forgone conclusion if you are all in on the Bollinger Bands strategy.

FYI.......130 minute bars are one of my favorite analytical timeframes (much more so than hourly bars) since it clearly divides the 6.5 hour (390 minute) trading day into 3 equal sections and helps (me) to better seen how momentum and volume are progressing from close to close.

To my cadre of British Mosaic users...please clue me in on the current BREXIT pulse so I can adjust my bets accordingly. Current odds TODAY favor a REMAIN vote, prompting the markets to reverse from a widely based global sell momentum.

Meanwhile...the current market undercurrent is still in a sell mode prompted by China and Russia, which we mentioned earlier in the week. The FED has also revised its hawkish babble and we're now likely to see none or only one rate hikes in 2016.

Following yesterday's post...below are the 130 minute bar charts for VIX and SPY with the 2 standard deviation Bollinger Band studies set to a 14 day moving average. Today's action was a technical forgone conclusion if you are all in on the Bollinger Bands strategy.

FYI.......130 minute bars are one of my favorite analytical timeframes (much more so than hourly bars) since it clearly divides the 6.5 hour (390 minute) trading day into 3 equal sections and helps (me) to better seen how momentum and volume are progressing from close to close.

Wednesday, June 15, 2016

Ready For the BIG One?...06.15.16

So the BREXIT deal has got the markets spooked big time...and probably with good reason. Fortunes will be made or lost following the June 23rd vote and trying to find an edge or a half way reasonable hedge is consuming many traders' energy. I've got some ideas of that and will put in my two cents over the weekend.

Until then here's a little study of old time Bollinger Bands applied to the VIX, SPY and XIV (inverse XIV ETN). These studies came to light in a recent Schwab bi-weekly technical study group and suggest that there may be a nice odds forecast hidden in the path of the bands. Bollinger bands have been around for decades of course and some folks swear by them and others swear at them...but, like any technical indicator, if properly configured and applied the results may be useful to your bottom line. These are NOT short term indicators and as shown cover 109 days of daily bars.

The RSI2 is shown in a separate chart window for reference and signal confirmation.

The VIX and XIV chart s are set to 2 standard deviations and a 14 day MA, the SPY chart is set to 1.5 standard deviations and 14 days MA. The band violation signals are few but the reliability of those signals is very high. We can nuance these studies further by honing in on shorter intervals such as 130 minutes and we'll post a couple of these later this week FYI.

Note the recent signals in all three charts.

Charts courtesy of Schwab,,, StreetSmart Edge platform.

Until then here's a little study of old time Bollinger Bands applied to the VIX, SPY and XIV (inverse XIV ETN). These studies came to light in a recent Schwab bi-weekly technical study group and suggest that there may be a nice odds forecast hidden in the path of the bands. Bollinger bands have been around for decades of course and some folks swear by them and others swear at them...but, like any technical indicator, if properly configured and applied the results may be useful to your bottom line. These are NOT short term indicators and as shown cover 109 days of daily bars.

The RSI2 is shown in a separate chart window for reference and signal confirmation.

The VIX and XIV chart s are set to 2 standard deviations and a 14 day MA, the SPY chart is set to 1.5 standard deviations and 14 days MA. The band violation signals are few but the reliability of those signals is very high. We can nuance these studies further by honing in on shorter intervals such as 130 minutes and we'll post a couple of these later this week FYI.

Note the recent signals in all three charts.

Charts courtesy of Schwab,,, StreetSmart Edge platform.

Tuesday, June 14, 2016

Ponzo Updates...06.14.06

This week's Ponzo Updates indicate a developing risk environment for SPY and VIX. These are outlier scenarios but given recent nervousness about the Brexit those low odds situations may see increased odds for realization and we'll watch next week's updates closely to see whether those scenarios have become more or less probable. I hope everyone looked at Mauldin's post yesterday...it sounds scary but he makes some compelling arguments. I love this tag...“Recession is when a neighbor loses his job. Depression is when you lose yours.”

– Ronald Reagan

Although the market was red today the technicals actually indicated a positive day....falling bond prices and stabilization of the VIX.

We had some nice green runners today in the big caps GE and WMT although the financials got hit hard on fears that large segments of credit debt may go into default.

Although the market was red today the technicals actually indicated a positive day....falling bond prices and stabilization of the VIX.

We had some nice green runners today in the big caps GE and WMT although the financials got hit hard on fears that large segments of credit debt may go into default.

Monday, June 13, 2016

VIX Hits 20 +...Now What?....06.13.16

A couple weeks ago the VIX PONZO forecast a VIX 20 scenario and here we are at 20.73....way ahead of schedule.

VIX was up another 21% today and based on historical patterns we're due for a pause. (see below)

VXX, the VIX proxy ETN has actually traded 20 million more shares than SPY today although late action may be short covering volume.

The odds of a FED hike are now zero near term...most likely trigger date has moved to December giving the markets time to stabilize over the late summer although Mauldin is less than optimistic for the summer outlook and cites some compelling arguments.

The VIX is now at mid term resistance (see below) although today's M1 studies of VXX and SPY indicate the odds favor more downside based on the Short Term Momentum mode..

VIX was up another 21% today and based on historical patterns we're due for a pause. (see below)

VXX, the VIX proxy ETN has actually traded 20 million more shares than SPY today although late action may be short covering volume.

The odds of a FED hike are now zero near term...most likely trigger date has moved to December giving the markets time to stabilize over the late summer although Mauldin is less than optimistic for the summer outlook and cites some compelling arguments.

The VIX is now at mid term resistance (see below) although today's M1 studies of VXX and SPY indicate the odds favor more downside based on the Short Term Momentum mode..

Saturday, June 11, 2016

VDX Updates and Trader's Outlook...06.11.16

This week's VDX updates have TLT overbought and SPY neutral/oversold. The 17% jump in the VIX on Friday has it peaking at (hypothetically) overbought levels but there may be some carry over selling into Monday after traders consider their positions over the weekend.

Note the VDX signal thresholds have been changed from the previous 40% to the current 50% and the moving average period has been shortened from the previous 14 to the current 10 day lookback.

Next Friday is monthly options expiration and we can expect heightened intraday volatility as the good, the bad and the ugly positions are re-aligned; The market has so far avoided or ignored the Sell in May mantra and the supposedly catalyst for Friday's swoon, the Brexit, is more likely a smoke screen for institutional traders doing their usual thing rather than a genuine market mover. Reflecting on yesterday's post on arbitrage opportunities in the Mexican markets ....this is the way it was with US markets only 10 years ago when specialists controlled each NYSE stock like a personal fiefdom and floor traders minted money all day long scalping the bid/ask spread. Those were the good ole days when smart traders just tagged along with the specialist orders which were fairly transparent watching level 2 order flow. Those days are long gone.

Note the VDX signal thresholds have been changed from the previous 40% to the current 50% and the moving average period has been shortened from the previous 14 to the current 10 day lookback.

Next Friday is monthly options expiration and we can expect heightened intraday volatility as the good, the bad and the ugly positions are re-aligned; The market has so far avoided or ignored the Sell in May mantra and the supposedly catalyst for Friday's swoon, the Brexit, is more likely a smoke screen for institutional traders doing their usual thing rather than a genuine market mover. Reflecting on yesterday's post on arbitrage opportunities in the Mexican markets ....this is the way it was with US markets only 10 years ago when specialists controlled each NYSE stock like a personal fiefdom and floor traders minted money all day long scalping the bid/ask spread. Those were the good ole days when smart traders just tagged along with the specialist orders which were fairly transparent watching level 2 order flow. Those days are long gone.

Thursday, June 9, 2016

Views of Market Direction...06.09.16

First of all I have to hand it to this guy...if he makes it work he'll be richer than Carlos Slim in no time. Sure wish I'd figured this out a few years ago but I actually believe there are still some nuance arbitrage opportunities for the little guy using this strategy if you've got the time and energy... and you don't need a $350,000 computer. More on this later..

Here's are a couple charts from my pals at State Street as the market mood turns cautious. The buzz today was regarding Soros's bearish moves, which we actually highlighted last week and which apparently every trader and his brother was already well aware of.. The little guy is always the last to know....which means you probably missed the institutional rally in GLD and GDX the past week.

To highlight the bizarre behavior of the current market the last chart shows the recent trend of the SPX versus VIX...both are up.

Here's are a couple charts from my pals at State Street as the market mood turns cautious. The buzz today was regarding Soros's bearish moves, which we actually highlighted last week and which apparently every trader and his brother was already well aware of.. The little guy is always the last to know....which means you probably missed the institutional rally in GLD and GDX the past week.

To highlight the bizarre behavior of the current market the last chart shows the recent trend of the SPX versus VIX...both are up.

Wednesday, June 8, 2016

Decoupling of SPY and TLT Volatility...06.08.16

There is a developing situation of SPY and TLT volatility decoupling....SPY is in a steady volatility decline while TLT volatility remains flat to slightly upslope. What are the possible implications of this pattern? In the case of SPY it most likely reflects an increasing complacency with the odds of a significant decline despite the fundamental and seasonal factors hinting that down is the best odds trend forecast. In the case of TLT the implication appears to be the opposite...that there is steady or increasing anxiety regarding short term treasuries' stability in the face of massive short interest.

Its been odd recently to see SPY and TLT move in relative lockstep in the face of a low VIX environment and with SPY just pennies away from an all time high and the odds for a consolidation or pullback cycle are heightened...despite the bullish technical outlook via the Ponzo and other guidance.

Its been odd recently to see SPY and TLT move in relative lockstep in the face of a low VIX environment and with SPY just pennies away from an all time high and the odds for a consolidation or pullback cycle are heightened...despite the bullish technical outlook via the Ponzo and other guidance.

Tuesday, June 7, 2016

MVP View of SPY and Credit Spread.Idea....06.07.16

Here's an expanded view of the MVP chart of SPY. Note the current status of the PCL chart....currently well below threshold levels for a high probability trade. This situation confirms our ongoing contention that the markets are more than ever at the whim of large institutional and prop traders who are confounding "normal" technical indicators (that's their job). Low volume has probably exaggerated much of the recent momentum but we may yet face the day of reckoning once the fear factor kicks in and the VIX climbs out of its doldrums (but not soon according to yesterday's Ponzo). For those who doubt the SPY can penetrate the 213 overhead resistance here's a credit spread idea that looks like a balanced risk/reward opportunity.

Subscribe to:

Posts (Atom)